hrui

Editor’s note: Seeking Alpha is proud to welcome B3 Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

This article was written in response to the significant drop in Algonquin Power & Utilities’ (NYSE:AQN) preferred shares (TSX:AQN.PRA:CA) (TSX:AQN.PRD:CA) on Oct. 11, 2022. My investment targets typically do not include preferred shares; however, I believe the price of the Algonquin’s preferred shares has fallen to levels where they have an attractive risk/reward profile.

Brief Background on Algonquin

Algonquin is an owner and operator of both regulated and non-regulated generation, distribution, and transmission utility assets. They generate most of their revenue from their U.S. operations, but also have revenue from Canada, Bermuda, and Chile.

The company has been on my radar for a number of years, but I never invested in it for two reasons:

- The alternative energy market is very cyclical. While this gives opportunities for trading, it wasn’t what I was looking for in a long-term investment.

- While it has an impressive series of acquisitions over its history, that has resulted in a significant increase in its share count.

In 2021 alone, AQN made six acquisitions and entered into a power purchase agreement with Meta. The company followed this up in 2022 with the New York American Water acquisition. Management also expects to close the Kentucky Power & Kentucky Transco acquisition in January 2023 if they receive regulatory approvals.

As a result of the 2021 investments, roughly $1.98 billion was spent on additions to property, plant and equipment and intangible assets and other long-term investments, and issued $0.99 billion in common shares. 2020 had a similar pattern with $1.47 billion spent, $0.82 billion in common share issuances, and $0.31 billion net increase in debt. While acquisitions can be accretive to existing shareholders through both incremental EPS and a diversification of risk, it also makes it more difficult to keep track of which assets you own as a shareholder.

Owning the preferred shares does not give you an ownership interest in the growth of the assets of the company. However, it does mean you can be less concerned about the specific assets of the company insofar as they are able to continue making their interest and preferred dividend payments.

What I Want From Preferred Shares

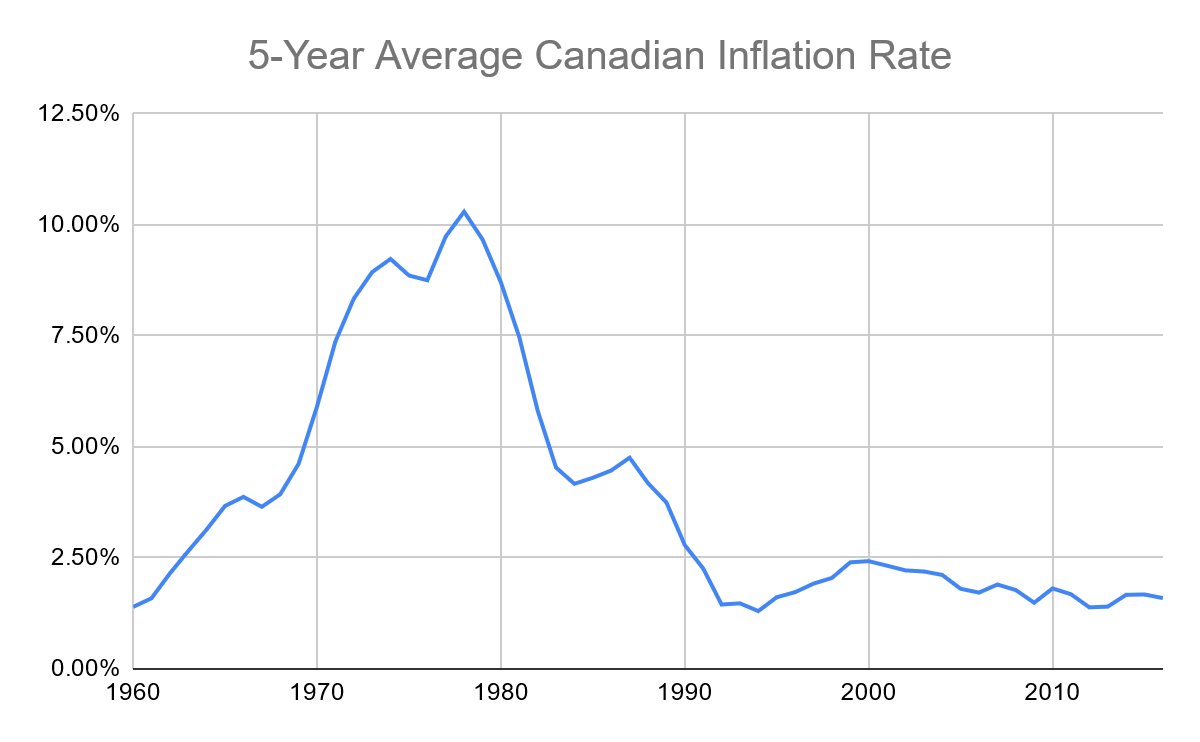

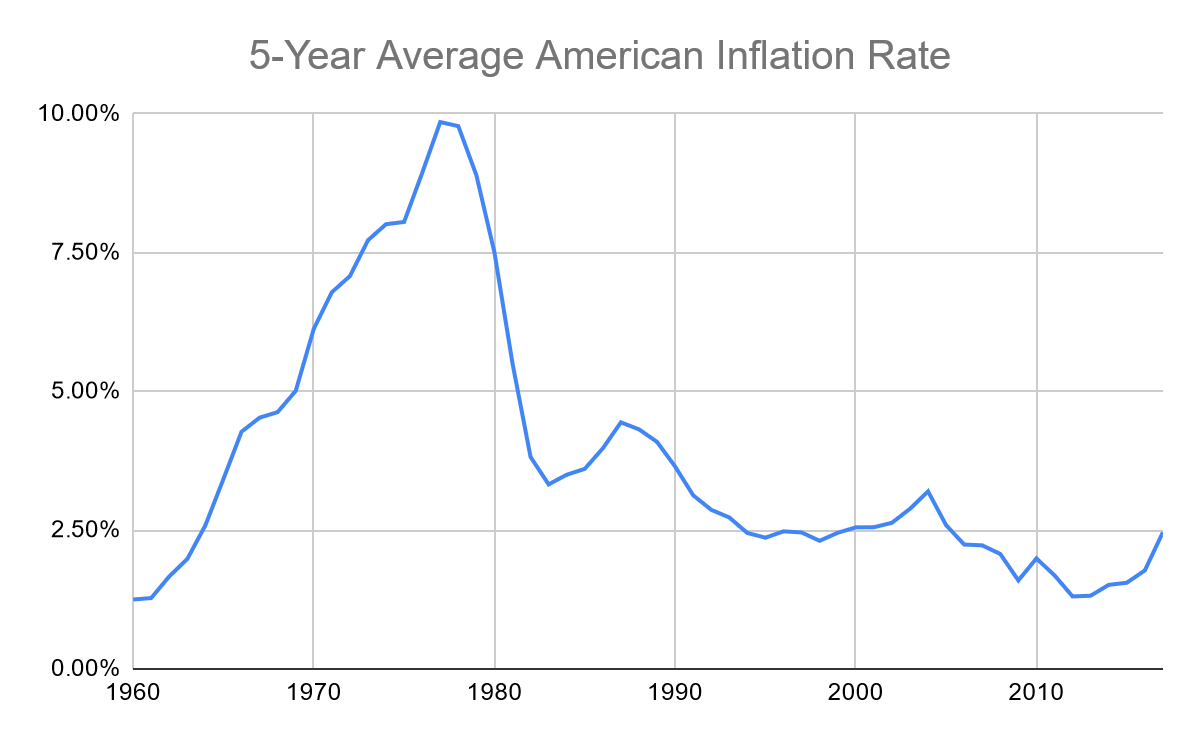

As a starting point, our goal for the investment is limited downside risk with sufficient growth to hedge against inflation risk. To start, let’s look at inflation in both Canada and the U.S. since 1960. Canada is included in this analysis because it’s where the Algonquin is based out of.

In Canada, since 1960, the highest per year inflation over a five-year period was 1978-82 at 10.30%. It was above 9.00% for four of 57 measured periods (7.0%). These were the rolling five-year periods of 1974-78 and between 1977-81 and 1979-83. The mean inflation rate was 3.86% and the median inflation rate was 2.41%.

Created by Author from macrotrends.net Inflation Data

In the U.S., since 1960 the highest per-year inflation over a five-year period was 1977-81 at 9.85%. It was above 9.00% for two of 57 measured periods (3.5%), from the five-year periods of 1977-81 and 1978-82. The mean inflation rate was 3.83% and the median inflation rate was 2.88%.

Created by Author from macrotrends.net Inflation Data

My target return on the preferred shares is to keep pace with the rate of inflation with a 95% confidence interval, so my target yield on the preferred shares is 9%.

There is no doubt that we are currently in a period of high inflation. I doubt, however, that inflation will be above the levels seen in 1977-81 for the next five years given the current position taken by the Canadian and U.S. Central Banks.

A Look at Algonquin’s Preferred Shares

|

Preferred Issuance |

Reset Date |

Reset Rate Mechanics |

Current Yield |

Reset Rate Estimate |

Yield at Reset |

|

AQN.PRA:CA |

31-Dec-23 |

GCAN5YR + 2.94% |

7.72% |

6.557% (3.617%+2.94%) |

9.586% |

|

AQN.PRD:CA |

31-Mar-23 |

GCAN5YR + 3.28% |

7.01% |

6.897% (3.617%+3.28%) |

9.330% |

In the table above, the current yield assumes if you held from today to Dec. 31, 2023, you’d get five dividends (December 2022, March 2023, June 2023, September 2023, and December 2023). The contractual language in the Preferred A prospectus indicates that the Dec. 31, 2023 payment would be at the new rate. Other websites have a lower forward yield as it excludes the final payment, but I have included it above as it reflects what you would expect to receive if you held the shares to the reset date. As per the Preferred Share Prospectus dated Nov. 2, 2012, page 9 (subscription required; also available on SEDAR):

‘Subsequent Fixed Rate Period’ means for the initial Subsequent Fixed Rate Period, the period from and including Dec. 31, 2018, to, but excluding, Dec. 31, 2023, and for each succeeding Subsequent Fixed Rate Period, the period commencing on the day immediately following the end of the immediately preceding Subsequent Fixed Rate Period to, but excluding, Dec. 31 in the fifth year thereafter.

Yield at reset assumes that the shares do not change in value. Under the assumptions above, the reset rate would be 6.557%, implying a $1.639 dividend on a $17.10 current share price. Both shares currently trade at a discount to the redemption price of $25 (Preferred A – 31.6%, Preferred D – 26.1%), providing further potential upside in addition to the dividend yield.

There is a risk that the five-year interest rate declines prior to the rate reset, lowering the yield at reset below our 9% threshold. That’s why I’d favor the Preferred A shares as they have a slightly shorter period over which the reference rate could decline. This rate reset occurring in 14 months also reduces the amount that the share price will decline if interest rates continue to rise, as the discount of the current coupon is over a relatively short period.

Another risk to consider when investing in these shares is the liquidity. The average volume is 2,000, which can make trading into or out of a position challenging and costly with the bid-ask spread currently sitting at $0.40, 2.35% of the share price. This makes this investment most suitable for those looking to buy and hold the investment for the long term.

Conclusion

After the recent significant decline in the share price, Algonquin’s preferred shares provide a reasonable risk-adjusted rate of return as a more conservative portion of a portfolio for those who are looking to buy and hold for the long term.

Be the first to comment