spxChrome/E+ via Getty Images

Never compete with someone who has nothing to lose.”― Baltasar Gracian

Average wage gains have not kept up with inflation for 18 straight months now. The average consumer has lost approximately six percent of their buying power since the beginning of 2021 as a result. The personal savings rate is now at its lowest level since 2008 as consumers have dipped into savings to maintain their standards of living. Credit card debit is also rising at its fastest pace in two decades.

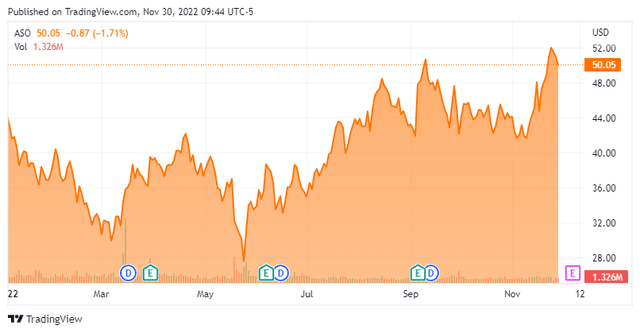

This has provided a difficult environment for the retailer sector in 2022. Today, we take a look at one of the few retailer plays that has beat expectations consistently this year and whose stock is up in the low teens this year despite a miserable year for the overall market. An analysis follows below.

Company Overview:

Academy Sports and Outdoors (NASDAQ:ASO) is based just outside of Houston, TX. This regional sporting goods and outdoor retailer has approximately 260 stores and three distribution centers in the southern and southeastern U.S., as well as ecommerce site www.academy.com. The stock currently trades around fifty bucks a share and sports an approximate market capitalization of $4.1 billion.

Second Quarter Results:

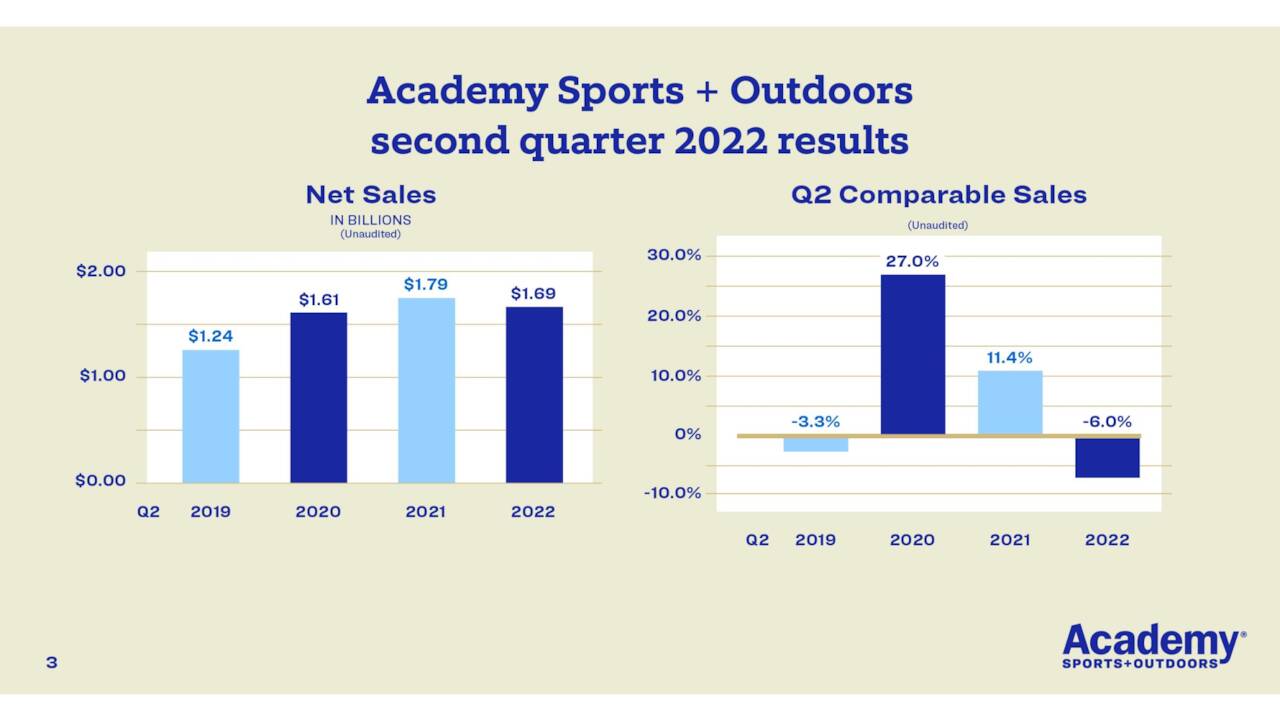

September Company Presentation

Academy Sports and Outdoors posted second quarter numbers on September 7th. The retailer had non-GAAP EPS of $2.30, a quarter a share above expectations. This was even as revenues declined 5.6% on a year-over-year basis to $1.69 billion, $10 million below the consensus. E-commerce sales did increase 12% from the same period a year ago and now make up 10% of overall revenues. It should be noted that Academy and most sporting goods retailers faced hard comps in FY2022 after the pandemic boosted sales significantly across the industry in FY2020 and FY2021. ‘Normalcy‘ should return in FY2023 in regards to comps.

