noel bennett/iStock Editorial via Getty Images

The investment thesis

The article presents my hold thesis on Philip Morris (NYSE:PM). You will see that the thesis took into consideration its business outlook, risks, and also valuation. After its price bottomed in Q4 2021, the sentiment has reversed, and the stock reported encouraging business fundamentals and pricing power. Its 2022 Q1 earnings reported a 5.3% growth in net revenue PER UNIT, demonstrating its pricing power in the face of shipment volume decline. IQOS acquired more than 1 million users despite its exit from Russia.

Looking forward, I have little doubt that the demand decline for combustible products will keep creating a headwind. However, its long-term pricing power and the growth from these new products will be more than sufficient to offset the secular decline of its traditional products.

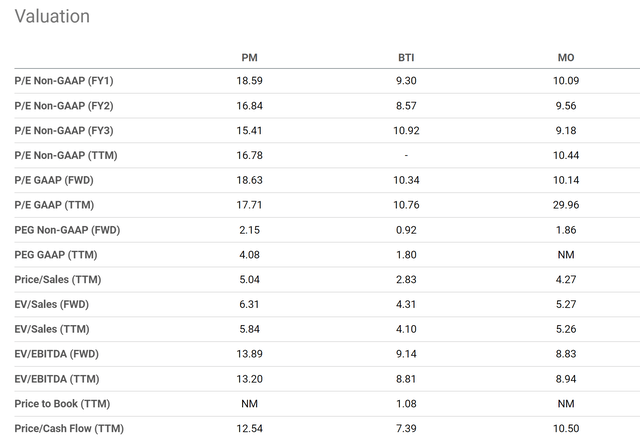

Finally, the stock is now in full valuation. Its 18.6x FW PE is about 9.5% above its historical average and is at about 85% to 100% premium relative to its peers such as Altria (MO) and British American Tobacco (BTI).

Strong technical signs

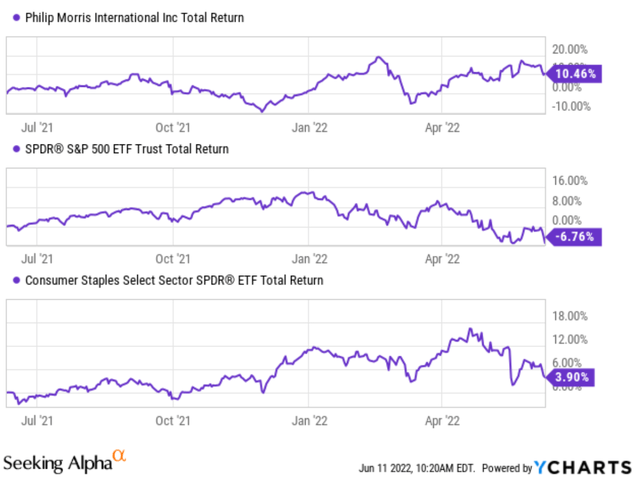

As you can see from the following chart, PM stock price suffered some volatilities and has bottomed in the 4th quarter of 2021 to as low as $85. Since then, its stock has rallied to the current level of $102 a share, a 20% appreciation. So far, PM has delivered a 1-year total return of 10.4%. In contrast, the S&P 500 has lost about 6.7%. In addition to beating the overall market, PM also outperformed the staples sector (which delivered about 3.9% of return) by more than 6.5%.

Even more telling is what has transpired YTD. The overall market peaked toward the end of 2021 and has lost more than 17% from the peak. Even the haven staples sector lost 6.3% YTD. While in contrast, PM’s price retained its upward advancement and rallied by more than 9.2% YTD. It is a classical sign of strong sentiment for a stock’s price to rally against the backdrop of a market-wide and/or sector-wide decline.

However, as we will see next, the rally is certainly supported by good fundamentals. But it has brought PM to a full valuation and leaves no margin of safety.

Business outlook

PM has delivered an overall positive Q1 2022 despite the exit from Russia, and it expects a robust full year ahead. Both topline and bottom line reported healthy organic revenue and EPS growth in Q1 2022. Net revenues grew 9% and adjusted diluted EPS grew 14% (on a currency-neutral basis). Two bright spots are of particular importance to me. First, net revenue PER UNIT grew 5.3%, demonstrating PM’s pricing power, over and over, to navigate flat shipment of its traditional products. And second, IQOS is another bright spot. IQOS acquired more than 1 million users over and reported 23% RRP pro forma organic net revenue growth.

Looking forward, I believe traditional cigarette volumes will continue to decline, and its heated products are well-positioned to offset such decline. Especially in the EU region (excluding Russia and Ukraine) and Japan, the heated products are gaining momentum. As CFO Emmanuel Babeau commented (abridged and emphasis added by me):

Our IQOS business delivered an excellent quarter, continuing the reacceleration seen last quarter as device supply constraints continue to ease.… RRP pro forma net revenues grew by 23%, with pro forma smoke-free net revenues over 30% of the total company. Importantly, pro forma HTU shipment volumes grew plus 18% compared to the prior year quarter. This reflects excellent progress in the EU Region, continued growth in Japan as well as over 50% growth in low and middle income markets. PMI HTUs are now the second largest nicotine brand in markets where IQOS is present as our efforts on innovation, portfolio and geographic expansion drive consumer trial and adoption. The impressive start for IQOS ILUMA continues in Japan and Switzerland, with very encouraging initial take-up in our latest launch market of Spain.

Valuation and expected return

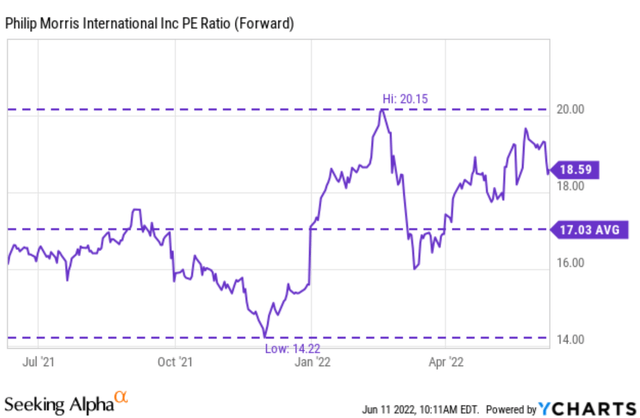

Despite the sable business fundamentals, the stock is now fully valued or even slightly overvalued given the sizable rally in the past year or so. The chart below shows its historical FW PE multiples. As you can see, in the past decade, its FW PE has been on average 17x and has fluctuated from a low of 14.2x to a peak of 20.1x. Currently, it is valued at 18.6x FW PE, nearly 9.5% above its long-term historical average.

When compared to its peers like Altria and British American Tobacco, it’s also trading at a substantial premium as you can see from the second chart. Its FY1 PE of 18.6x is almost 200% of BTI and 180% of MO. I view such large premiums difficult to justify given their similar business models and the many common risks they face.

Final thought and risks

PM has enjoyed positive sentiment and also solid fundamentals in the past year or so. Its stock price staged a robust rally against the backdrop of an overall market and sector decline. Its business outlook is robust given its pricing power and the success of its new smoke-free products. I share management’s outlook that the growth from these new products will be more than sufficient to offset the secular decline of its traditional combustible products.

However, the stock is now fully valued or even slightly overvalued. Currently, its 18.6x FW PE is about 9.5% above its long-term historical average, and almost 2x higher than BTI and MO. I view such a large premium difficult to justify.

Finally, risks. The Russian/Ukraine situation represents a substantial near-term risk. The immediate financial impact is not that large and estimable. However, the implications in terms of regulations, operating environments, and supply chain interruptions are harder to estimate and will be more persisting, as CEO Jacek Olczak commented below:

It is also clear that we cannot continue business as usual in light of regulatory and supply chain disruption, which has already impacted the Russian business in Q1. We have taken concrete steps to scale back our operations, such as the cancellation of all new investments and product launches, including IQOS ILUMA and IQOS VEEV.

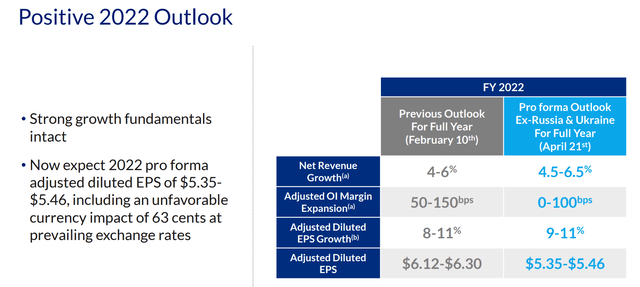

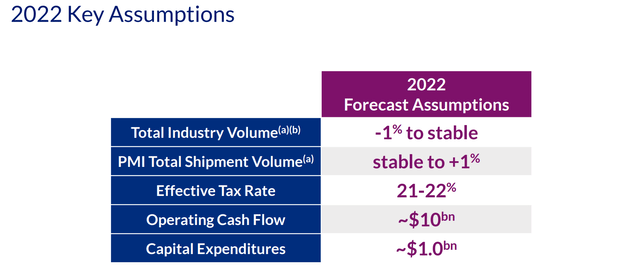

Its 2022 guidance is also based on several key assumptions. As aforementioned, total shipment volume is expected to stay flat or slightly decline, which is a secular trend I expect to continue. PM is dealing with semiconductor shortages and may not be able to completely fulfill IQOS demand. Finally, as a global business, PM is also susceptible to currency exchange rates. Its 2022 guidance includes an unfavorable currency impact of $0.63 under the current rates.

Be the first to comment