drnadig

A Quick Take On BKV Corporation

BKV Corporation (BKV) has filed to raise $119 million in an IPO of its common stock, according to an S-1 registration statement.

The firm is an integrated producer of natural gas and related fuels in the Barnett and Marcellus Shale regions of the United States.

I’ll provide an update when we learn more about management pricing and valuation assumptions for the IPO.

BKV Overview

Denver, Colorado-based BKV Corporation was founded to acquire, operate, develop, transport and generate power from natural gas and natural gas liquid fuel sources.

Management is headed by founder and Chief Executive Officer Christopher P. Kalnin, who has been with the firm since 2015 and was previously a senior executive at Level 3 Communications and a Strategy Advisor and Chief of Staff to the CEO at PTT Exploration.

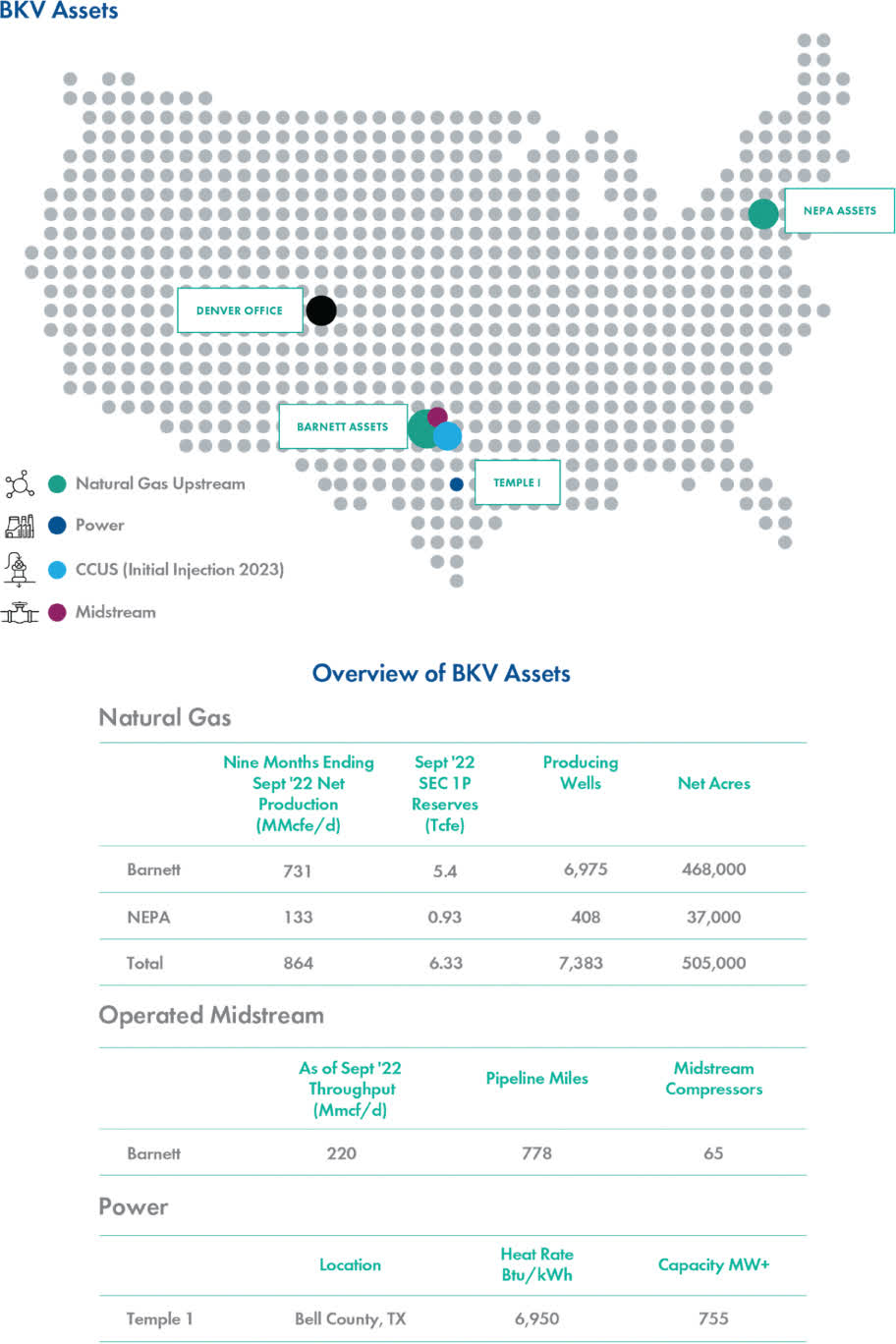

Below is a map and table of the firm’s drilling, midstream and power generation assets.

Company Assets (SEC)

As of September 30, 2022, BKV has booked fair market value investment of $1.05 billion from investors, including Banpu North America Corporation.

BKV’s Market & Competition

According to a market research report by the Dallas Federal Reserve, the Barnett shale is located in the Fort Worth/Dallas region encompassing 25 counties.

The formation has produced over 13 trillion cubic feet of natural gas since the first well was drilled.

The Marcellus Shale is located in the Appalachian region, from New York state through to Pennsylvania, Maryland, Ohio, Virginia and West Virginia.

Also, the formation has been the largest source of natural gas in the United States.

Major competitive or other industry participants include:

-

TotalEnergies

-

Lime Rock Resources

-

Chesapeake Energy

-

Repsol USA

-

Coterra Energy

-

Southwestern Energy

-

Others

BKV Corporation Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue

-

Variable operating profit

-

High but uneven cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Nine Mos. Ended September 30, 2022 |

$ 519,446,000 |

616.1% |

|

2021 |

$ 505,682,000 |

252.9% |

|

2020 |

$ 143,289,000 |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Nine Mos. Ended September 30, 2022 |

$ 8,120,000 |

1.6% |

|

2021 |

$ 20,323,000 |

4.0% |

|

2020 |

$ (9,907,000) |

-6.9% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Nine Mos. Ended September 30, 2022 |

$ 154,124,000 |

29.7% |

|

2021 |

$ (170,714,000) |

-32.9% |

|

2020 |

$ (43,806,000) |

-8.4% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Nine Mos. Ended September 30, 2022 |

$ 231,076,000 |

|

|

2021 |

$ 358,133,000 |

|

|

2020 |

$ (7,405,000) |

|

(Source – SEC)

As of September 30, 2022, BKV had $167.1 million in cash and $1.8 billion in total liabilities.

Free cash flow during the twelve months ended September 30, 2022, was $146.2 million.

BKV Corporation IPO Details

BKV intends to raise $119 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

we intend to use [an as-yet undisclosed amount] to repay in full the loan under the $75 Million A&R Loan Agreement with BNAC, [an additional amount] to make additional contingent consideration payments payable in connection with the Devon Barnett Acquisition and the remainder for other general corporate purposes, including to fund the expansion of our CCUS business.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said any legal matters currently at issue would not have a material adverse effect on its financial condition or operations.

The listed bookrunners of the IPO are Credit Suisse, BofA Securities, Barclays and other investment banks.

Commentary About BKV’s IPO

BKV is seeking U.S. public capital market investment to pay down debt for its corporate expansion plans.

The company’s financials have produced increasing topline revenue, fluctuating operating profit and high but variable cash flow from operations

Free cash flow for the twelve months ended September 30, 2022, was $146.2 million.

The firm currently plans to pay dividends according to a determination by the Board of Directors and subject to its various credit agreement requirements.

BKV’s trailing twelve-month CapEx Ratio was 1.87, which indicates it has spent significantly on capital expenditures as a percentage of its operating cash flow.

The market opportunity for extracting natural gas and NGL products from the Barnett and Marcellus Shale regions is large and expected to grow substantially due to increasing demand for cleaner fuel sources than existing sources such as coal.

Credit Suisse is the lead underwriter and there is no performance data on IPOs led by the firm over the last 12-month period.

Risks to the company’s outlook as a public company include the volatile price of natural gas prices as a result of geopolitical forces.

I look forward to learning more about management’s distribution expectations and about its pricing and valuation assumptions.

Expected IPO Pricing Date: To be announced.

Be the first to comment