Andressa Anholete/Getty Images News

Petrobras (NYSE:PBR) stock is well known for its high dividend yield. It recently announced a US$0.68 dividend, which annualizes to $2.72, giving us a possible annualized yield of 21.5%. I say “possible” because PBR’s dividend payments aren’t stable. We can talk about what the yield would be if the same dividend was paid four times a year, but there’s no guarantee that the dividend actually will be paid on such a schedule.

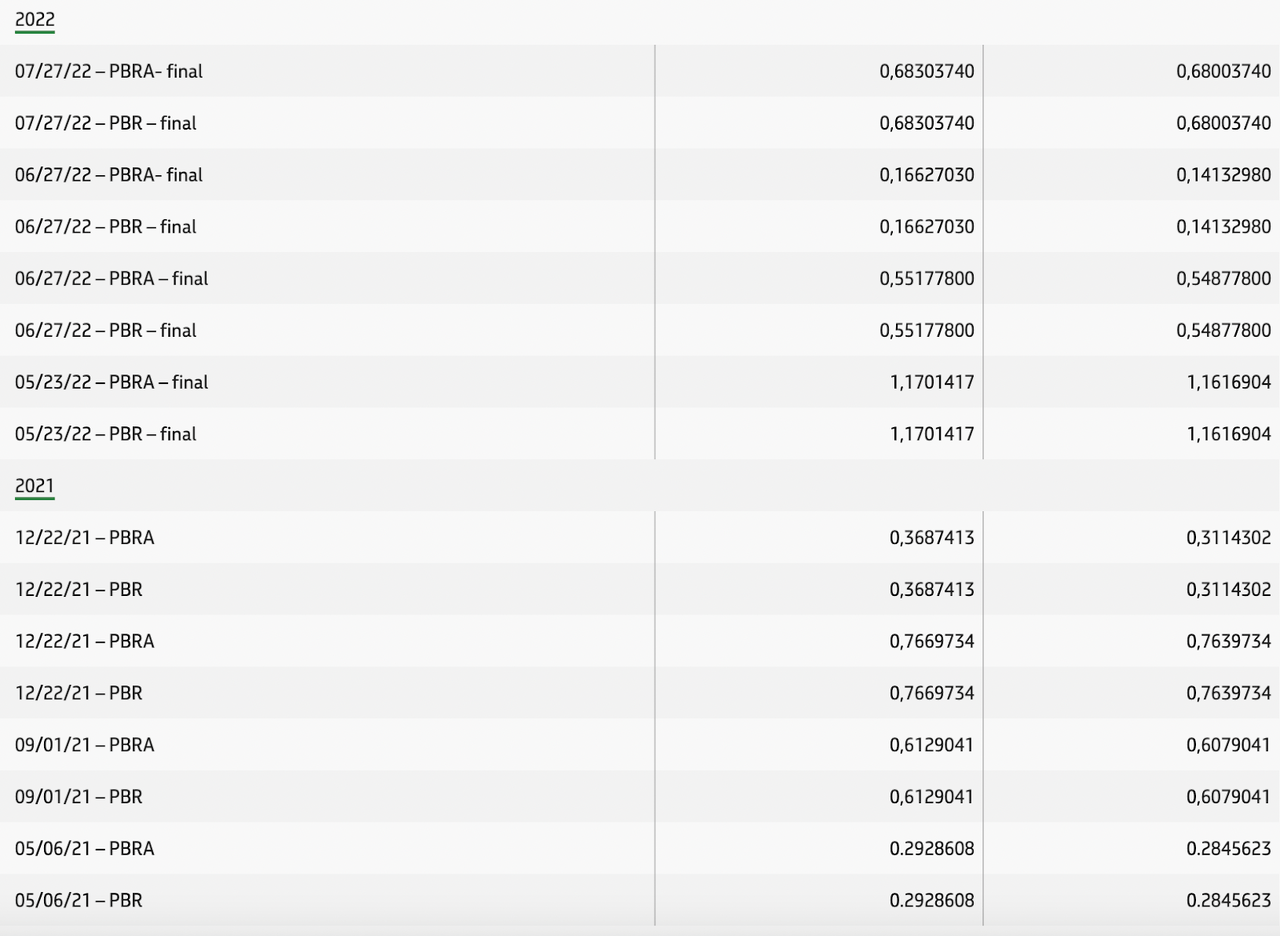

PBR’s dividend history has always been rocky. A quick look at the payouts on the ADRs (U.S. shares) reveals that they varied wildly in 2021 and 2022.

PBR dividends (Petrobras)

As you can see, the payout is all over the place. It varies in size as well as in frequency, and is sometimes rather large compared to the stock price. If you buy the stock today, ex-dividend, you really have no idea what your yield will be.

One thing is absolutely clear though: investors who bought at the end of December are crushing it.

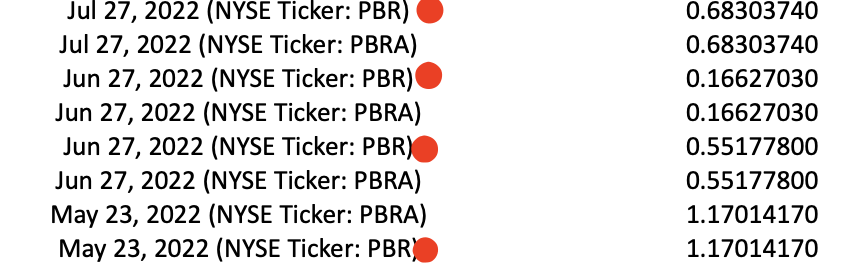

PBR stock cost $11.15 when trading opened this year. Since then, investors have collected the dividends shown below (red indicates the PBR shares, no red dot indicates a different share).

