Olivier Le Moal/iStock via Getty Images

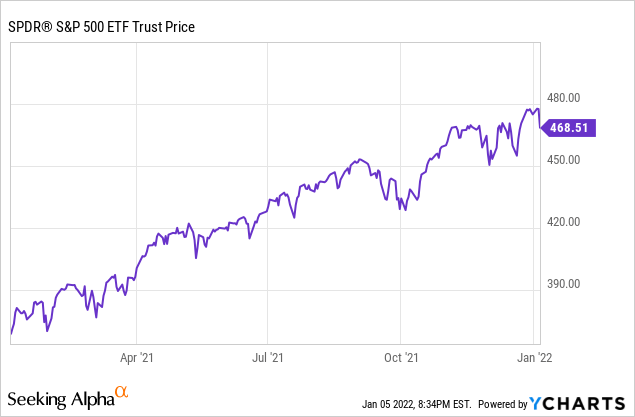

The year 2021 was another bumper year for the stock market, especially the S&P 500, which gained 28.5% and beat both the Dow Jones Industrial and Nasdaq. Obviously, we had several panic moments during the year and faced many challenges, including the highest inflation in many decades, supply chain issues causing shortages, and sure enough, the continued threat of the COVID pandemic. More recently, markets had a knee-jerk reaction to the discovery of a new COVID variant dubbed “Omicron,” even though it was short lived. In the new year, the biggest threat to the market remains the elevated inflation, exacerbated by supply chain issues and the resulting rise in interest rates. In addition, most of the asset prices are elevated, and some may be in the bubble territory.

Now, there are two big unknowns that we are starting the year 2022 with. How long will the current bout of inflation persist and the response of the Feds to deal with inflation? So far, the Fed has shown a rapid change in its outlook from being overly dovish to suddenly hawkish. During the last couple of days, we have seen some market reaction to the rise in Treasury yields and hawkish Feds. We certainly have other issues and factors that will have an impact on the market movement in 2020, for example, midterm year politics, geopolitical events, additional fiscal stimulus, tax laws, and of course, the COVID variants. Welcome to 2022!

Needless to say, with so many things going on, the direction of the market is a bit murky, in spite of a rising market. That said, we will always have this so-called wall of worries and concerns, and that’s what makes the market direction uncertain and unpredictable. That’s why it’s important that we should look at investing as a long-term game plan and not on the basis of day-to-day or week-to-week gyrations. We should always remind ourselves that there’s only one thing certain in markets, and that’s “uncertainty,” and our portfolios should be structured in such a way that they provide decent and proportionate returns when the market is booming but preserve the capital when times get tough.

S&P 500 ETF (SPY) 12-month chart, courtesy YCharts

As long-term dividend investors, we need to pay less attention to the short-term movements of the market and pay more attention to the quality of companies that we buy, especially when they’re being offered relatively cheap. The goal of this series of articles is to find companies that are fundamentally strong, carry low debt, support reasonable, sustainable, and growing dividend yields, and also trade at relatively low or reasonable prices. These DGI stocks are not going to make anyone rich overnight, but if your goal is to attain financial freedom by owning stocks that should grow dividends over time, meaningfully and sustainably, then you are at the right place.

The market is not easy to navigate, even during the best of times. At the same time, we do not want to lose our sleep over our investments. So, it’s all the more important that we invest in companies that have many years of dividend history, pay growing and sustainable dividends, and have low or manageable levels of debt. We remain on the lookout for such companies when they are trading cheap on a relative basis to the broader market as well as to their respective 52-week highs. We believe in keeping a buy list handy and dry powder ready so that we can use the opportunity when the time is right. Besides, we think, every month, this analysis is able to highlight some companies that otherwise would not be on our radar.

This article is part of our monthly series, where we scan the entire universe of roughly 7,500 stocks that are listed and traded on US exchanges, including over-the-counter (OTC) networks. However, our focus is limited to dividend-paying stocks only. We usually highlight five stocks that may have temporary difficulties or lost favor with the market and offer deep discounts on a relative basis. However, that’s not the only criteria that we apply. While seeking cheaper valuations, we also demand that the companies have an established business model, solid dividend history, manageable debt, and investment-grade credit rating. Please note that these are not recommendations to buy but should be considered as a starting point for further research.

