Dr_Microbe

The U.S. Biotech Industry Rocked by the Takeover of Imago BioSciences by Merck & Co.

Imago BioSciences, Inc. (NASDAQ:IMGO), a U.S. biotech developer of innovative treatments for bone marrow cancer patients, will become part of the Merck & Co., Inc. (MRK) family under a recently announced agreement.

All outstanding shares of Imago will be sold to Merck for a total consideration of $1.35 billion or $36 per share, payable in cash.

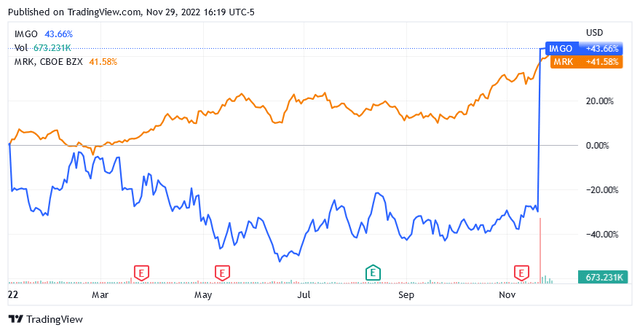

Following the announcement, IMGO’s share price has skyrocketed by over 100% and is now trading at $35.67 per share. Year-to-date, the stock is up 43.66%.

Shares of New Jersey-based drug giant Merck are up 41.58% so far this year at $108.84 as of this writing, versus a 12-month average price target of $109.61 and a mid-Buy rating.

Shareholders of the $59 billion revenue U.S. drug giant can expect this transaction to close sometime in the first quarter of 2023.

Imago will increase Merck’s presence in hematology, an area that is expected to grow steadily in the future.

Let’s take a closer look at Imago BioSciences, Inc., the subject of the transaction.

Imago BioSciences, Inc.

Based in Redwood City, California, Image BioSciences, Inc. is a biopharmaceutical discoverer and developer of innovative molecule-based treatments to target lysine-specific demethylase 1 (LSD1).

LSD1 is an enzyme involved in the production of blood cells found in the bone marrow. LSD1 is a major contributor to the process.

Imago states that it aims to improve the lives of patients with cancer and bone marrow diseases while increasing life expectancy.

The lead product candidate in Imago’s portfolio of products in development is Bomedemstat.

According to the company’s project, the aim is to bring to market an oral treatment based on a small molecule LSD1 inhibitor targeting certain myeloproliferative neoplasms (MPNs).

Myeloproliferative Neoplasms

MPNs refer to a group of diseases in which the bone marrow of affected patients produces too many blood cells. The condition can cause an abnormal amount of red blood cells, white blood cells, or platelets. As a result, the thickness of the blood changes, and sometimes these abnormal cells don’t function the way they do under normal conditions.

The type of MPN affects the patient’s recovery or his/her response to the therapy. The age of the patient or his/her health general condition can also influence the response to treatment.

It is not uncommon for MPN patients to have an excellent prognosis. They will live long lives with proper medical treatment and monitoring while reducing complications to a small number.

Most patients are 60 years or older. The disease could have a genetic cause.

RARECAREnet classifies MPNs as a rare disease as it is estimated that approximately 2.2 cases of this cancer of the main bone marrow function occur each year out of 100,000 people or 0.0022% of the population.

Bomedemstat is currently in Phase 2 clinical trials as a potential therapy for the treatment of essential thrombocythemia, polycythemia vera and myelofibrosis, and significant advances continue to be made for each targeted cancer.

Patient enrollment for essential thrombocytosis has been completed, with each remaining patient expected to receive 24 weeks of treatment before the end of 2022, according to Imago BioSciences.

Thrombocythemia causes the bone marrow to produce excess platelets, preventing the blood from clotting normally. The condition becomes more severe in patients who need to take blood thinners because they have had angioplasty surgery for a heart attack caused by a blocked artery. Polycythemia vera causes the bone marrow to produce abnormally high numbers of red blood cells, which can lead to serious blood clotting problems when the blood thickens. Myelofibrosis leads to the formation of scar tissue, which takes the place of healthy bone marrow tissue.

Regulator’s Designations Held by Bomedemstat

As a potential therapy for the treatment of essential thrombocythemia, polycythemia vera and myelofibrosis, Bomedemstat has been given the following designations.

Orphan Drug and Fast Track Designation by the US Food and Drug Administration (FDA) and Orphan and Priority Medicines (PRIME) Designation by the European Medicines Agency (EMA).

Orphan drug designation is granted by the regulatory agency to a drug to use for the treatment of a rare disease or condition. Orphan drug status allows those who fund the development of the potential treatment to receive specific incentives, usually in the form of tax credits, if clinical trials qualify.

Fast Track means that if the drug is intended to treat a serious or life-threatening condition and addresses an unmet medical need, the drug under investigation is approved for expedited regulatory review. This designation facilitates the development of the drug.

PRIME increasingly supports the development of medicines when they target unmet medical needs. When medicines are promising and can help the patient to improve the quality of life significantly, the development plan is optimized, and evaluation is accelerated so that these medicines can be available to patients faster.

The Pipeline of Products Under Development: An Update

On Dec. 12, 2022, the company’s Phase 2 Study of Bomedemstat as a Treatment for Essential Thrombocythemia will have an oral presentation at the American Society of Hematology Annual Meeting. The company will also announce data on Bomedemstat for the treatment of myelofibrosis.