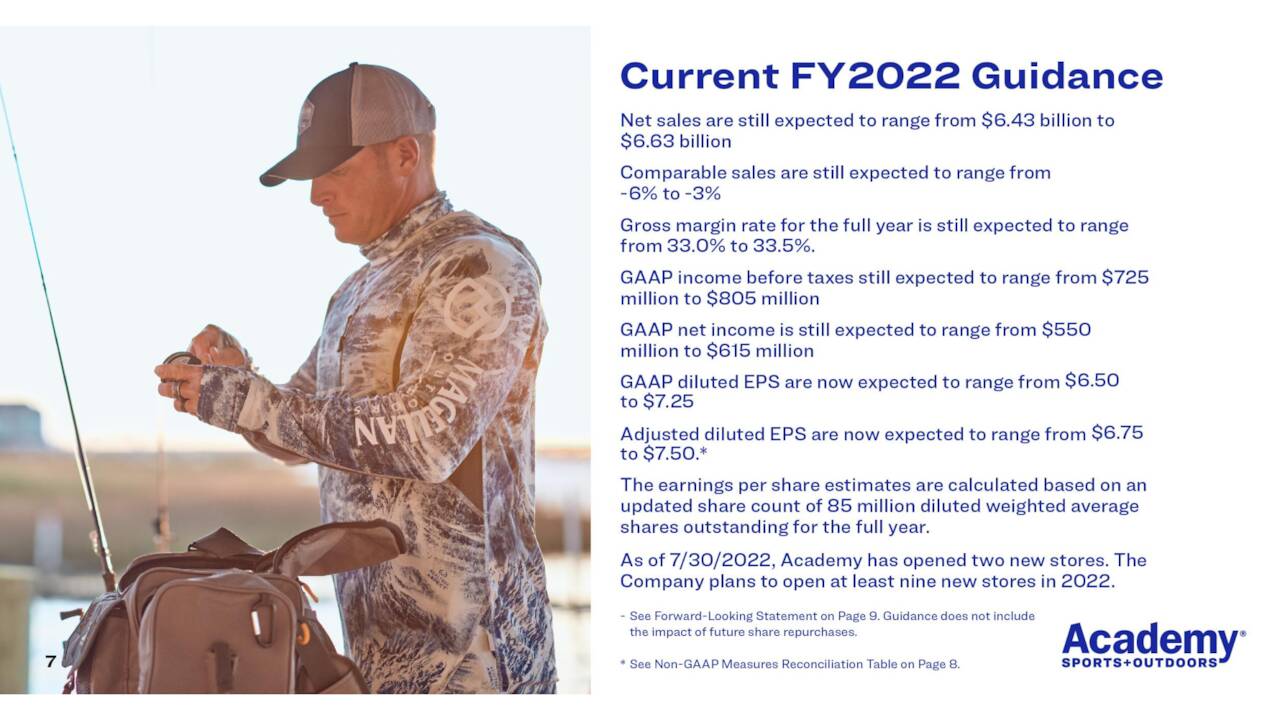

September Company Presentation

Management confirmed FY2022 sales guidance of $6.43 billion to $6.63 billion and raised its FY2022 EPS guidance to $6.75 to $7.50 a share from $6.55 to $7.25 a share previously.