This month, we highlight three groups of five stocks each that have an average dividend yield (as a group) of 3.14%, 5.69%, and 7.91%, respectively. The first list is for conservative and risk-averse investors, while the second one is for investors who seek higher yields but still want relatively safe investments. The third group is for yield-hungry investors but comes with an elevated risk, and we urge investors to exercise caution.

Notes: 1) Please note that when we use the term “safe” regarding stocks, it should be interpreted as “relatively safe” because nothing is absolutely safe in investing. Also, in our opinion, for a well-diversified portfolio, one should have 15-20 stocks at a minimum.

2) All tables in this article are created by the author unless explicitly specified. The stock data have been sourced from various sources such as Seeking Alpha, Yahoo Finance, GuruFocus, and CCC-List (dripinvesting).

Goals For the Selection Process

Note: Regular readers of this series could skip this section to avoid repetitiveness. However, we include this section for new readers to provide the necessary background and perspective.

We start with a fairly simple goal. We want to shortlist five companies that are large-cap, relatively safe, dividend-paying, and trading at relatively cheaper valuations in comparison to the broader market. The objective is to highlight some of the dividend-paying and dividend-growing companies that may be offering juicy dividends due to a temporary decline in their share prices. The excess decline may be due to an industry-wide decline or some kind of one-time setbacks like some negative news coverage or missing quarterly earnings expectations. We adopt a methodical approach to filter down the 7,500-plus companies into a small subset.

Our primary goal is income that should increase over time at a rate which at least beats inflation. Our secondary goal is to grow the capital and provide a cumulative growth rate of 9%-10% at a minimum. These goals are by and large in alignment with most retirees and income investors as well as DGI investors. A balanced DGI portfolio should keep a mix of high-yield, low-growth stocks along with some high-growth but low-yield stocks. That said, how you mix the two will depend upon your personal situation, including income needs, time horizon, and risk tolerance.

A well-diversified portfolio would normally consist of more than just five stocks and preferably a few stocks from each sector of the economy. However, in this periodic series, we try to shortlist and highlight just five stocks that may fit the goals of most income and DGI investors. But at the same time, we try to ensure that such companies are trading at attractive or reasonable valuations. However, as always, we recommend you do your due diligence before making any decision on them.

Selection Process

The S&P 500 currently yields less than 1.30%. Since our goal is to find companies for a dividend income portfolio, we should logically look for companies that pay yields that are at least better than the S&P 500. Of course, the higher, the better, but at the same time, we should not try to chase high yield. If we try to filter for dividend stocks paying at least 1.30% or above, nearly 2,000 such companies are trading on US exchanges, including OTC networks. We will limit our choices to companies that have a market cap of at least $10 billion and a daily trading volume of more than 100,000 shares. We also will check that dividend growth over the last five years is positive.

We also want stocks that are trading at relatively cheaper valuations. But at this stage, we want to keep our criteria broad enough to keep all the good candidates on the list. So, we will measure the distance from the 52-week high but save it to use at a later stage. After applying the current criteria defined so far, we got a smaller set of about 469 companies.

Criteria to Shortlist

- Market cap > $10 billion

- Dividend yield > 1.30%

- Daily average volume > 100,000

- Dividend growth past five years >= 0.

By applying the above criteria, we got roughly 469 companies.

Narrowing Down the List

As a first step, we would like to eliminate stocks that have less than five years of dividend growth history. We cross-check our list of 469 stocks against the list of so-called Dividend Champions, Contenders, and Challengers originally defined and created by David Fish. Generally, the stocks with more than 25 years of dividend increases are called dividend Champions, while stocks with more than ten but less than 25 years of dividend increases are termed as Contenders. Further, stocks with more than five but less than ten years of dividend increases are called Challengers.

After we apply this filter, we’re left with 211 companies on our list. However, so far in this list, we have demanded five or more years of consistent dividend growth. But what if a company had a very stable record of dividend payments but did not increase the dividends from one year to another. At times, some of these companies are foreign-based companies, and due to currency fluctuations, their dividends may appear to have been cut in US dollars, but in reality, that may not be true at all when looked at in the actual currency of reporting. So, by relaxing this condition, a total of 65 additional companies qualified to be on our list, which otherwise met our basic criteria. We call them category ‘B’ companies. After including them, we had a total of 276 (211+65) companies that made our first list.

We then imported the various data elements from many sources, including CCC-list, GuruFocus, Fidelity, Morningstar, and Seeking Alpha, among others, and assigned weights based on different criteria as listed below:

- Current yield: Indicates the yield based on the current price.

- Dividend growth history (number of years of dividend growth): This provides information on how many years a company has paid and increased dividends on a consistent basis. For stocks under the category ‘B’ (defined above), we consider the total number of consecutive years of dividend paid rather than the number of years of dividend growth.

- Payout ratio: This indicates how comfortably the company can pay the dividend from its earnings. We prefer this ratio as low as possible, which would indicate the company’s ability to grow the dividend in the future. This ratio is calculated by dividing the dividend amount per share by the EPS (earnings per share). The cash-flow payout ratio is calculated by dividing the dividend amount paid per share by the cash flow generated per share.

- Past five-year and 10-year dividend growth: Even though it’s the dividend growth rate from the past, this does indicate how fast the company has been able to grow its earnings and dividends in the recent past. The recent past is the best indicator that we have to know what to expect in the next few years.

- EPS growth (average of previous five years of growth and expected next five years growth): As the earnings of a company grow, more than likely, dividends will grow accordingly. We will take into account the previous five years’ actual EPS growth and the estimated EPS growth for the next five years. We will add the two numbers and assign weights.

- Chowder number: So, what’s the Chowder number? This number has been named after well-known SA author Chowder, who first coined and popularized this factor. This number is derived by adding the current yield and the past five years’ dividend growth rate. A Chowder number of “12” or more (“8” for utilities) is considered good.

- Debt/equity ratio: This ratio will tell us about the debt load of the company in relation to its equity. We all know that too much debt can lead to major problems, even for well-known companies. The lower this ratio, the better it is. Sometimes, we find this ratio to be negative or unavailable, even for well-known companies. This can happen for a myriad of reasons and is not always a reason for concern. This is why we use this ratio in combination with the debt/asset ratio (covered next).

- Debt/asset ratio: This ratio will tell us about the debt load in relation to the total assets of the company. In almost all cases, this ratio would be lower than the debt/equity ratio. Also, this ratio is important because, for some companies, the debt/equity ratio is not a reliable indicator.

- S&P’s credit rating: This is the credit rating assigned by the rating agency S&P Global and is indicative of the company’s ability to service its debt. This rating can be obtained from the S&P website.

- PEG ratio: This also is called the price/earnings-to-growth ratio. The PEG ratio is considered to be an indicator if the stock is overvalued, undervalued, or fairly priced. A lower PEG may indicate that a stock is undervalued. However, PEG for a company may differ significantly from one reported source to another, depending on which growth estimate is used in the calculation. Some use past growth, while others may use future expected growth. We’re taking the PEG from the CCC list, wherever available. The CCC list defines it as the price/earnings ratio divided by the five-year estimated growth rate.

- Distance from 52-week high: We want to select companies that are good, solid companies but also are trading at cheaper valuations currently. They may be cheaper due to some temporary down cycle or some combination of bad news or simply had a bad quarter. This criterion will help bring such companies (with a cheaper valuation) near the top, as long as they excel in other criteria as well. This factor is calculated as (current price – 52-week high) / 52-week high.

- Sales or Revenue growth: This is the average growth rate in annual sales or revenue of the company over the last five years. A company can only grow its earnings power as long as it can grow its revenue. Sure it can grow the earnings by cutting costs, but that can’t go on forever.

Below we provide a table (as a downloadable Excel spreadsheet) with weights assigned to each of the ten criteria. The table shows the raw data for each criterion for each stock and the weights for each criterion, and the total weight. Please note that the table is sorted on the “Total Weight” or the “Quality Score.” The list contains 276 names and is attached as a file for readers to download:

File-for-export-5_Safe_and_Cheap_DGI_Jan_2020.xlsx

Selection of the Final 30

To select our final 30 companies, we will follow a multi-step process:

We will first bring down the list to roughly 50 names by automated criteria, as listed below. In the second step, which is mostly manual, we will bring the list down to about 30.

