Feline Lim

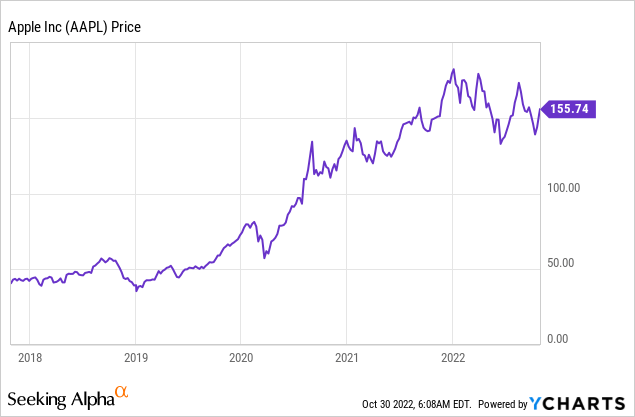

Apple (NASDAQ:AAPL) is arguably the greatest consumer electronics company that has ever existed. The company has the greatest market share of the smartphone market. While its Mac computers are iconic and highly regarded as best-in-class technology. Since the passing of Steve Jobs, CEO Tim Cook has continued to execute strong as Apple has diversified into the high-margin Services business and released iconic products such as Air Pods. Given the tough economic backdrop Apple has continued to perform strong beating both revenue and earnings estimates for the fourth quarter of the fiscal year 2022. The company has a strong brand, which enables significant “pricing power” and higher margins than competitors such as Samsung. Consumers are willing to pay more for an Apple product just because it is Apple. This is an essential competitive advantage given the high inflation environment. Therefore in this report, I’m going to break down the September Quarter for Apple in granular detail and reveal its valuation, let’s dive in.

Strong Fourth Quarter

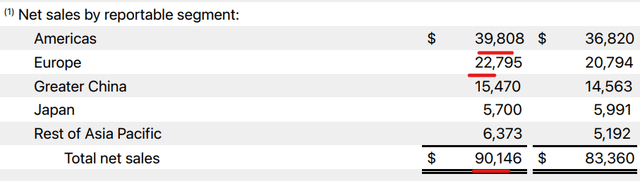

Apple Generated solid financial results for the fourth quarter of fiscal year 2022. Revenue was $90.1 billion which beat analyst forecasts by $1.37 billion and increased by 8% year over year. This was despite a 600 Basis points impact from foreign exchange, which was influenced by a strong US dollar. As you can see from the table below, Apple makes 44% of its revenue ($39.8 billion) from the Americas. However, the business makes approximately one-quarter of its revenue ($22.8 billion) from Europe. This is followed by Greater China ($15.5 billion), Japan ($5.7 billion) and the Rest of Asia Pacific ($6.4 billion). Any international revenue (outside of the U.S) will be impacted by the strong U.S dollar when Apple reports. Given this international revenue equates to ~56% of total revenue, the impact was surprisingly minimal for the company. Apple does have a series of FX hedges in place, which looks to have offset the impact, coupled with solid growth.

Apple Sales by Region (Q4 Earnings Report)

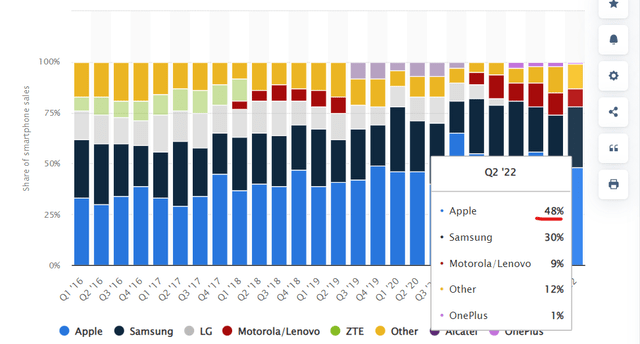

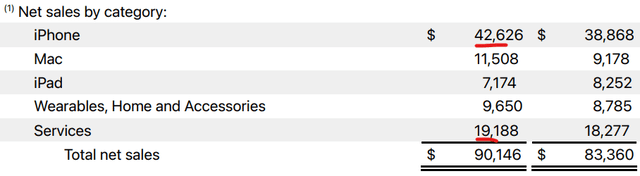

Products revenue was $71 billion, up 9% year over year and a record for the fourth quarter. This was driven by solid revenue growth for the iPhone which makes up 47% ($42.6 billion) of total revenue. The large skew towards the iPhone has always been a risk for Apple, as the revenue has historically popped on new iPhone releases. The latest iPhone 14 is not exactly revolutionary and the phone was even the butt of various memes going around the internet which basically alluded to the fact the phones are very similar. For more technical details, many review websites state, the upgrades over the iPhone 13 are “mostly iterative”. This includes “small refinements” in terms of photography, battery life, and GPU performance, hardly a game-changer. However, I believe the reason the iPhone continues to sell strong is because consumers who are already part of the Apple Ecosystem will choose to upgrade their phones naturally. Consumers choose Apple because of the brand and the “hands-off” approach to purchasing and using the device. The next alternative is Samsung (30% market share) of which its Galaxy models have similar features. But Apple’s software has an edge in my opinion, as the company develops its Apps under greater control. Apple’s market share (blue bars below) has fluctuated between 30% in 2016 to 65% in 2020 and thus looks to be in a similar range, with a slight uptrend in peaks as the years go by.

Apple/Smartphone Market Share. U.S.A (Statista)

Sales of the Mac hit an all-time high at $11.5 billion, up a staggering 25% year over year. This was driven by the launch of the MacBook Air with its new M2 processor which has 18% higher CPU performance for the equivalent power consumption. The company had some supply chain issues in the June quarter, thus some of those delayed sales acted as a tailwind into the fourth quarter. Apple makes ~12.8% of its Revenue from the Mac and thus it’s a fairly significant (and iconic) part of the business. iPad revenue was the only loser for Apple in the September quarter as revenue dipped by ~9% year over year to $7.17 billion. I discovered this decline was mostly driven by a timing issue, as new iPads were launched in September last year but October in 2022. Therefore the comparable between last year is not sufficient and management alluded to a solid quarter for the iPad.

Wearables, Home, and Accessories also generated solid growth of ~5% year over year ($9.65 billion). This was driven by the new Apple Watch and Air Pods pro. Many are skeptical of Smart watches and believe they only have a niche market. However, Apple stated that two-thirds of the customers who purchased Apple Watches in the fourth quarter were new to the product. Therefore this could be a “tipping point” into mass adoption of the product, especially as the form factor of the phone is reaching its limitations and many people wish to spend less time scrolling on a traditional screen.

Apple Sales by Category (Q4 Earnings)

Apple’s “Services” business is my favorite part of the company. As this segment is categorized by stronger margins than other segments (70% gross margin vs 40% gross margin average) driven by cloud and payment services. Apple has a brilliant system in which it will give you just a small amount of free iCloud storage when you buy an iPhone. Then usually a couple of months later, this storage will run out and if people want to protect their photos (if their iPhone is lost), a cloud upgrade is purchased with a simple click. In the September quarter Apple generated $19.2 billion in the quarter which was up 5% year over year. This growth was despite a 600 basis point headwind from the aforementioned foreign exchange rate environment. Services makes up approximately ~21.3% of its total revenue and the business has over 900 million paid subscriptions up from just 155 million in the prior year. Subscription revenue is my favorite type of business model as it generally entices the user into consistent and “sticky” payments which helps with cash flow forecasting. The services revenue also helps to diversify the business from its iPhone sales, which is relatively cyclical.

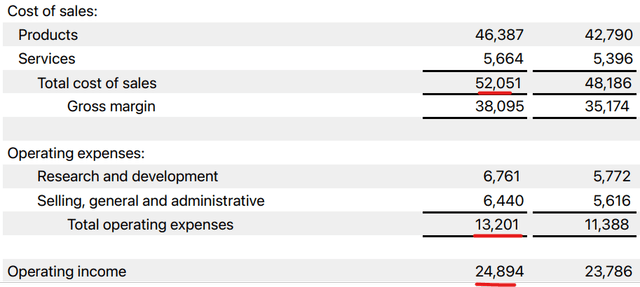

Profitability

Apple generated a strong Gross margin of 42.3%, which was a record for the September quarter, despite being down 100 basis points sequentially due to foreign exchange headwinds. Operating expenses increased by ~16% year over year to $13.2 billion, this was driven by cost inflation and a slight increase in R&D which isn’t exactly a negative. Although given the current environment costs are a key factor to watch. Overall Earnings Per share was $1.29 in the fourth quarter, which beat analyst expectations by $0.02.

Apple is a cash flow king and generated $20.182 billion of cash flow in the September quarter of 2022 which increased by 51% year over year.

The company has a 0.59% dividend yield which isn’t massive but better than the 0% offered by most tech companies. The company returned $3.7 billion to shareholders through this dividend in the September quarter. In addition, the company bought back $25.2 billion in shares.

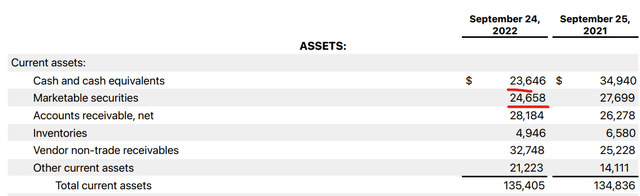

Apple has a fortress balance sheet with $48.304 billion in cash and marketable securities. In addition to total debt of $120 billion which is fairly high but Apple did refinance some of this debt and has solid free cash flow.

Apple Balance Sheet (Q4 earnings)

Tepid Outlook

Management believes that total year-over-year revenue performance will “decelerate” during the December quarter. The company is expecting a 10% negative headwind in FX exchange rate headwinds. In addition, the macro economic environment is uncertain (I will talk more about this in the risks section).

Advanced Valuation

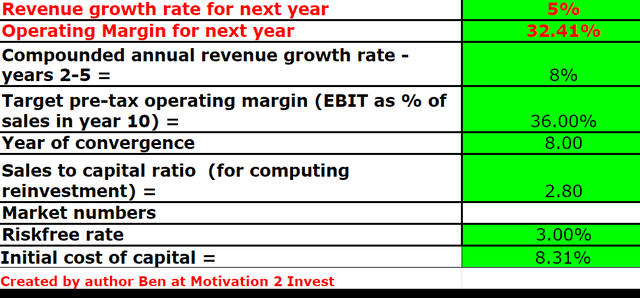

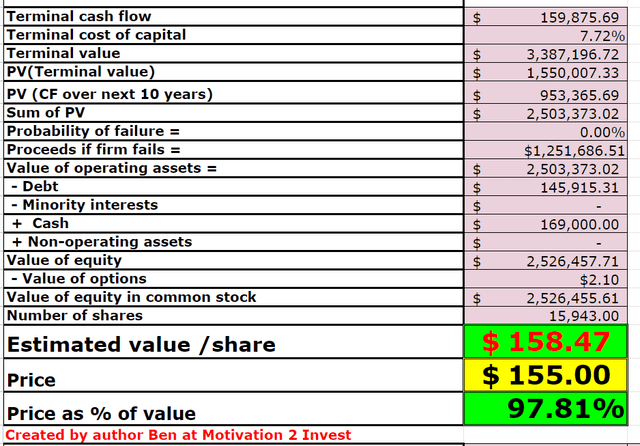

In order to value Apple I have plugged the latest financials into the advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a conservative 5% revenue growth for next year, driven by macroeconomic and FX headwinds. I have forecasted revenue to grow at a faster 8% rate per year in years 2 to 5. I expect this to be driven by a reversion in recessionary trends, FX improvements, and new iPhone releases.

Apple stock valuation (Created by author Ben Alaimo Motivation 2 Invest)

I have forecasted a target pre-tax operating margin of 36% by year 8. This includes an adjustment for R&D expenses, which has boosted the margin. In addition, I am forecasting continued growth in the higher-margin services segment.

Apple stock valuation (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $158 per share, the stock is trading at ~$155 per share at the time of writing and thus is “fairly valued”.

As an extra datapoint Apple trades at a P/E ratio = 25 , which is approximately 10% higher than its 5-year average.

Risks

Recession/FX Headwinds

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. Although I believe consumers deem a smartphone as necessary they may delay upgrades to the new iPhone next quarter given the macro economic conditions and how similar the phones are. The FX rates are also acting as a headwind against Apple’s international revenue, but I believe this is cyclical and not a long term issue.

Final Thoughts

Apple is arguably the greatest consumer electronics company that has ever existed. The company has continued to produce strong sales despite a tough economic backdrop. The stock is fairly valued at the time of writing and thus Apple continues to be a solid long-term investment.

Be the first to comment