Khanchit Khirisutchalual

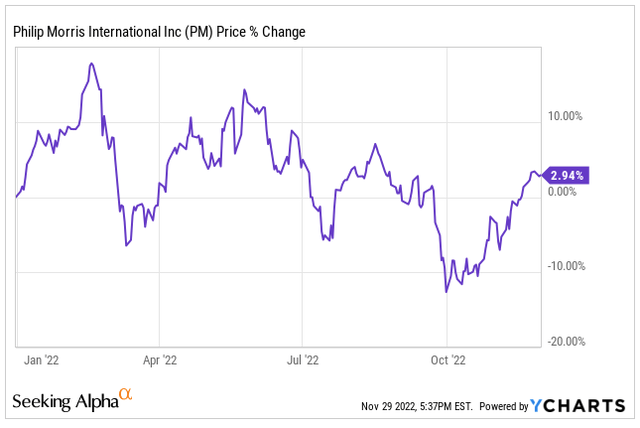

On the year, shares of Philip Morris International Inc. (NYSE:PM) have squeaked out a 3% gain thus far. However, with cigarette volumes continuing to decline around the globe combined with governments looking to go after big Tobacco companies, is PM still a worthwhile investment to have right now?

Big tobacco companies like PM and Altria Group (MO) have been popular stocks among the dividend income crowd, as they both possess high dividends.

Over the past three years, on a total return basis, Philip Morris has a total return of 40% compared to the S&P 500’s 31% return.

However, investors have become a little more concerned with the safety of the dividend moving forward.

The Dividend Seems Safe… So Far

Recently, PM released their Q3 earnings. They saw adjusted EPS come in at $1.53 compared to analyst expectations of $1.36, easily beating those expectations. As for revenues, PM generated Q3 revenues of $8.03 billion, beating analysts’ expectations of $7.3 billion.

The company also reaffirmed their full year pro forma adjusted EPS guidance of $5.22-$5.33.

In September, the board of directors increased the dividend to $5.08 per share, which was an 8% increase. The current dividend yield for PM currently sits at 5.2%.

Looking at the middle range of the end of year guidance, this would equate to a payout ratio of 95%.

Obviously, a stock payout ratio above 90% (that is not a REIT) is instantly a red flag for dividend investors and something to keep close watch of, so I can see why investors have their concerns.

That is the payout ratio using earnings, but dividends are paid from free cash flows (“FCF”), similar to debt, so it is important to look at both of these things when assessing the safety of a dividend.

Over the past 12 months, PM has generated FCF of $10.7 billion, which equates to $6.91 per share. As such, the FCF payout ratio is 74%, a much more reliable percentage.

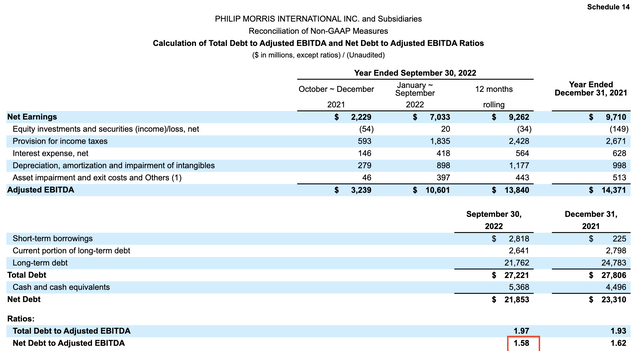

In terms of debt, PM currently has a long-term debt balance of $21.85 billion.

EBITDA over the trailing 12 months is $13.84 billion, which means the company’s debt to EBITDA ratio is 1.58x. This metric has improved since the end of last year, when it sat at 1.62x.

Based on this secondary metrics, the dividend seems plenty safe for the time being.

Innovation Is Heating Up

You think big tobacco, and really much of it is similar to your father’s tobacco company, meaning a lot has not changed over the years in terms of product offerings.

However, PM is changing that with its new heated tobacco products, IQOS, which they acquired from Altria Group for $2.7 billion. Not only are these new products sparking some growth for the company but they are supposedly “healthier” for the consumer as well.

IQOS has been growing at a strong clip for the company’s Heat Not Burn category, as those volumes were up nearly 22% in Q3.

During the most recent quarter, we saw the company report higher tobacco volumes of 0.6%, which is quite impressive considering the comparable quarter from a year ago during the pandemic, a time when tobacco volumes increased due to more isolation.

Another form of growth is coming within their acquisition of Swedish Match (OTCPK:SWMAY), now owning over 90% of the company. This was an intriguing acquisition, as it now adds the leading oral nicotine brand, Zyn, to their portfolio list, but more importantly, it once again gives them access to the U.S. market. This is something that has been lost for years since they spun off from Altria Group (MO).

Valuation Not Intriguing

There is no question that PM is doing a nice job of diversifying their product offerings and trying to appeal to the crowd in a different way. I personally do not think any of their new product offerings are going to draw in any non-smokers, but it may result in current customers trying different products.

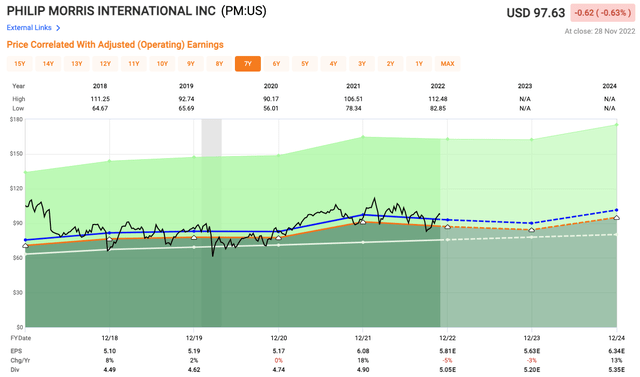

In terms of valuation, analysts are looking for PM to generate adjusted EPS of $5.63 in 2023, which would equate to a forward P/E of 17.3x. Over the past five years, PM shares have traded closer to an average earnings multiple of 16x.

Investor Takeaway

I like what Philip Morris International is doing in terms of diversifying their product offerings and moving more to the heated not burn products, which have been growing at a strong clip globally.

However, I still have concerns regarding organic growth. Growth is not necessarily coming from new customers, but what they do have on their side is pricing power, same thesis that goes with Altria Group here in the U.S.

Speaking of the U.S., that is going to take some time to come to fruition, but that is an intriguing long-term angle if you are an investor in PM.

I like Philip Morris International’s 5% dividend yield, but the lack of growth and long-term concerns regarding the stability of the dividend in addition to the valuation not being all that intriguing have me passing on shares of PM right now.

Be the first to comment