jetcityimage/iStock Editorial via Getty Images

Enphase (NASDAQ:ENPH) has seen its share price increase by 34% since my initial article on the company. While the company continues to be firing all cylinders on its fundamentals, I take the view that most of the upside has been priced in and that valuations appear rich at current levels. However, I am still optimistic about the company due to its strong fundamentals and cash generation abilities, as well as future growth opportunities brought about by new products and new markets.

Investment thesis

As highlighted before, Enphase is a company with strong fundamentals, in my view, as well as favorable industry tailwinds supporting it. The investment case for Enphase is as follows:

- In the US, Enphase is a market leader in micro inverter and premium player in the US MLPE duopoly.

- The company is taking a step in the right direction for market share gains in energy storage and has multiple drivers for growth from new markets and products.

- Enphase continues to operate a capital light business model that is profitable, unlike most of its solar peers, and generating free cash flows.

Solid 1Q results and 2Q guidance

Revenues were up +46% year on year to $441 million, while gross margins were at 41%, maintaining a similar level to one year before, both surpassing expectations. In addition, EPS was up 41% year on year to $0.79. There was a total of $90 million in free cash flows generated, implying free cash flow margins of 20% and the shipments for storage was also at the high end of its guidance at 120 MWh. Enphase continues to have existing capacity for buybacks of $200 million that has been authorised that can be deployed if deemed necessary.

The guidance for 2Q was also solid as revenues were expected to be in the range of $490 million to $520 million with gross margins between 38% and 41%. This revenue guidance range implies an increase of 60% in revenues at the middle point of the range. Operating income is expected to be $128 million in the middle point and the company expects to see 130 to 140 MWh in shipments for storage in the next quarter as supply improves.

Europe to drive further growth

As evident in the 1Q22 report, there is an accelerating demand for residential solar in Europe as the revenues from the region is expected to increase more than 40% from 1Q22. This will come from both increasing demand in its current markets as well as expansion into new markets. The current markets in Europe Enphase is in includes Netherlands, Belgium and France. The company plans to expand into new markets like Italy, Portugal, Spain, and Germany in the near future.

This increase in demand from Europe comes as the region is interested on the improving economics of residential solar as well as the increasing need for energy security in the Europe region. This heightened demand should be well supported by the recent announcement for REPowerEU as well as heightened geopolitical issues. I am of the view that there are huge opportunities for growth from the current strategy Enphase is taking as the company can still continue to increase its penetration and market share in the established markets like Netherlands while rolling out in new markets like Portugal and Germany.

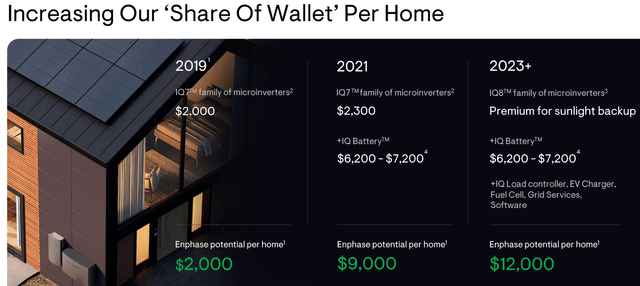

Growing wallet size per home

This has been discussed in my previous article, but there are increasing evidence of the ability and the opportunity set that Enphase could leverage on. First, in 2021, as shown below, Enphase introduced a storage offering increasing wallet share per home from the initial $2,000 to $9,000 and it is expected to grow to $12,000 by 2023, including additional services and products like EV charging and software, for example.

Growing wallet per home (Investor presentation)

For Enphase, the immediate focus is on storage and the company has been increasing the training for its installation partners because many of them have no experience in installation of storage systems. This is where, in my view, the compounding of growth could accelerate. Apart from the increasing of penetration of market share in the residential solar segment in Europe, there is also an opportunity for Enphase to increase wallet share in the region and the company is intending to introduce storage into one or two new countries each quarter to ramp up on its storage offerings. The company is already offering batteries in two European countries, Portugal, and Germany.

Beyond solar, the company is moving into other additional services apart from storage, like EV charging, which will bring additional revenue per home. EV charging. Enphase acquired ClipperCreek in the second half of 2021 and is in the process of integrating the company that offers EV charging solutions with its own range of products and solutions. I think that when included into the Enphase ecosystem of products, this could really improve the portfolio offering and complement the existing portfolio, thereby increasing the average spend per home on the Enphase ecosystem. With all these solutions and products offered by Enphase, customers can truly utilize the ecosystem to optimize their bills and save more money.

Update on supply chain and manufacturing

The company currently has 180 MW quarterly of battery manufacturing capacity which uses the LFP chemistry. There are currently 2 suppliers and there could be a 3rd one coming up in the second half of the year. Currently, the lead times for batteries are still rather long at 14 to 16 weeks due to logistical challenges. However, I think that the worst of the supply chain difficulties has already passed, and that Enphase has managed the challenging situation well. All in all, I think that management has executed well in these difficult times and adds to the list of strengths the company has been able to demonstrate.

Valuation

Enphase is currently trading at 46x 2023F P/E and, in my view, fully reflecting my target price listed in my initial article of $218. While Enphase has traded between 35x and more than 240x from 2019 to 2021, I think that there was lots of froth in its valuation particularly in 2021. As such, it is unwise to use historical P/E to judge Enphase’s current relative valuation.

With a forecasted 2023F EPS of $4.55, a 50x 2023F P/E would mean a target price of $227.50, which implies only 10% upside scenario. This would be my optimistic upside scenario given that 50x P/E in my view is not realistic in the current market environment.

My base case scenario assumes a 2023F P/E of 40x, and the target price will be $182. I think this is a more reasonable and realistic multiple for the company given the current multiple contraction we are seeing.

In conclusion, I think that there is not much upside to Enphase at the current price levels as its current valuations have priced in a whole lot of its investment case and it would need to execute to perfection. That said, I must add that I think that while valuation does not seem cheap, Enphase, in my view, is fundamentally attractive given that it is one of the few solar companies that is actually profitable with generation of free cash flows and has a net cash position. As such, I recommend a hold rating on the company as the fundamentals are solid while valuations could come down before I am willing to buy again.

Risks

Logistics and supply chain risks

While Enphase has done well in the recent quarters to tackle the challenging supply chain and logistics situation, there is the risk of the supply chain issues not easing or even, it could take the turn for the worse. If that is the case, Enphase may lack the parts, components, or systems it needs for delivery to customers, causing backlog in growth and slower revenue growth as a result.

Execution risks

While Enphase has done well in gaining share so far, there are execution risks pertaining to its new markets in Europe as well as new businesses like EV charging and storage. There is the risk that management may slip on execution in these areas, potentially resulting in downside risks.

Conclusion

While I can find no faults in Enphase in its 1Q22 results as it exceeded expectations amidst a challenging environment, I would suggest holding the stock given that valuations are not yet compelling enough to add. In fact, valuations are on the richer side and pricing in most of the share gains and increasing wallet share per home from storage and EV charging. With a target price of $182, it implies a downside risk of 12%. However, I think that given the very strong fundamentals of the company and the long-term strategy and stellar execution, I am suggesting to hold the shares rather than to sell it. I remain positive about the long-term fundamental outlook for Enphase due to favorable industry tailwinds, market share gains, new products and markets and I remain on a look out on any opportunity to accumulate the position on Enphase.

Be the first to comment