metamorworks/iStock via Getty Images

Investment Thesis

Perion (NASDAQ:PERI) delivers investors better results than they were hoping. Not only are its Q1 2022 results strong, but Perion also hints at the fact that it will upwards revise its full-year 2022 guidance.

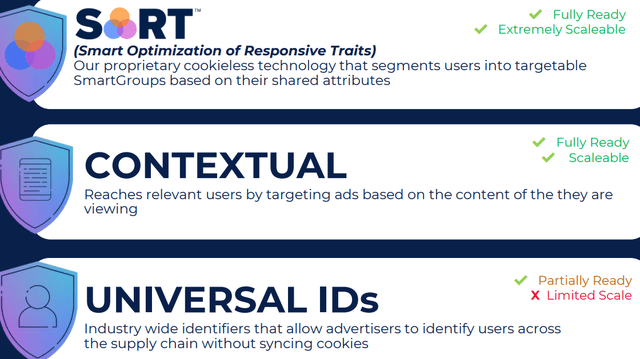

Why such strong results? Perion highlights its SORT product technology, for its ability to include more users that would have otherwise been excluded from traditional targeting measures.

I estimate that Perion is priced at approximately 10x this year’s free cash flows.

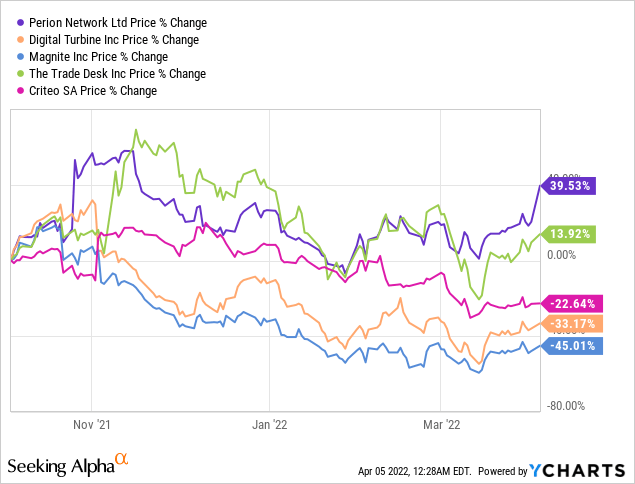

Investor Sentiment for Ad Tech Companies, Perion is Hottest

Above I’ve put together a list of some ad tech players. It’s not an exhaustive list, but it does give you a pretty broad lay of the land view. I’ve included the crowd favorite, The Trade Desk (TTD), as well as some less favored players too.

And over the past 6 months Perion has outperformed them all by some distance. And what’s particularly important to note is that the past 6 months have been horrendous for small and mid-cap tech investors generally.

Nevertheless, not only has Perion’s stock remained strong during this period but from what we can see so far from its 2022 results, the market has called this investment very right. There are many good reasons to be bullish on Perion.

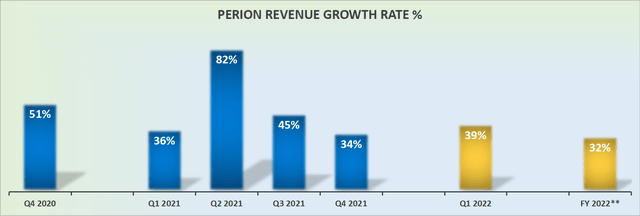

Revenue Growth Rates

Perion revenue growth rates

If you’ve followed Perion for a while now, you’ve become very accustomed to the trifecta, where Perion beats on the top line, beats on the bottom line, and further upwards revises its guidance for the remainder of the year.

Yesterday’s preannouncement didn’t upwards revise its guidance for 2022, but I believe that is only because Perion wanted to leave some good news on the table for when it reports its Q1 2022 results in roughly 4 weeks’ time.

Why Perion? Why Now?

As a brief reminder, Perion has two segments. Display Advertising, which includes video and CTV. This makes up 65% of Perion’s total revenues as of Q4 2021. While Search Advertising makes up approximately 35% of total revenue.

The press statement issued yesterday signaled that Perion’s recent acquisition of Vidazoo, which happened at the beginning of October, together with its own internally developed SORT technology are leading to strong results in its Display Advertising segment.

Perion’s press statement

As you can see above, SORT technology leads to meaningful click-through rates (”CTR”) compared against 3rd party cookie-based technology.

Indeed, part of the reason why ad-tech companies had taken a meaningful beating over the past 12 months had been because investors were worried that having to navigate the digital advertising space without being able to target users online would lead to the survival of only the strongest, meaning Google (GOOG)(GOOGL), Amazon (AMZN), Meta (FB) and perhaps The Trade Desk.

And that smaller players outside of the walled gardens of advertising would struggle to grow. Well, lo and behold, it turns out that facts got in the way of a beautiful story.

Perion’s SORT product technology

Indeed, Perion’s SORT technology leads to 2x CTR higher than third-party cookies and a 60% lift in interaction rates.

One key characteristic that SORT provides for advertisers is that users’ data get matched into predefined SmartGroups, and decided which ad is the most relevant to serve that user. And evidently, this is working very well.

Profitability Profile Ticks Higher

Including traffic acquisition costs, Q1 2022 is expected to report around $22.0 million compared with $8.8 million in the same period a year ago.

What this means in practice is that on the back of growing its top line by 39% y/y in Q1 2022, its bottom line truly shined, and its EBITDA was up 150% y/y.

Now consider this, Q1 is typically the low season for advertisers, with Q4 being the strongest period for advertisers in general.

And for Q1 2022, its EBITDA is expected to report nearly 32% of the EBITDA that Period reported during the whole of 2021. This is despite Q1 being arguably one of its weakest quarters of the year.

At this rate, it looks very likely that Perion’s EBITDA in 2022 could reach around $120 million.

What’s more, for 2021, Perion’s free cash flow conversion reached close to 100%. Thus, I believe we could reasonably expect to see Perion reporting similar free cash flow conversion rates this year.

PERI Stock Valuation – Still Very Attractive, Even Now

By my estimates, Perion may report around $120 million of free cash flow this year.

As I discussed in my previous article, Perion diluted shareholders in Q4. That means that the fully diluted number of shares outstanding has not yet been updated for Q1 2022.

Nonetheless, I had previously estimated the total number of shares outstanding to be around 45 million, thus, for now, this is as good as any other number. This implies that Perion’s market cap is around $1.2 billion.

This puts this rapidly growing ad tech player priced at 10x this year’s free cash flows.

What’s more, keep in mind that by my estimates, Perion carries at least $330 million of cash on its balance sheet and no debt. Thus, we are looking at a business that has at least a quarter of its market cap made up of cash.

The Bottom Line

Here’s the ultimate reality, Perion may be small but it delivers very strong results all around.

What’s more, even if investors were frustrated that Perion decided to dilute them at around $22 per share, Perion has admittedly demonstrated strong business acumen in making needling-moving acquisitions, most recently with Vidazoo. Thus, we should give credit where credit is due. Whatever you decide, good luck and happy investing.

Be the first to comment