Vertigo3d

If there’s one thing to learn from Peter Lynch, that would be to keep an eye on what is happening around us as we might stumble upon lucrative investment opportunities without even looking for them. Earlier this year, I worked with a client on a popular freelancing platform on a project related to a company called Hub Cyber Security, and I made a mental note to revisit this company in the future to understand it better. Hub Security is not publicly listed in the U.S. although the company is listed in Israel, and I stick to U.S. markets so Hub Security always looked out of reach (not that I would have invested in Hub Security anyways but I would have certainly added the company to my watchlist). Last March, Hub Security agreed to a deal with SPAC Mount Rainier Acquisition Corp. (NASDAQ:RNER), so we might not be far away from a U.S. listing for Hub Cyber Security. With this in mind, I thought now would be a good time to publish an article on this deal and Hub Security although I am not planning to invest in Hub at the time of its IPO.

The Company

Hub Cyber Security is an Israeli computing solutions provider that is trying to redefine the cybersecurity sector through the use of quantum-powered confidential computing. The company was established in 2017 by veterans of the Israeli Defense Forces’ elite intelligence units (8200, 81, MOD, C4I-IDF) to protect sensitive commercial and government information. Hub Security offers cybersecurity computing solutions as well as a full range of cybersecurity professional services in over 30 countries.

The company provides end-to-end data protection throughout the data lifecycle, as well as next-generation encryption technologies such as quantum computing defense. The company’s products include RAM Commander, Failure Reporting, Analysis, Corrective Action System (FRACAS), and Life Cycle Cost Decision (D-LCC). Hub Security also provides integrated logistics support and life cycle costing, risk management and analysis, thermal management, 5S, six sigma, software development, outsourcing, and aviation technical publications as well as courses in quality control and reliability.

For its suite of data theft prevention technologies and the powerful encrypted computing solution against hostile attacks at the hardware level, the company has been granted FIPS 140-2 Level 3 certification, which confirms that the company complies with some of the highest levels of security standards for cryptographic modules in the United States.

Cybersecurity and Confidential Computing

Technological advancements have increased the need for cybersecurity, data protection, and recovery to protect resources across several networks. As potential cyber threats increase, governments are investing more money and time in protecting crucial data. As more devices and computers connect to the Internet, the need for cybersecurity will only grow. According to Gartner, global cybersecurity spending rose 13% to $172 billion in 2021 and the research firm believes businesses will invest $77 billion in security outsourcing in 2022, with an increase in cybersecurity spending of 11% expected in both 2022 and 2023.

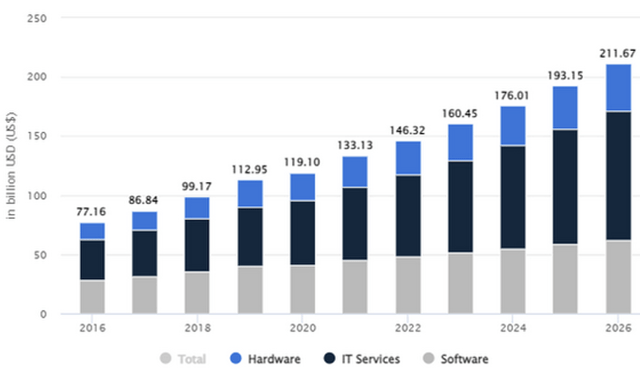

The hybrid work culture will be a key growth driver of this sector as well. The shift in the work model that began in 2020 in response to public health emergencies is expected to become the future of work. Many businesses have decided to become remote-first or to adopt a hybrid model. The demand for cybersecurity solutions and services that address the security challenges of distributed workforces will rise as more employees work from home on personal laptops and computers, which are less secure and more susceptible to cyber threats. 64 billion IoT devices are expected to be installed globally by 2026 because of the remote work trend, which will result in higher spending on cybersecurity. Because of the rising demand for intelligent security software solutions, data protection, and cost-effective data management services, the cybersecurity market revenue is expected to reach $146.3 billion in 2022.

Exhibit 1: Cybersecurity market revenue by segment

The adoption of AI and Machine Learning will further support the growth of the cybersecurity industry market as these technologies can be used to develop advanced, automated security systems and threat detection software. Such products enable the analysis of vast amounts of data at a considerably faster rate, which would help both major enterprises dealing with massive amounts of data as well as small and mid-sized businesses with limited resources. According to Fortune Business Insights, the global cybersecurity market will reach $366.1 billion by 2028, growing at a compound annual growth rate of 12%.

Confidential computing, an advanced way of protecting the most sensitive data, is in high demand today, particularly in highly regulated industries such as banking and healthcare as these industries deal with a large amount of highly confidential information. Confidential computing allows the protection of applications and sensitive data in use with the help of hardware-based trusted execution environments. This emerging security model is becoming essential today as more data-driven companies move to the cloud. The confidential computing market is forecast to reach $54 billion by 2026, growing at a CAGR of 90%-95%.

Recent Developments

Hub Security has entered into several partnerships and agreements to increase its market presence in the confidential computing market. To offer protection to banks and businesses in the EU, Latin America, and the Asia Pacific, the company entered a strategic agreement with Getronics in December 2021.

In January, Hub Security announced that it would work with the quantum technology research company QuantLR to offer the Israeli Ministry of Defense a new quantum security solution for the protection of critical data in the cloud. As businesses and governments invest heavily in human capital, Israel has emerged as a cybersecurity powerhouse. Israel seems to be enjoying competitive advantages in the field of cybersecurity thanks to its cutting-edge research facilities and first-hand expertise. With the Israeli government investing resources in the development and maintenance of critical information technology infrastructures, Hub Security’s collaboration with the government may help the company gain some much-needed recognition in the future.

Hub Security also established a partnership with Radiflow to incorporate Radiflow’s OT ICS intrusion detection software into its private computing platform for sensitive industrial environments. Additionally, the company is growing its healthcare offerings to safeguard health information and enable doctors to provide a faster and more accurate diagnosis. Hub Security and Enlitic formed a collaboration on March 14 at the HIMSS Global Health Conference & Exhibition under which they will use information from imaging systems and archives to support medical decision-making. With the pandemic jeopardizing the global healthcare system, the healthcare industry began steadily implementing advanced technologies to handle the volume and complexity of data to improve patient care and outcomes. The partnership will allow healthcare organizations to benefit from scalable data security and privacy and will enable fast decision-making.

Coming back to the SPAC deal, On March 23, Hub Security announced a $1.2 billion merger with SPAC Mount Rainier Acquisition Corp. to go public in the United States. Once the proposed merger is completed, the combined company will be known as “Hub Security” and its common shares will trade on Nasdaq under the ticker symbol “HUBC.” Following the merger, existing shareholders will own more than 75% of the company. This transaction is expected to close in the third quarter of this year. Hub Security executives believe the transaction will provide the company with the transparency and credibility it requires to compete in the Fortune 500 category in the coming years.

Hub Security is taking strategic actions to increase its global sales and market presence as it gets closer to the Nasdaq listing. The company recently partnered with Teamsystem S.p.A., a provider of digital business management systems in Italy, to launch D.Storm, the company’s DDoS Attack Simulation Platform which will be used to develop and test its DDoS remediation strategy. On May 31, the company announced the acquisition of cybersecurity assets of a European cyber firm with a large EMEA distribution network of cyber solutions for critical government and enterprise data centers. This acquisition is expected to help the company expand in Europe and the Middle East.

The company is not profitable yet, not surprisingly, but seems well-positioned to grow with the help of its intellectual property portfolio and the expertise brought to the table by executives with many years of industry experience. On the back of making significant losses in 2021 as a result of weaker-than-expected demand and higher R&D costs, the company anticipates total revenue of $115 million in 2022.

Takeaway

There is no doubt that the cybersecurity industry is poised to grow exponentially in the next few decades. However, I have always found it difficult to find investment opportunities in this sector for one reason or the other (but mostly due to concerns about valuation). I will most certainly never invest in a young cybersecurity company at the time of its IPO, but I will keep an eye on Hub Cyber Security’s merger and post-IPO market reaction to identify a potential investment opportunity. The company has a very long way to go to establish itself as a leader in the confidential computing market that is likely to get crowded in the future so keeping a close eye on recent developments seems the best way forward for now.

Be the first to comment