- Step 1: We will first take the top 20 names in the above table (based on total weight or quality score). We also remove a couple of names from the top (for example, VALE), which have a very high dividend yield but a very sketch dividend record.

- Step 2: Now, we will sort the list based on dividend yield (highest at the top). We take the top 10 after the sort to the final list. We only take the top three from any single industry segment because, otherwise, some of the segments, like energy, tend to overcrowd (selected 11 names).

- Step 3: We will sort the list based on five-year dividend growth (highest at the top). We will take the top 10 after the sort to the final list (selected 11 names).

- Step 4: We will then sort the list based on the credit rating (numerical weight) and select the top 10 stocks with the best credit rating. However, we only take the top two or three from any single industry segment because, otherwise, some of the segments tend to overcrowd (selected 12 names).

From the above steps, we have a total of 54 names in our final consideration. The following stocks appeared more than once:

Appeared two times: MS, SCCO (2 duplicates)

Appeared three times: C, CI, RIO (6 duplicates)

After removing eight duplicates, we are left with 46 names.

Since there are multiple names in each industry segment, we will just keep a maximum of three or four names from the top from any one segment. We keep the following:

Financial Services, Banking, and Insurance:

Banking: (NYSE: C), (JPM), (BAC)

Financial Services – Others : (GS), (MS)

Business Services:

(ADP)

Conglomerates:

(IEP)

Industrials:

(SWK), (CMI), (CAT), (PH), (MMM)

Chemicals:

(APD)

Materials/Mining/Gold:

Materials:

Mining (other than Gold): (RIO), (SCCO)

Gold: (AEM)

Defense:

None

Consumer/Retail/Others:

Cons-defensive: (ADM), (TSN), (PG)

Cons-discretionary: (QSR)

Cons-Retail: (TGT), (BBY), (HD)

Communications/Media:

None

Healthcare:

Technology:

(INTC), (TXN), (AVGO), (CSCO), (HPE)

Energy:

Pipelines/ Midstream: (EPD), (MPLX), (ENB)

Oil & Gas: (XOM)

Utilities:

None

REIT:

None

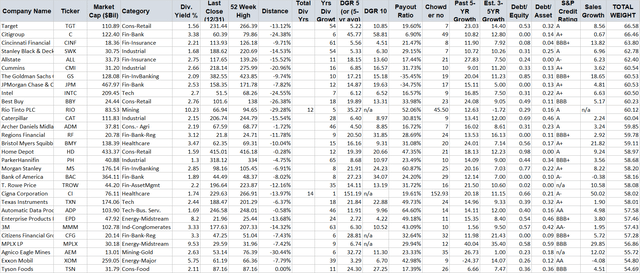

TABLE-1: List of Top 30 in the order of Total Quality Score (Total Weight)

Final Step: Narrowing Down to Just Five Companies

This step is mostly a subjective one and is based solely on our perception. The readers could certainly differ from our selections, and they may come up with their own set of five companies, with a target yield, but should pay attention to keep the group diversified among different sectors or industry segments. Below, we make three lists for different sets of goals, dividend income, and risk levels. We try to make each of the groups highly diversified and try to ensure that the safety of dividends matches the overall risk profile of the group. Nonetheless, here are our final lists for this month:

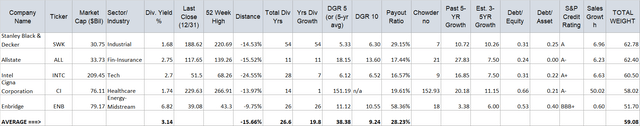

Final A-List (Conservative Safe Income):

Average yield: 3.14%

We think this set of five companies (in the A-List) would form a solid diversified group of dividend companies that would be appealing to income-seeking and conservative investors, including retirees and near retirees. The average yield is quite decent at 3.14% compared to 1.3% of the S&P 500. The average dividend growth history is roughly 20 years, and all but one of the companies support an “A-” or higher credit rating from S&P. The average discount from a 52-week high is also good at over 15%

We have two dividend aristocrats (SWK, ENB) on the list. Two other companies, ALL and INTC, have consistent dividend records as well. Our fifth selection, Cigna (repeat from last month), does not have a very long dividend history, but future dividend growth potential is very good. As such, the company has solid fundamentals and high growth prospects and is being offered at attractive valuations right now.

The A-List is for conservative and risk-averse investors, and that’s the reason the average dividend yield is reasonable but not that great. However, if you must need higher dividends, consider B-List or C-List, as presented below.

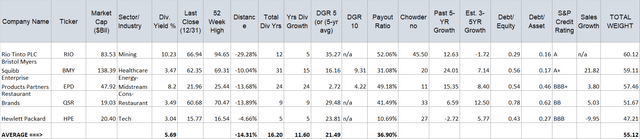

Final B-List (High Yield, Moderately Safe):

Average yield: 5.69%

- Note 1: Please pay attention that EPD is an MLP (Master Limited Partnership) and issues form K-1 at tax time instead of regular 1099-Div. Please use your due diligence.

- Note 2: Many times, we include low-risk stocks in B-List and C-list. Oftentimes, a stock can appear in multiple lists. This is done on purpose. We try to make each of our lists fairly diversified among different sectors/industry segments of the economy. We try to include one or two highly conservative names in the high yield list to make the overall group much safer.

In the B-List, we have included some moderately high-risk names to elevate the yield but will likely provide good growth, such as RIO, QSR, and HPE. Currently, RIO and other mining companies are offering attractive prices due to lower iron ore prices. Mining companies like RIO and BHP are especially attractive in an inflationary environment and provide very high dividends but are likely to be volatile. RIO was recommended last month as well. However, some of the discount has disappeared since then. The B-List includes two names with high credit ratings (A- or higher), namely, RIO and BMY.

This list offers an average yield for the group of 5.69%, an average of 12 years of dividend growth history, and very high past dividend growth.

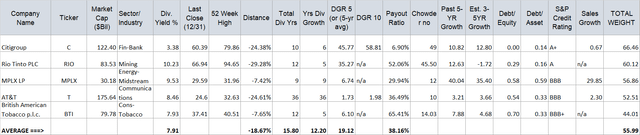

Final C-LIST (Yield-Hungry, Less Safe):

Average yield: 7.91% (will likely come down to 7.25% to 7.5%)

Note: Please pay attention that MPLX is an MLP (Master Limited Partnership) and issues form K-1 at tax time instead of regular 1099-Div. Please use your due diligence.

The C-List includes two stocks (RIO and Citi) with high credit ratings (A- or higher). There are four names (RIO, MPLX, T, BTI) that currently provide very high dividends.

AT&T is currently providing a very high dividend yield but is likely to cut dividends after the pending spinoff of WarnerMedia. But even if it was to reduce the yield to 5% (current is 8.25%), the average yield for the group would still be in the range of 7.25%.

RIO is likely to provide protection against inflation. MPLX is an MLP that has reasonably safe dividends. BTI (British Tobacco) is another high yield solid dividend stock that is included in this list, but we consider the dividend fairly safe.

Apparently, this list (C-List) is for yield-hungry DGI investors, but we urge due diligence to determine if it would suit your personal situation. Nothing comes free, so there will be more risk involved with this group. That said, it’s a highly diversified group spread among five different sectors. The average yield for the group of five goes up to 7.91%.

We may like to caution that each company comes with certain risks and concerns. Sometimes these risks are real, but other times, they may be a bit overblown and temporary. So, it’s always recommended to do further research and due diligence.

Below is a snapshot of five companies from each of the three groups:

Table-2: A-LIST (Conservative Income)

Table-3: B-LIST (High Yield)

Table-4: C-LIST (Yield-Hungry, Elevated Risk)

Conclusion

In the first week of every month, we start with a fairly large list of dividend-paying stocks and filter our way down to just a handful of stocks that meet our selection criteria and income goals. In this article, we have presented three groups of stocks (five each) with different goals in mind and to suit the varying needs of a wider audience. Even though the risk profile of each group is different, each group in itself is fairly balanced and diversified.

The first group of five stocks is for highly conservative investors who prioritize the safety of the dividend and preservation of their capital. The second group reaches for a higher yield but with only a slightly higher risk. However, the C-group comes with an elevated risk and is certainly not suited for everyone.

This month, the first group yields 3.14%, while the second group elevates the yield to 5.69%. We also presented a C-List for yield-hungry investors with a 7.91% yield. We believe the first two groups of five stocks each make an excellent watch list for further research and buying at an opportune time.

Be the first to comment