Evgenii Mitroshin

Permian Resources Corporation (NYSE:PR) was recently formed by a merger of Centennial Resource Development and Colgate Energy. Permian Resources provided its outlook for 2023, which calls for an approximately 9% growth in average production during 2023 (compared to Q4 2022). It also expects to generate close to $1.2 billion in positive cash flow in 2023 at current strip, although it should be noted that Permian has a relatively wide guidance range for various items such as production costs and production levels.

I estimate Permian’s value at $12 per share in a long-term (after 2023) $70 WTI oil and $4.00 Henry Hub gas scenario. This is improved compared to my expectations for standalone Centennial since the new combined company appears to have production costs that are several dollars lower per BOE.

Notes On 2023 Guidance

Permian expects to average between 150,000 BOEPD to 165,000 BOEPD (52% oil) in 2023. This is 9% production growth at guidance midpoint compared to its expected Q4 2022 production. Permian’s 2023 guidance range is quite wide though, with the high-end of its production guidance being 10% above the low-end of its production guidance.

Permian’s controllable cash costs (LOE, cash G&A and GP&T) are projected at a combined $7.25 to $8.75 per BOE in 2023. This is much lower than what standalone Centennial was previously reporting, and is around the range that Colgate was reporting. This (lower controllable cash costs) appears to be one benefit of the merger assuming that Permian Resources can hit guidance.

Permian’s Hedges

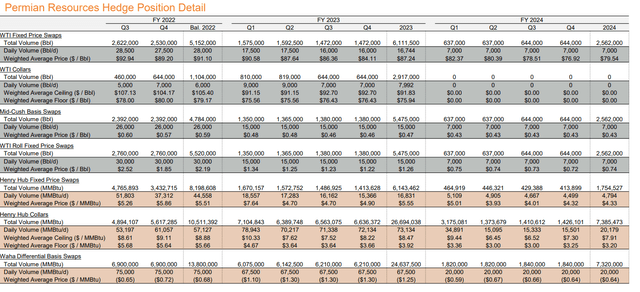

Permian Resources provided details about its hedges, and it appears that there has been no change since the last independent hedging updates for Colgate and Centennial.

Permian’s Hedges (permianres.com)

Permian has around 20% of its 2023 oil production hedged (based on its guidance midpoint) with WTI swaps at an average price of $87.24. It also has an additional 10% of its 2023 oil production hedged with WTI collars with an average ceiling of $91.83 and an average floor of $75.94.

2023 Outlook At Strip

Permian’s guidance midpoint for 2023 calls for it to average 157,500 BOEPD (52% oil, 19% NGLs, 29% natural gas).

The current strip for 2023 is approximately $83 to $84 WTI oil along with $5.50 Henry Hub natural gas. At those commodity prices, Permian Resources would generate $3.262 billion in revenues after the effect of its hedges. Permian’s hedges have modestly positive value at current strip prices.

| Type | Barrels/Mcf | $ Per Barrel/Mcf | $ Million |

| Oil | 29,893,500 | $81.00 | $2,421 |

| NGLs | 10,922,625 | $36.00 | $393 |

| Gas | 100,028,250 | $4.25 | $425 |

| Hedge Value | $23 | ||

| Total | $3,262 |

Permian expects its capital expenditures for 2023 to be in the $1.15 billion to $1.35 billion range. At $1.25 billion in capex it would be projected to generate $1.194 billion in positive cash flow in 2023.

| $ Million | |

| Lease Operating, Cash G&A and GP&T | $460 |

| Production Taxes | $243 |

| Cash Interest | $115 |

| Capex | $1,250 |

| Total | $2,068 |

Return Of Capital Program

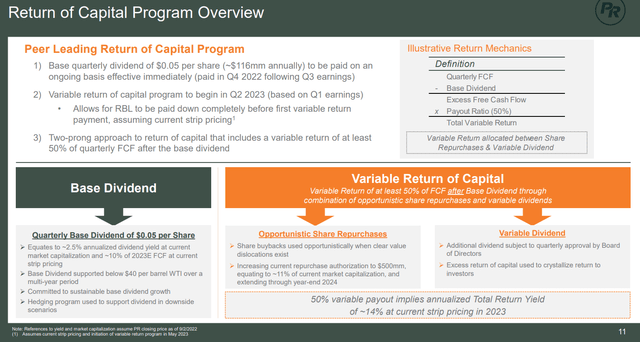

Permian is initiating a base quarterly dividend of $0.05 per share starting in Q4 2022. This is expected to add up to $116 million in annualized base dividends based on its current share count. It also is planning to begin a variable return of capital program in Q2 2023 (as it projects to fully pay down its credit facility borrowings by then).

Permian Resources Return Of Capital Framework (permianres.com)

This variable return of capital program aims to return at least 50% of Permian’s free cash flow (after its base dividend) via share repurchases and a variable dividend. Permian’s current share repurchase authorization has been increased to $500 million.

Based on 2023 results, Permian is thus projected to put $539 million towards variable dividends and share repurchases, in addition to its $116 million per year base dividend. That would leave $539 million to put towards debt reduction and acquisitions.

Notes On Valuation

I estimate Permian’s value at approximately $12 per share in a scenario where prices follow current strip until the end of 2023 and then average long-term $70 WTI oil and $4.00 NYMEX after the end of 2023. This assumes that Permian can hit the midpoint of its 2023 guidance.

Permian’s estimated value (compared to standalone Centennial) appears to be enhanced by the reduction in controllable cash costs. These items may end up several dollars per BOE less than what Centennial was reporting in early 2022.

Conclusion

Permian Resources is projected to generate close to $1.2 billion in positive cash flow in 2023 at current strip prices. It is aiming for controllable cash costs in the $7.25 to $8.75 per BOE range for 2023, which is several dollars per BOE less than standalone Centennial and around the same level as standalone Colgate.

With the lower controllable cash costs, I believe that Permian can be worth around $12 per share in a long-term (after 2023) $70 WTI oil and $4.00 NYMEX gas scenario.

Be the first to comment