FreezeFrames

PHX Minerals Inc. (NYSE:PHX) is an independent oil and gas company that operates in many of the major basins in the United States. This company uses a vastly different business model than most exploration and production companies, however, in that it does not produce any oil or natural gas itself. Rather, it actually purchases mineral-rich land that it then leases out to other companies that produce the oil and gas. PHX Minerals then takes a percentage of the resources produced.

This makes it similar to a royalty trust, although PHX Minerals is more sustainable over the long term because it can always acquire more property. Despite some of the advantages that this model has over the traditional exploration and production companies, PHX Minerals’ stock has greatly underperformed the broader energy sector. This may have created an opportunity for investors as the stock appears to be somewhat undervalued today.

About PHX Minerals

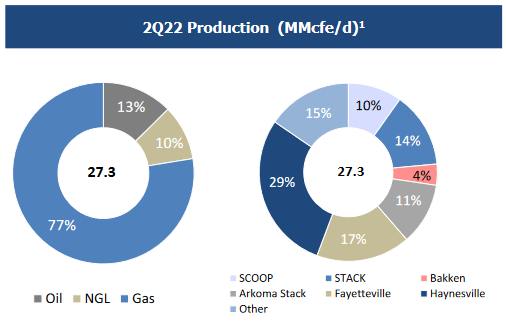

As stated in the introduction, PHX Minerals is an independent exploration and production company that operates in many of the major basins in the United States. Although it has acreage all over the nation, the majority of the currently operating wells are in Oklahoma, Texas, and Louisiana:

The one thing that we notice is that a sizable proportion of the company’s acreage is not leased. While PHX Minerals does not state exactly how much land it actually owns, it currently only has 74,250 net acres under lease to a producer. The mismatch between the company’s owned land and its net leased land may be a point of concern for many investors, but it makes sense to a degree. The company is constantly purchasing new land that contains resources so that it can replace the oil and gas that is extracted from the land currently being operated on.

This is critical because the oil and gas industry is an extractive one in that the resources are literally produced by removing them from reservoirs in the ground. As these reservoirs only contain a finite quantity of resources, new resources must continually be obtained in order to maintain production. It is quite possible that the company has gone overboard with its acquisitions, though, as 7% to 29% of the company’s acreage is not producing, depending on the basin. This, unfortunately, means that a non-negligible portion of PHX Minerals’ assets is tied up in non-productive assets.

PHX Minerals tries to obtain resource-rich acreage in high quality basins, and this is reflected quite well in the firm’s reserves. As of September 30, 2021, PHX Minerals had total proved reserves of 82.992826 billion cubic feet of natural gas equivalent, which gives the company a PV-10 of $155.7 million at current prices assuming the company’s current royalty interest remains constant across all its acreage.

This is a very real sign that PHX Minerals may be substantially undervalued at the current stock price. The PV-10 represents the present value of the discounted cash flow that PHX Minerals will receive from the production and sale of its reserves, discounted at a 10% rate. As such, this value should be relatively equal to the company’s enterprise value. PHX Minerals currently has an enterprise value of $129.89 million, so it is 16.58% undervalued based on the resources that it has in the ground.

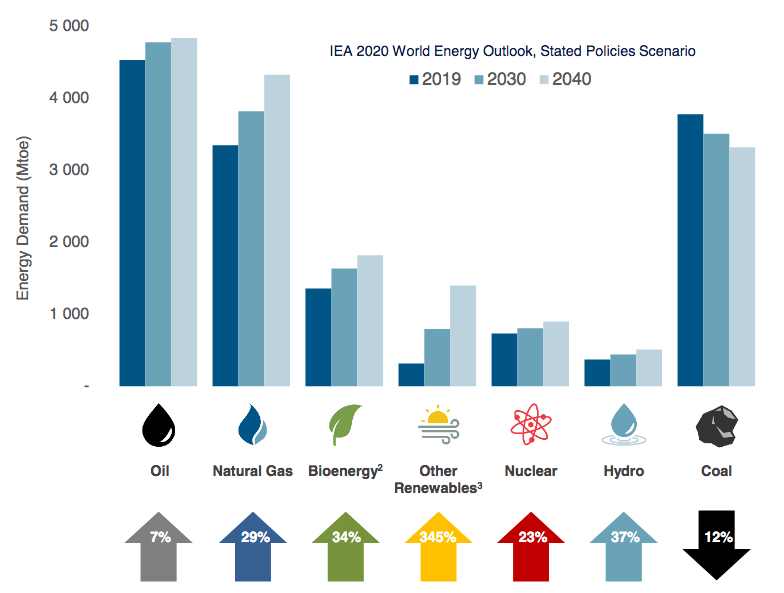

The overwhelming majority of PHX Minerals’ reserves consist of natural gas. Indeed, about 78% of its reserves consist of natural gas, with the remainder consisting of crude or natural gas liquids. This is roughly proportional to production, as 77% of the firm’s second quarter 2022 royalty interest received was natural gas:

PHX Minerals

As such, PHX Minerals is much more exposed to natural gas than to other resources. This is generally a good place to be, as the fundamentals for natural gas are stronger than the fundamentals for crude oil. We will discuss this more later. As a result of the strong natural gas fundamentals, PHX Minerals may be able to attract natural gas producers to its acreage. This could help the company reduce some of its unleased inventory of acreage. This would, of course, help the company better monetize its asset base, which any investor should appreciate, and it may help remove a problem that is weighing on the stock price.

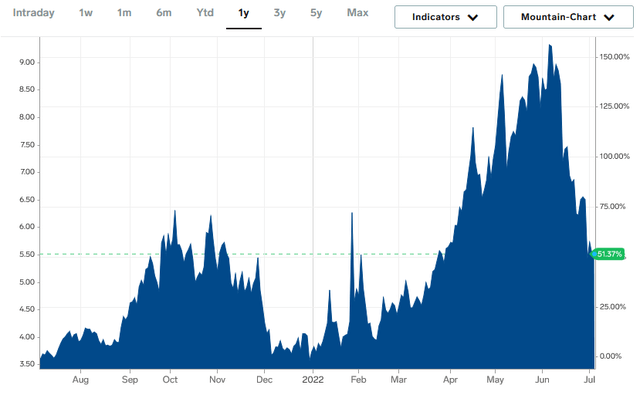

We can see further evidence of the company’s exposure to natural gas prices by looking at PHX Minerals’ financial performance. As everyone reading this is no doubt well aware, natural gas prices have appreciated significantly over the past twelve months. As of the time of writing, the price of Henry Hub natural gas is up 51.37% over the past year:

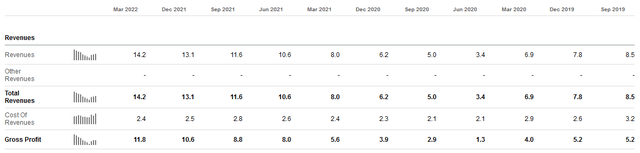

As PHX Minerals’ basic business model is taking a percentage of the minerals produced on its acreage, we might expect this to have boosted PHX Minerals’ revenues and profits. This is indeed the case, as PHX Minerals reported the highest revenues and gross profits in the first quarter that it has seen since well before the pandemic:

Unfortunately, the price of crude oil and natural gas has fallen significantly since their highs in the first quarter of 2022. This means that the company will likely see its financial performance decline a bit in the next quarter compared to the first. This is probably why the stock price declined so precipitously in the second quarter. With that said, PHX Minerals does have several hedges in place to effectively lock in a price for the natural gas and crude oil that it receives and sells from its acreage, but this certainly does not cover all of the crude oil and natural gas that it sells, so it will still be quite affected by the price declines of these resources.

Natural Gas Fundamentals

As we have just seen, the financial performance of PHX Minerals directly correlates to the price of natural gas. Fortunately, the fundamentals point to a consistently high price for natural gas. This is mostly because the demand for natural gas is likely to grow much more than the supply of it.

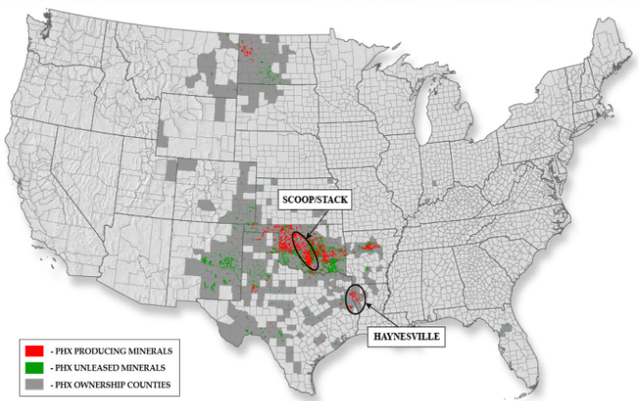

This is something that could be quite surprising considering all the demonization of fossil fuels that we hear from politicians and the media. However, natural gas is a critical part of the conversion to a “green economy.” This is because renewable energy is not reliable enough to support a modern electric grid. After all, solar power does not work at night and wind power does not work when the air is still (or, ironically, when it is blowing too quickly). Natural gas does not have this problem, as natural gas turbines can reliably generate electricity no matter what and natural gas burns cleaner than any other fossil fuel. This makes these turbines an ideal supplement to renewables in order to ensure that the electric grid remains reliable until renewable technology improves sufficiently to allow them to accomplish this on their own. The International Energy Agency projects that this will cause the global demand for natural gas to increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

It is highly unlikely that the production of natural gas will increase sufficiently to meet this demand growth. As many of you are well aware, natural gas is frequently produced as a byproduct of crude oil production so the two are intrinsically linked. According to Moody’s, the energy industry must immediately increase upstream spending by $542 billion annually in order to avoid an oil supply shock.

We can assume that an impending shortage of natural gas is coming too since it is highly unlikely that the energy will actually do this. The industry has absolutely no reason to do so. After all, it is under tremendous pressure from politicians and activists to improve the sustainability of its operations and from investors to improve returns. Thus, we have a situation in which demand is almost certain to increase more rapidly than supply. According to the laws of economics, this causes prices to rise. As we have seen, PHX Minerals benefits when natural gas increases in price so we can see how this should prove to be a positive long-term trend for the company.

Financial Considerations

It is critical that we analyze the financial structure of a company before we make an investment into it. This is because debt is a riskier way to finance a company than equity. After all, debt must be repaid at maturity, which is generally accomplished by issuing new debt to raise money to pay off the maturing debt. This may cause the company’s interest costs to increase depending on market conditions. In addition, the company has to make regular payments on its debt or it will become insolvent. Thus, a decline in cash flows may cause the company to be forced into bankruptcy if it has too much debt. This is always a concern for commodity companies as they are subject to the shims of the commodity markets.

One metric that we can use to evaluate a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which the company is financing its operations with debt as opposed to wholly-owned funds. This ratio also tells us how well the company’s equity will cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important. As of March 31, 2022, PHX Minerals had a net debt of $23.2 million compared to $84.7 million in equity. This gives the company a fairly reasonable net debt-to-equity ratio of 0.27. Here is how that compares to some of the company’s peers:

| Company | Net Debt-to-Equity |

| PHX Minerals | 0.27 |

| Northern Oil and Gas (NOG) | -31.62 |

| Continental Resources (CLR) | 0.80 |

| Coterra Energy (CTRA) | 0.17 |

| Range Resources (RRC) | 1.56 |

As we can clearly see, PHX Minerals has a very reasonable debt load relative to that of its peers. We can therefore conclude that the company is not using an excessive amount of leverage to finance its operations. Overall, investors should not have too much risk with respect to the company’s leverage.

Valuation

We have already seen that PHX Minerals appears to be significantly undervalued relative to the present value of its reserves. There are other metrics that we can use to value the company as well, which also point to it being significantly undervalued. One of these is its forward earnings, which is highlighted in the forward price-to-earnings ratio. This ratio tells us how much investors are paying today for each dollar of earnings the company is expected to generate over the next year. As of the time of writing, this ratio is 4.94, which is well below most other things in the market. However, as I have pointed out in the past, pretty much everything in the energy industry is significantly undervalued right now so let us see how PHX Minerals compares to its peer group:

| Company | Forward P/E |

| PHX Minerals | 4.94 |

| Northern Oil and Gas | 3.51 |

| Continental Resources | 5.18 |

| Coterra Energy | 5.98 |

| Range Resources | 4.92 |

Admittedly, PHX Minerals is not the cheapest stock on the list as both Range Resources and Northern Oil and Gas appear to be cheaper using this metric. However, both of those companies have significantly higher leverage. Overall, PHX Minerals appears to be offering a good risk-reward in terms of valuation here, which is nice to see. This could be a sign that the company deserves consideration for a portfolio today.

Conclusion

In conclusion, PHX Minerals appears to have a great deal to offer potential investors. Most notably, the company has an attractive business model that puts much of the risk on its lessee customers that actually operate the wells, not on itself. While PHX Minerals is certainly highly exposed to fluctuating natural gas prices, the long-term outlook for natural gas is quite positive so I cannot view this as a negative. The company also has very little leverage and an attractive valuation, which makes for a good risk-reward balance. Overall, there appears to be quite a lot to like here.

Be the first to comment