Alistair Berg

One of the biggest problems that American investors have is outsized exposure to the United States. On the surface, it seems as if having all or most of your money in the United States is not a bad thing, as the United States’ market has been outperforming most of the world for the past decade. In fact, almost anyone under age 35 has never known a true bear market.

However, there is no guarantee that this situation will last forever, and the fact is that the American capital markets are still substantially overvalued. This is true despite the fact that the S&P 500 index (SPY) is down 14.82% year-to-date. In addition, there is still a great deal of political division in the United States that presents risks to anyone that is heavily exposed to the United States. After all, who knows what will happen with taxes, regulations, and other things going forward that might have an impact on your investments?

Thus, it would make sense for anyone to have exposure to foreign markets in order to diversify away from some of these risks. As it can be difficult for Americans to obtain information about foreign markets, let alone trade in them, the easiest way to achieve this diversification is by investing some money into a closed-end fund (“CEF”) that specializes in global investments. This technique gets you exposure to an internationally diversified portfolio of assets run by a professional team that has more resources and expertise than most retail investors. In addition, many of these funds are able to boast remarkably high yields, which can be attractive for those depending on their portfolios for income.

In this article, we will discuss the Clough Global Dividend and Income Fund (NYSE:GLV), which is one fund that can be used for this purpose. I have discussed this fund before, but more than a year has passed since that time, so obviously a great many things have changed. This article will focus specifically on these changes as well as provide an updated analysis of the fund’s financial condition. Therefore, let us continue and see if this 14.41%-yielding fund could be right for a portfolio today.

About The Fund

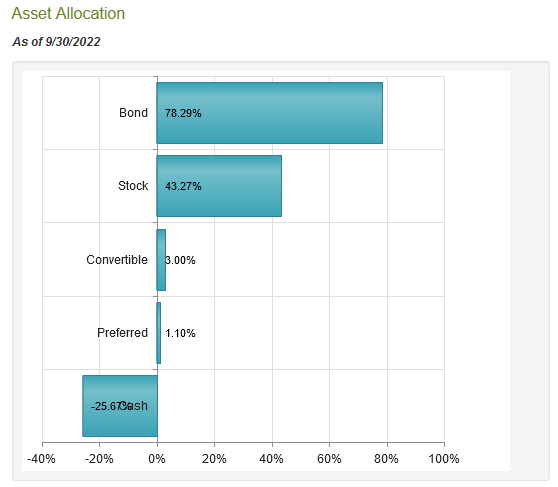

According to the fund’s webpage, the Clough Global Dividend and Income Fund has the stated objective of providing a high level of total return. This is something that we commonly see as the primary objective for closed-end funds, considering that most people invest in financial securities in the hopes of getting both income (through interest or dividends) and capital gains. However, it is somewhat rare to see this as the stated objective for a non-equity fund. The Clough Global Dividend and Income Fund actually invests in both common equities and fixed-income securities:

CEF Connect

The fact that the fund invests in both fixed-income and equity securities could prove to be an advantage over other funds that only invest in one or the other. This is because fixed-income securities, specifically bonds, tend to be much safer than common stocks. There are a growing number of signs that the United States, along with the rest of the world, will soon be entering a recession. This, in fact, seems to be the goal of many central banks around the world, as they have been raising interest rates to combat inflation. However, in so doing, they are making it more expensive for businesses to obtain money to grow and expand. This slows down the economy, which is ultimately the cause of recessions. The Federal Reserve, for its part, has implied that it is actually trying to push the United States into a recession in order to defeat inflation. We have not heard such statements from other central banks, but it seems likely that will be the result.

A recession tends to have a negative impact on corporate profits, since people spend less money due to uncertainty. This will generally result in declining stock prices, which we have already seen over the course of 2022. However, fixed-income securities are less susceptible to this, since issuing companies still have to pay their obligations to creditors. Thus, they tend to be somewhat safer securities to hold during difficult economic times.

Unfortunately, bond prices tend to vary inversely with interest rates. Thus, when interest rates rise, bond prices fall. This is something that will likely prove to be a drag on the fund’s performance for a while, since the world’s central banks are likely to keep raising interest rates until inflation is brought under control. This will cause the value of the bonds held by the fund to decline, which will likely also drag down the market price of the fund. While it is possible that the fund will be able to offset this with gains in its stock portfolio, that is by no means certain to be the case. The fund is already down 29.66% year-to-date and likely has further to fall. It therefore might make some sense to dollar cost average so as to minimize your own unrealized losses until the market turns back toward the fund’s favor.