PBR dividends up close (petrobras)

These amounts sum to $2.57. Going by the stock price at the start of the year, we get a 23% yield collected by shareholders who bought on January’s first trading day.

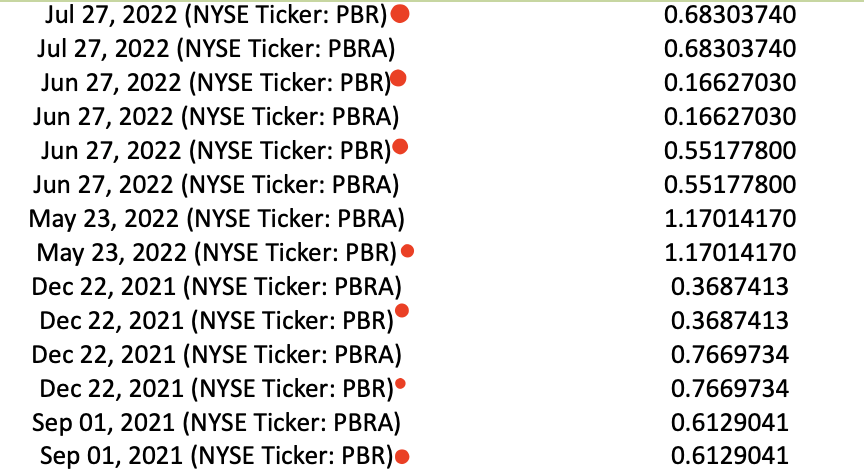

The yield grows even higher when we consider a one-year holding period. If you had bought PBR on August 16, you’d have paid $11.15, and collected this bucket full of dividends:

12 month dividends (Petrobras)

These dividends sum to $4.316, giving us a truly massive 39% yield.

Depending on who you ask, PBR stock has a yield ranging anywhere from 4.5% (what Seeking Alpha Quant has on file) to 80%. These varying yield estimates come from the inconsistency of PBR’s dividend. The company tends to announce dividends on the fly when quarterly earnings come out, and there’s no predictable pattern to what the payouts will be. There seems to be some correlation with oil prices, but it’s not as consistent as you might think. For example, the December 2021 dividends added up to more than the June 2022 dividends, even though the second quarter of 2022 had higher oil prices than the fourth quarter of 2021.

