Arkadiusz Warguła/iStock via Getty Images

Investment Thesis

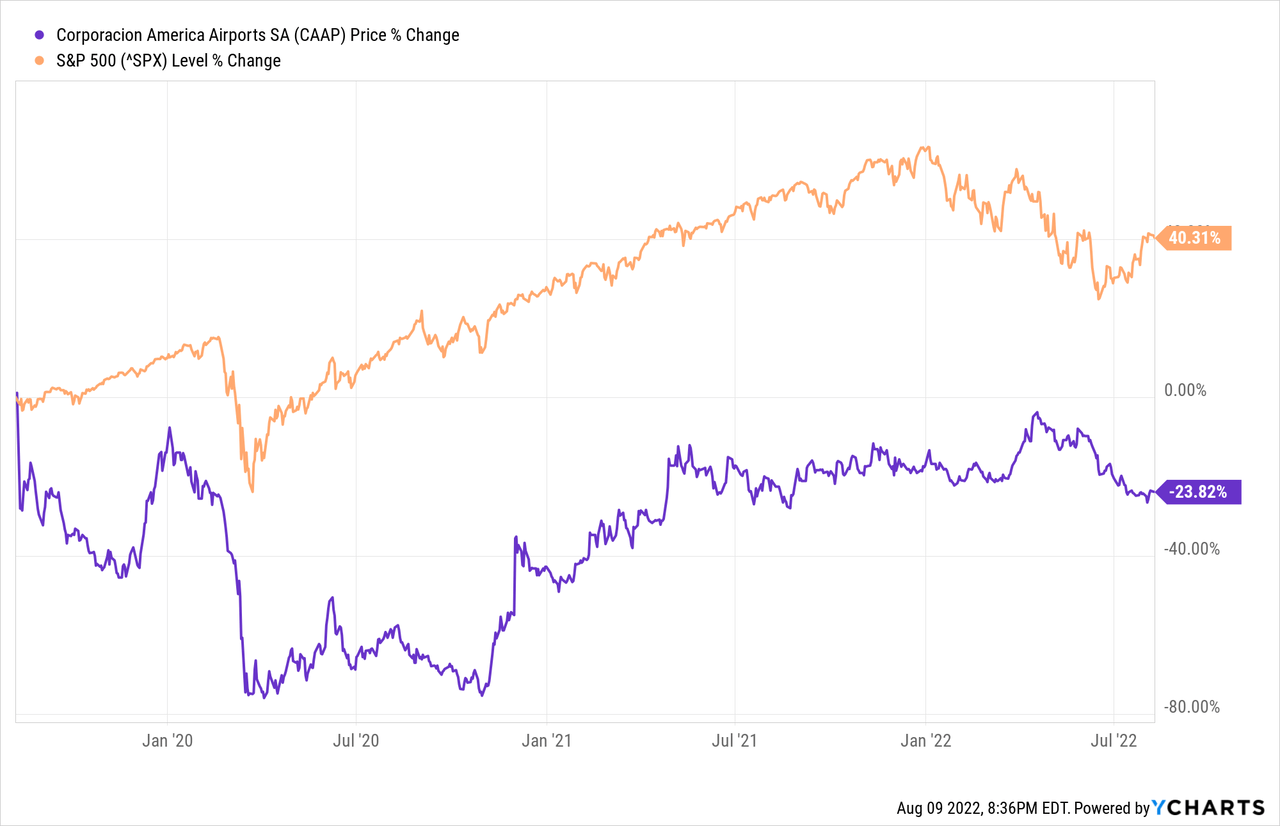

Corporación América Airports S.A. (NYSE:CAAP) has trailed along with the market in the previous year and YTD but has failed to recoup from its meteoritic crash since the pandemic. The company has significantly underperformed the market since its NYSE listing in 2018, generating negative returns, largely due to a loss of about three-quarters of its share value during Q1 2020.

Airports were one of the worst performing sectors in the aviation industry due to the pandemic’s blow. The financial crunch caused by COVID-19 exposed a severe problem in the industry’s operational performance, which needs to be addressed for future stability.

If these issues aren’t addressed, the companies in this sector will remain vulnerable to such incidents despite growing cyclical revenues. CAAP has recognized these issues and is actively working to improve its performance, resulting in a great profitability improvement.

