byryo/iStock via Getty Images

Thesis: Improving Fundamentals

CareTrust REIT (NYSE:CTRE) is a skilled nursing and senior care real estate investment trust that owns about 200 properties leased on a triple-net basis to 18 operators across 21 states.

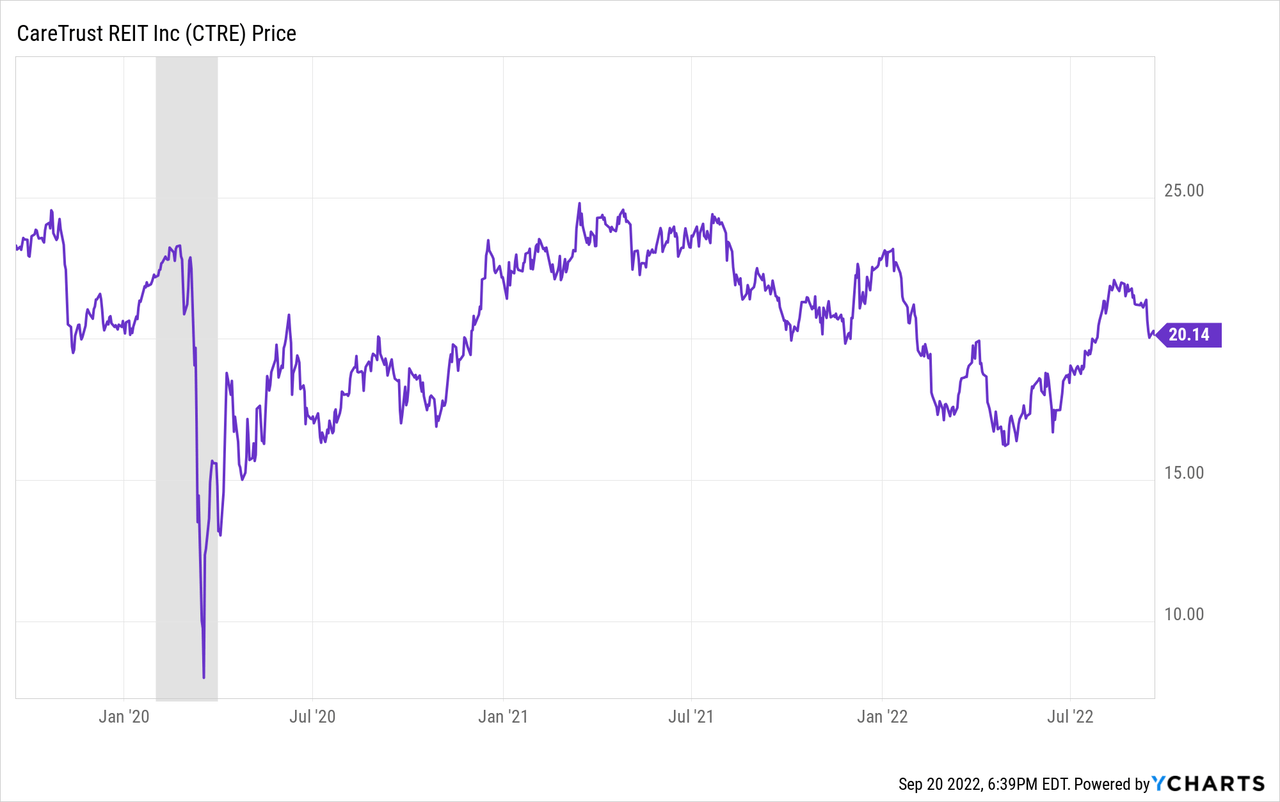

Over the last few years, CTRE has been more or less rangebound as its tenant-operators’ financials and ability to cover rent obligations have eroded.

But in a few key ways, the fundamental backdrop is improving for SNF operators and also for CTRE directly.

Meanwhile, CTRE’s 5.5%-yielding dividend continues to appear safe and liable to continue growing year after year, even in the midst of a meaningful portfolio transformation effort.

Let’s dive in for a midyear update on CTRE and see if we can discern light at the end of this dark tunnel.

Midyear Update On CTRE

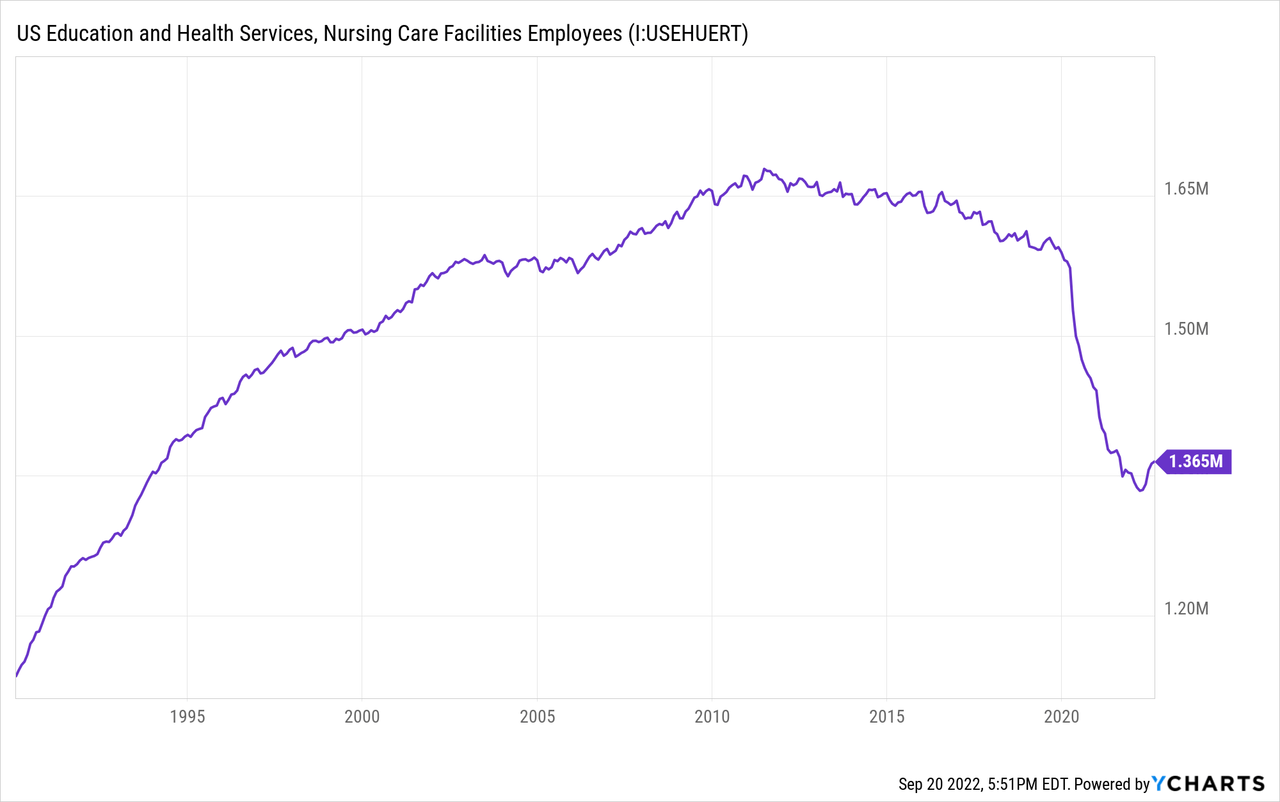

Most of CTRE’s portfolio is in skilled nursing facilities (“SNFs”) and nursing homes. The nursing care industry was one of the hardest hit by the pandemic, as extra precautions on top of unpleasant preexisting work conditions caused a huge wave of workers to leave that line of work altogether.

Total employment in nursing care dropped by around 300,000 people nationwide to the lowest level since 1993. But fortunately, as you can see below, that self-reinforcing cycle seems to have burned itself out and turned around. The industry’s labor force seems to be on the rebound.

A rebound in the nursing care workforce has multiple beneficial effects.

First, it allows occupancy to increase. Part of the reason that SNF occupancy wasn’t rebounding very fast after COVID-19 began to fade was that SNFs simply lacked the staff to take more residents. Many potential residents remained sitting in hospital beds waiting for an opening.

In the second quarter, occupancy rose 98 basis points quarter-over-quarter at CTRE’s skilled nursing facilities and 215 basis points at its senior housing properties.

But the labor shortage also affected operators’ financial wherewithal by pushing up wages. The workers that remained demanded higher pay, and operators also had to rely on agency labor (e.g. travel nurses making 2-3x more than normal staff) to fill the gap. Huge increases in labor costs necessarily eroded rent coverage.

The good news is that as workers return to the nursing care industry, wage growth seems to have peaked. CEO Dave Sedgwick mentioned on the Q2 conference call:

What we’re hearing is that applications for jobs are up. Agency usage is trending downward. I spoke with an operator on the East Coast the other day, who said that they are now hiring everybody at their facility, seniors housing operator, the historical rates before the big spike. So while it’s still elevated, I think we’re going to see some signs that wages are moderating again.

As tenant-operators’ finances improve, we can see this show up in rent payments. CTRE reported cash rent collections rising from 92% in Q2 to 94% in July and August.

Another way in which the environment is improving for CTRE is in pricing of SNF properties. As interest rates rise, lender-dependent buyers are increasingly backing out of deals and decreasing the buyer pool, allowing pricing to come back down to the levels at which CTRE has traditionally made acquisitions (8-9% cap rates).

CTRE is well-capitalized and able to issue equity accretively for deals. Thus, its ability to write checks gives it an advantage in a market where buyer capital is drying up.

At the same time, the market is apparently still hot enough to make dispositions worthwhile. In February, management announced their intent to sell, reposition, or re-tenant about 10% of its total portfolio by base rent. It’s looking like most of that will be accomplished via dispositions that then get reinvested into higher-quality properties/tenants.

Management says that they expect to complete the bulk of the portfolio transition by the end of the year.

At the same time, CTRE continues to make investments. Year-to-date, CTRE has invested $144 million into new investments at an average yield of about 9%. These are mostly loans to SNF operators that are secured by real estate. As property prices fall, management expects to return to making more direct real estate property investments going forward.

Even amid industry headwinds and portfolio transformation, CTRE appears intent on continuing its policy of maintaining and growing its dividend year after year. Earlier this year, the REIT upped its dividend by 3.8%.

The payout ratio sits at a comfortable 71% based on normalized FAD.

Balance Sheet Strength

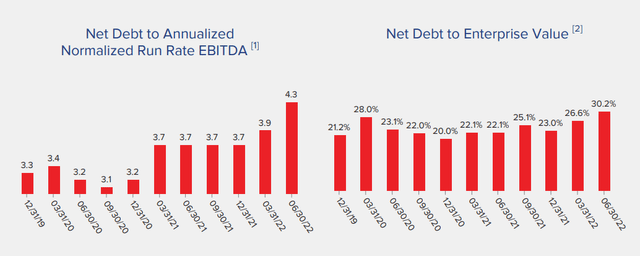

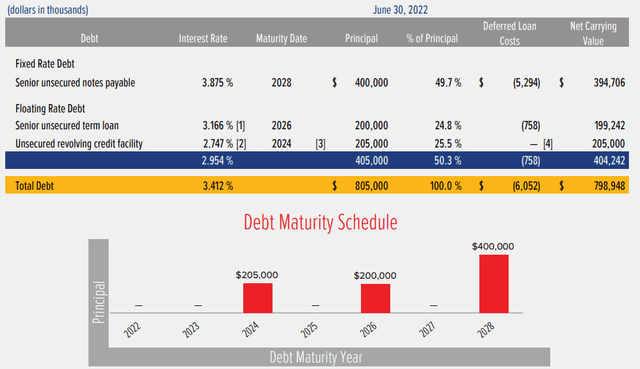

CTRE’s balance sheet remains resilient. Although CTRE has increased borrowings on its credit facility to $205 million from $80 million at the end of 2021 (probably to fund investments), the REIT had plenty of room to let leverage metrics rise, as it was underleveraged (according to its own targets) before.

There still remains total liquidity of $401 million ($16 million in cash plus $385 million of availability on credit facility), which amounts to 20.5% of CTRE’s current market cap.

Meanwhile, net debt to normalized EBITDA of 4.3x only just broke into management’s target range of 4-5x.

Since this debt was just credit facility borrowings, I don’t believe the net leverage ratio metric will remain above 4x indefinitely.

Though CTRE has a sub-investment grade credit rating of BB+/Ba2, the REIT enjoys a very low cost of debt, with a weighted average interest rate of 3.4% in Q2. This goes a long way toward achieving the very high fixed charge coverage ratio of 7.5x.

Though only about half of debt is fixed-rate, CTRE does enjoy favorable terms on its floating rate term loan, which should keep that borrowing cost reasonable even as the Fed hikes rates.

Bottom Line

While there is still some execution risk surrounding management’s plan to transition/recycle 10% of the portfolio this year, I believe in CTRE’s long-term growth prospects.

The labor shortage in the nursing care industry will probably persist for the foreseeable future, but that actually gives an advantage to the higher quality operators in the space that can afford to remain fully staffed. CTRE’s portfolio transition appears to be an effort to concentrate only on those strong operators, led by the REIT’s ~37% exposure to The Ensign Group (ENSG) with its >3.5x rent coverage.

Plus, after listening to several conference calls now, I just get a good gut feeling about management. They strike me as straight-shooters who are not only smart but also honest and humble. After all, we as individual shareholders are investing in this team of investors just as much as we are investing in a portfolio of properties or a balance sheet.

You can find higher yields in the SNF REIT space, namely with Omega Healthcare Investors’ (OHI) 8.4% yield, but I don’t believe you will find a safer dividend than the 5.5%-yielding one offered by CTRE.

Be the first to comment