IgorSPb

Investment Thesis

Cheniere Energy is one of the beneficiaries of the energy crisis in the world, including in the EU. The objective of the European countries to replace natural gas from Russia with imported LNG is conductive to long-term contracts. It’s noteworthy that despite decelerating world economic growth natural gas prices in USA and EU did not show significant contraction due to tight demand for LNG. Moreover, next 2 years Cheniere Energy will show significant rise of gross profit margin due to widening the drift between contract prices and the Henry Hub benchmark price. We stay positive on Cheniere Energy and now is good point to buy shares.

The LNG market

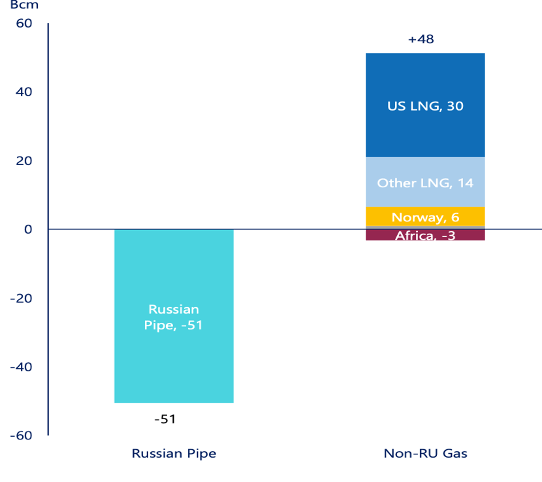

As 3Q 2022 wrapped up, the EU countries were able to substitute up to 50 bcm of Russian gas, mostly with LNG from the US, according to company’s data.

Cheniere Energy

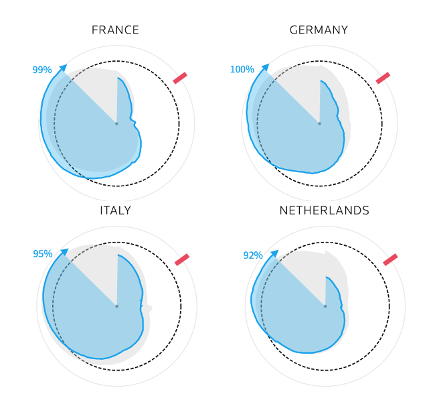

The intense race and struggle for any outside LNG supplies on the part of the EU helped TTF gas prices to reach the highest ever level in September, and gas storage facilities to be filled more than the recommended level of 85% of capacity, according to Reuters.

Reuters

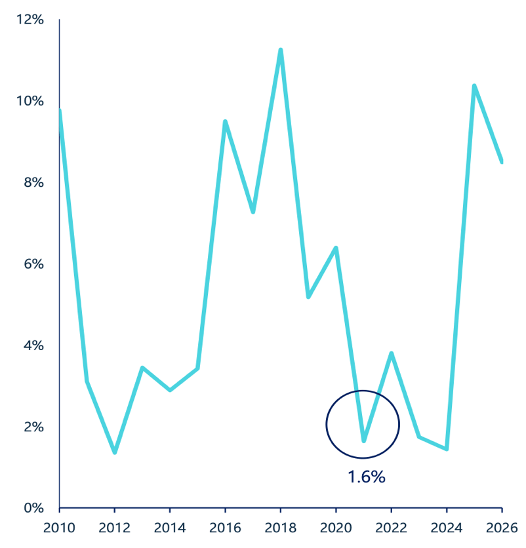

However, the next heating season could become critical for EU countries as it will be harder to come by free capacity required to secure supplies. That’s primarily because of China, which banned the resale of available LNG volumes to the EU so the Asian country can get ready for an incremental reopening of its economy in 2023 following coronavirus-related restrictions. Also, no substantial LNG projects are scheduled to start operating in 2023. According to Cheniere Energy, supply will increase by ~1.6% y/y.

Cheniere Energy

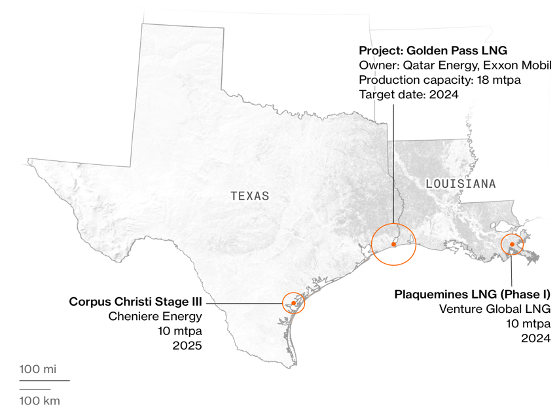

The next significant projects will start operating only in the US, in 2024-2025, according to Bloomberg, and we suppose their LNG supplies will be immediately locked down by the EU as part of its plan for an aggressive replacement of Russian gas.

Bloomberg

Gas prices and spreads

LNG prices across all segments averaged $779 a ton in 3Q 2022, in line with our forecast for $756 a ton.

Even as gas prices in the EU and the US slumped by 50% from their peak levels due to a warmer weather at the start of the winter season and a lower-than-expected demand for the commodity from industrial companies, we don’t expect a major downward revision of contract prices at Cheniere Energy.

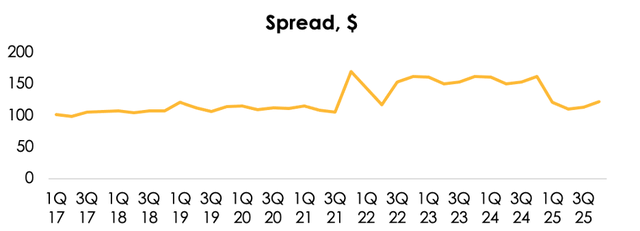

That’s mostly because of the widened spread that persists between the company’s selling price and the Henry Hub benchmark price as LNG continues to enjoy high demand while production capacity remains limited for the next two years. We have revised the spread from the average of $111 per a cubic meter to $147 per a cubic meter, and anticipate that it will return to its historical area of ~$111 per a cubic meter in 2025.

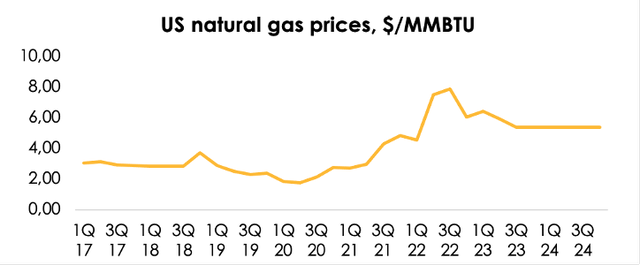

The wider spread makes up for the decline of price projections for the Henry Hub benchmark in 2022 from the average of $7 per MMBTU to $6.5 per MMBTU. The US Energy Information Administration expects the Henry Hub price to average $5.5 per MMBTU in November (down from the prior forecast for $9 per MMBTU), and rise to $6 per MMBTU in December with the onset of cold weather in the country. The EIA also reduced the gas price forecast for 2023 to an average of $5.4 per MMBTU for the year, compared with the previous estimate of $6.2 per MMBTU, as domestic production of the fossil fuel will rise while US exports will drop.

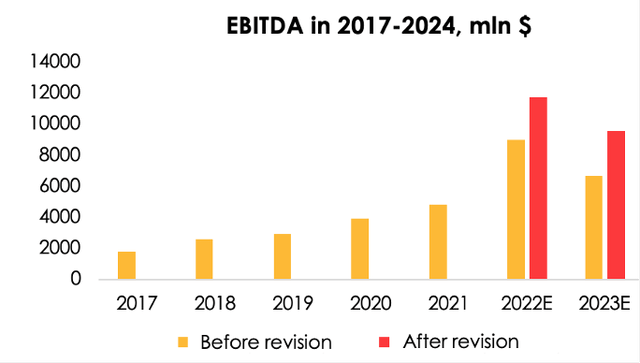

The COGS model and EBITDA

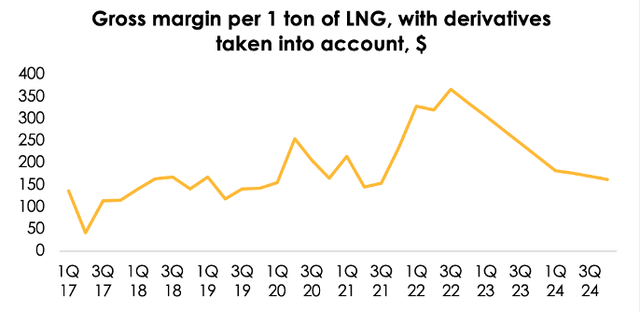

We earlier wrote that the company’s gross costs are fairly volatile, fluctuating from 52% to 152% in terms of their ratio to revenue (if derivative trading generates losses) and that, in general, the company succeeds in maintaining the average spread of about $200 per 1000 cubic meters between the selling price and costs. When computing the spread before, we used to take into account the periods without substantial losses or profits from derivative trading.

Now when computing the average production cost per 1 ton we take into account the profit/loss from derivative trading in COGS (net COGS). The basic approach to computing COGS – the use of the dollar-denominated margin – has remained unchanged. That approach gives a better understanding of the company’s real current gross margin per 1 ton of LNG. A higher spread in selling prices causes a higher spread in gross dollar-denominated margin. We expect gross margin per 1 ton of LNG to get back to normal in 2024 as well.

That approach gives a better understanding of the company’s real current gross margin per 1 ton of LNG. A higher spread in selling prices causes a higher spread in gross dollar-denominated margin. We expect gross margin per 1 ton of LNG to get back to normal in 2024 as well.

Valuation

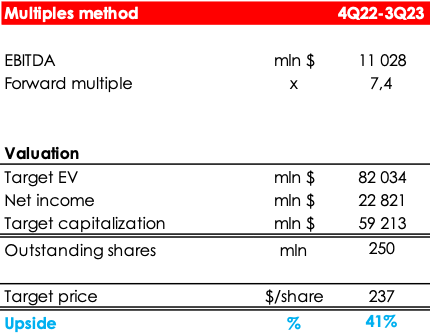

According to our estimates the fair value of LNG stock is $237. The upside is 41%.

Invest Heroes

Conclusion

We believe that shares of Cheniere Energy are undervalued by market participants. According to our estimates, future spread widening in contract prices in 2023-2024 is not priced in LNG stock, and it is time to buy LNG shares. Moreover, coming severe winter weather in the EU can increase the rate of gas outflow from storages that will support natural record gas prices despite a cap price.

The EIA and Bruegel data can be monitored to understand the economic situation.

Be the first to comment