BalkansCat

Estée Lauder (NYSE:EL) is arguably one of the most profitable businesses in the consumer staples space that has also built one of the strongest global skin care brands and thus attracted a loyal customer base across the globe.

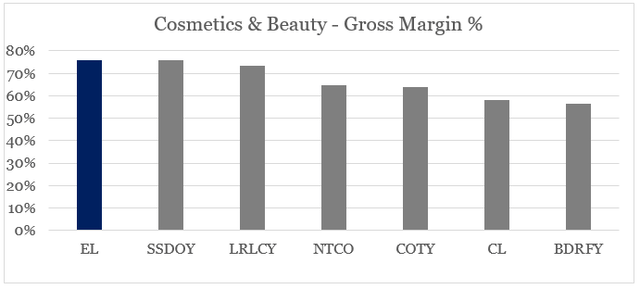

prepared by the author, using data from Seeking Alpha

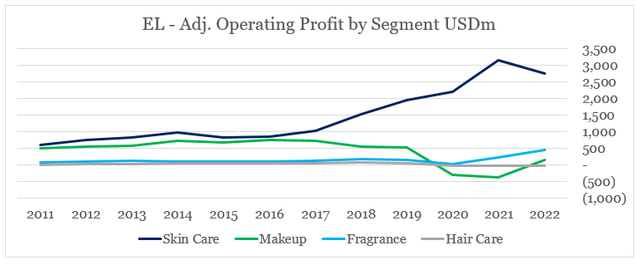

By, focusing almost exclusively on its high margin skin care business and pursuing growth initiatives in China, EL has been able to support its premium valuation for years.

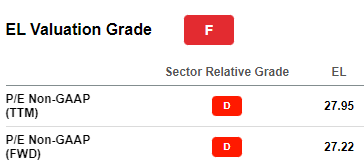

Seeking Alpha

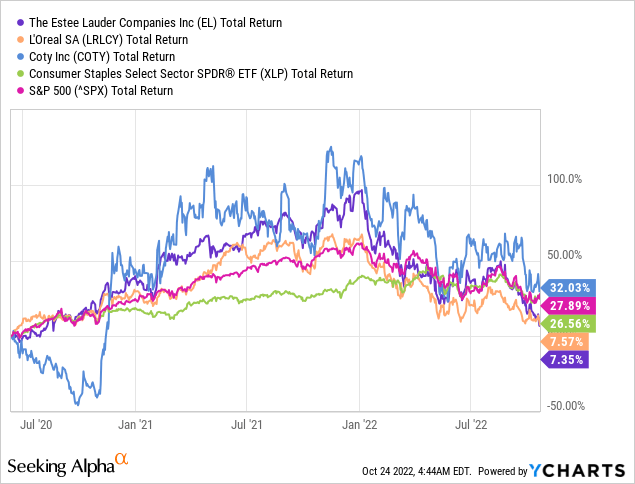

Back in the summer of 2020, however, I warned that in spite of the company’s strong standing, there are some important red flags related to its valuation and high product segment concentration. Competitive pressures were also on the raise within the lucrative skin care space.

This led to the company now significantly underperforming the broader equity market as well as the consumer staples sector as a whole.

Not surprisingly, supply chain disruptions and inflationary pressures have been to blame for this lacklustre performance. These, however, represent only part of the story around Estee Lauder and I have reasons to believe that the company is not yet an attractive opportunity.

The Set Up

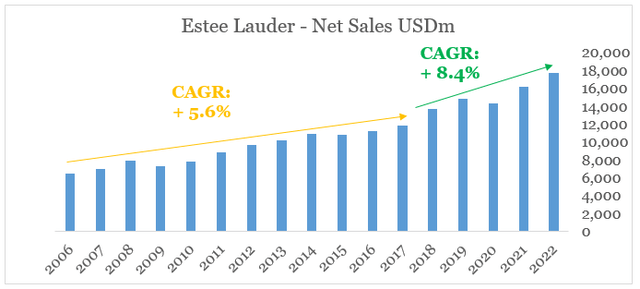

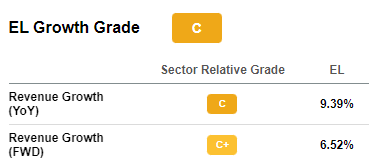

On a historical basis, the past few years for Estee Lauder, and 2021 in particular, seem more like an anomaly. This was caused by significant sales momentum that saw annual growth accelerating from 5.6% for the 2006-17 period to 8.4% during the past 5 years.

prepared by the author, using data from SEC Filings

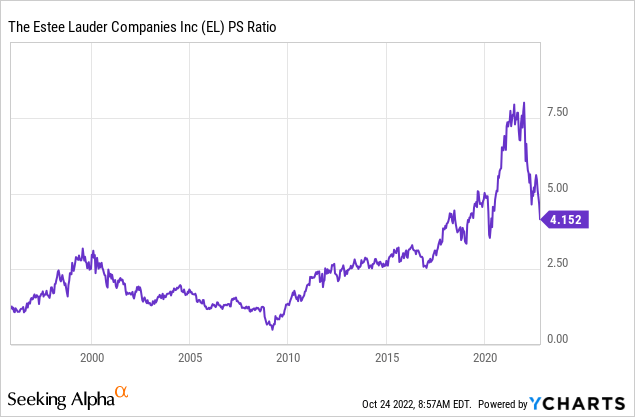

As a result, Estee Lauder’s Price-to-Sales ratio briefly increased above 7.5 and still remains above the levels seen when the company was growing at more moderate rates.

Expected topline growth, however, is moderating and the recovery of the Chinese business remains uncertain.

Seeking Alpha

For the past fiscal year, La Mer, Bobbi Brown and Clinique brands were the main growth drivers of Estee Lauder as travel retail business in China has been recovering.

Reported skin care net sales increased in fiscal 2022, primarily reflecting incremental net sales attributable to the increase in our ownership of DECIEM in the fiscal 2021 fourth quarter and higher net sales from La Mer, Bobbi Brown and Clinique, combined, of approximately $837 million. Net sales from La Mer increased, led by our travel retail business and mainland China (…)

Source: Estee Lauder 10-K SEC Filing 2022

On the contrary, the company’s iconic skin care master brand experienced a sharp decrease that I noted back in the summer of this year.

Partially offsetting the fiscal 2022 increase in skin care net sales were lower net sales from Estée Lauder and Origins of approximately $528 million, combined. The decrease in net sales from Estée Lauder and Origins reflected the challenges due to the resurgence of COVID-19 cases in Asia during the second half of fiscal 2022, which led to restrictions to prevent further spread of the virus.

Source: Estee Lauder 10-K SEC Filing 2022

This is now causing speculations that Estee Lauder should be back on track once China fully reopens from its strict lockdown measures. However how and when will mainland China fully reopen remains highly uncertain. Not only that, but the global demand for travel retail cosmetics and premium skin care products is overshadowed by geopolitical tensions and consumers faced with rising costs of living. All that while competition in the skin care space is on the rise as well.

This environment creates significant risks for EL, which relies almost exclusively on its skin care products and is also heavily exposed to the troubled Chinese market.

prepared by the author, using data from SEC Filings

With margins in skin care likely to remain under pressure for the time being, makeup and fragrance business units will need to fill in the gap, however, they remain too small in size to compensate for lower profits in skin care.

The Issue

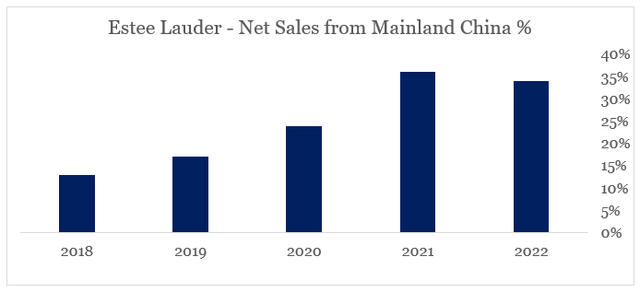

As I noted above, high exposure to the Chinese market could quickly turn from a major growth driver to a major problem for Estee Lauder. The company’s share of net sales coming from this one market has grown form 13% in 2018 to 34% during the fiscal year 2022.

prepared by the author, using data from SEC Filings

Not only that, but for such a large enterprise, Estee Lauder also relies heavily on one customer within this market which accounts for 13% of the company’s consolidates sales for the past fiscal year.

Our largest customer in fiscal 2022 sells products primarily in China travel retail and accounted for 13% of our consolidated net sales for fiscal 2022, 14% for fiscal 2021 and 7% for fiscal 2020, and 24% and 10% of our accounts receivable at June 30, 2022 and 2021, respectively.

Source: Estee Lauder 10-K SEC Filing 2022

While sales to this customer decreased slightly in fiscal year 2022, EL’s receivables from this same entity more than doubled.

