ChrisHepburn/E+ via Getty Images

Introduction

Persimmon PLC (OTCPK:PSMMF) is the UK’s largest housebuilder, with a multi-decade track record of profitable growth. Unlike most of its peers, it avoided diluting heavily after the financial crisis, and hence has an admirable long-term performance chart. Indeed, shareholders who invested at the turn of the millennium would have made an annualized return of ~14%: not bad for an old fashioned business like this, with no tech risk and no real disruption. And even better, noting that the return I just mentioned was generated after the stock has spent the last year in freefall, losing 60% of its value!

I believe forward returns from today look even better than that, and hence it is a compelling opportunity for investors with a long-term perspective.

In this piece, I will argue three things:

- Persimmon is a high quality business; the “best in class” housebuilder, with strong economics and a business model which works through the cycle

- Investor’s biggest fears about the business are overstated; everyone is fighting the last war and comparing today to 2008. We are not even close, and Persimmon is positioned incredibly well for any potential downturn

- The valuation is dirt cheap; dirt cheap on a cashflow perspective, dirt cheap on an earnings perspective, and dirt cheap on an asset perspective

In my view, these are “holy grail” investments. You get everything you could ask for. You don’t need to compromise on business quality or valuation. You get both.

You just need to look through a lot of short term noise, potential volatility, and be willing to buy when other people don’t have the stomach. We all know that this is when the real money is made: you don’t get opportunity like this when everyone agrees that the sky has no clouds.

Business model

The UK housebuilders function similarly to the U.S. ones. To give an overview, in case you’re not familiar, it looks like this:

- They buy land: either outright, or with options agreements to minimize upfront cash flows. Sometimes this land has planning permission to build immediately; this is more expensive, but obviously means you can get to work immediately. Sometimes, it will require the next step

- They work land through the planning system: aiming to maximize the value of their land by optimizing the number and type of homes, and generally adding value by enjoying the premium that comes from taking brownfield or agricultural land and turning it into residential

- They market and sell new homes on these developments: housebuilders don’t tend to use traditional estate agents – they don’t want to pay the fees. But they do extensively list properties online, use local newspaper advertising, and advertise “on-site”

- They build, nearly always “to-order”: Persimmon and others essentially manage their sites such that their build-rate more or less matches their sales rate. They build when orders are in the bag; if orders aren’t coming in, they’ll stop building

It’s that simple. It’s a straightforward business model.

Persimmon mostly builds traditional brick houses, similar to the type you’ll see in the picture just above. That’s actually a shot of one of Persimmon’s recent developments, not too far from London. Since they mostly aim at the entry-level of the market, shooting at first-time buyers, they’re typically semi-detached or terraced: meaning you’ll share walls with your neighbors. This keeps costs down, and is a distinction from the usual U.S. approach.

The business keeps circa 4.5 years of land supply on hand. This gives it enough depth of inventory and plot type to maintain a high building rate, without burdening the balance sheet with too much deadweight.

Financial history

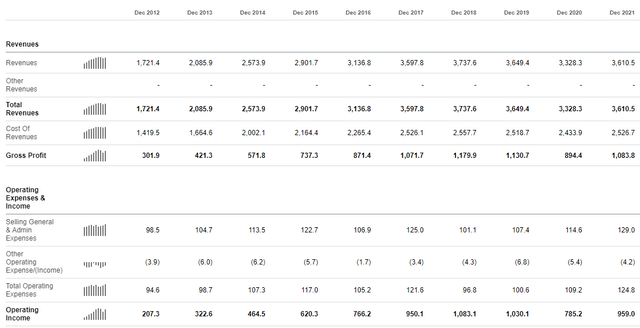

Persimmon’s financial history is glowing, as you can see from Seeking Alpha’s financial snapshots:

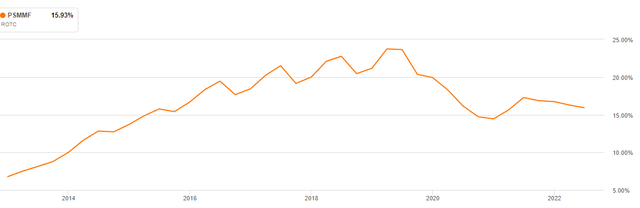

Consistent revenue growth and consistent EBIT growth are good bedrocks for consistent share price growth. Better yet, they have managed it with a strong return on equity through the period:

That return on equity has driven perhaps the most attractive feature of Persimmon as a business: its superlative history of shareholder returns. Against a current market capitalization of £4.2bn, Persimmon has distributed £3.0bn in the last five years alone. That’s while investing in the business and delivering the growth you see above.

The group’s capital return strategy is to distribute truly excess cash, and in typically British spirit, the definition of “excess cash” is much more conservative than peers across the pond. Persimmon has had no debt for the last decade. Currently, it insists on holding £700m of cash (circa 1x EBIT) as a buffer against uncertainty. Given no debt and £3bn of land and WIP on its current asset side, I think they’re pretty secure.

Clearly, something must be wrong. This is too good to be true.

Let’s address that head on, then. What is the market so scared about, such that Persimmon is down 60% from its peak and available at these levels?

Recessionary fears

The answer here is simple, and it’s the same reason U.S. housebuilders are cratering: everyone is panicking about recession, and panicking about rising interest rates.

I’m not going to deny that these are real issues facing housebuilders.

I do want to provide some context about why I think Persimmon is better positioned than most to face these issues, and why I think that – while profitability will probably dip in the short-term – in the medium term, Persimmon will come back stronger.

My first observation is that there is a structural undersupply of housing in the UK, which supports prices and provides a big, unsatisfied pool of demand. Think kids not leaving home, people in house shares and undesired multi-generational families.

This is a real issue. There is a great report from the UK Government on it here:

https://researchbriefings.files.parliament.uk/documents/CBP-7671/CBP-7671.pdf

UK Parliament

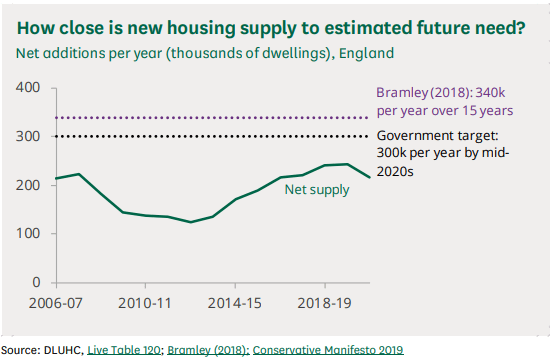

I’ve included perhaps the most important chart from the paper above. It shows the Bramley estimate of the UK’s housing need (340k) and the current net supply, which is significantly below the necessary level. Worse: there is a significant historic backlog.

My second observation is that Persimmon is one of the best-placed to meet that chronic undersupply. As I will shortly show in the comparator analysis, Persimmon build cheap, starter houses which serve to address the most undersupplied part of the market. They are likely to be beneficiaries of Government policy, which is (even as I write this) pivoting to once again emphasize the important of helping housebuilders build. See the following article by the BBC: “Michael Gove commits to 300,000 homes target.”

Finally, I observe that – as late as August 2022 – Persimmon was still reporting a good demand environment. While I don’t doubt things have moderated since then, particularly as a result of the political chaos in Westminster in late September, it is reassuring to note that long after people were calling for doom and gloom, the group was saying that:

“Demand is strong with the Group’s average private sales rate in the period around 1% ahead year-on-year and a robust forward order book of £2.32bn.”

and

“Robust start to the second half; average private sales rates for the first seven weeks 11% down year on year against a strong comparator and as we return to a more normal seasonal pattern, and up 8% on 2019 being the most recent, more typical trading year.”

Persimmon’s balance sheet and strong profitability metrics (gross profit margin of ~30%, operating profit margin of ~27%) means that any downturn is, essentially, a timing issue. Gross margins that fat mean that Persimmon could absorb even a 2008 scenario, which saw house prices falling by 20%, whilst remaining profitable. And that is – really – a worst case.

The housing market has remained surprisingly robust, even as rates have risen and the so-called “cost of living crisis” has started to bite. My hunch is that the British desire for homeownership and the pool of latent demand is so large that Persimmon will outperform fears.

Even if it does not, Persimmon is positioned such that it will come out of any downturn fighting fit.

Comp Analysis

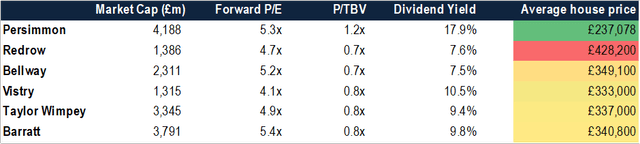

As promised, I include a comp table above which shows Persimmon against its UK housebuilding peers.

If you want to own any of them, I will not argue with you. They are all dirt cheap. Investors might consider hedging their bets by owning one or more of the others, too.

But, for my money, Persimmon is the highest quality business. It certainly is on financial metrics, its historic track record is the best, and that differential in terms of average house price will insulate it in tougher times. Paying a marginal higher price on an earnings and price-to-book basis seems an easy trade off.

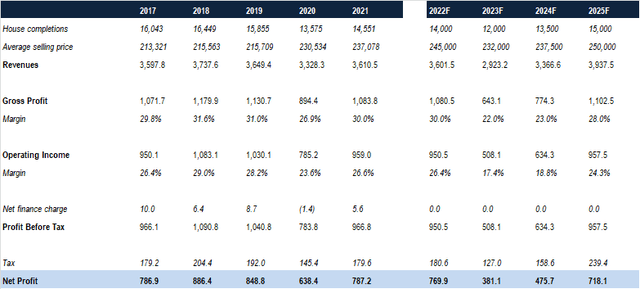

My model

Shown above is my simplified model which considers how the next few years might look. 2022’s numbers are almost in the bag, so there is not a huge amount of likely variance. The group’s robust order book will see it through the remainder of this year, and help next.

There are a few key inputs, which I’ll describe and explain below:

- House completions

- I’ve assumed a ~20% drop in house sales in 2023, driven by difficulty in the mortgage market.

- This might seem low, but as mentioned elsewhere, the entry-level price point will be helpful in this respect. It’s also important to note that there has been a significant shift away from fixed rate mortgages (which are incredibly expensive at the moment) and toward lower-cost tracker mortgages, which has enabled customers to retain similar monthly payments. This will support demand.

- Average selling price

- I consider prices falling from £245k in 2022 to £232k in 2023. If this doesn’t sound like a large drop, note that UK general inflation is currently around 10%. In real terms, this would be a significant drop in house prices.

- Even my “normalization” to £250k in 2025 would imply house prices falling very significantly in real terms from 2020 – 2025.

- Gross margins

- Essentially track the house price reductions detailed above

- Tax

- Rises to reflect the UK increasing corporation tax to 25%, effective next year

I think this model captures a reasonable “base case” scenario, with some harsh but realistic assumptions about the state of the housing market, and profitability which never returns to its 2025 peak.

If I was asked to be more bullish, I would note that the business’s land positions were predominantly built up in the 2015-2020 period, before the current extreme levels of inflation, and hence that there is actually scope for very significant gross margin expansion when conditions normalize.

But let’s not get too excited. We don’t need to!

Let’s again ground ourselves with the risks, before we finish off discussing prospective returns for investors today.

Risks

If you’ve made it this far, the risks to this investment will be abundantly obvious to you.

The risks are not balance sheet-based: Persimmon has a huge pile of net cash. I also think there is no reasonable scenario where the business is ever actually threatened. Gross margins of 30% are more than enough to absorb a scenario worse than the global financial crisis.

But there are risks to our earnings figures, and to just reiterate what we mentioned above, consider that:

- The volume of sales could fall further than I have suggested

- If the Bank of England pushes rates too hard, it will create a situation where first time buyers cannot access the housing market. I don’t think they want to do this: but it is possible.

- Prices might collapse

- There is, of course, a possibility that I haven’t been pessimistic enough – and housing falls further than I think it will.

- That said, brick housing in the UK is essentially a non-depreciating asset. It lasts for hundreds of years and culturally is seen as being the best way of saving for your retirement and ensuring intergenerational wealth. I don’t see that changing any time soon. For decades, every dip has been bought.

- International investors might face currency issues

- Year-to-date, the Sterling has fallen by 14% against the dollar. This is a stark reminder of one of the risks of investing in international assets.

- … although enterprising investors might be licking their lips at the chance of buying into the Sterling at a depressed level: certainly, UK corporate takeovers are on the increase as foreign businesses try to snap up bargains.

I will be watching the trajectory of UK house prices carefully. I view this as the most critical risk factor.

Prospective Returns

If you refer back to my model, you’ll see that I think Persimmon will be earning ~£720m in 2025.

Pricing is more art than science, but let’s look at the historic P/E trading range of Persimmon to estimate what it might be valued at in a “normal” market:

I would peg 12x as being a reasonable estimate of the “normal” level. It doesn’t seem too ambitious a target for a good business.

If we were to hit my net income estimate of £720m and return to that ratio, Persimmon will be trading with a market cap of £8.6bn in 2025. Let’s not forget that essentially all of the net income will translate into cash generation, given the group’s good free cash flow conversion and the lack of necessity for rapidly ramping investments in what will be a difficult few years. That should be around £1.6bn in the intervening three years.

Hence, I believe that an investment in Persimmon today – at approximately £13 – will turn into around £27. That’s still below it’s prior share price peak. It will also generate £5.10 of dividends during the hold period.

Put it together, and this generates a 35.2% IRR. It’s a brilliant return; but you are running when everyone else is running for the hills. You want to be getting paid for it!

Conclusion

Persimmon is a winner. It’s a business which has been through the wringer, through a variety of economic environments, through political upheaval and management team changes, and consistently come out stronger. Its success is not built on being in the “right place at the right time.”

Now is, assuredly, not the right time. We’ve discussed that, too.

But at the start, I said I hoped to persuade you of three things: that Persimmon is a good business; that investor fears are exaggerated; and that the business is available for a bargain basement price.

My assessment is that, if you throw all the pros and cons into the great judgement game that is investing, Persimmon is as compelling as they come.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment