DutcherAerials/E+ via Getty Images

Main Thesis & Background

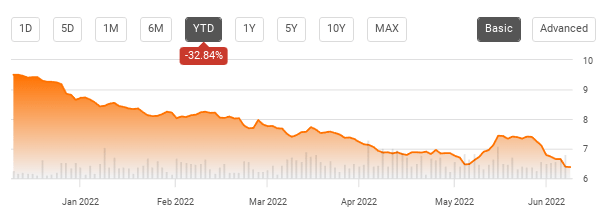

The purpose of this article is to evaluate the Pimco California Municipal Income Fund II (NYSE:PCK) as an investment option at its current market price. The fund invests primarily in California municipal bonds, and therefore “seeks to provide current income which is exempt from federal and California income tax, as well as the alternative minimum tax.” It has been a while since I looked at this fund, but I thought it was timely to do so given how much pain the muni sector has been experiencing in 2022. This is not unique to California munis or PIMCO CEFs. The entire universe has been struggling this year, but PCK has been hit particularly hard, with a loss around 30% once we account for distributions:

PCK’s YTD Performance (Seeking Alpha)

With this drop on the forefront of investor’s minds, it begs the question – where could PCK be headed from here?

In my opinion, I think the next move of significance will be higher. PCK has a nice discount to NAV, the sector as a whole seems oversold, and the underlying securities are backed by a state that has seen its fiscal fortunes improve since the depths of the pandemic. While I acknowledge there are headwinds ahead, including inflation, Fed rate hikes, and alternative California muni CEFs that have larger discounts, I think PCK is a buy here. I will explain why in more detail below.

Valuation Is Key

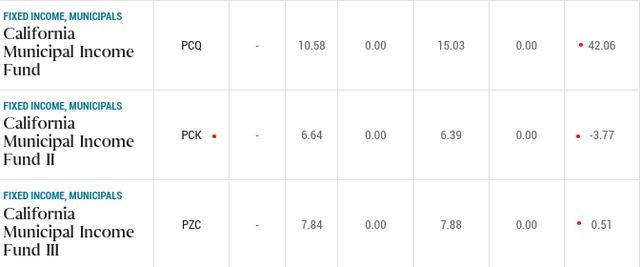

To begin, I want to focus on a key reason why I like PCK right now. As my readers know, valuation is always top of mind for me – whether in equity positions of debt CEFs. With respect to munis, there are often many options to purchase CEFs at discounts to NAV, so it is rare that I would pick one up at a premium. Today’s market is no exception, with many funds selling at discounts given the rapid selling across the sector. Fortunately for those looking at fresh positions here, this includes PCK. Of note, while PCK has a discount to NAV nearing 4%, it is worth noting both of its sister funds from PIMCO trade at premiums. While the premium for the California Municipal Income Fund III (PZC) is very minor, the premium for California Municipal Income Fund (PCQ) is simply astounding:

The takeaway here is fairly straightforward. If one is considering a muni CEF from PIMCO with a focus on California, PCK seems like the logical choice. PCQ is simply outrageously priced, giving me absolutely no incentive to purchase it. PZC is more reasonable, but it seems to make sense to opt for PCK on valuation alone, given how similar the funds are.

That said, this is not a “screaming” buy signal either. I like the fund and its valuation here, and its advantage over its sister funds speaks volumes. However, muni investors, even those who specifically want a fund focused on California, have a lot of options. There are other CEFs out there, many of which I cover, from shops like Nuveen and BlackRock that are trading near the double-digit discount range. So, if valuation is a reader’s primary concern, than PCK may not have enough going for it. But if you are committed to PIMCO and want this sector exposure, PCK wins out, in my view.

Let’s Focus On A Reason For The Big Drop

While the valuation is a positive attribute here, I want to discuss one of the major pain points for PCK. This is important before I get into some of the other positives of the fund because I want to emphasize this is not a “risk free” play. Munis have been hammered hard this year, and while I believe they are ripe for a turnaround, that may not be the case. For those who already have a lot of exposure to this sector or who can’t withstand positions with some volatility going forward, this may not be the best bet at the moment.

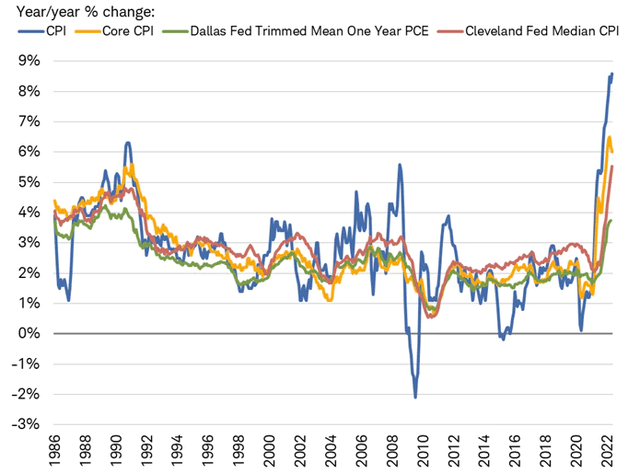

To understand why, let us consider a key reason that PCK (along with many muni CEFs) have dropped so hard, so fast. The word is inflation, which is likely top of mind for most investors these days. The problem is that munis entered in to 2022 with long maturity dates, amplifying the duration (or interest rate) risk within the funds. This meant that as inflation accelerated and the Fed begin hiking rates, munis were very exposed to these developments. Unfortunately, we are not really out of the woods yet in this regard. While the Fed has taken direct action combat inflation, and many market participants do expect it to cool in the coming months, that hasn’t occurred yet:

Inflation Metrics (Charles Schwab)

This is a critical piece because the inflation story is clearly not over yet. If inflation cools, or reverses course, than I believe equities and bonds are due for a strong pop. This is a potential tailwind for PCK too. The downside is that despite the sharp losses PCK has already faced this year, if inflation and rate hikes continue to come in more aggressive than anticipated, watch out below.