This customer accounted for $2,232 million or 13%, $2,278 million or 14% and $1,031 million or 7% of the Company’s consolidated net sales for the year ended June 30, 2022, 2021 and 2020, respectively. This customer accounted for $399 million, or 24%, and $179 million, or 10%, of the Company’s accounts receivable at June 30, 2022 and 2021, respectively.

Source: Estee Lauder 10-K SEC Filing 2022

This highlights not only the significant geographical and credit risk that EL is exposed to, but also the exceptionally high bargaining power of this Chinese customer in its ability to delay accounts receivable.

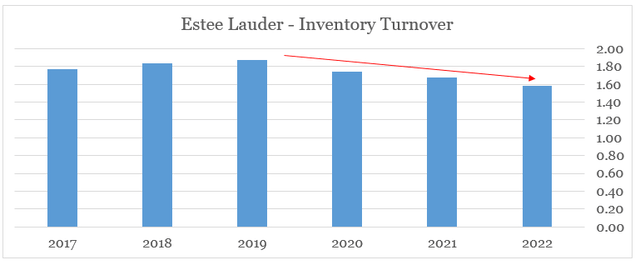

In addition, EL working capital requirements have also been under pressure as the company needs to pile up more inventory to cope with ongoing supply chain disruptions.

prepared by the author, using data from SEC Filings

These higher working capital requirements will likely persist for much longer than currently expected and with that EL’s free cash flow could remain under pressure.

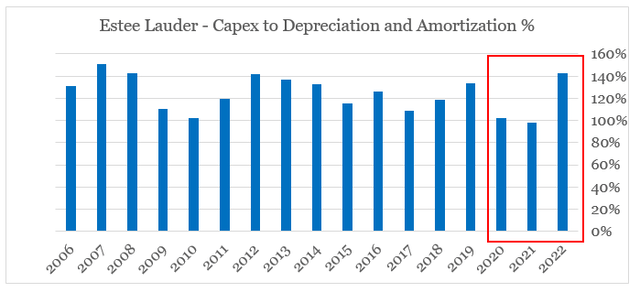

But this is not the only free cash flow headwind that EL could face in the coming years. The company will also need to keep its capital expenditure high as it needs to make up for the much lower capex during the 2020-21 period.

prepared by the author, using data from SEC Filings

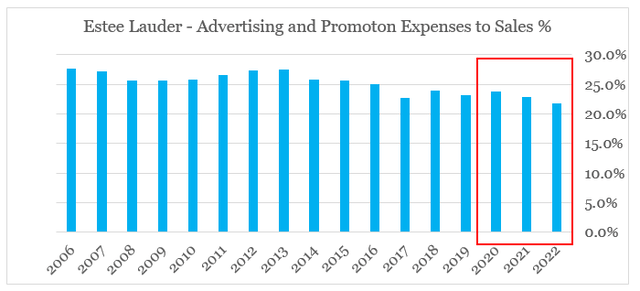

As we saw in the previous section, margins have also been under pressure and in response to that EL’s management has been reducing the level of advertising and promotion expenses, which are necessary in for the long-term health of its brands.

prepared by the author, using data from SEC Filings

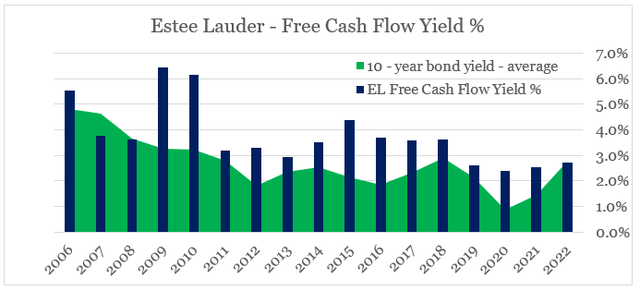

Having said all that, EL free cash flow is highly likely to remain under pressure for the time being. This is a major issue since the company now trades at around 2.7% free cash flow yield which is not only at one of its lowest levels historically, but also is at-par with the average yield of the 10-year government bonds.

prepared by the author, using data from SEC Filings

Conclusion

Estee Lauder’s case clearly illustrates why highly profitable businesses with strong brands in their portfolio are not always attractive investment opportunities. Management decisions and heavy reliance on certain product and geographical markets created major risks for shareholders. Even though the share price is now nearly 50% off its 2021 highs, it is not yet in buy territory.

Be the first to comment