What exactly is going on here?

There are many things going on, but politics seems to be the big one. The Brazilian government is PBR’s largest shareholder, owning 29% of the shares. Lately, President Jair Bolsonaro has been taking advantage of this leverage to pull some weight with PBR. He has been pressuring the company to lower gasoline prices charged to consumers, while also paying out more dividends to shareholders. The political pressure on PBR is not a good thing. Political leaders aren’t oil and gas experts, their demands often conflict with oil companies’ business needs. However, PBR stock is cheap enough, and the oil industry’s prospects are strong enough, that its stock is a worthy play for a risk-tolerant investor.

PBR’s Financial Picture

We can start our analysis of PBR by looking at its balance sheet. PBR’s balance sheet boasts tons of assets and comparatively few liabilities. Some highlight metrics include:

-

Total assets: $192 billion.

-

Total liabilities: $113 billion.

-

Equity: $78.8 billion.

-

Current assets: $42 billion.

-

Current liabilities: $32 billion.

-

Cash & equivalents: $16 billion.

-

Long term debt: $34 billion.

From these figures we can calculate the following ratios:

-

Long term debt to equity: 0.43.

-

Current ratio: 1.31.

-

Cash ratio: 0.5.

The long term debt to equity ratio indicates strong solvency. The current ratio of 1.31 suggests high liquidity. The cash ratio is slightly weaker. Normally a 0.5 to 1 cash ratio is considered “good,” and PBR’s cash ratio is right at the bottom of that range. It is not especially high, but is just on the border of the healthy range.

How does PBR stack up to other oil companies in this regard?

We can use Seeking Alpha Quant’s data to come up with debt/equity and current ratios for similar companies: Occidental Petroleum (OXY), Cenovus Energy (CVE) and Shell (SHEL).

|

Debt |

Equity |

Current assets |

Current liabilities |

Debt/equity ratio |

Current ratio |

|

|

OXY |

$21.4 billion |

$27 billion |

$10.4 billion |

$9.7 billion |

0.79 |

1.07 |

|

CVE |

$8.7 billion |

$20 billion |

$11.9 billion |

$6.88 billion |

0.43 |

1.72 |

|

SHEL |

$50.1 billion |

$194 billion |

$165 billion |

$118 billion |

0.25 |

1.39 |

Generally speaking, the lower the debt to equity ratio the better. That’s because too much debt indicates solvency issues. Conversely, the higher the current ratio the better. You want your short term assets to be able to pay for your obligations.

How does PBR stack up compared to these other three oil companies by these metrics?

It beats OXY on both debt/equity and liquidity: OXY’s DE ratio is higher and its current ratio is lower.

It scores a slight win over CVE on the DE ratio, but loses with a lower current ratio.

It loses out to Shell on both metrics.

So, in terms of liquidity and solvency, PBR is in the middle of the pack for the oil companies sampled. It’s not the best, but it’s not the worst. Certainly, it’s not at risk of going bankrupt.

Petrobras Selling Assets

One thing about Petrobras to keep in mind is that it has been selling a lot of assets lately. This year alone, it has sold:

-

A $1 billion stake in a Brazilian on-shore oil field.

-

A 20% stake in MP Gulf of Mexico.

Additionally, it sold off a massive $16.3 billion in assets in 2019 to pay off what was then a massive debt-load.

This point about asset sales is important because it helps put PBR’s balance sheet in context. The balance sheet looks healthy on the surface of it, but its current health was achieved by massive asset sales that are still ongoing. PBR is definitely reducing its debt but it may reduce its future earnings power if it keeps up the sales. That in turn could reduce the dividend, since PBR’s minimum dividend is set as a percentage of earnings.

