ridvan_celik

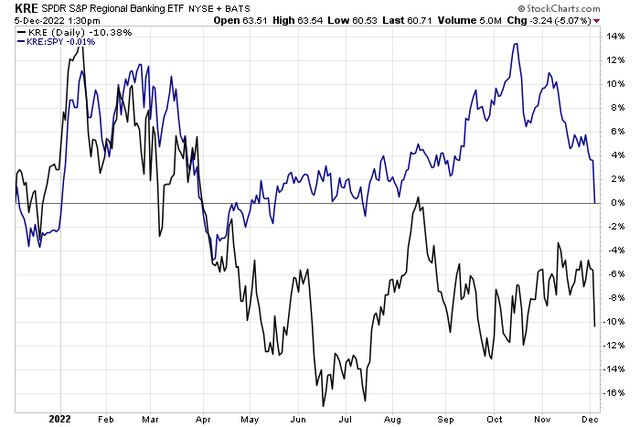

Regional banks have given back all of their 1-year relative gains against the S&P. A further inverting yield curve, driven by a drop in the U.S. 10-year yield has been bearish lately. Moreover, rising risks of a first-half 2023 recession could spell problems for regional banks that are tied to how the business cycle performs. Elevated credit losses and weaker loan demand, all while paying out more cash to depositors are net detractors.

The banks enjoyed higher rates earlier this year when they were generally able to keep deposit account yields low. Now, though, capturing 3% or more with negligible risk is commonplace. Let’s check in on the valuation and technical pictures with a popular regional banking ETF.

Regional Banking ETF Now Flat YoY Versus The S&P 500

The SPDR S&P Regional Banking ETF (NYSEARCA:KRE) tracks an index that follows the regional banks segment of the S&P Total Market Index. With its inception in 2006, the fund has grown and is a popular trading vehicle for exposure to an often highly volatile area of the Financials sector. KRE is a low-cost way to play U.S.-focused regional banks that are often small and mid-cap in size. Its annual expense ratio is just 0.35%, according to SSGA Funds.

The forward EPS growth rate over the coming three to five years is 8.4% while the 143-holding portfolio features a low forward price-to-earnings ratio of 10.7 as of December 2, per the fund’s website.

The weighted average market cap of KRE is $10.0 billion and the fund yields an above-market dividend rate of 2.3%. There’s also strong liquidity with KRE as its median 30-day bid/ask spread is just 0.02% and average volume is high above one million per day. Total assets under management are $3.1 billion. Overall, the cost is reasonable and the tradeability of KRE is good for day trades and longer-term positions.

The portfolio is equal-weighted, so there is strong diversification with the fund. Morningstar has KRE with just a 2-star rating with its historical risk-adjusted returns not being all that impressive relative to other funds in the same category. The ETF does have a silver rating from the research firm, though, due to its low cost and strong five “Ps.”

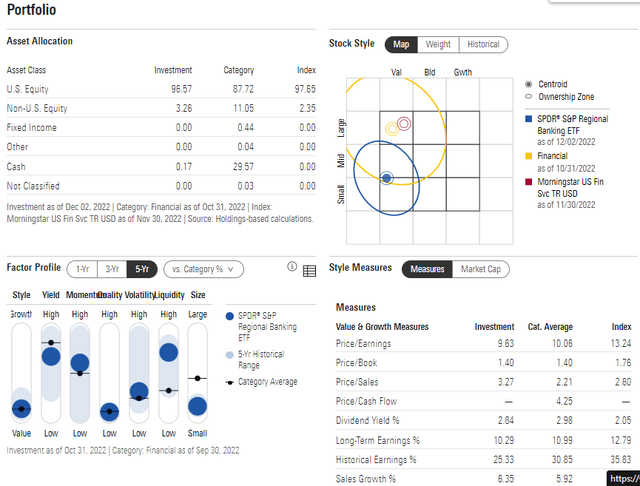

KRE Factor Analysis & Portfolio Statistics

Digging into the portfolio, KRE is on the border between a small-cap and mid-cap fund. Regional banks are very much in the value style, though. In general, the area benefits from rising interest rates, so it performed well relative to the market during the first three quarters of the year, but a recent drop in intermediate-term rates while short-term yields are high is not a favorable macro development for KRE’s holdings.

Other characteristics include low quality, somewhat low volatility, and somewhat high liquidity. The forward PEG ratio is under 1 using Morningstar’s long-term earnings growth rate of KRE, so that’s a good value.The top 10 holdings represent 21% of the fund.

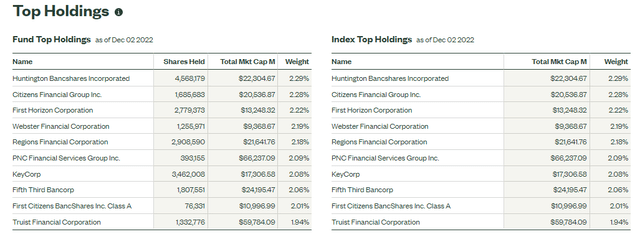

KRE Top Holdings: Diversification Through An Equal-Weight Approach

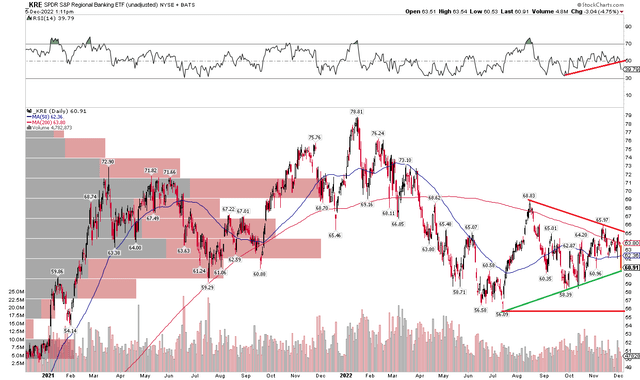

The Technical Take

While KRE is priced attractively, I see the fund right at key support. Notice in the chart below that the ETF has lost its upward momentum trend while the stock is hanging at an uptrend support line off its July low. Shares, while rising above the 200-day moving average on two occasions, failed to make new highs above the August peak on an attempt in November.

On Monday, the fund printed fresh 6-week lows. A break below $60 would trigger a bearish price objective to near $49 based on the size of the triangle consolidation pattern. First support comes in near the July low of $56.

KRE: Momentum Breaking Trend, Shares Could Be Next To Go

The Bottom Line

I like the valuation on KRE, but technical damage has been done. There could be downside momentum in the cards, but long-term investors can still hold KRE for its yield and value.

Be the first to comment