Scott Olson

Dear readers/followers,

Since I wrote my first neutral article on Hostess Brands (NASDAQ:TWNK), the company first bounced up, then dove down in conjunction with the market. Still, the outperformance here is double digits and just goes to show you how far things can go when a company is trading with a premium expectation such as this one.

And you know what? It could be deserved. In today’s economic macro, investors are flocking to anything that promises safety – and their tendency is understandable.

So, let’s see what we have going here, why Hostess is doing so well – and whether we should actually allow this sort of premium and “go in” to the stock here.

Revisiting Hostess Brands and its significant premium

So, Hostess typically enjoys a massive premium to its valuation, due to some significant market advantages. It’s a leading snack/sweets company whose focus is the complete chain of snack products, primarily in the North American market. Its popular products such as Ding Dongs, Twinkies, Cupcakes, Donettes, and similar products are found under the Hostess and Voortman brands.

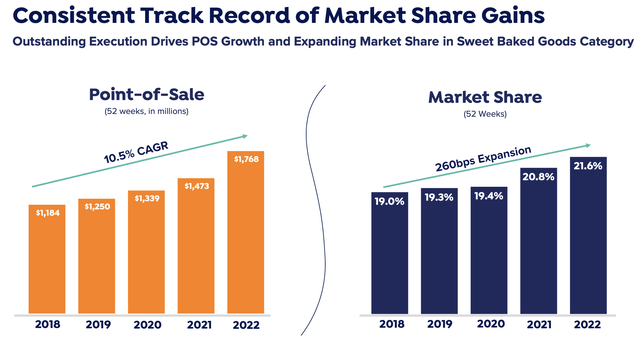

As I mentioned in my first article, this company operates among a best-in-class business model with market-leading analytics and excellent supply chain management. This leadership has made it possible for the company to “own” over 20% of the NA market share for their relevant category – all the while posting historical and projected growth in the bottom and the top-line.

Voortman is a recent M&A – completed in 2020 – and these two giants under the Hostess Brands company now operate in a very attractive segment – who doesn’t love sweets?

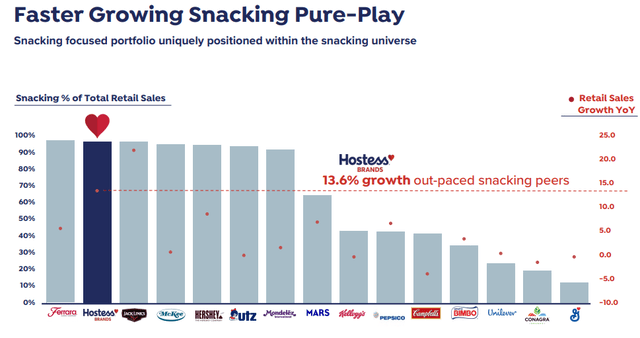

The company’s outperformance is visible on a peer basis.

Growth from Hostess comes in part from marketing, but mostly from the timeless recognition of its brand. Hostess works with a TAM of over $50B+ in the US alone, and the growth in these segments is expected to at least average 5% per year going forward – again, people love their sweets.

There is some degree of uniqueness to this model. It ensures wide availability of products and uses a unique go-to-market approach with centralized distribution and common carriers, and ships most of its products from Kansas, which is its distribution center.

This is further made possible by the company’s extended shelf-life technology – I’m sure you’ve heard the theory that Twinkies can last for decades. The simple fact is that Hostess brands operate a superb model with good margins while having their logistics simplified to a relatively high degree.

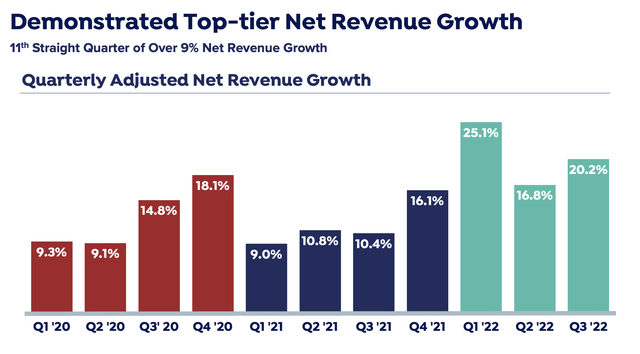

The latest set of quarterly results is impressive enough, showcasing strong, topline momentum with double-digit, 20%+ organic net revenue growth due primarily to a better price/mix while maintaining the overall sales volume. That’s top-line – and the positives here were good enough that the company is raising the full-year guidance, and ramping up further the ongoing advertising investments we’re seeing here.

