yuriz/iStock via Getty Images

The Updates:

Tiptree’s (NASDAQ:TIPT) long-awaited investment in Fortegra by Warburg Pincus has finally closed. I was never particularly worried that regulators would not bless the investment. Still, it is nice to finally have the money in the door.

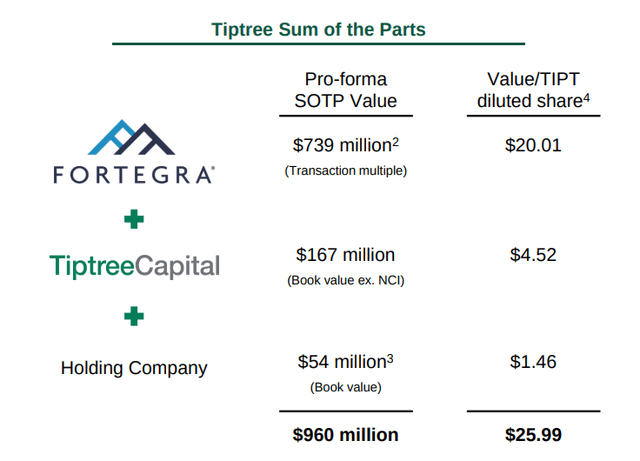

As a reminder, Warburg invested in $200 million comprised of two different tranches for 24% ownership of Fortegra. That investment translated to multiple paid of about 13.5x adjusted net income, which over the past twelve months is now ~$75 million. That investment and multiple translates to Tiptree’s stake in Fortegra being worth about $739 million, or about $20 per share–almost 100% higher from the current share price.

Fortunately, that is not all of the value of Tiptree realized today. In almost all of my write-ups on the company of the past several years, I have been begging management to sell the ships they own and exit the shipping business. They are doing just that. In addition to the dry bulk ship for which they entered into a sales contract in April, the company disclosed today that they sold the other two dry bulk ships they owned for ~$46 million, about a 47% gain versus book value.

While that gain represents about $.50/share, it is worth much more in my mind as I am not the only person who loathes shipping. Boats are an awful, highly cyclical business and therefore just trade at a discount to book value. Removing these boats from the equation should help remove the discount to the sum of the parts the company is experiencing.

Valuation

As a reminder, last quarter the company calculated its SotP (Sum of the Parts) at just under a hair under $26.

Sum of the Parts Calculation of Tiptree (Company Presentation)

I am assuming normal core profitability plus the gain on the boats and without subtracting major losses from the continued P/L cancer that is Invesque (OTCPK:MHIVF) should drive SotP to close to $27. With the stock closing at $10.27, that would imply a 62% discount to the SotP. Given the validation by Warburg of the quality of Fortegra’s business and now the exit from the dreaded shipping business, I see absolutely no reason for such a discount. Even marking Invesque to zero would only impair SotP by less than $1/share.

Risks

With the Warburg deal put to bed and the company is net cash, the main risk to Tiptree is the health of Fortegra. Fortunately, given the nature of the warranty business, there is very little tail risk. Therefore, the biggest risk to Fortegra’s business is new competition. That is hard to handicap but I believe the stock’s discount to SotP and even book value more than mitigates that risk.

Conclusion

I have been pushing management in these write-ups to strip out the other businesses and essentially convert the company to Fortegra. Their actions indicate they are along that road. With a net cash balance sheet, a key strategic investor in a very healthy business and fewer distractions, I see this management team continuing to harvest the value they have built up within this company. Just getting to old SotP means 150% gain from here.

Be the first to comment