Justin Sullivan

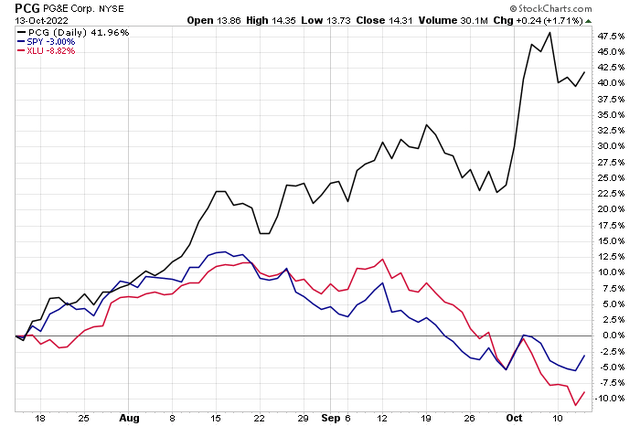

Utilities have been slaughtered over the last month, falling more than 20% from their September highs. That move is much worse than the S&P 500’s drop, which surprised some investors given that the Utilities sector typically outperforms during market turmoil. One high-profile utility has bucked the trend though, and the stock could be poised for even higher prices.

Last 3 Months: Utilities Hammered, PG&E Up Big

According to Bank of America Global Research, PG&E Corporation (NYSE:PCG) is the owner of the Pacific Gas & Electric Company, a regulated utility servicing 13 million people in a 70,000 square mile (about twice the area of Kentucky) service area in Northern and Central California. The utility has businesses in electric and natural gas distribution, electricity generation, procurement, and transmission, as well as natural gas procurement, transportation, and storage. Pacific Gas & Electric manages 5.2 million customer accounts and 4.3 million gas customer accounts.

The San Francisco-based $28.0 billion market cap Electric Utilities industry company within the Utilities sector trades at a high 185.8 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend yield, according to The Wall Street Journal.

The firm continues to improve operations following wildfire liabilities in recent years across California. Its management team has put PG&E on a path toward mitigating future risks, too. With a strong EPS growth outlook, ongoing natural disaster risk is decently compensated for. Downside risks aside from wildfires include unfavorable regulatory outcomes, rising interest rates, performance from Edison Energy, and other ESG concerns.

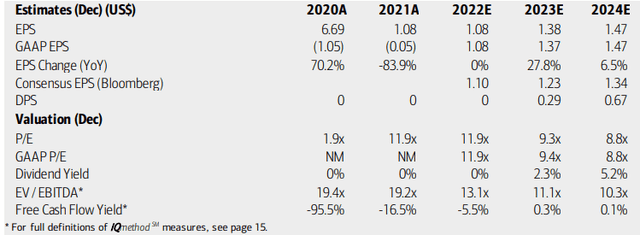

On valuation, analysts at BofA see earnings steady this year but then growing sharply in 2023 and reverting to a moderate rate in 2024. The Bloomberg consensus forecast is not as optimistic as BofA, but still solid.

What’s encouraging is that PG&E is expected to reinstate its dividend starting next year. Meanwhile, the firm’s operating and GAAP P/E ratios are at attractive levels this year, in aggregate, and looking ahead. Finally, free cash flow is not stellar but may turn positive in 2023. Overall, the valuation continues to look good.

PG&E: Earnings, Valuation, Dividend Forecasts

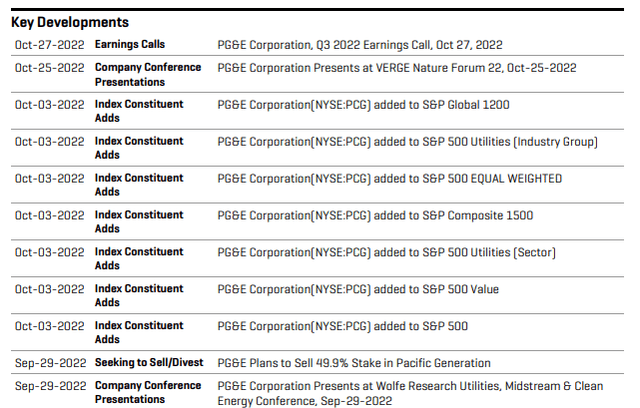

Looking ahead, PCG has a Q3 2022 earnings date on Oct. 27 with an earnings call immediately after results are announced. Before that, there could be share price volatility around its Oct. 25 presentation at the VERGE Nature Forum 2022 conference.

Key Corporate Events

The Options Angle

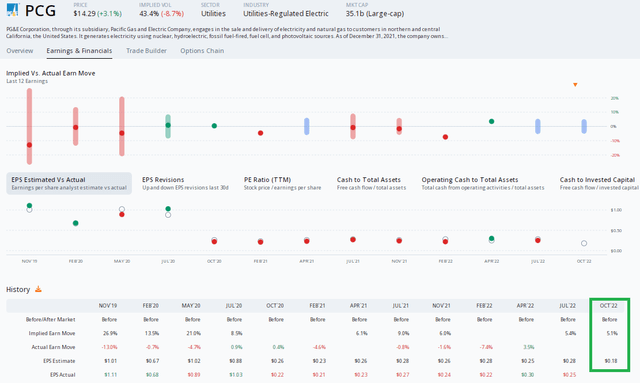

Data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $0.18 for PG&E’s Q3 report due out later this month. That would be a slight decline from the per-share profit amount reported in the same quarter a year ago.

Options data also reveal an expected stock price move of 5.1% using the nearest-expiring at-the-money straddle per ORATS. Take some caution into earnings as the stock has a poor EPS beat rate history.

PCG Earnings Preview

The Technical Take

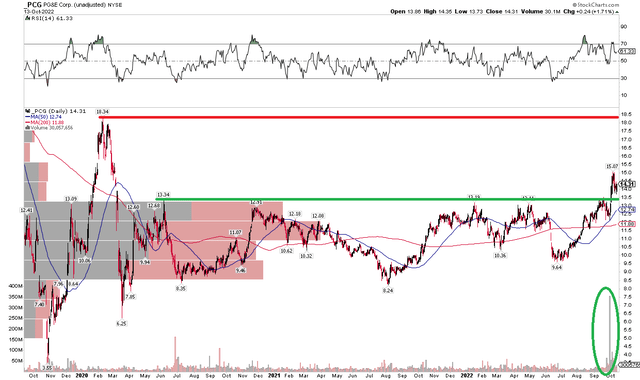

Since my last look at PCG, shares indeed broke out from their multi-year trading range. Notice the big volume spike around the bullish upside move, too. I see a potential next stop for the stock at its early 2020 peak north of $18.

On the downside, look for support at prior resistance near $13. What I like is the high amount of volume starting at $13, so shares should have natural demand on an approach of that spot.

A bearish indicator, though, is possible negative divergence between a new high in price and a lower high in the stock’s daily RSI as seen at the top of the chart. Keep your eye on that as it might portend a near-term drift lower in the stock price.

Overall, the stock is performing well on an absolute and relative basis, so it remains a technical buy.

PCG: Bullish Breakout But Possible Bearish RSI Divergence

The Bottom Line

With a still-solid valuation and favorable chart set up, I continue to like PG&E. Volatility could come later this month around its earnings report and as it presents at an industry conference.

Be the first to comment