Altug Galip

Perion (NASDAQ:PERI) performs above expectations and remains unrewarded on the stock market. It’s a fast-growing advertising technology company with diversifying revenues and increasing profitability.

A strangely timed offering in December threw the market off, and the stock still hovers around the same price as then. The company stated it wanted to fund its growth, including potential acquisitions. It hasn’t made any acquisitions since and sits on a large pile of cash. My best guess is that they had a target, and the deal went south.

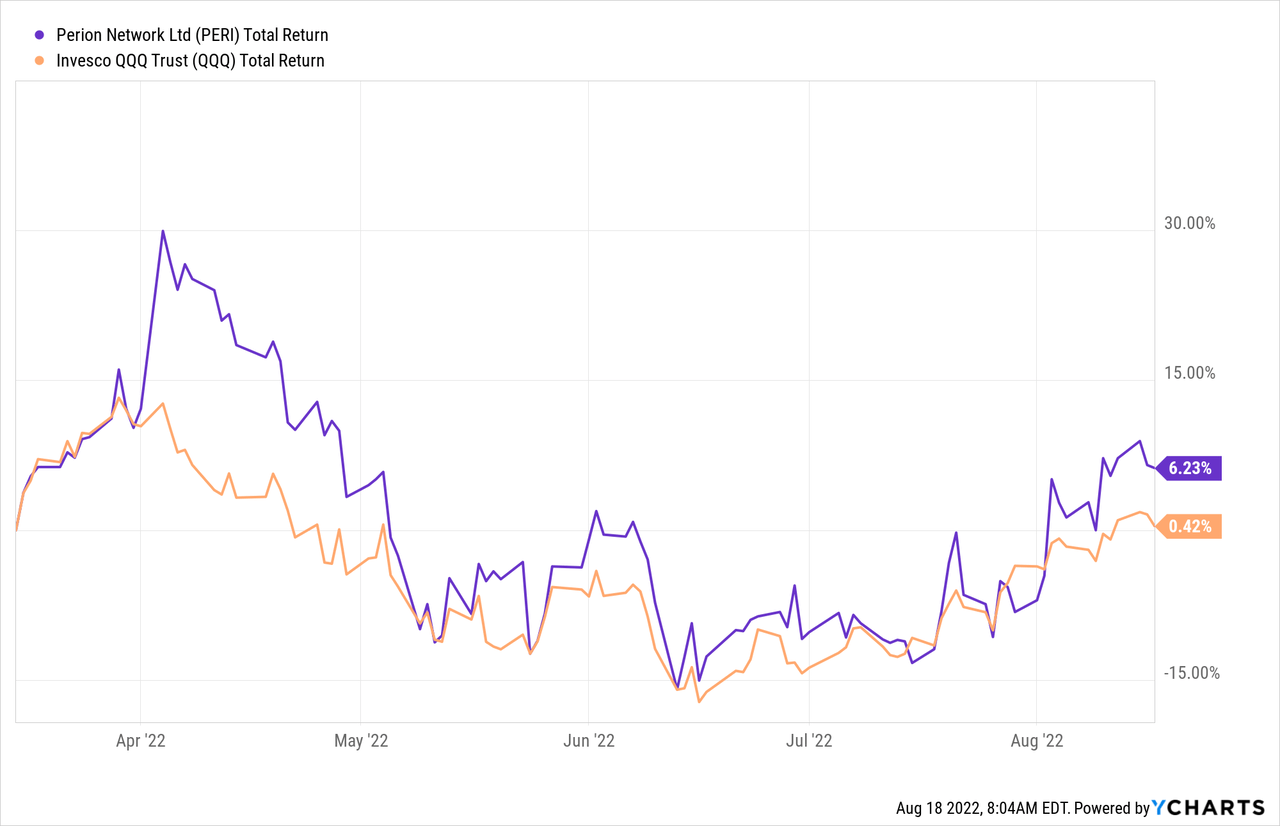

I initiated coverage of Perion in March. Consider reading it for more background about the company. The company had a positive evolution and slightly outperformed the Nasdaq since then.

Potential Share Price Catalysts

- Its cookieless solution, SORT, experiences the flywheel effect. It capitalizes on new regulations and the trend for more privacy demand.

- Expanding multiples as the market recognizes the strong execution and increased guidance.

- Potential acquisition targets became cheaper in 2022.

Growth

Q2 Results Impressed

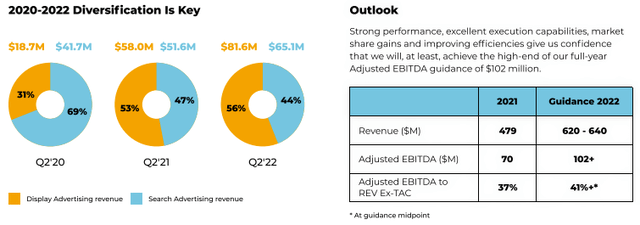

Both recent growth and Perion’s outlook are impressive. It managed 34% revenue growth in Q2. It acquired Vidazoo in October; correcting for Vidazoo, I estimate 23% organic growth. For the full year, Perion still expects 34% revenue growth. It could even significantly increase its EBITDA to above previous guidance.

Perion

It already increased its revenue outlook in Q1.

Acquisitions Or Organic Growth

It looks like Perion grows very well on its own strength without acquisitions. The CEO, Doron Gerstel, had an interesting comment on the latest earnings call:

it’s always a question of the build versus buy. At this point we are doing a lot of the build in order to close this gap but there are some great opportunity in the market. I must tell you that we are waiting that valuation will come down as we are expecting and start seeing it from privately held companies.

It seems Perion has focused on building features on its own instead of acquiring features from external companies. I like his approach, as they don’t look to buy revenue. They look to build the best product and then organically increase revenue. It’s wise to choose the most value-adding path, buy or build. If an acquisition happens, it’s probably at a lower price than it would’ve been in December.

One of the prime examples of the build strategy is SORT. SORT is a cookieless advertising solution launched in October 2021. SORT customers increase quickly, almost doubling quarter-over-quarter. It already represents $11M revenue or 7.8% of total revenue in Q2. It shows that increased privacy demand and regulation don’t need to be bad for ad tech players.

Free Cash Flow Generation

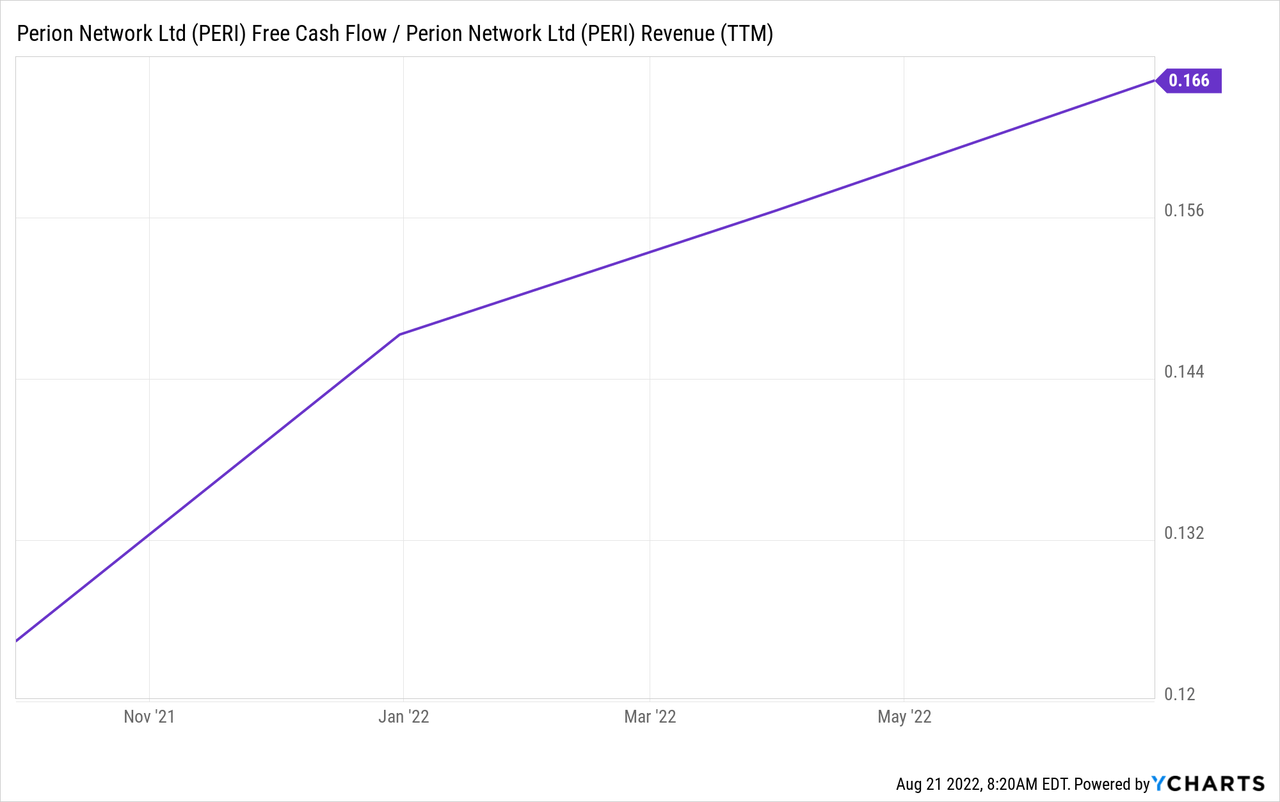

Free cash flow is vital as this is what a company could use for shareholder returns. Potential buybacks or dividends are only possible if the company produces enough cash.

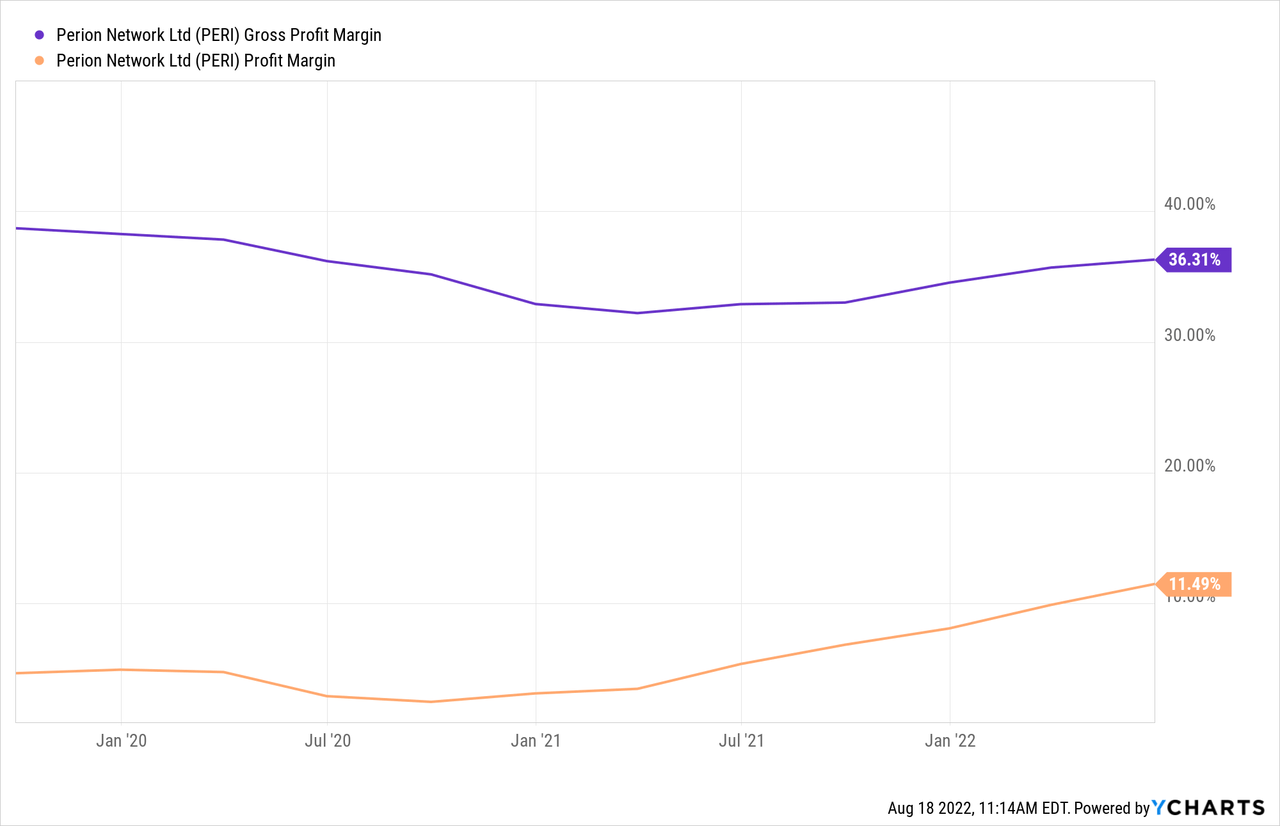

Perion nicely improved margins by growing its revenues and keeping costs under control. It leads to snowballing profits.

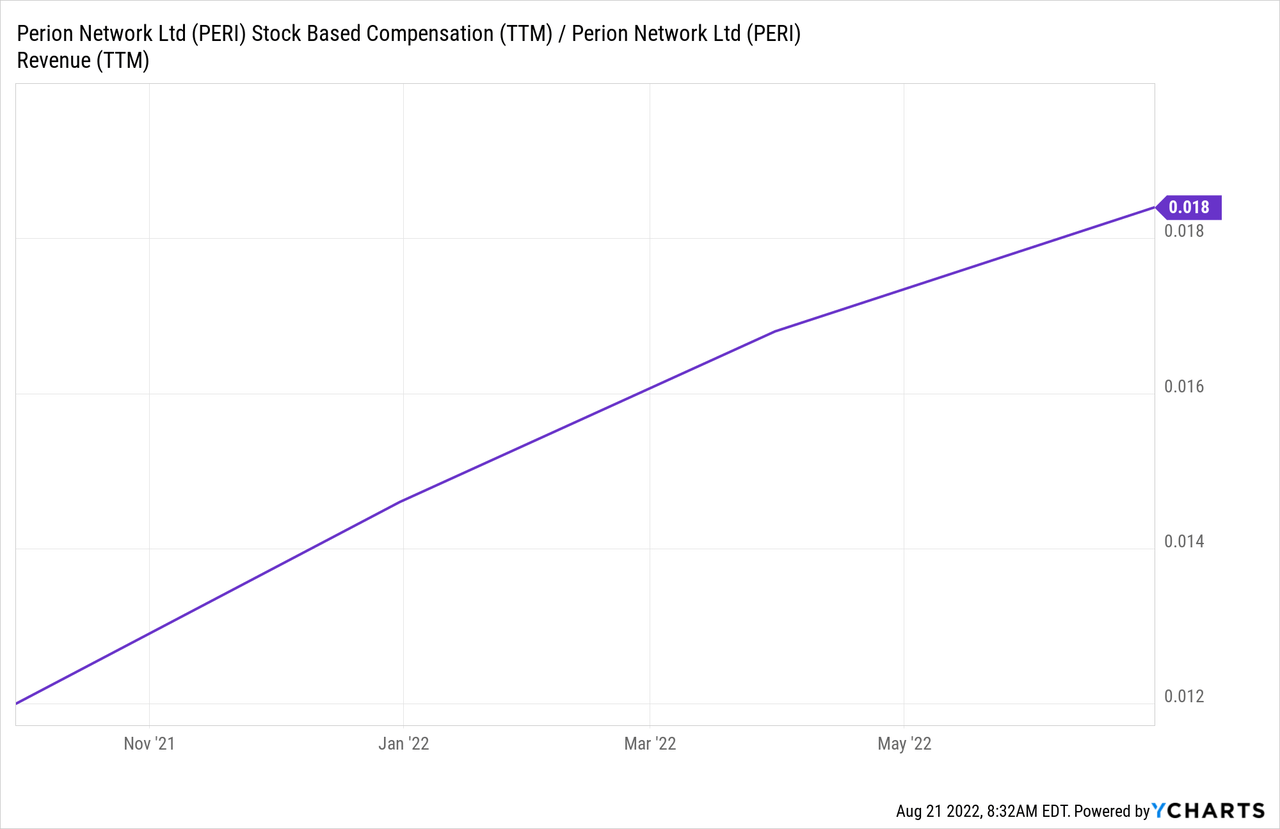

It also improved its free cash flow conversion while SBC stayed in check. Perion’s free cash flow conversion is excellent. It produced $70.5M FCF in 2021, and I expect +$100M FCF in 2022.

Shareholder Returns

Perion doesn’t intend to pay dividends and hasn’t made any buybacks recently. Given the offering in December, I don’t expect any cash returns to shareholders shortly.

It currently invests everything in its business, and it makes sense to me. The advertising technology market is growing fast and is undergoing substantial changes. Perion needs to invest and stay ahead of its many competitors with new solutions like SORT.

Shareholder returns become more critical as the company matures.

Balance Sheet

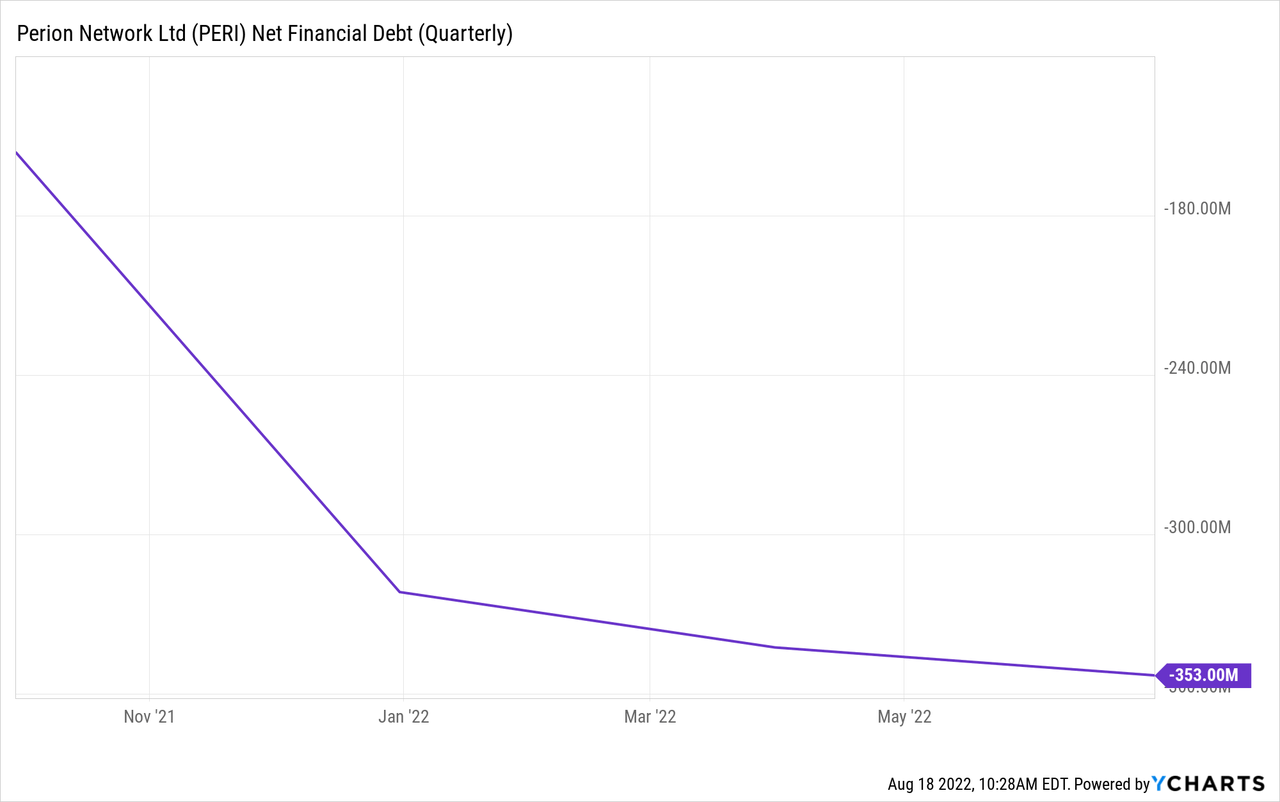

Perion has a strong balance sheet. It has a significant cash position and no long-term debt.

The $353M net cash position grows further as the company generates positive free cash flows.

Valuation: Higher Share Price, Cheaper Stock

PERI rose 20% in share price over the past year, and the market cap increased even more with the share offering in December.

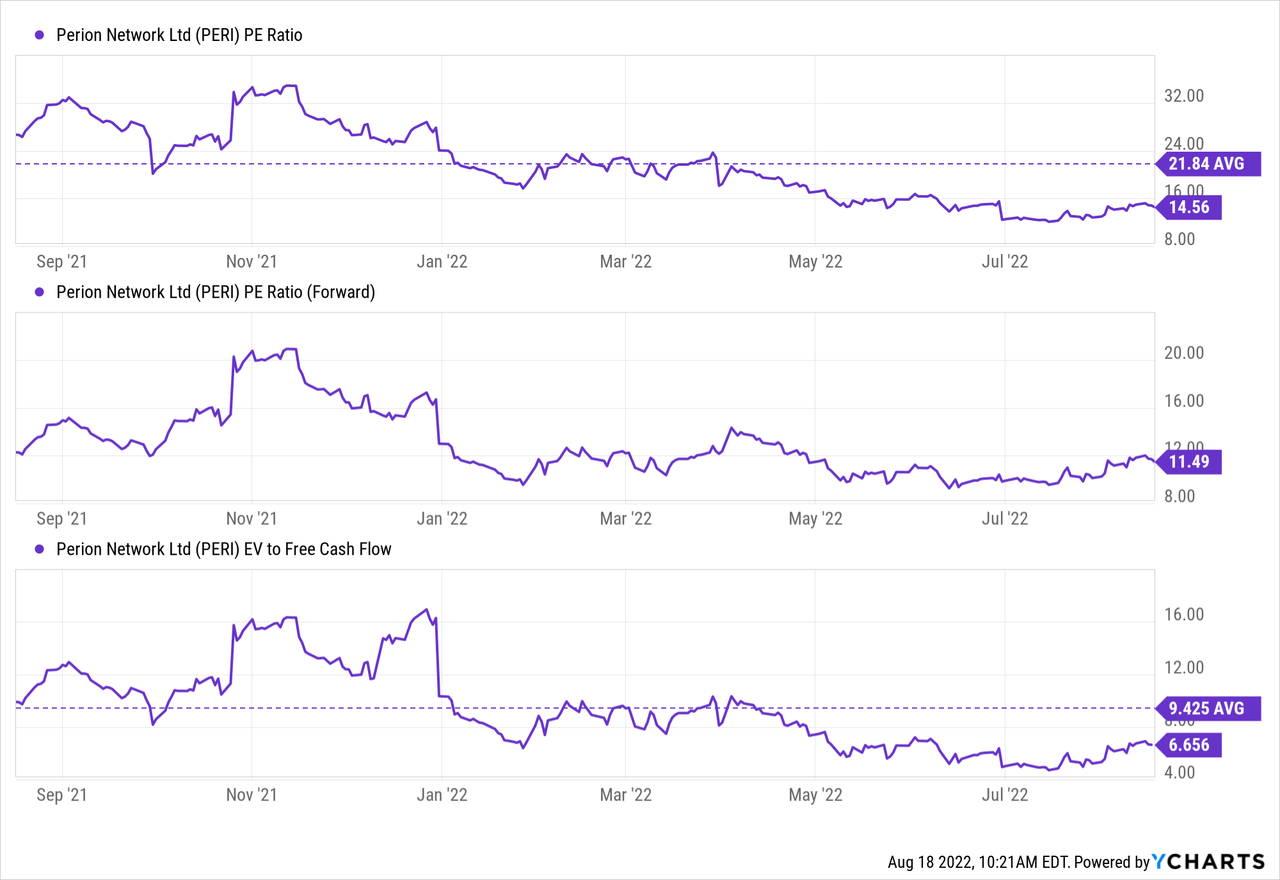

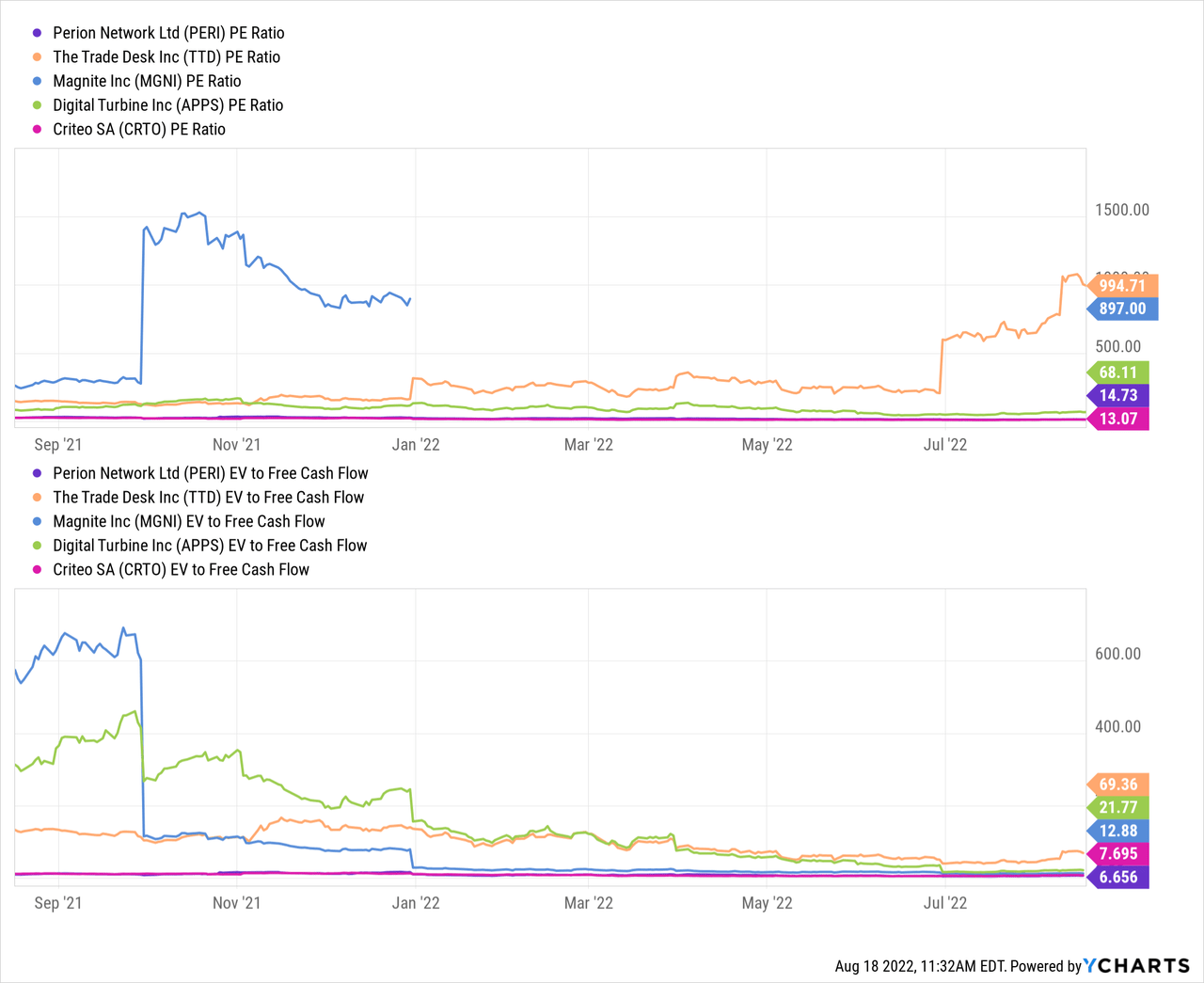

Despite the higher price, the valuation metrics dropped over the past year. It trades at a 14.8 PE, relatively low for a company with 30%+ growth rates. EV to FCF is just at 6.6. Far below its average of the past year. Perion is cheaply valued for a stock that just increased its guidance.

Risks

The biggest uncertainty today is the large cash pile. The unexpected offering in December rattled investors, and Perion didn’t explain it well. A missed deal is probable but unconfirmed. I expect Perion to make intelligent acquisitions as it did so far with Doron at the helm since 2017.

Perion has a contract with Microsoft to supply AdTech for Bing. Microsoft recently acquired another AdTech company, but that doesn’t seem to threaten Perion per the Q1 CC:

We are in a four-year contract, which is going to end in 2024. But what is more important for us is our ability now to leverage the great partnership that we had with Bing into other parts of Microsoft advertising. So with the Xandr acquisition and the fact that they’re going all the way into retail fits very well. Some of the strategic efforts that we are doing. And I have no doubt that we are able to leverage this success and take it into other important areas.

Comparison To Peers

Seeking Alpha

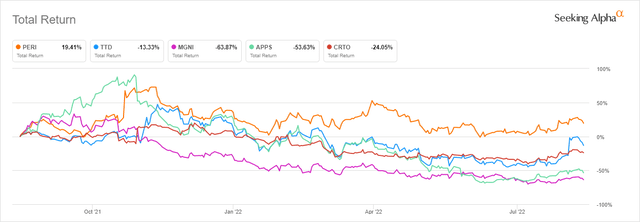

Most ad tech companies’ prices dropped over the past year. Perion’s share price kept up relatively well as its results didn’t slow down as opposed to some others.

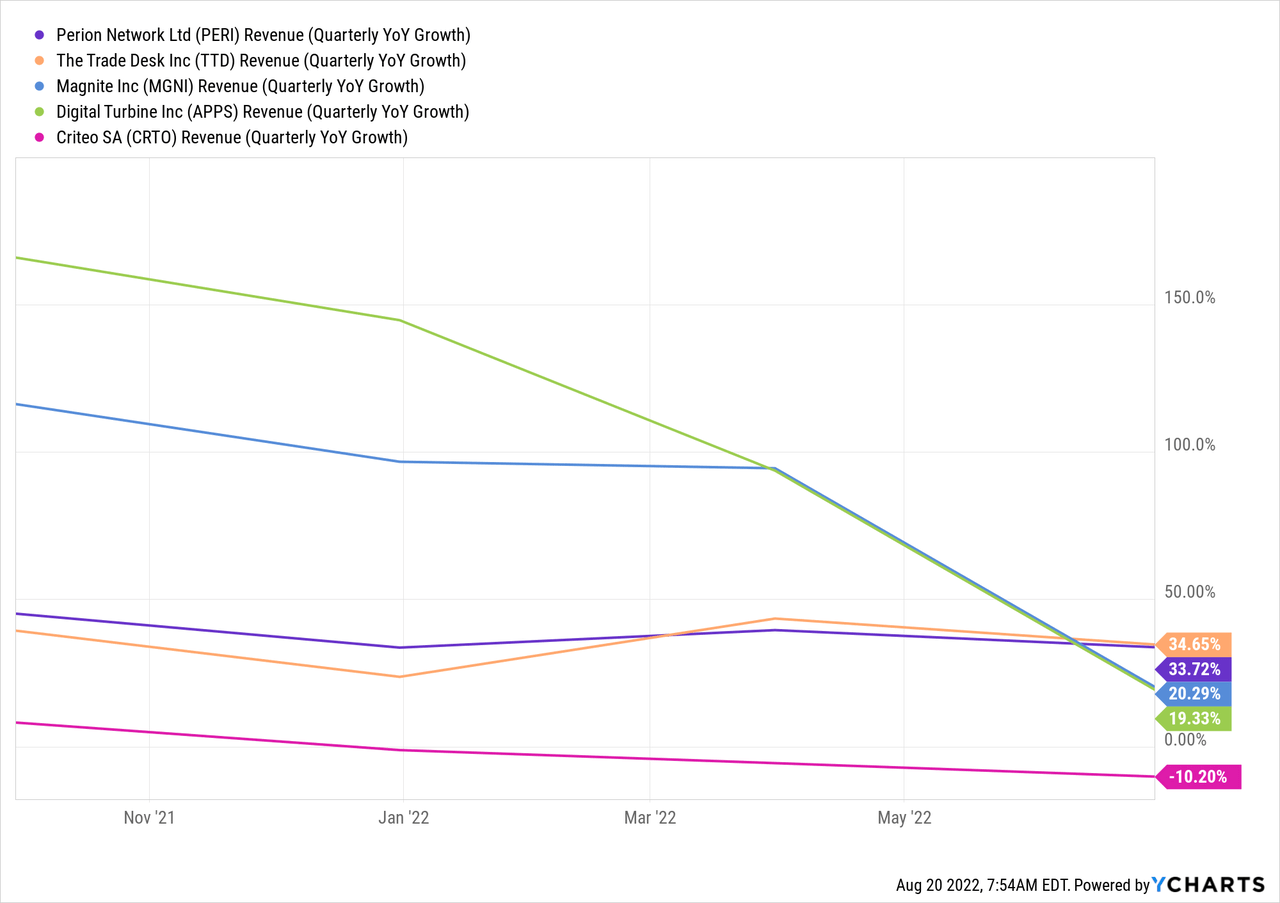

Perion’s revenue growth remained in line with expectations and was among the leaders during the latest quarter. It’s remarkable that it grew in line with The Trade Desk (TTD) and left competitors Magnite (MGNI), Digital Turbine (APPS), and Criteo (CRTO) behind in Q2 2022.

Despite the promising results, Perion is still one of the cheapest ad tech companies on PE and EV/FCF ratios. It looks too cheap in comparison to peers. I wouldn’t expect it to reach The Trade Desk valuation levels as it’s the market leader. An upgrade in multiples is plausible.

Conclusion

Perion’s execution is on par. It has the right cookieless solutions to keep attracting customers. Its outlook increases in a challenging environment. The company expects strong growth in the near future and should continue its growth path beyond that.

The robust and profitable growth comes at a very reasonable price. I estimate it trades at less than six times 2022 EV/FCF. Other growth companies trade at the same sales multiple. Perion is very cheap.

Be the first to comment