g-stockstudio

Thesis

BlackRock just announced the results of its rights offering for the Corporate High Yield Fund (NYSE:HYT):

BlackRock Corporate High Yield Fund, Inc. (HYT) (the “Fund”) today announced the successful completion of its transferable rights offer (“the Offer”). The Offer commenced on September 20, 2022, and expired on October 13, 2022.

The Offer entitled rights holders to subscribe for up to an aggregate of 24,463,440 shares of the Fund’s common stock, par value of $0.10 per share (“Common Share”). The final subscription price of $8.23 per Common Share was determined based upon the formula equal to 90% of the Fund’s net asset value per share of Common Shares at the close of trading on the NYSE on the expiration date. The Common Shares subscribed for will be issued promptly after completion and receipt of all shareholder payments.

The Offer is expected to result in the issuance of more than 20.3 million Common Shares (including notices of guaranteed delivery), resulting in anticipated gross proceeds to the Fund of approximately $168 million. The Fund will receive the entire proceeds of the Offer since BlackRock Advisors, LLC, the Fund’s investment adviser, has agreed to pay all expenses related to the Offer. The Fund intends to invest the proceeds of the Offer in accordance with its investment objectives and policies.

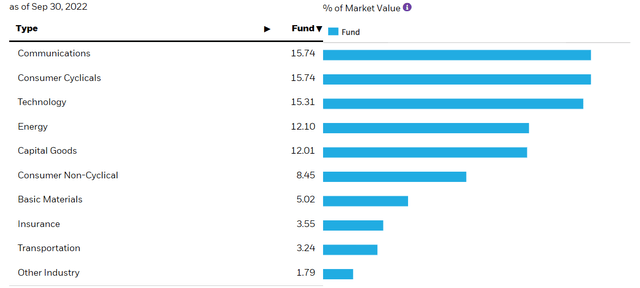

Let us frame the results. The fund has a NAV of $9.14 and a market price of $8.31 as of Oct 13, 2022:

Individual investors who would have subscribed to the rights offering would have received a better price than the closing market level, given the fact that the final subscription price ended up at $8.23/share. However, in our mind, the results are a bit disappointing. Via this corporate action, the fund raised $168 million in new money, or basically a bit over 15% of unencumbered assets. We were expecting something above 20%, but given the recent liquidity issues in the market, some of the lack of buyer demand is understandable.

Where does that leave us? Ultimately, as we have said before, the rights offering is a capital-raising exercise and the timing could not be better. That is why we were rooting for a higher take-out. We are currently seeing all-in high yields at decade-long highs:

That translates into HYT having now $168 million of cash to deploy at yields close to 10%. When we factor in the leverage the fund is going to overlay, we are getting shareholder yields closer to 13%. It is a great time to have dry powder! The fact that the fund was able to raise liquidity is going to turbocharge returns into 2023. If a CEF is fully invested, the only way to buy into new assets is by either selling bonds you already own or re-investing matured bond principal. If you sell existing collateral, you are crystalizing mark-to-market losses, while maturing principal is fairly scarce. Thus, CEFs which are already fully invested have little flexibility to benefit from market deals and liquidity constraints. Conversely, HYT is now sitting on a sizable cash pile that can be deployed at the most opportune time in the market – i.e. now when liquidity has dried up, bid/ask spreads are wide and bond volumes are low.

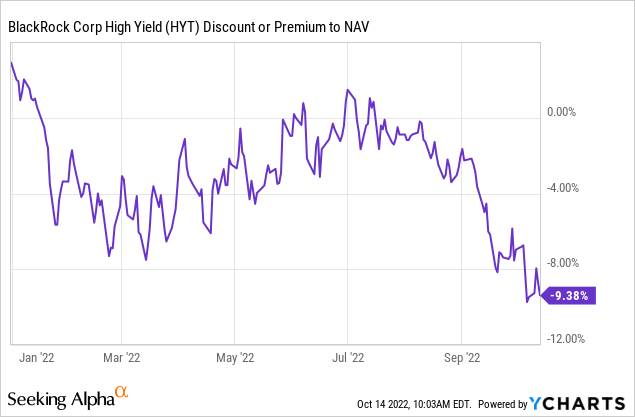

Premium/Discount to NAV

The discount to NAV widened with the risk-off environment and the rights offering:

We believe this is toward the wider historic range, and we are going to see the fund trade at a premium to NAV in 2023.

Collateral

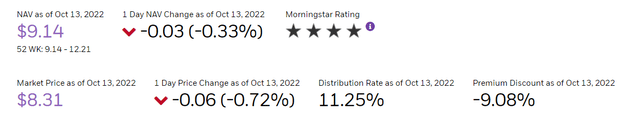

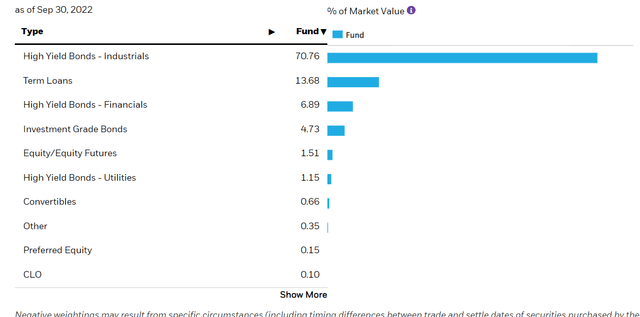

The fund is focused on high-yield bonds:

The fund has a nice industry granularity:

Industry Segmentation (Fund Website)

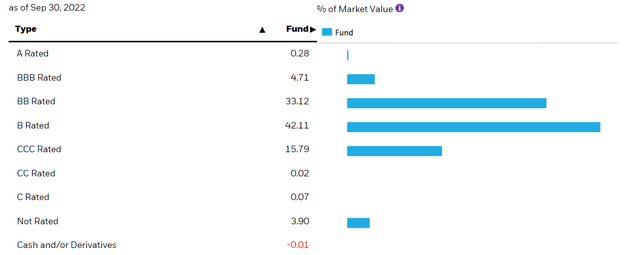

The portfolio has a middle-of-the-road credit quality, with a concentration on “B” rated names:

Unlike other vehicles which are overweight very risky CCC credits, HYT has a balanced composition. We have seen the CEFs holding riskier debt move to a substantial discount to NAV this year on the back of impairment concerns for their collateral.

Conclusion

HYT just announced the results of their rights offering. A retail investor would have benefited from subscribing by obtaining a price that is lower than where the market closed yesterday. The fund was able to raise more than 15% of unencumbered assets in new cash. The percentage of new money translates into $168 million of cash that will be used to purchase new securities in the secondary market. We feel this is an ideal time to buy high-yield bonds, with yields at decade highs and a liquidity-constrained market which allows for great deals to be had.

Be the first to comment