In the September quarter, Imago conducted relevant ramp-up activities for the next studies. These will be the following, scheduled for early 2023:

- Phase 3 of a pivotal study to evaluate the potential of Bomedemstat in the treatment of essential thrombocythaemia. The result of this pivotal study is expected to provide additional evidence, thereby confirming previous phases’ results that the treatment is safe for humans and effective in treating the disease. If successful, it will support the application to submit to the US Food and Drug Administration [FDA] for marketing approval of Bomedemstat.

- Phase 2 of a study to evaluate the potential of Bomedemstat in the treatment of polycythemia vera. Researchers will assess the treatment’s effectiveness in patients with polycythemia vera and collect more data on its safety.

Imago BioSciences in the Third Quarter of 2022

Imago BioSciences is not yet selling any treatment, so for the third quarter of 2022, it reported no revenue but instead a net loss due to the sustainment of operating costs.

Research and development expenses were $13.5 million, an increase of 55.2% over the prior year, primarily due to activities aimed at preparing phase 3 and phase 2 of the clinical trials for evaluating Bomedemstat in essential thrombocythemia and polycythemia vera, respectively. The company also bore expenses for ongoing clinical trials, as well as labor costs and fees for research and development personnel.

General and administrative expenses increased 37% year-over-year to $4.1 million in the third quarter of 2022, driven by higher labor costs associated with fees for attorneys, auditors, and other professionals.

As a result, Imago BioSciences reported a net loss of $0.50, missing analysts’ median forecast by $0.06.

The Financial Condition

As of September 30, 2022, Imago’s balance sheet reported cash and short-term investments of $178.4 million, a decrease of 18% from the last quarter of 2021.

According to Imago BioSciences’ third-quarter 2022 earnings report, the next entry in Merck’s vast portfolio should rely on its own financial resources, providing it with sufficient liquidity to support operations through at least 2025.

However, based on progress in the development of Bomedemstat and an accelerated regulatory review to gain marketing approval in the U.S. and Europe, Merck’s new asset could potentially be profitable well before 2025.

Data Bridge market research estimates that chronic blood disorders are on the rise in the population and will play a key role in the growth of the global hematology market over the next several years.

Merck & Co., Inc. Stock Valuation and Performance

Merck shares traded at $108.84 as of this writing, for a market cap of $272.56 billion and a 52-week range of $71.50 to $109.06.

Merck has a forward P/E Non-GAAP of 14.69 versus the sector median of 19.37.

The stock will pay a quarterly cash dividend of $0.73 per share on Jan. 9, resulting in a forward dividend yield of 2.7% as of this writing, versus the S&P 500’s dividend yield of 1.65%.

Merck’s financial results for the third quarter of 2022 were better than expected. Revenue rose ~14% year over year to $15 billion as sales of Keytruda, a cancer immunotherapy, beat analysts’ projections and accounted for 35.3% of total sales.

Gross margin for the quarter declined slightly, down 10 basis points YoY to 73.7%, and net income declined ~29% YoY to $3.25 billion. The deterioration reflects significant impairments of intangible assets following the acquisition of ArQule Inc., a developer of selective cancer therapeutics.

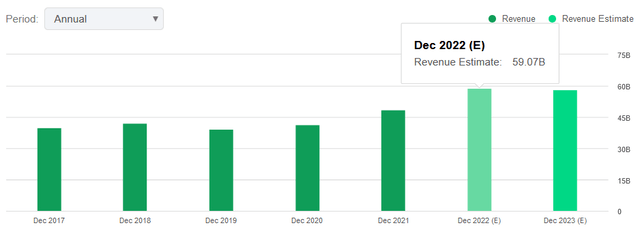

Looking ahead to 2022, Merck calls for revenue of $58.5 billion to $59 billion versus the consensus estimate of $59.07 billion.

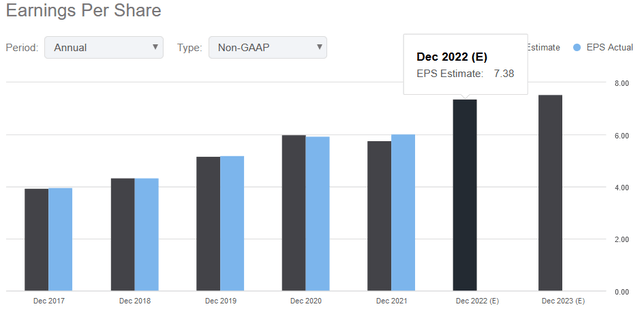

Also, it forecasts pro forma earnings per share in the range of $7.32 to $7.37 versus the consensus estimate of $7.38.

Conclusion

Imago BioSciences, Inc., a U.S. biotech developer of innovative therapies for patients with specific cancers of the bone marrow, will become the next division in Merck’s portfolio dedicated to hematology.

The transaction is valued at $1.35 billion, or $36 per Imago BioSciences share.

Imago BioSciences’ pipeline has made significant advances and now consists of treatments for essential thrombocythemia, polycythemia vera, and myelofibrosis that are on their way to market approval.

IMGO will be a nice addition to Merck, as hematology is seen as a fast-growing area of medicine.

Be the first to comment