I expect the company to sustain these improvements and translate the strong topline growth it will achieve with the recovering air traffic into optimistic profit margins.

The Company

Until Vinci SA’s (EPA: DG) acquisition deal with the Mexican airport operator, Grupo Aeroportuario del Centro Norte (OMAB), which is expected to finalize by the end of this year, CAAP remains the largest private sector airport concession operator in the world based on the number of airports under management. It operates 53 airports in 6 countries, including 37 in Argentina, 2 in Armenia, 2 in Brazil, 2 in Ecuador, 2 in Italy, and 8 in Uruguay.

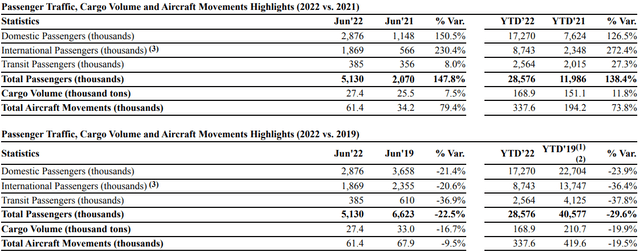

The company also claims to be the tenth largest private sector airport operator in the world based on passenger traffic, with 84.2 million passengers served in 2019. In June 2022, the company’s passenger traffic improved to 5.13 million, up 147.8% from 2.07 million passengers in the same period the previous year and reaching 77.5% of June 2019 levels.

Corporación América Airports S.A. June 2022 Passenger Traffic Report

The company’s revenues are segregated into Aeronautical and Commercial, accounting for 51% and 49% of total revenues, respectively.

CAAP and The Industry

Passenger traffic is a molding metric for CAAP, dictating its revenues. The company generates revenue through fees charged to departing passengers, landing and parking fees charged to aircraft operators for using its premises and aeronautical services, warehouse usage, duty-free, retail and food and beverage shops, advertising, and parking fees. Therefore, analyzing the passenger traffic data is an integral part of analyzing the company.

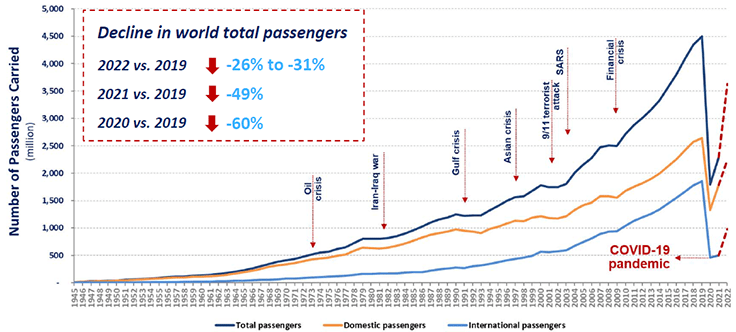

The global number of airline passengers has been rising for years because of the increasing convenience and affordability offered by the aviation industry. This is largely facilitated by the growth in low-cost carriers, the global middle-class, and airport infrastructure spending. The Covid-19 pandemic struck a massive blow to the travel industry, especially the aviation industry, which suffered phenomenal setbacks in 2020.

According to McKinsey & Company, after enjoying hefty global average annual profits of $5 billion from 2012 to 2019, airports suffered about $31.6 billion in economic losses in 2020, generating about $70 billion in revenues, 65% lower than the pre-pandemic forecasts of $199 billion. It was the most devastating aviation industry sector, second only to the airline sector, which lost a massive $168 billion.

McKinsey & Company

2021 was riddled with fluctuations because of a sharp spike in Covid infections during the first quarter, followed by some stability caused by easing travel restrictions and rising vaccination rates in the second and third quarters, and finally by the emergence of the Omicron variant during the fourth quarter.

According to the International Civil Aviation Organization (ICAO), domestic passenger traffic recovered to 68% of pre-pandemic levels, while international traffic lagged at 28% in 2021. ICAO estimates that passenger traffic in 2022 will be 69% to 74% of the pre-pandemic levels.