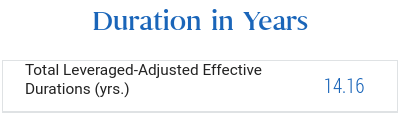

The reason for this is that PCK is very interest rate sensitive. The fund has a duration of a whooping 14 years, meaning the fund will lose 14% in value for every one percentage point increase in interest rates:

PCK’s Duration (PIMCO)

My conclusion here is that if one is expecting inflation to persist at these levels, or perhaps even to keep accelerating, then PCK is not the right move. The buy case rests on the notion that inflation has either peaked or will peak soon. If that is not the case, the downtrend can continue.

PCK Primarily Exposed To Cali – That’s A Positive

Digging in to PCK in isolation, I want to point out this is a Cali-specific muni play. While any investor can purchase this fund, it makes the most sense for California residents because they could be exempt from both state and federal taxes. Residents outside of California probably will not enjoy the state income tax savings.

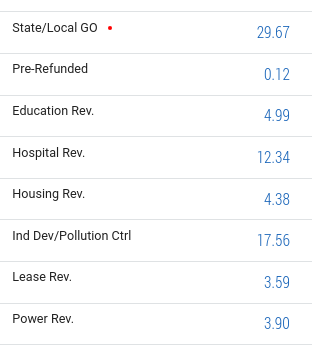

With this in mind, when we look at the breakdown of PCK’s holdings, we see the largest sub-sector within the fund are bonds backed by state and local governments within California. These are known as General Obligation (GO) bonds, and are backed by the issuer’s creditworthiness (in this case California) and its ability to levy taxes on its residents. This is in contrast to a revenue muni bond, which is tied to a specific project, levy, or some other revenue stream in isolation:

PCK’s Sub-sector Exposure (PIMCO)

My take here is to view this positively. In truth, California is facing some challenges right now. There is a statewide drought, above-average unemployment, and a more mixed revenue picture due to the declining stock market.

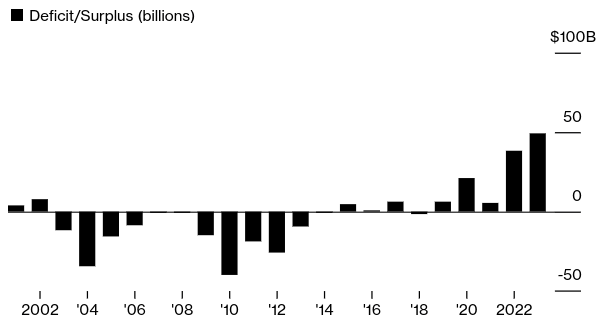

This is important because California has very high state taxes on upper-income households, including capital gains taxes. When the market tanks, tax collection drops, so 2022 could end up being a weaker than average year for the state. However, the past two years have seen strong market gains, to the point where it allowed California to enjoy a surplus. In fact, 2020 and 2021 saw some of the strongest tax collection in the past two decades:

California’s Surplus (or Deficit) by Year (California Department of Finance)

While I would not suggest California is going to continue enjoying such a wide surplus going forward, the point to emphasize is that the state is sitting on a nice cushion to weather any upcoming storm. If spending plans increase, tax collections drop, or the state incurs some natural disaster, there appears to be ample funds in the coffers to meet those challenges. At the very least, it suggests to me that defaults or delinquencies on Cali-backed GO bonds are very unlikely at this juncture. This supports the underlying value of PCK’s securities, and improves my outlook for the fund as a whole.

Income Story Provides Comfort

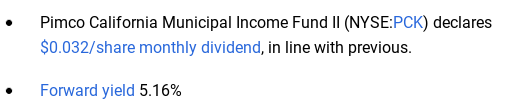

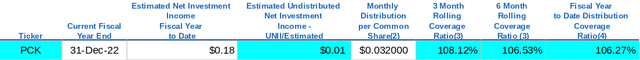

My last topic related to PCK has to do with the fund’s distribution, specifically its stability. This is certainly a paramount attribute when evaluating muni CEFs because the income stream is so vital to total return. Fortunately, despite the wild ride the share price has been on in 2022, the income picture is much more stable. The most recent UNII report from PIMCO shows that PCK is over-earning its stated distribution, and has a slight income cushion in reserves:

This provides some assurance that the current yield on PCK is safe for now. That is always good news, of course, but it is especially good because the yield for PCK is quite high at the moment given the drop in share price:

June Distribution Highlights (Seeking Alpha)

When we factor in the tax savings on a federal level, as well as the state benefits, it is hard not to like PCK’s income here. When I couple this with the discount to NAV that is prevailing right now, it seems like a reasonable option.

Bottom-line

The hope across the board is that the second half of 2022 will be better than the first. Frankly, I don’t see how it can’t be. This tells me that buying in to value positions here will probably be rewarded in the near term. This includes equities and bonds alike, including munis. PCK has caught my eye because its decline seems disproportionate to the risks facing the fund. The state of California has plenty of reserves to make good on its obligations, allowing PCK to keep pumping out a tax-exempt income stream. While risks remain, chief among them duration risk, I think a buy rating here is warranted. As a result, I would suggest readers give this idea some consideration at this time.

Be the first to comment