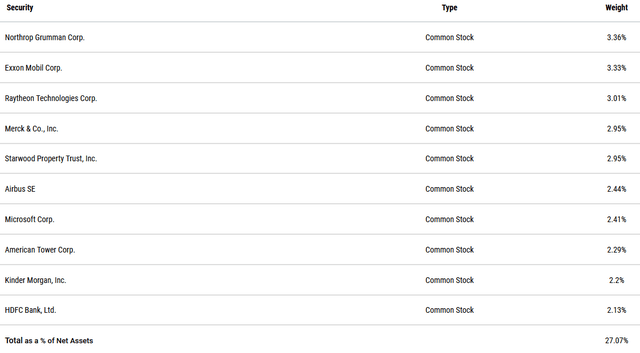

Despite being a global fund, the majority of the Clough Global Dividend and Income Fund’s largest positions are American companies. Here they are:

In fact, the only two companies here that are not American firms are Airbus SE (OTCPK:EADSF) and HDFC Bank Ltd. (HDB). This unfortunately goes back to one of the biggest problems that I had with the fund the last time that we looked at it. In short, the fund was heavily weighted toward the United States. This is still a pretty significant problem, as the fund currently has 114.81% of its assets invested in the United States, which is quite a bit above the level that it had a year ago. At this point, there may be some readers that question how the fund can have more than 100% of its assets invested in one single country. The reason for this is that the fund is using leverage, which we will discuss later in this article. It also has a net short position in Canadian, German, and Japanese securities.

As the fund received the payment from selling these securities short, it has extra money to invest in American securities. In fact, it is investing nearly all of these funds in American securities since the highest weighting apart from the United States is the 2.68% of assets invested in the Netherlands. Thus, at the moment this looks like this is only a global fund because it is betting against the rest of the world in favor of the United States. That is certainly not what we want to see if we are aiming to diversify our assets globally.

The fund has changed its positions significantly since the last time that we looked at it. In fact, out of all ten of the largest positions, the only two that were on the list a year ago are Microsoft (MSFT) and Raytheon Technologies (RTX). This would undoubtedly lead one to believe that the fund has a very high turnover and does a lot of trading. This is certainly the case, as its annual turnover is 147.00%. This is something that can be problematic since excessive trading creates a drag on the fund’s performance. The reason for this is that trading stocks or other assets cost money, which is billed directly to the fund’s shareholders. Management will, therefore, need to generate sufficient returns to cover these added costs as well as deliver a return that is acceptable to the fund’s shareholders.

This is, to put it mildly, very difficult, and this is the reason why many actively-managed high-turnover funds struggle to outperform index funds. In addition to this problem, constant stock trading will result in a lot of capital gains, which means that the investor has to pay more in taxes. Of course, this second concern is not a problem if the fund’s shares are held in some sort of tax-advantaged vehicle, like most retirement accounts.

One thing that is rather nice to see though is that the fund is not particularly heavily-weighted toward any individual asset. As my regular readers on the topic of closed-end funds are likely well aware, I do not like to see any individual asset in a fund account for more than 5% of the fund’s portfolio. This is because this is approximately the point at which the asset begins to expose the portfolio to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification but if an asset accounts for too much of the portfolio, then this risk will not be completely diversified away. Thus, the concern is that some event may occur that causes the price of a given asset to decline when the market does not, and if the asset accounts for too much of the portfolio, then it may end up dragging the entire fund down with it. As we can see above though, there is no individual asset that accounts for such an outsized portion of the fund. Thus, there appears to be little need to worry about this risk here.

The Overvaluation Of American Markets

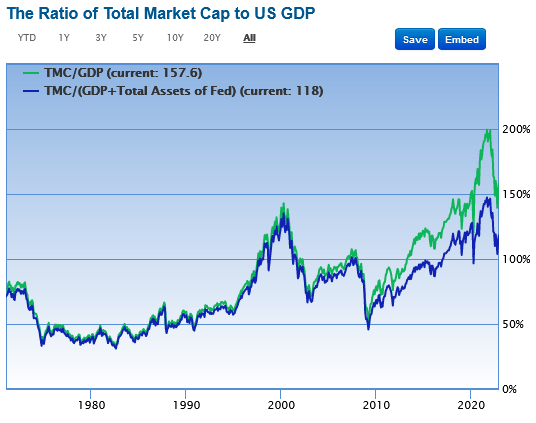

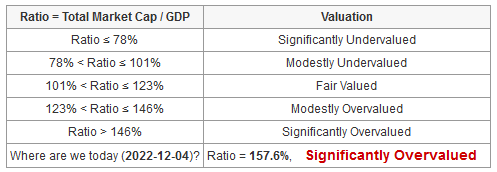

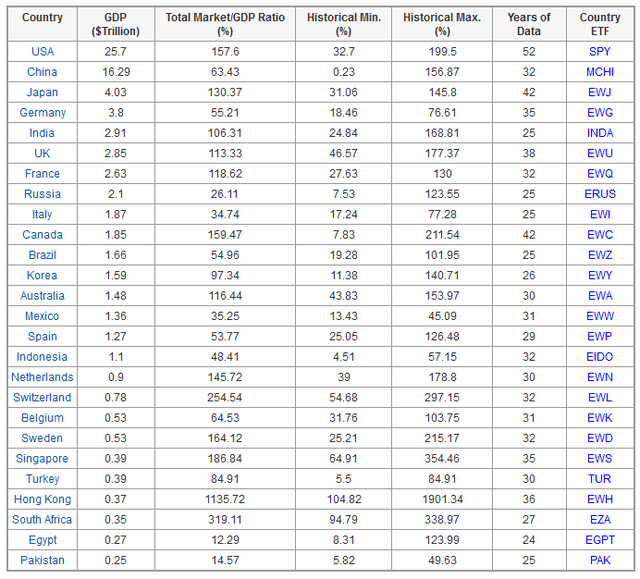

In the introduction to this article, I pointed out that American markets are generally overvalued, which is still true despite the fact that the S&P 500 has declined 14.82% year-to-date. We can see this quite easily by looking at the total market capitalization-to-GDP ratio. This is a ratio that we do not often hear about, although famed investor Warren Buffett once stated that it is the “best measure of where valuations stand at any specific moment.” This ratio is calculated exactly as it sounds. In short, we take the total market capitalization of all the companies in a given nation and compare the figure to that country’s gross domestic product.

As of December 4, 2022, the total market index stood at $40.5041 trillion, which is 157.6% of the last reported gross domestic product of the United States. This is quite a bit lower than the 206.3% ratio that we saw the last time that we looked at this fund, but it is still well above the nation’s historical average, as seen here:

GuruFocus.com

The reason that this is important is that the total market capitalization to gross domestic product ratio tends to mean revert over time. The historical mean ratio is about 115%:

GuruFocus.com

Thus, we can clearly see that the market does still have quite a bit further to decline until it is fairly valued. It does, however, look much better than it did a year ago. The conclusion though is that we are likely to see further market weakness going forward, particularly as the Federal Reserve continues to raise rates and push the country into a recession.

The rule about a country’s total market capitalization-to-GDP ratio reverting to its mean over the long term holds true for foreign nations as well. This is one reason why international diversification is important as the markets of several other countries are much closer to their average valuations than American ones:

In particular, we can see that the current valuations of Singapore (EWS), Spain (EWP), Belgium (EWK), and the United Kingdom (EWU) are fairly valued based on this ratio. This could be a sign that these markets will outperform the United States over the next few years. While that is certainly far from a guarantee, it still might be a good idea to have some exposure to these markets so that if this ratio does prove to be an accurate predictor of future performance, as it historically has, you will be benefiting from the higher returns in these markets. Unfortunately, as we have already seen, the Clough Global Dividend and Income Fund does not appear to be a good way to gain this exposure despite being a global fund. This is because of the fund’s incredibly high exposure to the United States relative to other countries in the world.

Leverage

As mentioned earlier in this article, the Clough Global Dividend and Income Fund uses leverage, which is one way that it is able to deliver a much higher yield than any of the underlying assets possess. Basically, the fund borrows money and uses the borrowed funds to purchase stocks and bonds. As long as the purchased assets deliver a higher return than the interest rate that the company pays on the borrowed money, the strategy works pretty well to boost the overall portfolio yield. However, the use of leverage is a double-edged sword since debt boosts both gains and losses. As such, we want to ensure that the fund is not using too much debt since that would expose us to too much risk.

I do not generally like to see a fund’s leverage above a third as a percentage of assets for this reason. Unfortunately, the Clough Global Dividend and Income Fund is quite a bit above this as its current leverage ratio is 49.45% of its assets. This is easily the highest leverage ratio that I have ever seen among closed-end funds and it admittedly does put the fund at a fairly high risk of losses should the market weaken further, but it will likely do quite well should the market move in its direction. Clough Global Dividend and Income Fund should be considered a high-risk, high-reward fund.