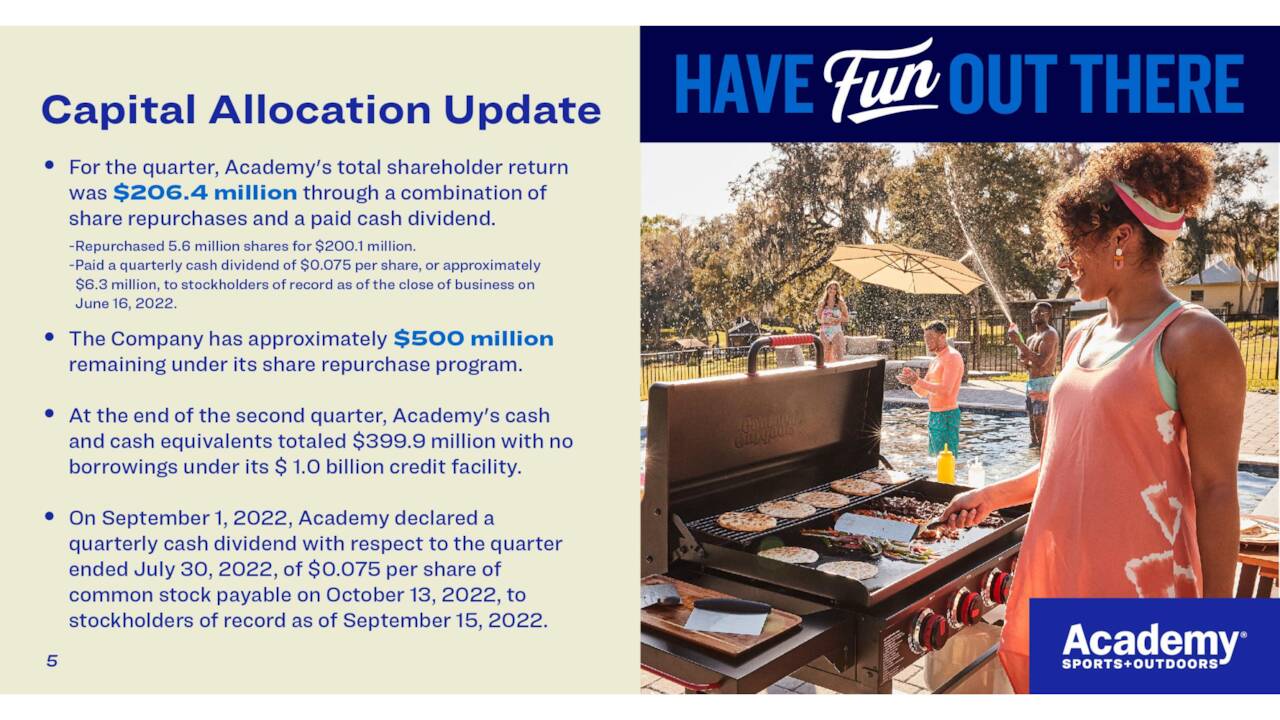

September Company Presentation

Analyst Commentary & Balance Sheet:

Since second quarter earnings posted, seven analyst firms including Goldman Sachs and Oppenheimer have reiterated or initiated Buy/Outperform ratings on Academy Sports and Outdoors. The majority of these contained upward price target revisions. Price targets proffered range from $53 to $60 a share. Morgan Stanley maintained its Hold rating and $54 price target on ASO. Loop Capital had this to say within their Buy initiation and $60 price target they issued on September 9th.

We think Academy’s recent resumption of new store openings could result in up to $2 billion of incremental annual revenue. We believe Academy has plentiful remaining margin expansion opportunities, and are encouraged by the company’s strong free cash flow, which is consistently returned to its shareholders through stock purchases and a recently enacted quarterly cash dividend.“

Approximately one out of every six shares of the outstanding float of the stock is currently short. There has been a noticeable pick up in insider selling in November with two insiders disposing of approximately $7.5 million worth of equity so far this month.

At the end of the second quarter, Academy had cash and marketable securities of approximately $400 million with no borrowings under a $1 billion credit facility. In addition, the company returned $206.4 million in cash to stockholders through a combination of share repurchases and dividends during the quarter. Most of this capital return was via $200 million worth of stock repurchases. The retailer still has $500 million left of an existing stock repurchase program. Net cash provided by operating activities during the second quarter was $161.3 million.

September Company Presentation

Verdict:

The current analyst firm consensus has the company earning on approximately $7.20 a share in FY2022 even as sales decline three percent to $6.56 billion. Revenue growth of five percent is projected in FY2023 with EPS increasing to $7.64.

The company has opened two new stores so far this fiscal year and now has 261 overall. It plans to open seven more by yearend and 80 to 100 over the next five years. As for valuation, the stock currently trades at approximately seven times forward earnings and just over 60% of annual sales. The shares are a bit cheaper if equating for net cash on the balance sheet. This is roughly in line with competitors like Hibbett (HIBB) which reported third quarter results yesterday. HIBB is down some 14% in 2022.

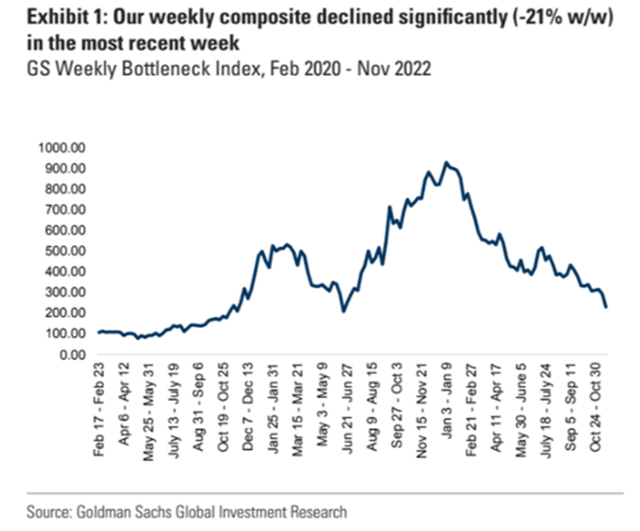

One positive as we head into 2023 is supply chain bottlenecks seems to be finally easing. Goldman Sachs proprietary supply chain tracker (above) continues to drop as do shipping rates. This is good news for most manufacturers and retailers such as Academy.

The recent spate of insider selling this month bears watching to see if it is just a blip for this month. That said, ASO even after an approximate 12% gain in 2022, seems like a reasonable value. Options are available against the equity and they are liquid. Therefore, I will continue to hold my stake within the stock via covered call positions.

Competition reveals the competent.”― Jeffrey Fry

Be the first to comment