Revenue growth rates continue to impress here.

While the company can’t claim to grow the bottom line as quickly as the revenue, the EBITDA and EPS are still growing either at double digits, or close to double digits, with EPS coming in at a 9.5% YoY growth. Specifically, Cookies accounted for a significant 33.2% YoY growth, with Sweets at around 18.7%, and the company’s pricing actions and increases are bringing in these improvements, despite more or less unchanged volumes.

What’s More, consumers are continuing to view the company’s products very favorably, with Point-of-Sale growth up 28.8% and 17% respectively for cookies and Sweets over the YoY period.

The company’s market share is essentially completely flat despite the market volatility. It’ll be interesting to see where the company’s market share development goes from here – because the past couple of years has been absolutely excellent.

Still, there comes a time when this sort of growth and expansion is hard to repeat – and at over a fifth of the overall market share, the company may start to reach that level.

Guidance is updated as of the last quarter. We have stable CapEx of around $135M, with increase in EBITDA as high as $293M for the year, with an EPS that’s trending very close to the $1 mark per share on an adjusted basis.

The company has started selling its Bouncers, and so far sales have been very impressive across the board.

Again, dear readers – plenty to like here, and it’s really hard to find operational “clouds” on the horizon. They don’t really exist here – not obvious ones at the very least.

We could of course mention input risks. The company’s inputs are primarily flour, cooking oil, sugar, and coatings – as well as the corrugated and film for packaging. The company buys as well as it can to reduce pricing volatility – but the fact is inflation and costs are going to be driving the company’s trends. Still, this risk is relatively quickly argued against in this latest quarter given the price/mix trends that essentially prove that the company can handle, and effectively manage potential headwinds here.

How about the concentration of revenue-generating businesses? Customer-wise, the company’s 10 top customers made up almost 60% of annual revenues. The biggest customer is Walmart (WMT), which represents nearly 19% of revenues, with no other more than 10% of 2021 revenues.

It’s doubtful that any of the top 10’s would change its relationship with Hostess, but if it did, this would obviously be a disaster for the company’s sales. Again though, no signs of this – the signs are the opposite of this. You could argue that Walmart and similar stores could provide store-brand alternatives. The fact is that Walmart already does this. Under their Great Value brand, the company offers snack cakes, and I’ve actually tried them. I would say that compared to Hostess, they don’t really measure up.

The company presents industry-leading margins. Adjusted GM is around 37%, and adjusted EBITDA/FCF margins are around 24-25%. Compared to a margin in the sector that’s usually below 20%, this is excellent, and part of the reason to invest in Hostess. Other reasons include very low private label exposure, which is otherwise the death of margins, broad access to virtually all sales channels, and exposure to the indulgent snacking segment – which is the fastest-growing snacking segment out there.

So what risks one can usually see for this sort of company, is one I don’t really see here in this case.

The company’s market share is “too good” and things are developing much too well for this to be any sort of risk that would considerably impact how I see the company as an investment.

Instead, the problem is one we find in valuation – and it’s worse now than before.

Hostess Brands Valuation

While the company valuation isn’t at the near-30x peak we saw only a few months back, it’s still significantly above any level where I would want to be buying a company with a BB- rating and zero dividends.

Because let’s face it, dear readers. The fact that Hostess doesn’t give shareholders any share of its annual profits in the form of a dividend is one of the major downsides of this stock – together with its valuation.

At an EPS yield of just north of 4%, you don’t need a college course in valuation to understand that this company is at levels where we wouldn’t want to necessarily buy it, even with solid growth estimates in the bag for the company for the next few years.

