undefined undefined/iStock via Getty Images

Here at the Mare Evidence Lab tower, we extensively cover the European pharmaceutical sector. Looking at the half-year earnings season, we already reported the Q2 performance of Novartis, Roche and Sanofi. In conjunction with the quarterly report, we initiated coverage on Lonza Group AG to better assess the specialty pharma sector. Today is the day for Grifols (NASDAQ:GRFS) as the company released its three-month numbers yesterday.

In our latest company’s publications, we would like to report the following:

- There was a strong rationale behind the Biotest acquisition and we criticized some negative comments from JP Morgan;

- When we initiated to cover Grifols, we knew of the possibilities of short-term turbulence but we provided a positive view of the long-term upside;

- We forecasted the Biotest bolt-on acquisition outcome providing support on the valuation and after the Q1 analysis, we reaffirm the Grifols’ strong fundamentals.

After the Q2 report, Grifols’ stock price declined more than 10%. Some accounts are undoubtedly impacted by the Biotest acquisition but we also see supportive numbers in the Biopharma division.

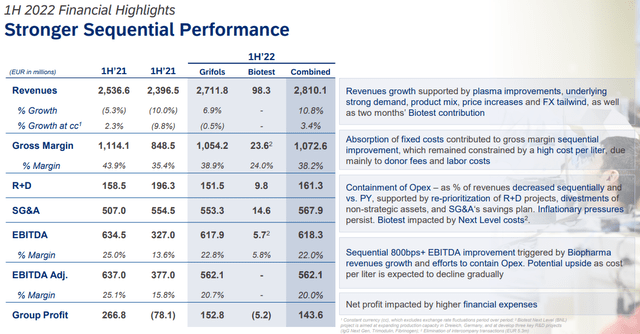

More in detail, the biopharmaceutical company reported top-line sales of $2.8 billion in the first half of 2022, which represents an increase in revenue of 10.8%. As we already mentioned, this was driven by the solid evolution of the biopharma division but also by a favorable product mix development and a better exchange rate evolution. Most important to note is the positive evolution of plasma donations which increase by +22%. This has always been a pushback from the investor community. Whereas, the diagnostic division delivered a minus 16.7% in turnover and stood at €329 million. This was due to the lower COVID-19 test and also as reported in the press release by the “Zika-virus screening termination“. EBITDA also improved at the margin level as a consequence of the higher operating leverage.

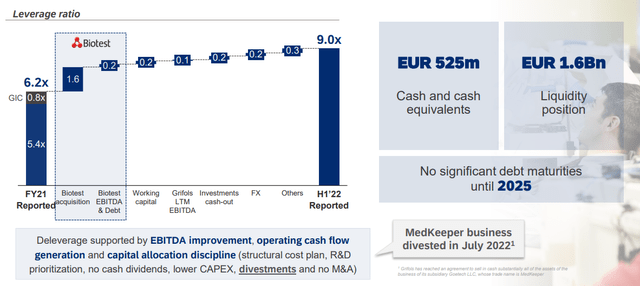

The worst result was recorded at the net income level. Grifols profit stood at €143.6 million which represents a decrease of 46.2% compared to last year’s accounts. This is due to the higher interest expenses that finance the German company Biotest. The cost of the external acquisition continues to be very visible in the P&L, in which financial expenses have skyrocketed by 66% compared to the previous year. However, looking more accurately, we see that the Spanish company has low exposure to interest rate increases since approximately 65% of its debt is fixed rate and only approximately 22% is linked to a variable interest rate in US dollars.

Conclusion and Valuation

We like to report the CEO words that explained how the company “is more than ready to continue delivering on its commitments and to take on new challenges, unlocking further growth and profitability while maintaining financial discipline. And above all, to boost innovation as we continue to deliver life-saving medicines for our patients”.

Other important news to report is the Grifols disinvestment of Goetech LLC for a total amount of €91.6 million. The company was focusing its activities on the development of computer applications for hospitals and it was included as a non-strategic asset.

For the second half of the year, the company expects to maintain its increase in sales in the double-digits. In addition, they are targeting more profitability per liter of processed plasma and saving additional costs from the Biotest acquisition. Unlocking Biotest value and deleveraging is the priority to check over the next quarters.

Concerning the valuation, our internal team believes that Grifols is well positioned for a rebound. Adjusting interest expenses in our model, we confirm our buy rating and we lower the target price from €28 to €25 per share. Grifols is trading at a P/E discount compared to the European pharma specialties and also versus its closest Australian competitors. In numbers, we see a 40% discount on the P/E ratio. To posterity the arduous sentence.

Risks to our target price include the following:

- higher competition;

- lower plasma donations and higher donor fees that could trigger Grifols’ profitability;

- COVID-19 new waves;

- Biotest acquisition execution risk.

Be the first to comment