shironosov

The BlackRock Resources & Commodities Strategy Trust (NYSE:NYSE:BCX) is a closed-end fund that invests across oil and gas producers, mining stocks, and agriculture-related companies. The idea here is to capture exposure to trends in real assets through global equities. The fund is actively managed by also utilizing a call options buy-write strategy in support of a monthly distribution that currently yields 6.2%.

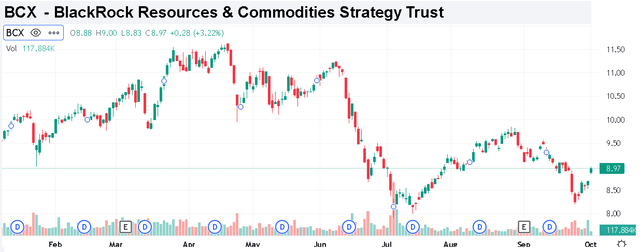

While commodities were a big winner to start the year amid a theme of worldwide supply chain disruptions and high inflation, the segment has been more volatile in recent months. The combination of macro growth concerns and the impact of a strong U.S. Dollar has pressured sentiment in the segment. Indeed, BCX is off nearly 20% from its Q2 high while still holding on to a positive return year-to-date.

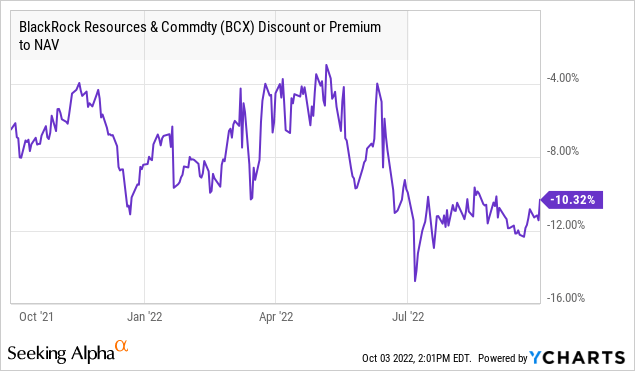

We last covered the fund with an article last year noting it was relatively expensive at the time based on its spread to NAV. The update today notes that the spread has narrowed while the fund has been able to outperform strategy benchmarks. We are bullish on BCX with a sense that the current level offers an attractive buying opportunity with commodities well-positioned to rebound.

What is the BCX Fund?

BCX is relatively unique among CEFs as unlevered and focuses on commodity producers. With a portfolio of just 46 stocks, BCX writes, or “sells”, call options against its positions covering approximately 31% of the overall exposure. The effort as part of the portfolio management process at the discretion of the investment team helps generate cash flows through the collection of the options premium while helping limit volatility as a partial hedge.

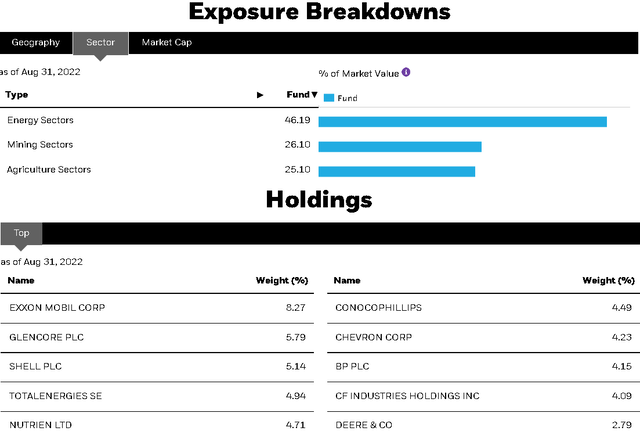

Currently, 46% of the fund is in energy sector stocks followed by mining names and agriculture each representing 26% and 25% of the weighting respectively. The positions here include mega-cap leaders like ExxonMobil Corp (XOM), ConocoPhillips (COP), and Chevron Corp (CVX) along with global mining giant Glencore Plc (OTCPK:OTCPK:GLCNF) as the top holdings.

On the agriculture side, fertilizer producers from CF Industries Holdings Inc (CF) and Nutrien Ltd (NTR) are represented. Deere & Co (DE), the world’s largest manufacturer of agriculture and farming equipment, is also a holding in the fund that highlights the flexibility of the fund manager in terms of stock picking and a broader interpretation of “resources”.

BCX Performance

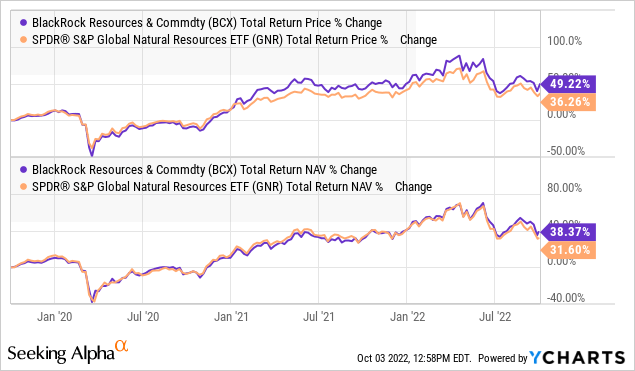

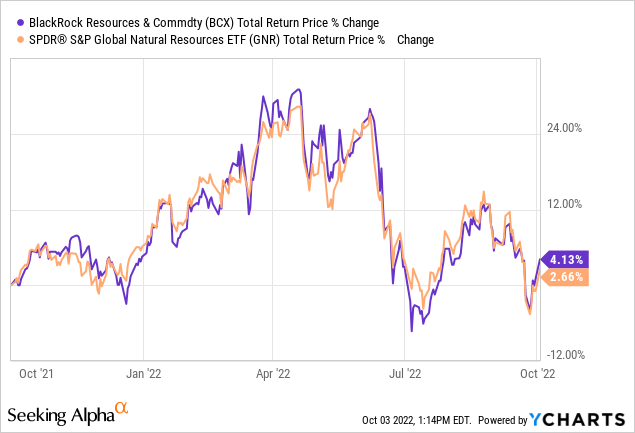

We always like to benchmark CEFs against an ETF alternative to measure the strategy’s ability to generate excess returns. In this case, the SPDR S&P Global Natural Resources ETF (GNR) is likely the most comparable fund to BCX as it invests in stocks across the energy, mining, and agriculture sectors.

The key difference with BCX is that GNR is passively managed to track an underlying index with the weighting of each sector being fixed at one-third of the fund. GNR’s strategy is more vanilla without the use of selling options, translating to a lower dividend yield at 4.7% compared to BCX’s 6.2% distribution. On the other hand, GNR has the advantage of charging a lower expense ratio at 0.4% compared to 1.1% for BCX.

Nevertheless, the data suggest that the higher fee has been worth it for BCX shareholders considering the stronger performance in the recent several years. BCX has returned 49.2% over a three-year time frame compared to 36.5% with GNR. BCX has also outperformed in terms of its total return to net asset value, which excludes the effect of a shifting market price spread to NAV.

As mentioned, resources-related stocks have been volatile this year since the strong gains in Q1 during the early stages of the Russia-Ukraine crisis. The price of oil approached a record high above $130 a barrel, while various metals and grains also reached decade highs on fears of supply chain disruptions. Fast forward to Q2, concerns of a slowdown in the global economy and its impact on the demand side have largely reversed much of the gains.

Favorably, BCX has still returned a 4% total return year to date, which is above the 2.7% performance by GNR. The positive spread here reflects BCX’s slight overweighting of energy stocks that have been relatively more resilient compared to weaker mining and materials sector industries. Keep in mind that even with the recent weakness, current commodity prices remain elevated compared to levels from a few years ago. For most companies, the operating environment is positive for earnings and cash flows as a tailwind.

BCX Analysis and Forward-Commentary

We’re looking at BCX as a good option to capture diversified exposure to commodity producers through a compelling income vehicle. If we had a crystal ball that showed a particular stock will lead higher or even that mining sectors would outperform energy, for example, the fund would not be necessary. That type of uncertainty is part of the appeal of BCX investing through a portfolio of several stocks.

From a high-level perspective, global economic activity and trade levels are core drivers of commodity prices which in turn support the growth and earnings outlook for the underlying companies. By this measure, we want to see sentiment towards the macro outlook improve for BCX and its underlying stocks to regain momentum. In our opinion, there are several reasons to expect the segment to trade higher from here.

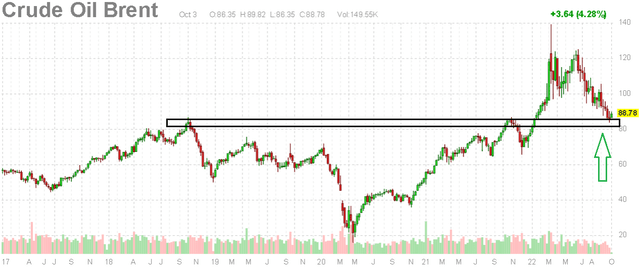

The first point is a sense that the selloff in commodity prices has already gone too far. Brent crude oil, for example, currently trading under $90 a barrel is down more than 25% from its average in the first half of the year, taking it back to levels from Q4 2021 and even its 2018 high before the pandemic. According to the U.S. Energy Information Administration (EIA), a forecasted 2% increase in global petroleum consumption for 2023 is expected to outpace a 1% increase in production leading to global inventory draws for next year. Tight supplies should limit the downside.

As it relates to the Russia-Ukraine conflict, the situation remains tense with the possibility of an escalation with further disruptions creating the potential for higher prices. The impact is already being seen in natural gas ahead of the winter months.

There is also the dynamic of the global coordinated effort since Q1 to release strategic petroleum reserves as an effort to mitigate high fuel costs. In the U.S. indications are that reserve levels at historically low levels mean the Biden Administration will be forced to end or scale back the releases which would allow oil prices to rebound higher.

With metals and agricultural commodities, an important theme that has weighed on prices is the strength of the U.S. Dollar. Here, the factor relates to the hawkish monetary policy and rising interest rates. The way we see it playing out is that getting into the September and October CPI data, evidence that inflation has peaked could mark a near-term top in bond yields which would also reverse the Dollar trend. Materials stocks would get a boost as a positive for the BCX strategy.

Finally, we note that BCX is trading at a discount to NAV of around 10%, materially wider than an average closer to 5% in the first half of the year. In a scenario where sentiment towards resources and commodities recover, we expect the discount to narrow providing an incremental return to the upside for shareholders.

Final Thoughts

BCX is a quality closed-end fund, that delivers on its objective of providing a high current income along with a long-term capital appreciation. A fund is a good high-yield vehicle and can work in the context of a broader portfolio for investors to gain tactical and or strategic exposure to trends in real assets.

Putting it all together, the recent selloff in the sector and BCX fund presents an attractive entry point for long-term investors. We are bullish and expect BCX to lead higher and outperform its benchmarks going forward. In terms of risks, deterioration to the global macro outlook including a sharper slowdown in consumer spending and industrial production would be bearish. The June low price of the fund at $8.00 per share represents an important level of support.

Be the first to comment