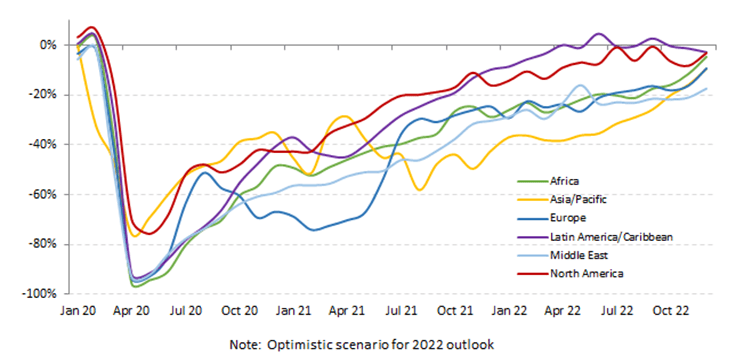

International Civil Aviation Organization

Pertinent to the company, the report shows that Latin America has the world’s highest passenger traffic recovery rate.

International Civil Aviation Organization

The company’s results in 2022 align with the above projections, with the passenger traffic in the first half of 2022 at 70% of pre-pandemic levels, despite Omicron’s impact in January and February. This resulted in the total Q1 revenues at around 82% of 2019, with commercial revenues surpassing 2019 by 9%.

| H1 2019 | H1 2020 | H1 2021 | H1 2022 | |

| Passenger Traffic (millions) | 40.6 | 17.5 | 11 | 28.57 |

| YoY Change | 4.64% | -53% | -37% | 160% |

| % of 2019 levels | 47% | 27% | 70% | |

| Net Revenue (millions) | $612.4 | $311 | $232 | $502 (E) |

| YoY Change | -8.4% | -49% | -25.4% | 116% |

| % of 2019 levels | 51% | 38% | 82% |

*Since Q2 2022 revenue has not been reported, I have based it as a percent of Q2 2019 revenue, with similar percentages of Q1 2022 to Q1 2019.

With improving traveling conditions around the globe, and a faster passenger traffic recovery in Latin America, CAAP’s figures can reasonably be expected to improve faster than the global average, leading to a competitive advantage in a down-struck industry.

Improving Profitability

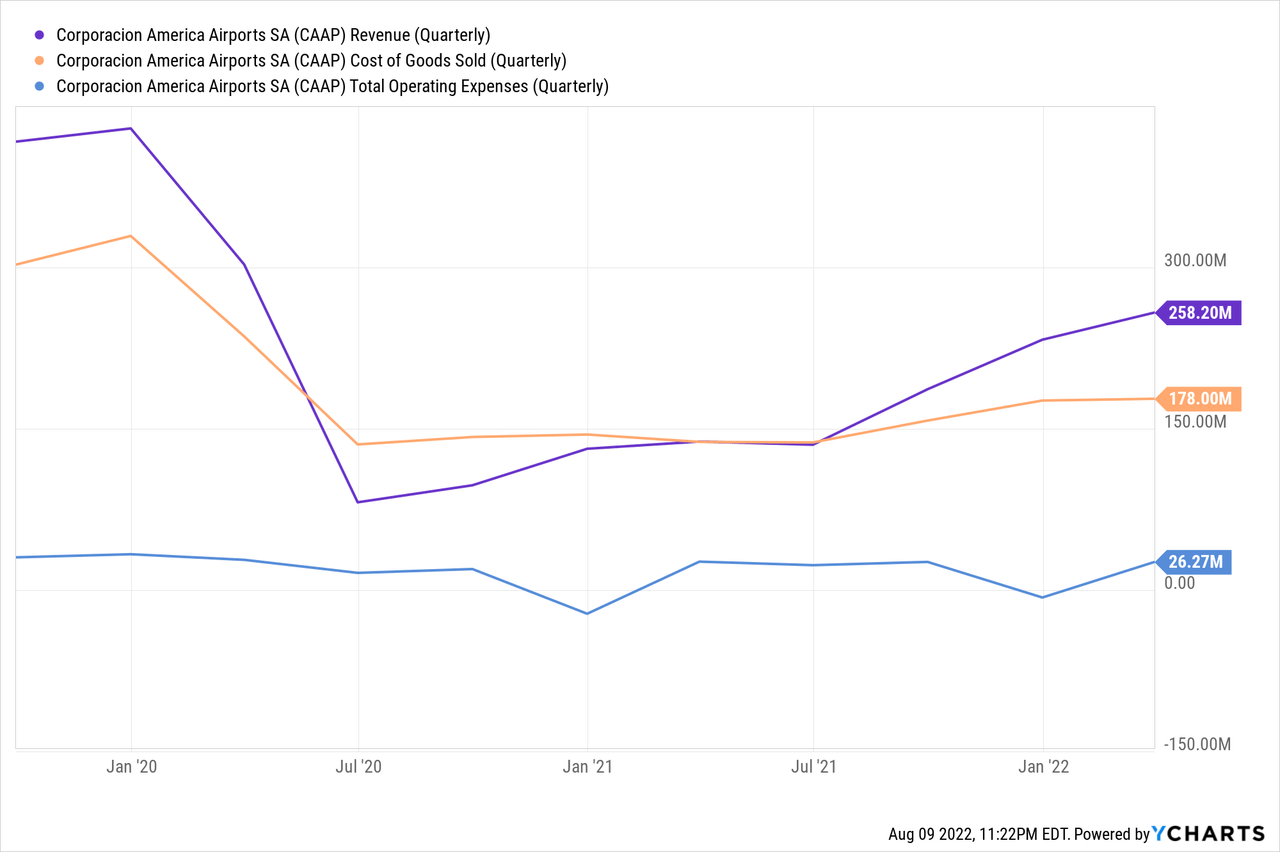

The pandemic exposed an inherent challenge in the business model of most airports: high fixed costs and mainly variable revenue flows. Dwindling traffic led to heavy economic losses of $32 billion, or 45 percent, in 2020. The Airports Council International estimates that airports’ performance improved somewhat last year, drawing in 26 percent more revenues than 2020. However, last year’s revenues remained more than 50 percent lower than in 2019.

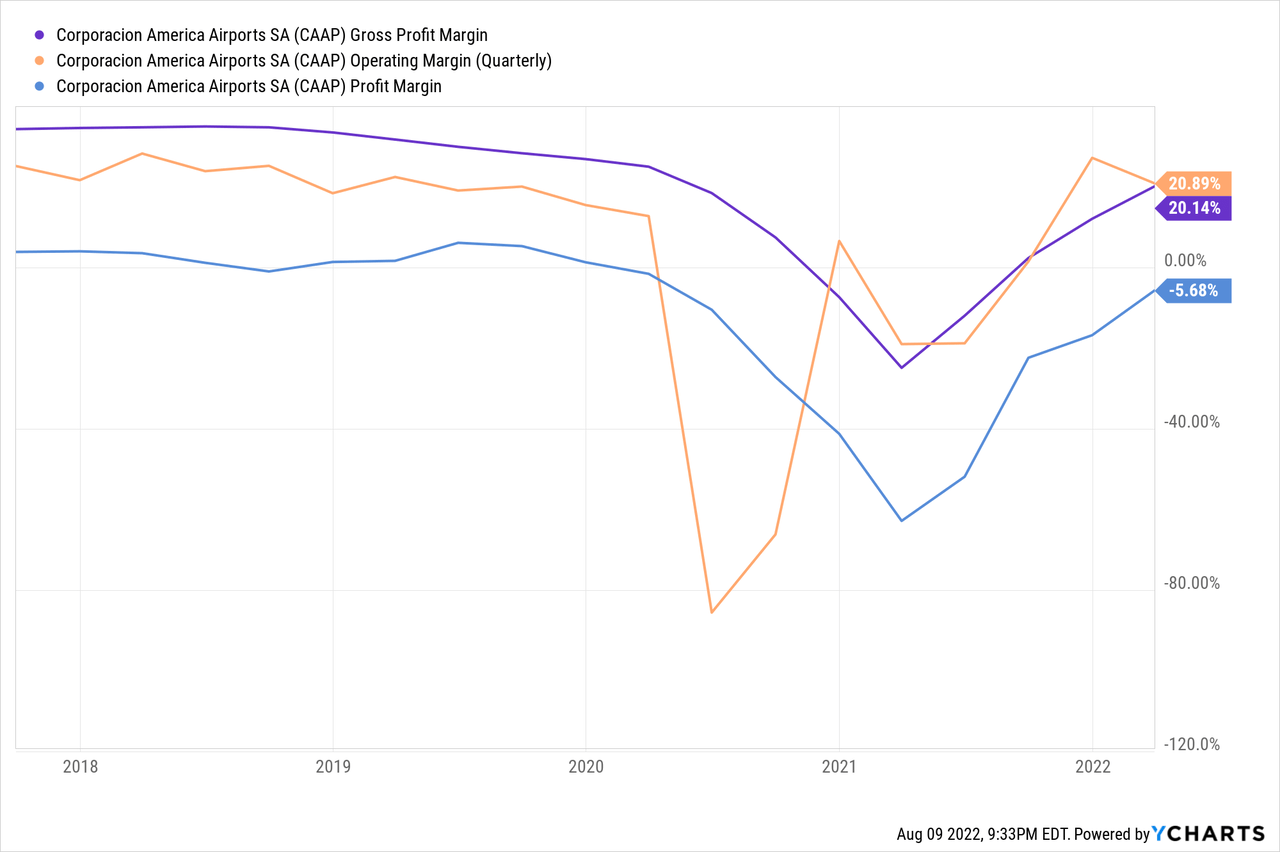

This can be observed in the below chart as the company’s revenue nosedived in 2020, whereas the expenses took a relatively lower hit. Given the above, scrutinizing the company’s profitability margins would be a great way to pick apart any strengths and weaknesses in its operations.

The chart below reveals that the relatively stable operating expenses resulted in a crashed operating margin, and the company’s profitability suffered throughout the year. However, it is quickly recovering to pre-pandemic levels, with improvement across all segments.

CAAP’s Seeking Alpha profitability page may look scary, but the figures there represent the trailing twelve months, which are still being dragged through the aftermath of the pandemic when the Airport sector was so busy implementing passenger protection protocols that it barely looked beyond the quarter.

The company is strategically focusing on cost control initiatives to maintain a lower operating expense growth than its revenue growth. Accordingly, the company’s recent expense increase of 41% is significantly below the 121% revenue growth, in line with the growing recovery. However, there is still room for improvement as the $197 million expenses accounted for about 86% of Q1 2019 operating costs and expenses of $228, even though the revenues stood at 82%.

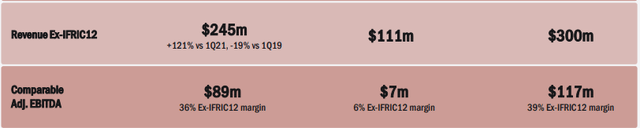

This growth and efficiency combination resulted in an improved EBITDA of $89.2 million, 76% of Q1 2019 but over 13x YoY growth, and the EBITDA margin of 36%, 3% below 2019 level but 30% higher YoY.

The management’s affinity to recognize a core issue and its solution-oriented attitude toward improving its financial performance is a positive sign that it can leverage the growing passenger traffic and translate it into higher growth and profitability metrics.

Valuation

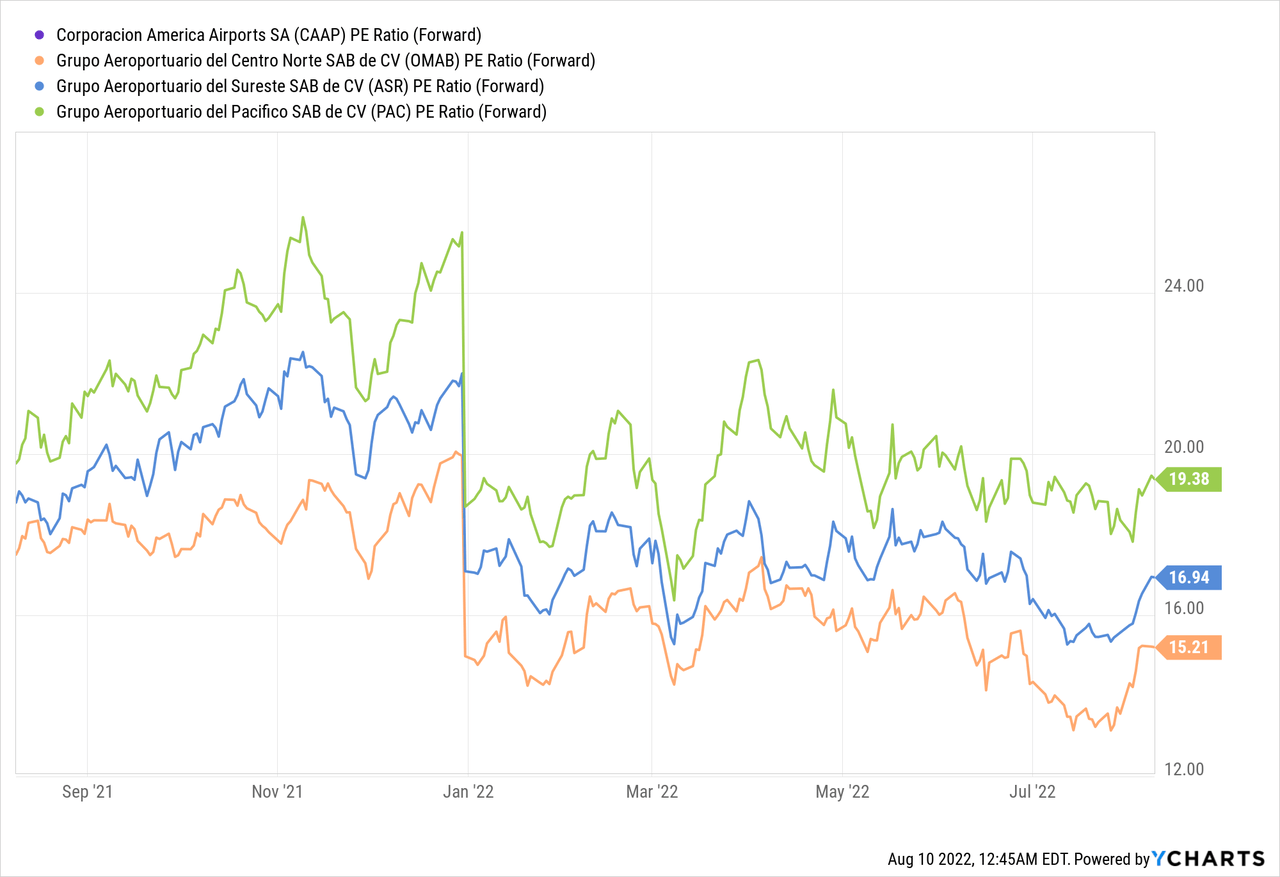

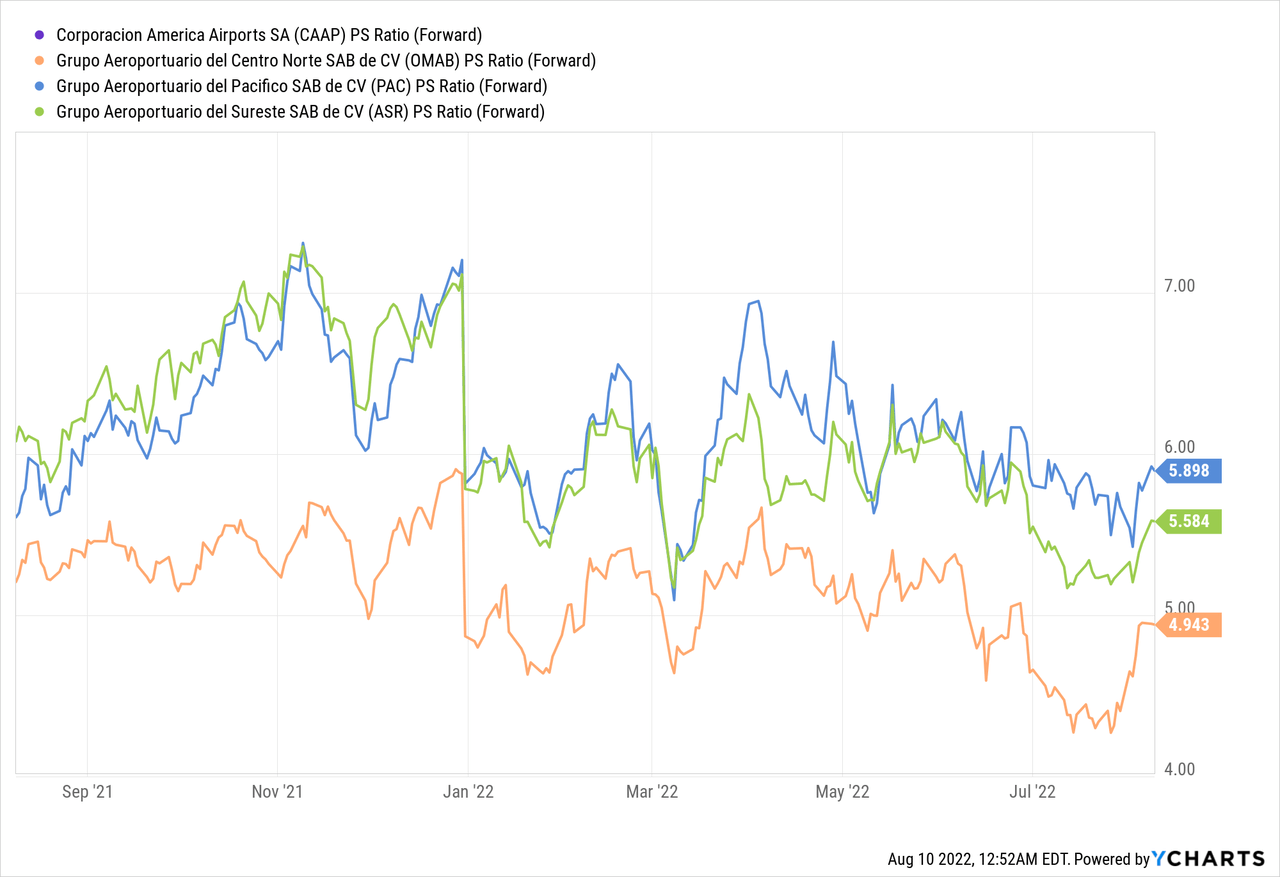

Given the current profitability trajectory, it is reasonable to expect that CAAP will surpass its 2019 EPS in 2022 and likely achieve the estimated $0.58 EPS. This values the stock at around 9x based on 2022’s EPS, significantly cheaper than its peers trading at double the median forward P/E of 17.95x.

Similarly, with a TTM P/S of 1.03, the forward P/S ratio likely falls below 1 as the company’s revenue per share exceeds its current $5.15 value. This again indicates a significant discount to its peers, with a median forward P/S multiple of 1.32x.

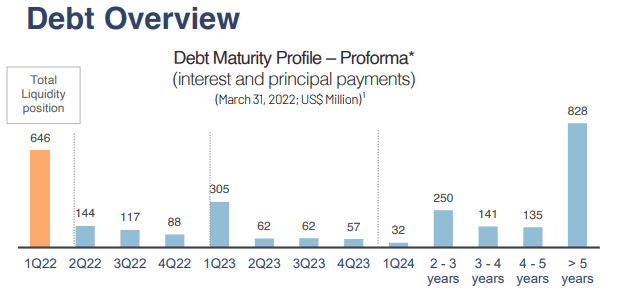

The company exceeds its peers in all relative valuation metrics, partly because of its lower market cap and higher leverage, making it a higher-risk company. The company’s high leverage strains its cash flows with significant interest and principal payments.

CAAP Investors’ Presentation

However, the risk isn’t unaffordable, with a market cap of almost $870 million, $646 million in cash, a positive FCF per share, and a solid levered FCF margin of almost 21%. Further, my previous article explains the benefits of investing in lower-capped stocks during this macroeconomic environment.

Conclusion

Corporación América Airports is a part of an industry poised to thrive in the long-term but has been bashed down by the pandemic. With intrinsic improvements in its operational performance, the company can easily leverage the recovering industry to improve its profitability and generate shareholder returns.

The leaner cost structures are an essential part of its profitability and must be closely monitored in relation to the revenue to keep track of the company’s progress.

Based on its high leverage, the downside risks appear to be priced into the stock, but the upside seems to have been missed, making this stock a great pick for value players.

Be the first to comment