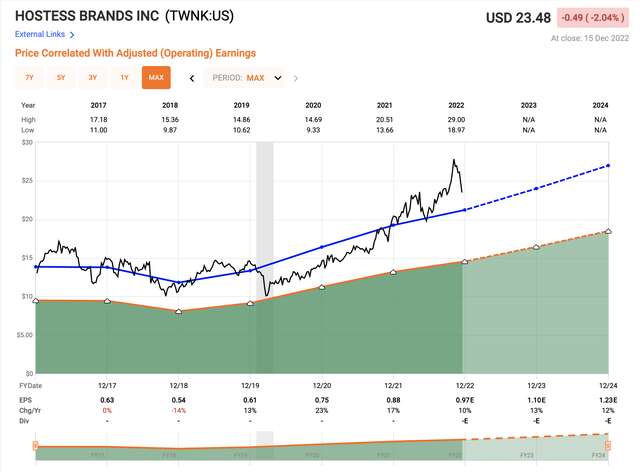

F.A.S.T Graphs TWNK upside (F.A.S.T graphs)

Hostess has a history of trading at a premium to the sector, and to peers. The 5-year average is close to 22X P/E – and the company is at a significant premium even to this as things stand today

A snacking company growing EPS double-digits is, of course, a good investment – at least in theory.

However, today’s market environment calls for downside consideration. The potential downside for Hostess is at least as low as we saw in the pandemic, at which time the company trended close to that 15X P/E line. The fact that there is no dividend enhances this risk greatly in my mind.

TWNK is a company with a record, market-leading growth rate, and a legacy that spans decades, with some of the most well-known products out there. Calling such a company “overvalued” needs to be based on sound considerations, forecasts, and facts. So let me try to do just that.

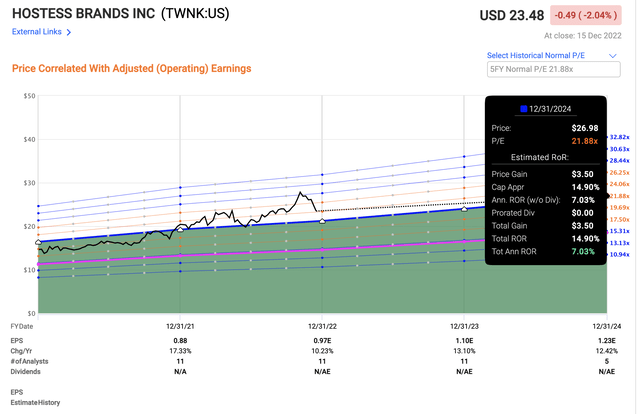

The company’s P/E is currently over 24x. That means that even on a 5-year normalized P/E basis of 21.8x, almost 22x, that’s an upside of no more than 7%, and that’s with a double-digit growth estimate of almost 12%.

Hostess Brands Upside (F.A.S.T graphs)

Those are not impressive rates of return – not in the least, considering some of the valuations and upsides we can get in today’s market.

Normally and in a normal market situation, an 8-8.5% annual might have been enough. However, because we’re battling a 6-8% annual rate of inflation, this puts things into different perspectives.

Because of the complete lack of any dividend, this means that this return, gross of any buybacks, of course, is all that we can expect from Hostess.

To me, this is definitely not enough.

If we were at 16-18X P/E, that rate of return might have been as high as 15-20%. But that’s not where we are – and I’m unwilling to rate it any higher.

Analysts following the company consider the business valuation in the following manner – being fully onboard with a massive premium for the business, and completely lacking any sort of justifiable structure. A year ago, the company was rated with a PT of around $18.5 – but as the price increased, the analysts keep going higher. Today the average target is almost $30/share, with 9 out of 11 analysts rating the company a “BUY” or equivalent.

That means either my calculations and discounts are way off, or these analysts are caught up in investing in one of the fewer “safe” companies out there in the midst of a crisis. I tend toward the latter explanation as an argument for the average 25.3% upside to the current PT from the analyst side.

Me, I take a different tact.

Here is my updated thesis on Hostess Brands.

Thesis

- Hostess is one of the greatest snack brand companies out there – with industry-leading margins, a great organization, and good growth prospects. It’s not outside the realm of possibility that growth could be even higher than expected.

- However, Hostess also comes at a substantial premium, has no yield whatsoever, faces supply chain, inflation, and energy risks as well as the general movement against sugar snacks, and because of that, I’m a bit hesitant to go in here.

- I’ll consider the company a “BUY” at around $20/share when the company’s upside is higher than 10% – and even then, I’d be careful.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

It can also be argued that the company, due to its BB- credit rating, isn’t qualitative enough. However, in this case, I don’t see the credit rating as the major risk, but the valuation.

Be the first to comment