Arkadij Schell/iStock Editorial via Getty Images

Introduction

We review our investment case on Pernod Ricard SA (OTCPK:PRNDY) (referred here as “PR”) ahead of its H1 FY23 results release on February 16.

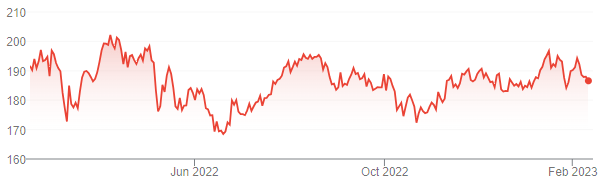

We upgraded our rating on PR to Buy in March 2022, after its share price fell 13.5% in two months and returned to our target range. PR’s share price is at present roughly flat from the level at our upgrade and down 3% versus a year ago.

|

PR Share Price (Last 1 Year)  Source: Google Finance (10-Feb-23). |

(A previous Buy rating on PR, between August 2019 and June 2021, returned 19% in less than two years.)

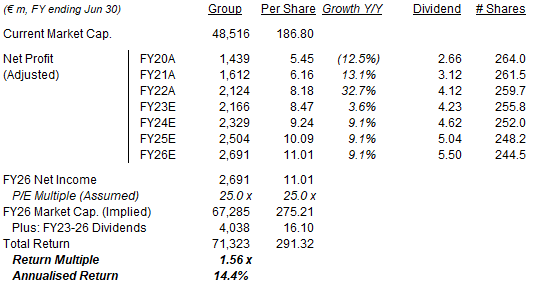

PR has FY23-25 targets that include a revenue CAGR of 4-7% and average margin expansion of 50-60 bps, which imply an Operating Profit CAGR of 6-9%. We expect PR to report another set of strong results, similar to what Diageo (DEO) has reported for the same period. Most markets should see a further rebound from a COVID-impacted prior-year, even if the U.S. may decelerate somewhat and China will be disrupted by COVID-19 in December. PR shares are trading at 22.8x FY22 Adjusted EPS and have a 2.2% Dividend Yield, similar to Diageo shares. On balance we do not believe FY22 earnings to be too elevated. Our forecasts indicate a total return of 56% (14.4% annualized). Buy.

Pernod Ricard Buy Case Recap

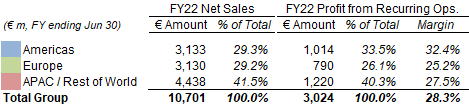

Pernod Ricard is a global Spirits company with headquarters in France but sales and profits from all world regions:

|

PR Net Sales & Profit by Region (FY22)  Source: PR results release (FY22). NB. Net sales are net of excise taxes. “Europe” excludes Turkey, which is in “APAC / Rest of World”. |

PR’s most important markets are the U.S., China, India and Travel Retail.

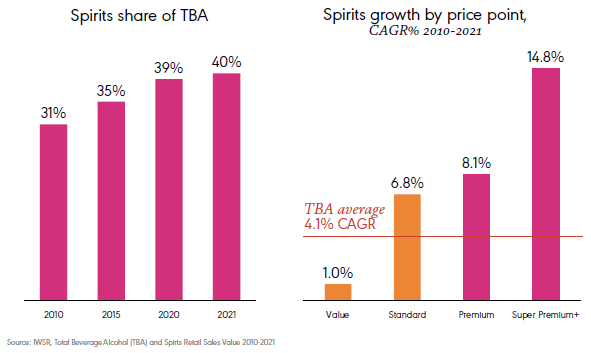

Our investment case on Pernod Ricard (similar to that on Diageo) has been based on the structural volume and value growth in global spirits, and PR’s ability to take advantage of this growth:

- The global spirits industry is benefiting from structural increases in the population of drinkers, penetration rates (including share gains from wine and beer) and premiumisation. In 2010-21, total Retail Sales Value of spirits grew at a CAGR of 4.1%, with Premium spirits growing at 8.1% and Super Premium+ spirits growing at 14.8%

|

Global Spirits Retail Sales Value Growth (2010-21)  Source: Diageo results presentation (FY22). NB. TBA = Total Beverage Alcohol, RTD = Ready To Drink. |

- Industry leaders like PR can grow sales faster than the spirits market thanks to its over-indexation to premium brands (76% of PR’s net sales by FY22), as well as its strong brands, scale, and capabilities in innovation, marketing and distribution

- PR can continue to expand its operating margin, from a combination of pricing, positive mix shift, operational leverage and cost efficiencies

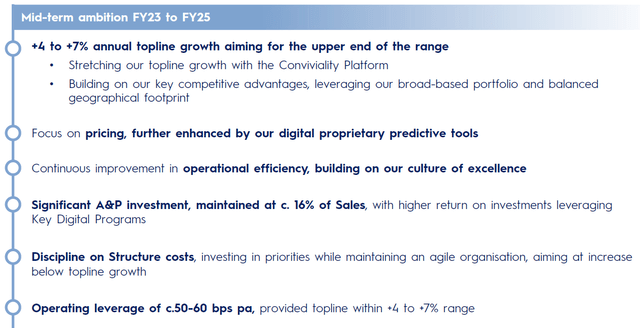

These structural dynamics have been reflected in PR’s new FY23-25 targets.

Pernod Ricard’s FY23-25 Targets

At its investor day in June 2022, PR announced new FY23-25 targets that include:

- Average annual Net Sales growth of 4-7%, “aiming for the upper end of the range”

- Average annual operating margin expansion of 50-60 bps

With a Profit from Recurring Operations (“PRO”, equivalent to EBIT) margin 28.3% in FY22, these targets imply a FY23-25 PRO CAGR of 6-9% approximately (similar to Diageo’s medium-term targets).

|

PR FY23-25 Targets  Source: PR investor day presentation (Jun-22). |

Read-Across from Diageo Results

We expect PR to report another set of strong results in H1 FY23, based on what Diageo has already reported.

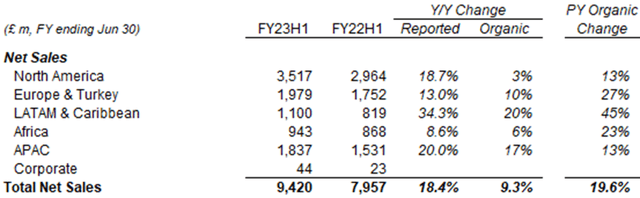

Diageo reported its H1 FY23 results two weeks ago (on January 26), with year-on-year organic growth of 9.3% in Net Sales (and 9.5% in Adjusted EBIT), on top of double-digit growth the year before:

|

Diageo Net Sales by Region (H1 FY23 vs. Prior Year)  Source: Diageo company filings. |

Three of Diageo’s five regions reported organic Net Sales growth of 10% or more, a further rebound from a COVID-impacted prior-year. The exceptions were North America and Africa.

Diageo’s organic Net Sales growth in North America was only 3%, but this reported growth was 1 ppt lower than reality because shipments were lower than depletions by the same amount. PR may not have been affected by the same issue. The U.S. is also a much smaller part of PR compared to Diageo. (In FY22, the Americas region is 29% of PR’s sales, whereas North America alone was 40% of Diageo’s.)

Diageo’s organic Net Sales growth in Africa was only 6% largely due to a weak 2% growth in Beer; PR does not sell beer so the figure is not comparable. More relevantly, Diageo’s Spirits sales in Africa grew 15% organically.

Diageo’s organic Net sales growth in APAC was still a strong 17% in H1 FY23, despite the disruption from the end of “zero COVID” polices and a subsequent wave of infections in China in December. We expect any impact on PR’s H1 FY23 to be similarly modest.

Pernod Ricard’s Q1 FY23 Results

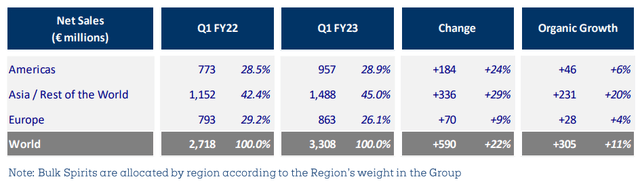

PR has also reported about half of its H1 FY23 results already – in its Q1 FY23 sales update on October 20:

|

PR Net Sales by Region (Q1 FY23 vs. Prior Year)  Source: PR results release (Q1 FY23). |

Q1 FY23 was helped by a 7% average price increase globally (compared to mid-single-digits in FY22), which should also benefit the rest of H1.

Management was confident about FY23 at the time of the update. As CFO Helene de Tissot said on the call:

“We continue to expect, for the full year, dynamic, broad-based net sales growth, albeit moderating on a normalizing comparison basis … We are, as well, expecting a significant positive currency effect for fiscal year ’23”

Q1 FY23 organic sales growth of 11% limits the room for negative surprise in H1 FY23 results.

Pernod Ricard Stock Valuation

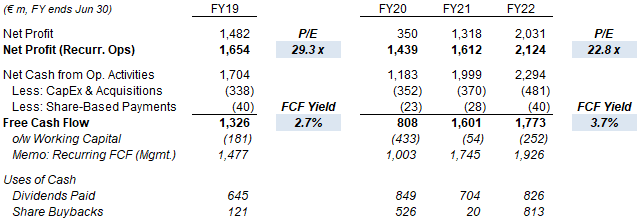

At €186.80, PR stock is at a 22.8x P/E and a 3.7% Free Cash Flow (“FCF”) Yield with respect to FY22 financials:

|

PR Earnings, Cashflows & Valuation (FY19-22)  Source: PR company filings. |

The 22.8x P/E is attractive and lower than our long-term assumption of 25.0x. Even with respect to pre-COVID FY19, PR stock has a P/E of 29.3x and a FCF Yield of 2.7%.

