Zocha_K/E+ via Getty Images

Investment thesis

It’s been almost four months since I’ve covered lithium-ion battery recycling company American Battery Technology Company (OTCQB:ABML) and I think this is a good time to take another look at the company considering its market valuation has doubled since late February.

Construction of ABML’s $35 million pilot plant seems to be going well and retail investor interest is still strong. However, I can’t find a catalyst that can justify the company’s much higher market valuation and I think this creates a good short selling opportunity. Let’s review.

Overview of the latest developments

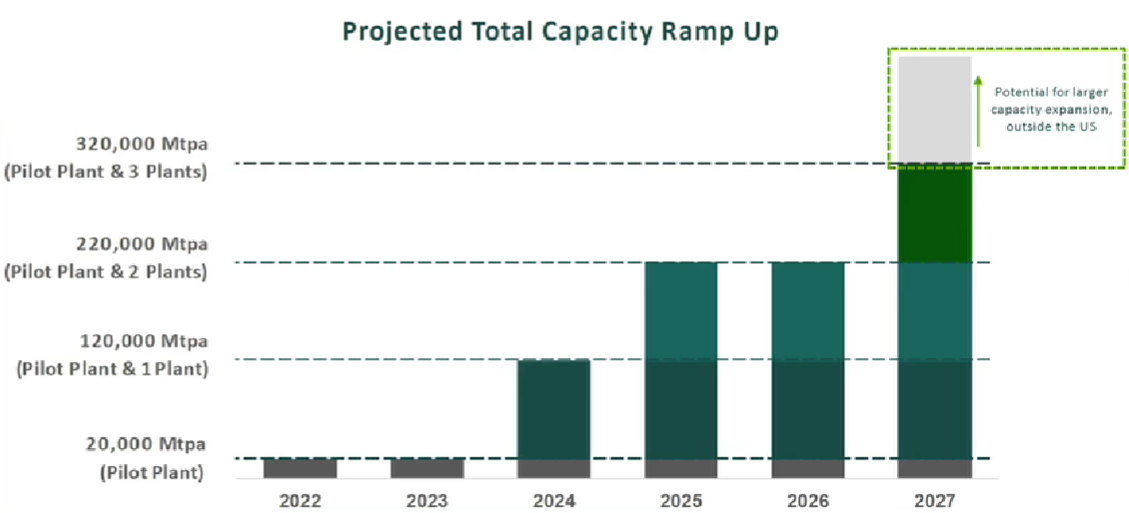

In case you haven’t read my previous articles on ABML, the company is building a pilot plant for the recycling of lithium-ion battery metals in Fernley, Nevada. The facility is very large for a pilot plant as it’s designed to manage 20,000 metric tons of scrap materials and end-of-life batteries per year. The first red flag that I see here is that the forecast margins look too good to be true – the plant is supposed to be able to generate around $160 million of annual revenues, with an EBITDA margin of 80%. For comparison, Li-Cycle (NASDAQ: LICY) forecast a 2024 EBITDA margin of below 50% during its listing.

Looking at the latest pictures of the plant, space frames have been placed together with corrugated metal roofing over the production facility.

ABML

In my view, progress seems slow and I have doubts that the facility will become operational in 2022 as ABML plans. You see, we’re over three months into 2022 and the complex still needs an office building with laboratories and a finished goods warehouse which will have a total of 100,000 square feet of floor space.

ABML

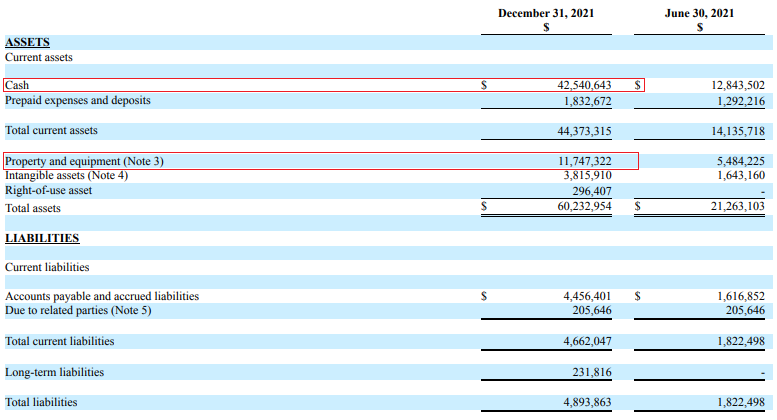

Turning our attention to the Q4 2021 financial results, ABML’s balance sheet still looks strong as the company had $42.5 million in cash as of December. It should have more than enough resources to finish the construction of its Fernley facilities and I think stock dilution risk is low at the moment.