Distribution Analysis

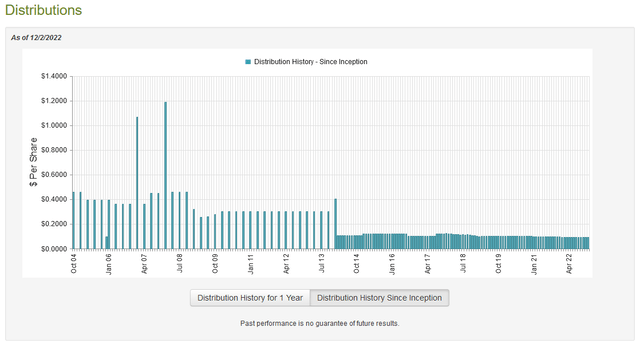

One of the biggest reasons why investors purchase shares of closed-end funds is the high yields that they pay out. Indeed, as we have already discussed, the Clough Global Dividend and Income Fund even uses leverage to boost the yield of its portfolio beyond that of any of the underlying assets. As such, we might assume that the fund would have a very high distribution yield. This is indeed the case as the fund pays a monthly distribution of $0.0906 per share ($1.0872 per share annually), which gives the fund an incredible 14.41% yield at the current price. The fund’s distribution has varied quite a bit over time and it did cut it back at the start of this year, but it has admittedly been more consistent than what might be expected from its high-risk, high-return strategy:

The fluctuations that we see here over time may certainly be a bit of a turn-off for those investors that are looking for a stable and secure source of income that can be used to pay their bills and cover other monthly expenses. However, the fund’s incredibly high yield means that even if it does cut it again somewhat, it will still be one of the highest-yielding investments available in the market. Naturally, though, we want to look at how well the fund can maintain its distribution since that yield is almost too good to be true.

Unfortunately, we do not have an especially recent report that we can consult for this purpose. The fund’s most recent financial report corresponds to the six-month period ending April 30, 2022. As such, it will not have any information about how well the fund handled the somewhat choppy market that we saw over most of this year. However, the market was highly volatile during the first quarter due to the Federal Reserve starting its interest rate hikes and the Russian invasion of Ukraine. Thus, we can still get an idea of how the fund is navigating the market volatility and gain some insight into why it cut the distribution at the start of 2022. During the six-month period, the Clough Global Dividend and Income Fund received $1,192,763 in dividends and another $527,564 in interest from the investments in its portfolio. When we combine this with a small amount of income from other sources, the fund had a total income of $1,735,747 during the half-year period. It paid its expenses out of this amount, leaving it with $124,239 available for investors. This was nowhere close to enough to cover the $6,380,927 that the fund paid out in distributions during the period. This is something that is certain to be concerning at first glance.

However, a fund like this has other methods through which it can obtain the money that it needs to pay its distributions. Chief among these other methods is capital gains. However, as everyone reading this is certainly aware, the American markets did not perform very well during that period, which makes it somewhat unlikely that the fund would be able to generate much in the way of capital gains. This is indeed the case, as it had net realized losses of $6,273,830 and suffered another $13,497,792 net unrealized losses.

Overall, the fund’s asset base declined by $22,882,602 during the period after accounting for all inflows and outflows. This certainly illustrates the fund’s high-risk strategy and explains why it had to cut the distribution. As the fund’s performance has unlikely been much better in the past several months that are not covered by this report, it seems that this is something that we should watch closely as the fund may have to cut the distribution again.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Clough Global Dividend and Income Fund, the usual way to value it is by looking at the net asset value. A fund’s net asset value is the total current market value of all the fund’s assets minus any outstanding debt. This is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a cost that is less than the fund’s net asset value. This is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. That is unfortunately not the case with this fund today. As of December 2, 2022 (the most recent date for which data is available as of the time of writing), the Clough Global Dividend and Income Fund had a net asset value of $7.52 per share but the shares traded for $7.54 per share. That gives the shares a premium of 0.27% to the net asset value. This is admittedly not a very large premium, but it is still much more than the 6.81% discount to net asset value that the funds have traded at on average over the past month. As such, the shares are looking pretty expensive right now and it may be a good idea to wait until they come down a bit in price before buying in.

Conclusion

In conclusion, one of the biggest problems that most American investors have is outsized exposure to the United States. This is a concern because the American market still looks incredibly expensive and is wrought with considerable uncertainty. Despite its name though, the Clough Global Dividend and Income is not a particularly good way to diversify away from the United States as the fund only has very minimal exposure to foreign markets. In addition, the fund’s highly levered nature makes it somewhat inappropriate for those investors that are concerned about preserving their capital.

The Clough Global Dividend and Income Fund’s risky nature showed itself this year as it took heavy losses that may force it to make another distribution cut in the near future. When we combine this with a fairly expensive price today, I can really only recommend Clough Global Dividend and Income Fund for those readers that are comfortable with taking on some risks in order to generate a significant amount of income.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment