SunnyVMD

A Quick Take On Society Pass

Society Pass (NASDAQ:SOPA) went public in November 2021, raising approximately $26 million in gross proceeds from an IPO that was priced at $9.00 per share.

The firm operates a commerce, customer loyalty and related analytics platform for merchants in Vietnam and Greater Southeast Asia.

The current market environment is heavily penalizing companies with increasing operating losses and has little regard for their growth trajectory.

I’m on Hold for SOPA until we see a meaningful move toward operating breakeven.

Society Pass Overview

Carson City, Nevada-based Society Pass was founded to acquire, develop and operate consumer-facing and merchant-facing ecommerce systems to sell consumer lifestyle and Food & Beverage products in Southeast Asia.

Management is headed by Founder, Chairman and CEO, Dennis Nguyen, who has been with the firm since inception and was previously in various roles at Nortel Networks and Citigroup.

The company has or seeks to acquire ecommerce websites in the following countries:

-

Vietnam

-

The Philippines

-

Indonesia

-

Singapore

-

Malaysia

-

Thailand

-

Cambodia

-

Laos

-

Myanmar

-

South Asia (India, Pakistan, and others)

The company markets its #HOTTAB system to merchants who seek to make it easier for their customers to purchase goods and receive loyalty points and personalized deals.

Management plans further expansion efforts in Southeast Asia, especially in the Philippines, India, and Bangladesh.

Society Pass’ Market & Competition

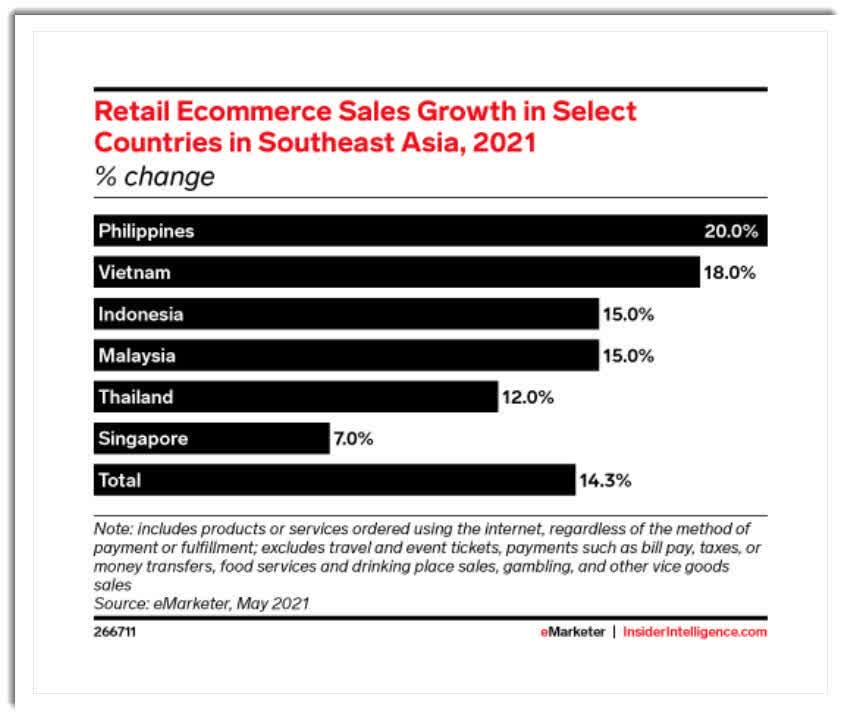

According to a 2021 market research report by eMarketer, the market for ecommerce activity in Southeast Asia is expected to grow by 14.3% in 2021.

The report estimated that ecommerce grew by a hefty 35.2% in 2020, likely aided in large part by the global pandemic.

The respective growth rates show significant divergence between countries, with the Philippines and Vietnam expected to generate higher growth rates in part due to their smaller bases.

Below is a chart indicating the report’s growth expectations, by country:

Retail Ecommerce % Change In Southeast Asia Countries (eMarketer)

Also, below is a chart showing the estimated ecommerce sales by country in 2021:

Retail Ecommerce In Southeast Asia Countries (eMarketer)

Major competitive or other industry participants by type include:

-

Online platforms

-

Food ordering systems

-

Lifestyle online marketplaces

-

Point of sale systems

Society Pass’ Recent Financial Performance

-

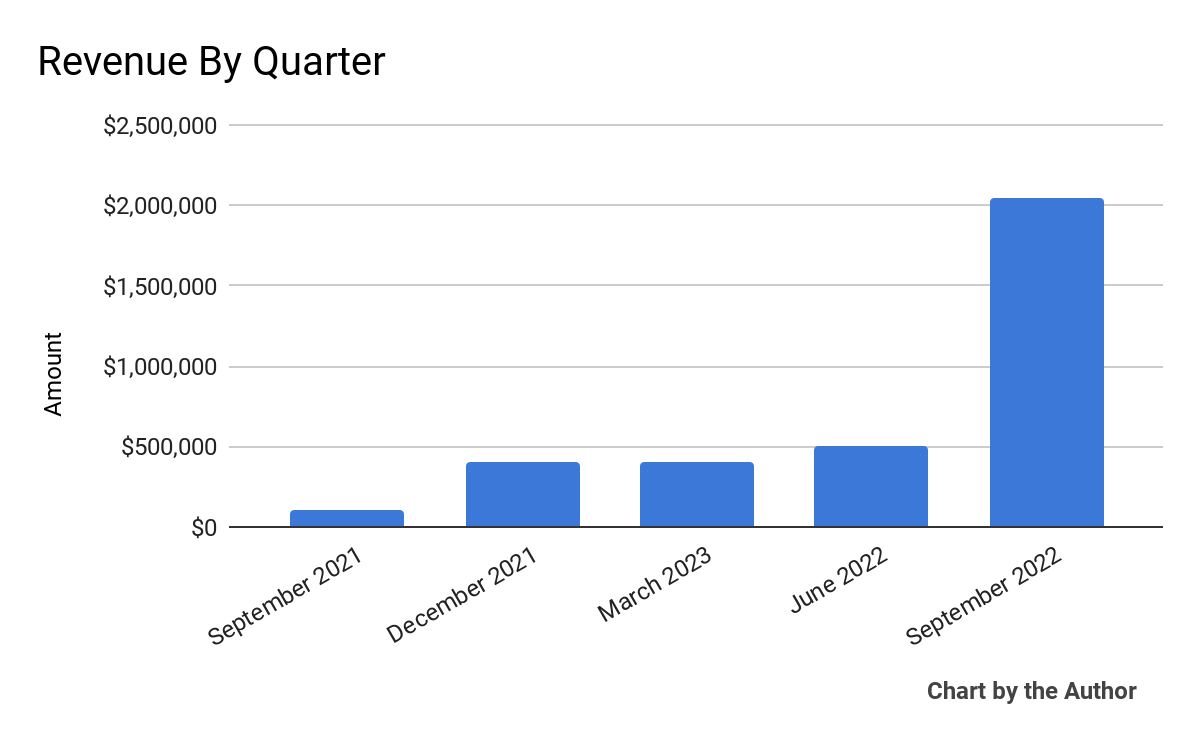

Total revenue by quarter has grown from a tiny amount in recent quarters to over $2 million in Q3 2022:

5 Quarter Total Revenue (Seeking Alpha)

-

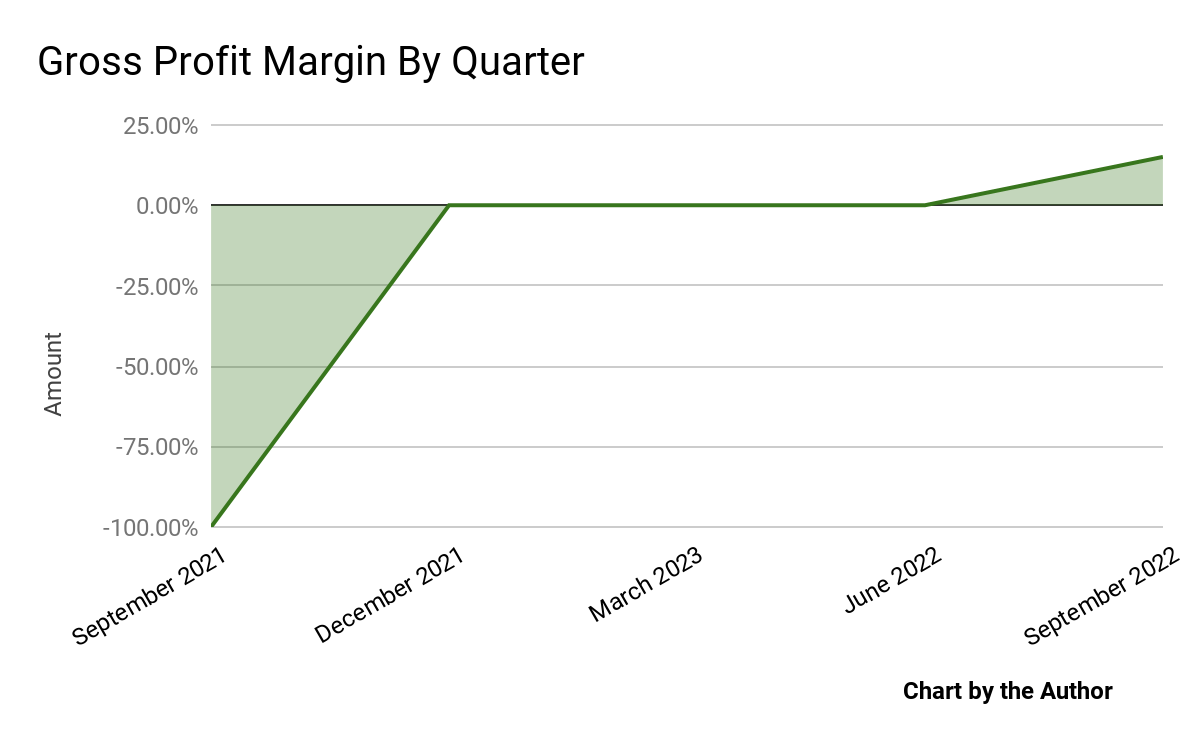

Gross profit margin by quarter has been either negative or breakeven in recent reporting periods:

5 Quarter Gross Profit Margin (Seeking Alpha)

-

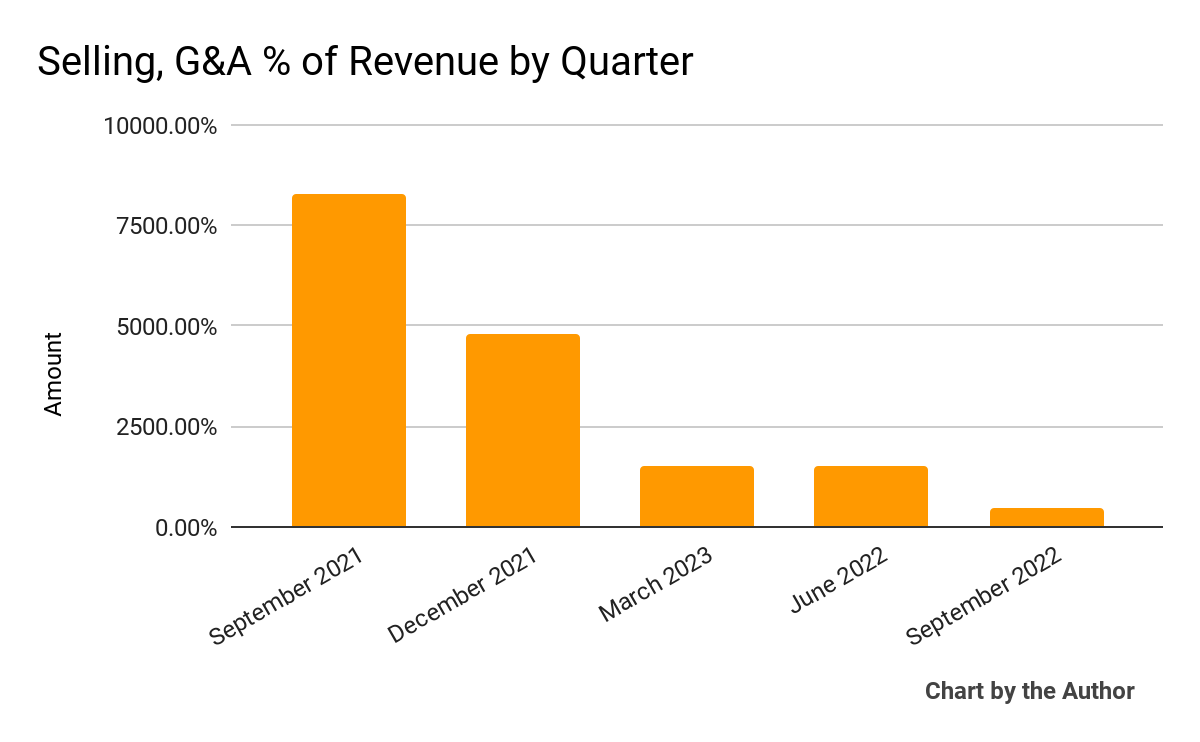

Selling, G&A expenses as a percentage of total revenue by quarter have remained far higher than revenue:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

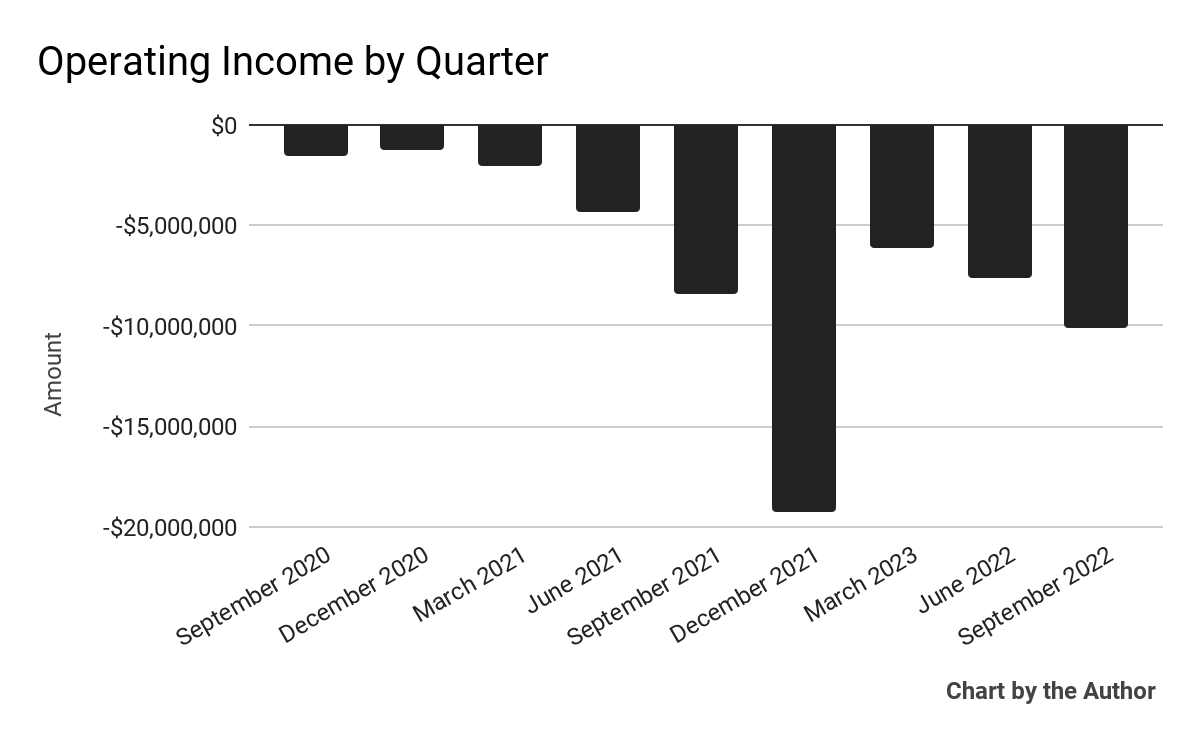

Operating losses by quarter have worsened in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

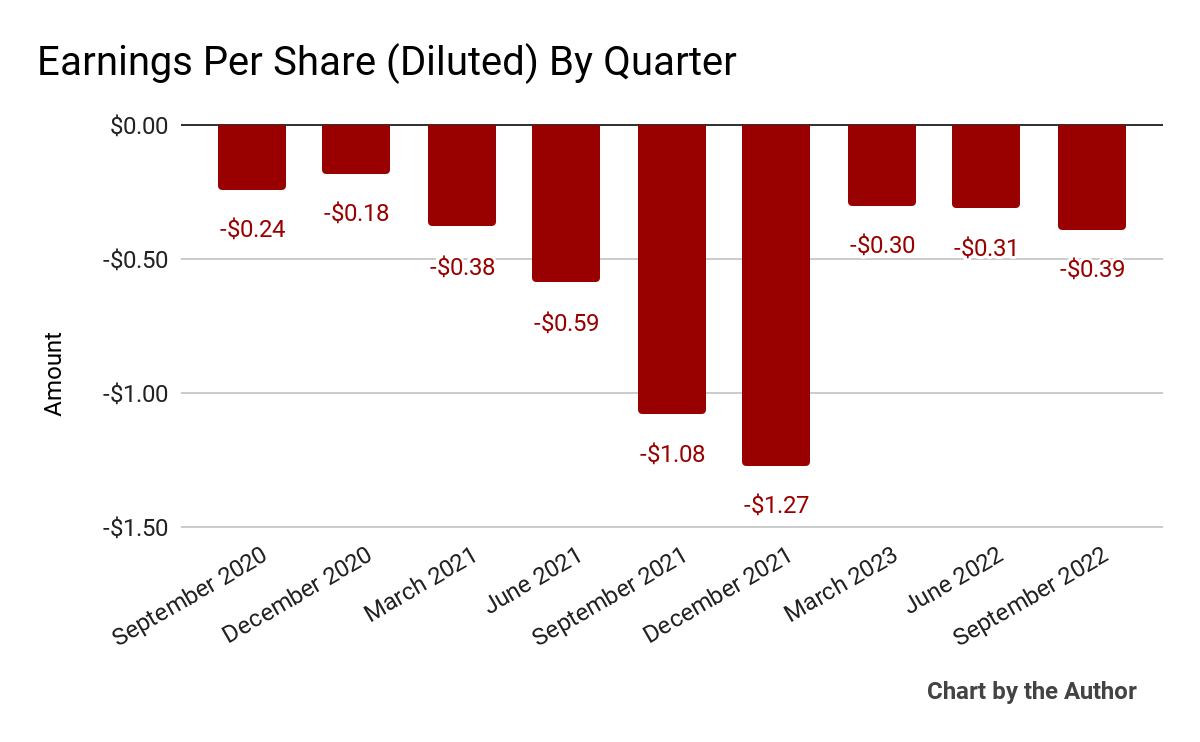

Earnings per share (Diluted) have remained heavily negative, as the chart shows below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

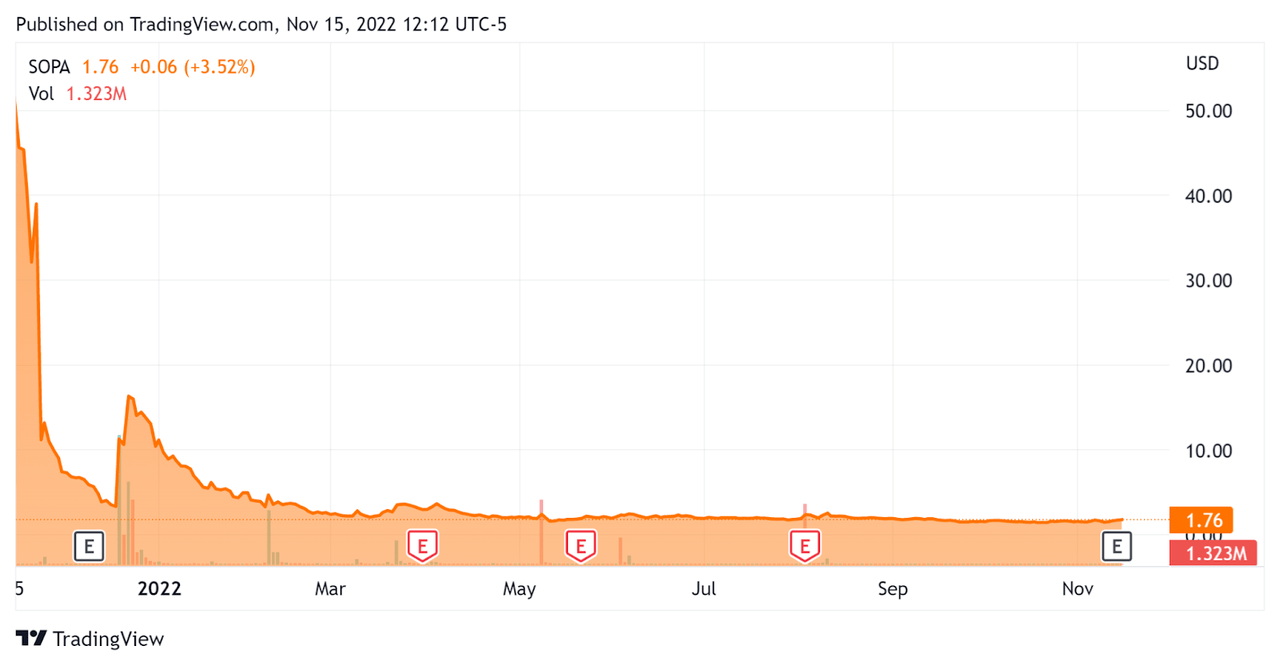

Since its IPO, SOPA’s stock price has fallen 96.6% vs. the U.S. S&P 500 Index’s drop of around 14.3%, as the chart below indicates:

Stock Price Since IPO (Seeking Alpha)

Valuation And Other Metrics For Society Pass

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

4.45 |

|

Revenue Growth Rate |

2947.0% |

|

Market Capitalization |

$43,140,000 |

|

Enterprise Value |

$15,550,000 |

|

Operating Cash Flow |

-$19,060,000 |

|

Earnings Per Share (Fully Diluted) |

-$2.96 |

(Source – Seeking Alpha)

Commentary On Society Pass

In its last earnings release (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the completion of three acquisitions, with the companies acquired operating in Thailand, the Philippines, and Indonesia.

The firm now counts 3.3 registered users and 205,000 registered merchants/brands in its expansion efforts in the Southeast Asia region.

Also in Q3, management succeeded in opening two local offices, one in Bangkok, Thailand, and one in Jakarta, Indonesia.

As to its financial results, revenue rose 2,354% year-over-year from a tiny base.

Gross margin turned positive for the first time in company history while SG&A expenses as a percentage of revenue dropped sharply while still remaining very high.

Management spent approximately $9.9 million on G&A expenses on $2 million in revenue.

For the balance sheet, the firm finished the quarter with $23 million in cash and equivalents and no debt.

Over the trailing twelve months, free cash used was $11.3 million, of which capital expenditures accounted for $449,545.

Looking ahead, management sees continued growth in revenue and further activity in its ‘acquisitions focused operating model.’

Regarding valuation, the market is valuing SOPA at an EV/Revenue multiple of around 4.45x.

The primary risk to the company’s outlook is its ‘acquisitions focused operating model’ which requires acquiring firms at reasonable prices, integrating them efficiently and effectively, and ultimately producing organic growth.

A potential upside catalyst to the stock could include further revenue growth.

A major question is whether the company can continue its acquisition growth model while reducing operating losses, which are currently worsening.

The present market environment is heavily penalizing companies with increasing operating losses and has little regard for their growth trajectory.

I’m on Hold for SOPA until we see a meaningful move toward operating breakeven.

Be the first to comment