Earnings multiples based on historic financials may overstate PR’s valuation for euro-focused investors, given the significant weakening of the currency in recent months.

PR declared total dividends of €4.12 in FY22 (up 32% year-on-year), which represents a Dividend Yield of 2.2%.

With respect to FY22 financials, PR’s valuation is almost identical to Diageo’s (22.6x P/E, 3.4% FCF Yield, 2.2% Dividend Yield)

PR expects to execute €500-750m of buybacks in FY23, representing 1.0-1.5% of the current market capitalization. This is potentially a lower amount than the €750m program in FY22.

PR is spending more capital on investments and acquisitions. CapEx is expected to rise from 4.5% of sales in FY22 to 7% in FY23, and may stay elevated for a few years; management has been investing in capacity projects such as a new distillery in Kentucky, U.S., and new facilities at existing distilleries in Ireland and Scotland. PR has also continued to make acquisitions, for example acquiring a majority stake in Codigo 1530 Tequila in October 2022.

Net Debt / EBITDA was a reasonable 2.4x at FY22 year-end.

Are Pernod Ricard Earnings At Cyclical High?

On balance we do not believe FY22 earnings to be over-elevated, though we do not rule out a deceleration in FY23.

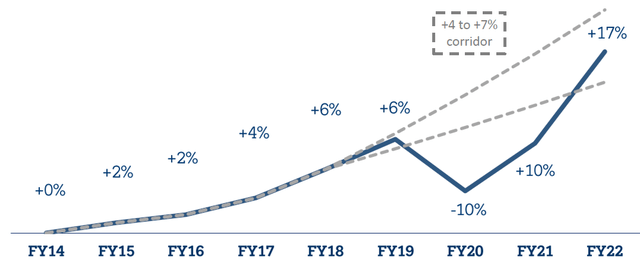

While PR saw double-digit organic Net Sales growth in FY21 and FY22, these follow a 10% decline in FY20 (the result of COVID-19), which means PR sales remain in the long-term corridor of 4-7% annual growth:

|

PR Organic Net Sales Evolution (FY14-22)  Source: PR results presentation (FY22). |

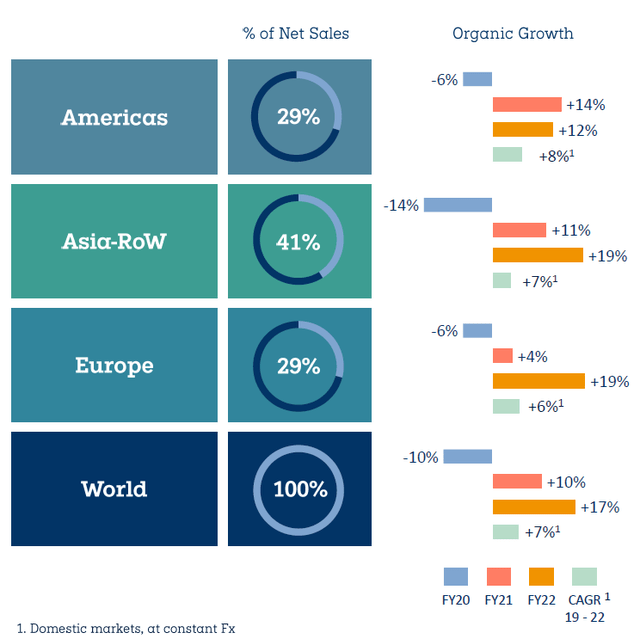

Each of PR’s region had FY19-22 Net Sales CAGR of between 6% and 8%, which we see as sustainable given the spirits’ long-term growth, premium spirits growing faster, and PR gaining share within premium spirits:

|

PR Organic Net Sales By Region (FY20-22)  Source: PR results presentation (FY22). |

Illustrative Pernod Ricard Stock Forecasts

We update our forecasts and extend by a year to FY26. Our key assumptions now include:

- FY23 Net Profit growth of 2% (unchanged)

- Net Profit to grow at 7.5% each year thereafter (unchanged)

- Share count to fall by 1.5% each year (unchanged)

- Dividends Payout Ratio of 50% (unchanged)

- FY26 year-end P/E of 25.0x (was 27.0x)

We are intentionally conservative on FY23 to reflect the possibility of a U.S. recession later this year.

We have a FY26 EPS forecast of €11.01:

|

Illustrative PR Return Forecasts  Source: Librarian Capital estimates. |

With shares at €186.80, we expect an exit price of €275 and a total return of 56% (14.4% annualized) by June 2026.

Is Pernod Ricard Stock A Buy? Conclusion

We reiterate our Buy rating on Pernod Ricard SA stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment