sebastian-julian/E+ via Getty Images

Thesis

Pioneer High Income Fund (NYSE:NYSE:PHT) is a closed end fund that focuses on fixed income. The CEF has current income as its stated goal, and its current dividend yield is 10.6%. The fund contains a mix of U.S. high yield (both bonds and leveraged loans), International high yield, emerging markets bonds and catastrophe bonds (the fund calls them event-linked bonds). It is not often that one finds catastrophe bonds (‘cat bonds’) in a CEF portfolio, and we find it interesting. In our view, cat bonds represent a portfolio diversifier because they have a quasi-zero correlation to credit spreads. The ‘Catastrophe bonds’ section below gives a more in-depth look at this often overlooked asset class.

PHT is built with a high leverage of 33% and a 3-year duration, and has lost value as rates have gone higher and credit spreads widened in 2022. The fund is down -20% year to date, especially given its composition: over 57% of the portfolio is invested in ‘B’ and ‘CCC’ credits, the riskiest type of debt. The fund is a cyclical vehicle, having failed to produce a good long-term total return. The 5- and 10-year annualized total returns sit at 2.37% and 0.03% respectively. We like PHT’s diversification and granularity, but it represents a very credit risky vehicle, especially in light of a potential upcoming recession. The rest of 2022 is going to be challenging for this CEF. An investor is best suited to wait until the end of 2022 and revisit the fund.

What are Catastrophe Bonds?

Catastrophe bonds are a form of securities where insurers transfer risk from a catastrophe or natural disaster to investors. Insurers and reinsurers typically issue cat bonds through a special purpose vehicle. Cat bonds pay high interest rates and diversify an investor’s portfolio because natural disasters occur randomly, and are not correlated with other economic risks. The incidence of hurricanes and tornadoes is largely unrelated to economic and financial activity. During the great financial crisis of ’08-’09, cat bond prices were virtually unaffected outside of liquidity bid/ask spreads.

That said, there are some cases where cat bond losses might happen at the same time as a downturn in the broader economy. For example, if a high-magnitude earthquake were to hit the San Francisco Bay Area, there could be both substantial losses on many catastrophe bonds and large drops in stock prices. Depending on how a cat bond is structured, if losses reach the threshold specified in the bond offering, the investor may lose all or part of the principal or interest

A retail investor might ask how they can lose money via a cat bond. Usually, there are three common types of triggers for a cat bond: indemnity, industry loss, and parametric. “Indemnity triggers base cat bond payouts on the actual insurance losses experienced by the issuer, and function similarly to traditional reinsurance. Industry loss triggers base payouts on aggregate losses to the insurance industry and employs a third-party modeler to provide an independent estimate of these covered losses. And finally, parametric triggers base payouts on the measured strength of the covered catastrophe-such as an earthquake’s magnitude or a hurricane’s wind speed and barometric pressure.”

PHT Holdings

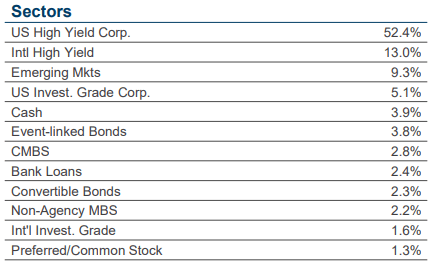

The fund is overweight U.S. high yield:

Holdings (Fund Fact Sheet)

We can see, from the sectoral parsing, the fund is overweight U.S. leveraged loans and high-yield bonds. The next buckets are composed by international high yield and EM debt. Unlike other fixed income CEFs PHT has a sizable cat bond bucket, which currently clocks in at 3.8% (the fund manager calls cat bonds ‘Event-linked Bonds’).

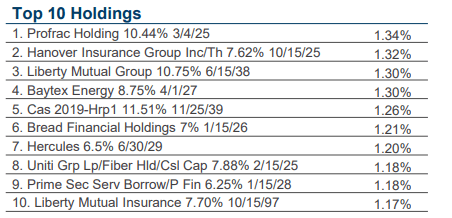

The fund is very granular:

Top Holdings (Fund Fact Sheet)

We can see from the holdings table that none of the issuers breach the 2% fund threshold, hence an extremely granular portfolio. For fixed income securities individual issuer concentration is to be avoided unless a retail investor feels extremely comfortable with certain fund managers.

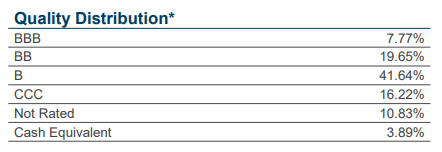

The fund takes a lot of credit risk via its holdings:

Ratings (Fund Fact Sheet)

We can see, from the above table, the portfolio is concentrated in ‘B’ and ‘CCC’ names, which constitute the riskiest parts of the capital structure.

Performance

The fund is down -20% year to date:

YTD Total Return (Seeking Alpha)

The fund is at the bottom of the performance cohort for 2022 given its higher leverage.

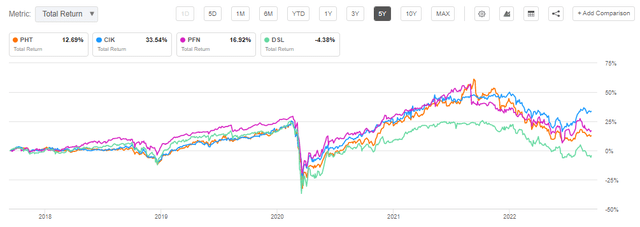

On a 5-year basis, the fund is on par with one of the premier funds from PIMCO:

5Y Total Returns (Seeking Alpha)

Long term, the fund tends to be a cyclical one, with annualized total returns that disappoint:

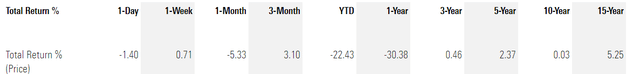

Annualized Total Returns (Morningstar)

We can see from the above table that the annualized 5- and 10-year total returns are fairly low, especially in comparison with the PIMCO gold standard high yield CEFs.

Premium/Discount to NAV

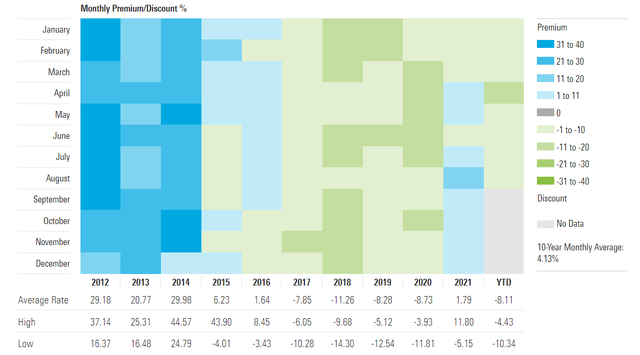

The fund has traded at discounts to NAV since 2017:

Premium/Discount to NAV (Morningstar)

Currently, PHT has a -10% discount to NAV, which is close to its historic numbers.

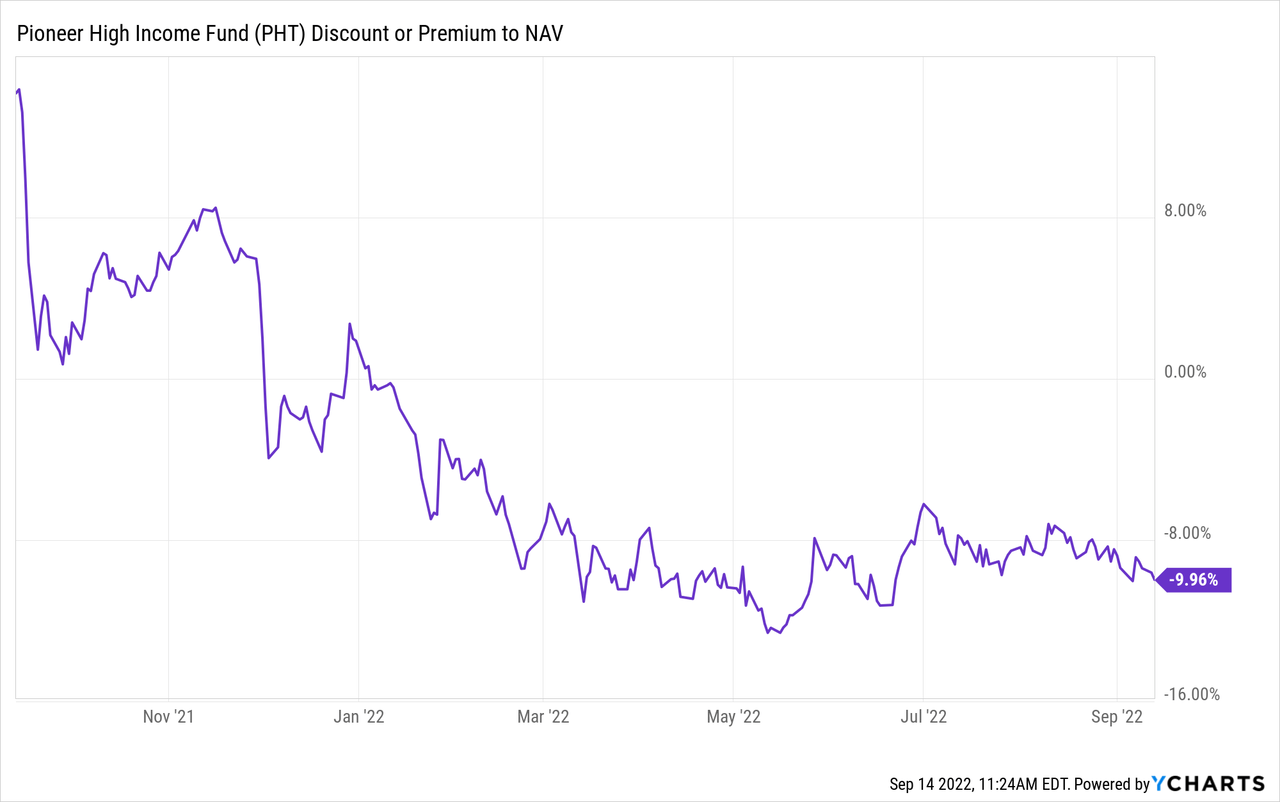

Let us take a look at the fund’s discount performance in the past year:

We can see that the market observed the credit-riskiness of the fund’s portfolio (high concentration of ‘B’ and ‘CCC’ credits) and started assigning the fund a discount as the year started. Until the recessionary fears are over, do expect PHT to exhibit a discount due to its portfolio composition.

Distributions

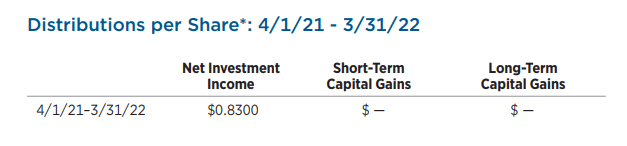

The fund has distributed just investment income in the recent past:

Distributions (Annual Report)

Given the high-yielding nature of the collateral and the embedded leverage, the current yield is tenable from underlying assets’ cash flows. The greatest risk here is loss of cash flows from underlying assets’ bankruptcy and impairment.

Conclusion

PHT is an interesting fixed income CEF. The fund has a very credit risky build, with a high concentration of ‘B’ and ‘CCC’ credits. The vehicle is very granular, and it contains a bucket of cat bonds, a very good portfolio diversifier in a credit spread widening environment. The fund is cyclical given its composition and has decreased by -20% this year due to higher rates and wider credit spreads. The fund is currently trading at a wide -10% discount to NAV (due to recessionary fears and portfolio build) but we expect this to reverse after the recessionary fears are played out. The rest of 2022 is going to be challenging for this CEF. An investor is best suited to wait until the end of the year and revisit the fund.

Be the first to comment