ABML

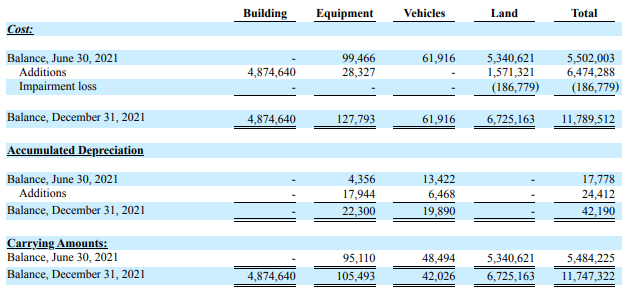

As you can see from the table below, the book value of buildings increased by $4.87 million between June and December, which reflects the progress of construction works. ABML also had equipment deposits of $1.13 million as of December.

ABML

Looking at the income statement, general and administrative (G&A) expenses came in at $3.92 million in Q4 2021 which I consider to be very high for a company building a $35 million production plant. Well, at least ABML is using shares instead of cash to pay its expenses. Non-cash expenses related to shares issued for professional services stood at $1.8 million in Q4 2021.

Turning our attention to the share price performance, you can see that the market valuation of ABML has been rising rapidly since the middle of March and volume has been high. More than 9 million ABML shares changed hands on April 4 alone.

Seeking Alpha

I think that some part of the share price increase can be attributed to strong retail investor interest as ABML continues to be popular on social media platforms like StockTwits, and Twitter. On YouTube, several videos about ABML were released during the past month by channels focused on stock trading, including Trading Secrets, Buy Hold Sell with Damian, Mr. Frugal Investor, B.INV3STED, IPO Market Watch, Stock Talk w/Erik Anthony, Equity4keeps Programme, and FinTalk. Four of the videos have over 1,000 views each as of the time of writing. Note that the company wasn’t promoting its business or shares itself, but this is being done by several stock traders.

In my view, the trading volume seems too large for the share price increase to be explained by retail investor interest. And I see no recent developments that could justify a doubling in the market valuation in less than two months. Whatever the reason is behind ABML’s over $900 million market capitalization, I think this share price increase creates a good short selling opportunity as the major issues for ABML haven’t changed since my last article. The lithium battery recycling space is just too small at the moment for two major players in North America and AMBL still hasn’t secured a single off-take agreement with a major player. Li-Cycle, in turn, already has over 40 commercial contracts and off-take agreements through 2030. In light of this, I don’t think ABML will be able to realize its ambitious growth plans.

ABML

I also continue to doubt that the EBITDA margins at the Fernley facility will be anywhere close to 80%.

So, how can you take a short position? Well, ABML still hasn’t uplisted to NASDAQ despite talking about it for over a year now, so there are no put options available at the moment. According to data from Fintel, the short borrow fee rate stands at just 3.45% as of the time of writing. Since there is no opportunity to hedge short selling with call options, I think the best course of action could be to open a small position.

Looking at the risks for the bear case, I think the major one is that ABML’s market valuation could continue to soar despite the lack of clear catalysts. Also, it’s possible that the pace of construction at Fernley picks up or that I’m wrong that the EBITDA margins will be much lower than 80% once the facility is up and running.

Investor takeaway

ABML is still building its lithium-ion battery recycling and hasn’t secured any major off-take agreements over the past few months. Yet, its market valuation has doubled in the span of less than two months, and I cannot find a reason can justify this increase. Sure, retail investor interest is strong, but the trading volumes seem too large for this to be the reason.

In my view, ABML still has no chance of competing against the likes of Li-Cycle and this sudden increase in its market valuation opens a good short selling opportunity. Since there are no options available yet, consider opening only a small position.

For risk-averse investors, I think it could be best to avoid ABML.

Be the first to comment