Recent Performance

Having looked at PBR’s balance sheet, we can turn to its recent performance. The company’s most recent earnings release was a huge beat, exceeding revenue estimates by $2.2 billion and delivering 61% growth in free cash flow.

The long term trajectory is pretty good as well.

According to Seeking Alpha Quant, PBR delivered the following results over the last five years:

|

TTM |

2021 |

2020 |

2019 |

2018 |

2017 |

|

|

Revenue |

$108 billion |

$81 billion |

$52.3 billion |

$65 billion |

$80 billion |

$78 billion |

|

Operating income |

$50 billion |

$33 billion |

$15.4 billion |

$19.3 billion |

$18.2 billion |

$14.4 billion |

|

Net income |

$30 billion |

$19 billion |

$1.3 billion |

$9.9 billion |

$6.6 billion |

$-134 million |

|

Operating cash flow (“CFO”) |

$44 billion |

$36 billion |

$28.5 billion |

$25.3 billion |

$24.7 billion |

$26 billion |

|

Free cash flow (“FCF”) |

$38 billion |

$17.6 billion |

$17.9 billion |

$696 million |

$13.8 billion |

$9.1 billion |

The growth in revenue is pretty modest, but the bottom line growth is excellent. This comes down to two things:

-

Rising oil prices. The oil prices in 2022 were much higher than in the 2017-2021 period. Prices in 2021 were also higher than the five years before that, except parts of 2018.

-

Debt reduction. From 2017 to the TTM period, we see PBR’s interest expense shrink from $4.4 billion to $1.8 billion. That’s about $2.6 billion shaved off of costs over five years, a big boost to earnings.

Earlier, I wrote that PBR’s asset sales may have hindered future growth. On the top line, they did: PBR’s second quarter sales growth was 65%, which might sound like a lot, but Occidental Petroleum and others grew sales 80% in Q2. PBR’s top line growth has been a little behind the industry this year, but on the flipside, its debt reduction is improving the bottom line. So it’s a pretty good picture overall.

Valuation

Now we can finally get to the part of the analysis that has PBR investors the most excited, apart from dividends:

Valuation.

PBR stock is truly dirt cheap by most common valuation multiples, and it holds up pretty well in a DCF valuation assuming only modest growth.

At today’s prices, PBR trades at:

-

3.7 times earnings.

-

0.8 times sales.

-

2.51 times forward operating cash flow.

-

2.5 times free cash flow.

-

1.1 times book value.

So the stock is incredibly cheap going by multiples. Similarly, I got a present value above the current stock price in a simple DCF model. Starting with $2.8 in free cash flow per share, I assumed 10% annual growth over five years, followed by no growth. Using a 10% discount rate, I got $42 in intrinsic value-approximately triple the current price!

The Big Risk to Keep in Mind

As I’ve shown in this article, Petrobras is cheap, pays big (if unpredictable) dividends, and is paying off its debt. It looks like a good situation. However, there is one risk factor to keep in mind:

Lower oil prices.

If oil prices go down a lot, it will negatively impact PBR’s earnings. The company makes most of its money by selling oil, so the commodity price influences its top-line. Thanks to all the debt reduction it’s been doing, PBR can grow even with oil prices just staying flat. However, in the event of a truly colossal drop, like in 2020 or 2015, you’d expect some weakness. According to some slides PBR put out at the start of the year, its forward break even price is $20 per barrel. That’s an admirably low break-even, so losses don’t look like they’re part of the picture. But if oil really crashes hard, earnings could go down quite a bit.

To put it all together:

PBR’s dividend is safer than it looks. It’s extremely erratic, but investors generally get a lot of income at the end of the day. On top of that, Petrobras’ balance sheet is actually fairly healthy these days, which is something that wasn’t the case in past years. Overall, this stock is not a bad value. Just keep in mind the oil prices. PBR can withstand lower prices than most oil companies, but 2020-tier prices would break the thesis.

Be the first to comment