coward_lion

English soccer team Manchester United (NYSE:MANU) is listed on the NYSE and the stock has recently risen from its record lows. Some big options activity, an Elon Musk Tweet, and a recent sale of a rival hint at potential gains of up to 100%.

Unusual options activity in MANU is well timed by Elon Musk

Elon Musk found time in his busy Tweet schedule recently to make a statement that he was buying the famous English soccer team, Manchester United.

After starting off on a political tone, Musk then pivoted to a completely random quote about the 144-year-old iconic sports franchise.

“To be clear, I support the left half of the Republican Party and the right half of the Democratic Party! Also, I’m buying Manchester United ur welcome,” Musk told his 103 million followers.

The strange coincidence about the quote was that the Tesla (TSLA) founder has never mentioned the sport in the past… oh, and the fact that the stock had seen unusual options activity in the previous week.

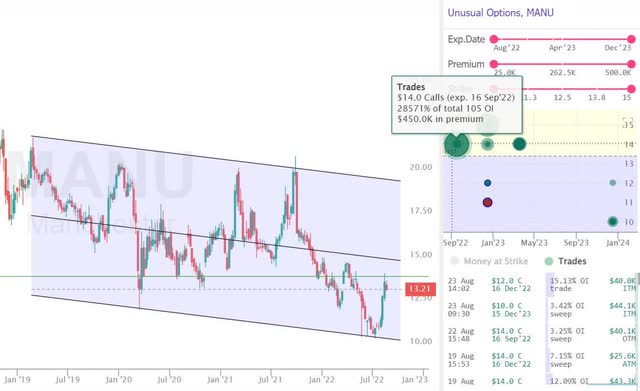

MANU Options Activity (Trend Spider)

As the chart above highlights, MANU now has outsized call option activity clustered at the $14 strike price. That is less than one dollar away from the current price and the expiry date for the out-of-the-money calls is 16 September. There are further calls nestled ahead of the year-end expiries and those were placed this week, accounting for 18% of open interest.

Musk later retracted his statement and said that it was a “long-standing joke” about sports team ownership, but the timing seems a little too coincidental to me. However, I am not convinced that he would be part of any deal.

“Although, if it were any team, it would be Man U,” Musk added. “They were my fav team as a kid.”

The storied club could be set for a revival

Manchester United holds the record for English League Title wins at twenty. A huge thirteen of those titles came in a twenty-year span under the reign of Scottish managerial legend, Sir Alex Ferguson, with his first being in 1993.

The club has suffered a decline in fortunes since the departure of the iconic coach, and it was a fate that they had to endure while watching the emergence of their city rivals as a major player. Following a big investment from the Abu Dhabi United Group; Manchester City has won only eight titles, however, three of those have come within the last ten years and they will be one of the key contenders again this year.

Manchester United was previously floated on the London Stock Exchange in 1991, but the club was taken private in 2005 after a buyout by American businessman, Malcolm Glazer, with the club valued at around £800 million.

The deal raised eyebrows at the time with much of the deal being financed with debt, secured against the club’s assets. That has led to a long-standing distrust of the owners amongst the club’s fans, who blame the Glazers for much of the decline in on-field success. The owners then put 10% of the club’s shares on the NYSE in 2012, which was an effort to raise capital.

There are hopes for a revival in the team’s success with the arrival of a new coach in the summer and after a tough start to the first two games of the season, the club secured a win against another major rival in Liverpool F.C. That team also has US owners in the form of Fenway Sports, with LeBron James holding a minority stake in the club.

US buyout of another rival club sets out the marker

Yet another US takeover of a top English Soccer team was completed recently with the deal for Chelsea F.C. led by Todd Boehly. Boehly’s consortium consists of Clearlake Capital, Mark Walter, and Hansjörg Wyss. The group completed the deal on 30 May 2022 for a price of £4.25bn ($5bn). Walter and Boehly are owners of the Los Angeles Dodgers and the Los Angeles Lakers.

That was somewhat of a forced deal, with the club’s previous owner, Russian oligarch Roman Abramovich, pressured to find a buyer after the Ukraine tensions erupted.

Boehly’s deal highlights an appetite for soccer teams and another big deal in the last year was a deal for Newcastle United F.C. backed by the sovereign wealth fund of Saudi Arabia. As attention turns to other targets, there are few bigger than Manchester United, which is said to be the third-most supported club in the world after Barcelona and Real Madrid of Spain, however, the latter two have the added advantage of a large South American following. Manchester United also reported a record number of global memberships sold for the 2021/22 season in their recent earnings.

Largest Social Media Fanbase (Goal.com)

The $5 billion deal for Chelsea is interesting because Manchester United trades at a market cap of only $2.25 billion on the NYSE. That means that the club could fetch a price tag above the $5 billion mark and a +100% return for investors.

The Glazer family is said to be weighing up the sale of a minority stake in Manchester United, according to Bloomberg.

“The owners have held some preliminary discussions about the possibility of bringing in a new investor… The American Glazer family is not yet ready to cede control of Manchester United, which could be valued at about £5 billion ($6 billion),” according to the report.

One interested party in a deal is the UK’s richest man, Sir Jim Ratcliffe. The billionaire founded the Ineos energy giant and a spokesperson for the company said:

“If the club is for sale, Jim is definitely a potential buyer”.

It is clear that a potential deal could be on the horizon and the recent options activity is interesting, alongside the Musk tweets. If the Tesla owner had inside knowledge of a coming deal then that could see a big US investor in a bidding war against Britain’s richest man.

A deeper dive into the finances of soccer teams

For those that are interested in the financials of a soccer club, I will share some of the recent third-quarter results from Manchester United.

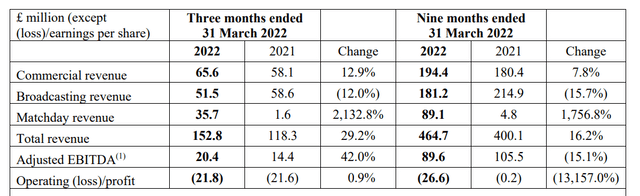

MANU 3Q Earnings (Manchester United)

Commercial revenue for the recent quarter was £65.6 million, an increase of 12.9%, over the same period last year. Sponsorship revenue added £39.2 million, up 9.4%. Merchandise, broadcasting, and matchday revenues brought the total to £152 million ($178.3 million).

After total operating expenses of £175.3 million for the quarter and employee benefit prices of £101.8 million, the club lost £21.8 million ($25.57 million) for the quarter. However, all of these figures were affected by Covid shutdowns in the previous year, which is why matchday revenue is shown to have grown over 2,000% y-o-y.

Net Debt was £495.7 million ($581 million), which would be around 10% of a potential sale price for the club.

There is a risk that the Glazers would not sell the club or even a part stake. The other risk is that a new minority owner might create boardroom tensions and put some headwinds on the stock price over the medium term.

Conclusion

Manchester United’s fortunes had dipped on the field and its stock price, and morale were both at record lows. Both have now seen an uptick and the move higher in MANU stock was strangely accompanied by large options open interest and a Tweet from Elon Musk. As US investor interest heats up for English Premier League clubs, Manchester United is the last real prize that could be available. The recent deal for Chelsea F.C. highlights that there is a potential return of over 100% for investors in the event of a deal announcement. The Glazer family is believed to be considering the sale of a minority stake, but they would likely sell at the right price in the face of fan hostility. The latest developments may be leading to a rise in the stock to a more favorable price for the owners. Investors should keep in mind the options activity for September and late December 2022 for potential announcement and deal closing targets.

Be the first to comment