Tabitazn/iStock via Getty Images

With this post, I am continuing my coverage of B Corps publicly listed in the US. I earlier wrote about VivoPower and Zevia.

Natura &Co (NYSE:NTCO) is quite likable. The sixth largest beauty company in the 2021 global ranking, it was the only one in the top 20 hailing from an emerging market, Brazil. What’s more, it is the world’s largest B Corp which is a manifestation of responsible business values it espouses.

Although Natura &Co is not exactly a household name, the four brands it now comprises — Natura, Aesop, The Body Shop and Avon — are collectively a force to be reckoned with. According to Brand Finance, the original brand, Natura, is seventh overall among Brazil’s most valuable brands and is “the world’s strongest cosmetics brand” based on factors ranging from emotional connection to financial performance and sustainability. The entire group, which sells in more than a hundred countries, is 19th among beauty brands globally in terms of brand value.

But as an investment, Natura &Co is the case of the negatives outweighing the positives. It has been stuck in a financial rut for a long time now, unable to break through its own income ceiling set in the early 2010s. Annual growth rate in net income between 2012 and 2021 averaged -85%, according to Seeking Alpha numbers. Although the expansion beyond Brazil has allowed the business to continue growing its top line (by 13.8% per year on average during the same period), in the current environment there is little to suggest significant improvement in profitability in the years ahead.

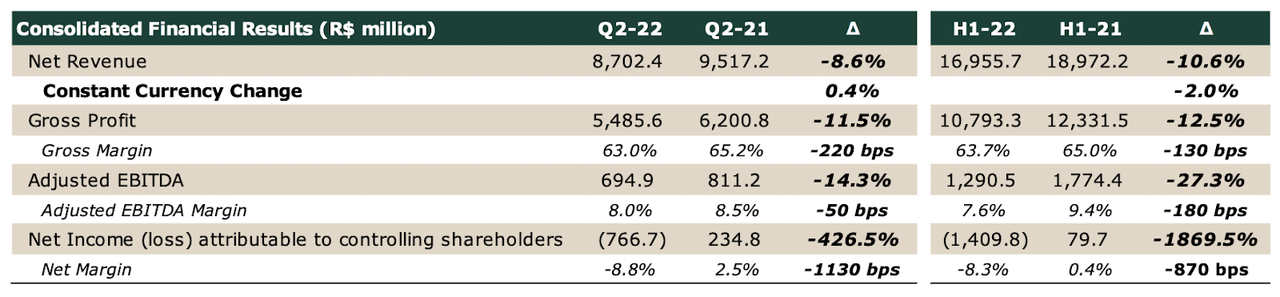

Latest financials

2022 has been trying for Natura &Co so far. Inflation, supply chain snags and repercussions from the war in Ukraine made an appearance in the first quarter and intensified in the second. Problems with Avon’s product portfolio (mainly the problematic Fashion & Home) made it worse. In Q1, the group’s revenue shrank by 12.7% quarter-over-quarter while industry peers globally expanded by 3.8% on average. In Q2, sales improved somewhat but bottom-line losses widened; aside from rising costs, unfavorable foreign exchange rates have also affected profitability.

Q2’22 Report

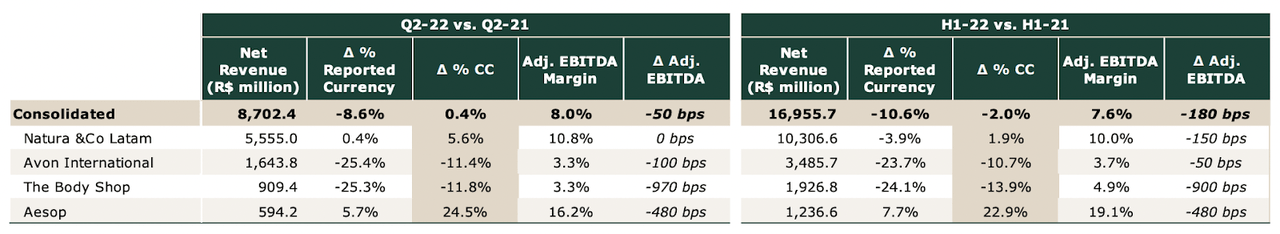

Zooming in on individual units within Natura &Co, there is a wide disparity in brand performance. Natura &Co Latin America (Latam) was back to growth in Q2 after some low times with Avon joining Natura in the region, where Hispanic markets are presently the main driving force behind growth. Aesop has been a stellar performer so far, delivering good store productivity and expanding in major Asian markets (entrance into China is planned for Q4 this year).

Q2’22 Report

Avon and The Body Shop, on the other hand, have been struggling. The former is having to deal with fewer consultants (called ‘representatives’) and lower consumer purchasing power in Europe. Retail recovery at The Body Shop has been slow while digital sales have started decreasing post-pandemic.

Despite fluctuating income numbers, the group maintains an adequate cash buffer at R$4.3b as of end-June which covers payments through 2028 on the total debt position of R$8.5b. But the leverage ratio has increased recently due to lower earnings and new issuances to cover large expenses: net debt/EBITDA widened from 2.02x in Q2 last year to 3.46x at present.

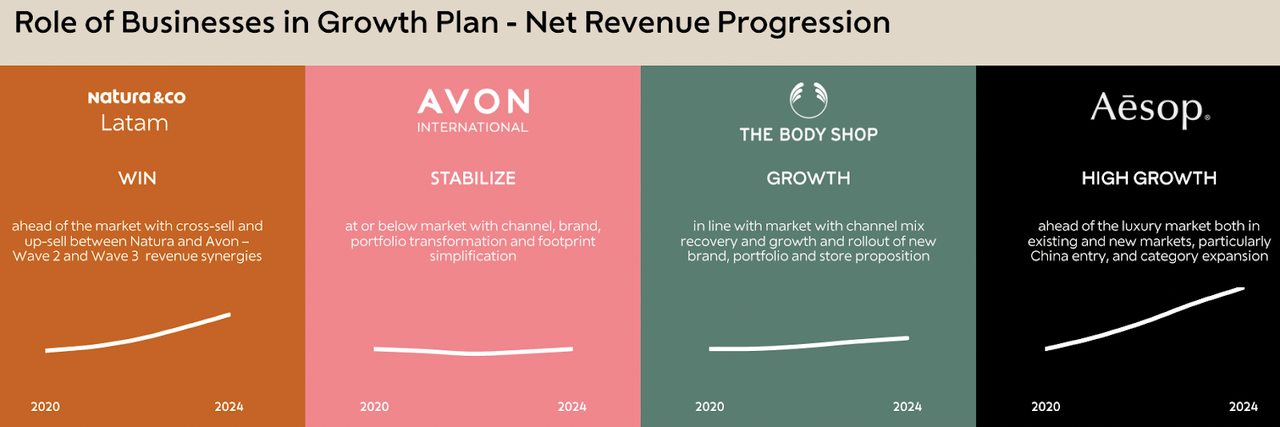

In the continuing challenging environment, the management — under new CEO Fábio Barbosa who has big plans but is yet to prove himself — will focus on “defending margins and generating cash flow” through cost discipline (as much as 40% of annual corporate expenses are under review) and structural changes (building a governance model that is “leaner and more decentralized”). Consolidated net revenue is expected to reach R$47-49b by 2024, up from R$40.2b in FY21; adjusted EBITDA margin is forecasted to improve to 15-17% compared to 10.3%.

Investor Day presentation, 9 May 2022 Investor Day presentation, 9 May 2022

Brand perception

Natura &Co self-describes itself as a one-level marketing company that relies on direct selling by more than 8 million representatives, the largest such network in the world with the recent addition of Avon’s workforce. In essence, it practices multi-level marketing since representatives are non-salaried and earn from both sales and downline distributors.

But unusually for an MLM, Natura &Co does not receive that much hate, especially in its home ground in Brazil and Latin America where Natura the brand is firmly established. It appeals not only with its mid-range pricing for high quality but also natural ingredients that are derived locally and sustainably. The company is also known for its environmental activism and social programs and is, in fact, ahead of most other multinationals in terms of sustainability commitments.

Commitment to Life: 2021 progress

Avon in this sense is an odd one out. Unlike the other two acquisitions — The Body Shop and Aesop — it came into the group with a very different history and culture. But the goal seems to be to overhaul the brand, the way it is popularly perceived, along with its commercial model. Avon is supposed to verify its ESG impact by 2023 and achieve a B Corp certification by 2026, joining the rest of Natura &Co. For one, the company’s army of representatives have been promised better reward packages to promote productivity and retention.

Speaking of productivity, Natura &Co has turned direct selling, which contributed 75% of sales in the latest fiscal year, digital by utilizing e-commerce and social platforms. Natura Latam increased its aggregate online sales by 42% in 2021, with the number of representatives selling online (through digital brochures and dedicated apps) up by 50%. Avon is following a similar trajectory, hoping that digital presence will rejuvenate the brand and the bottom line. Overall, more than half of the group’s sales are currently ‘digitally enabled’.

Stock performance

Natura &Co listed in Sao Paulo in 2004 when it was still a purely Brazilian business. (The first foreign brand, Aesop, was acquired an entire decade later.) In January 2020, the company began trading on the NYSE through ADRs (1 ADR = 2 common shares).

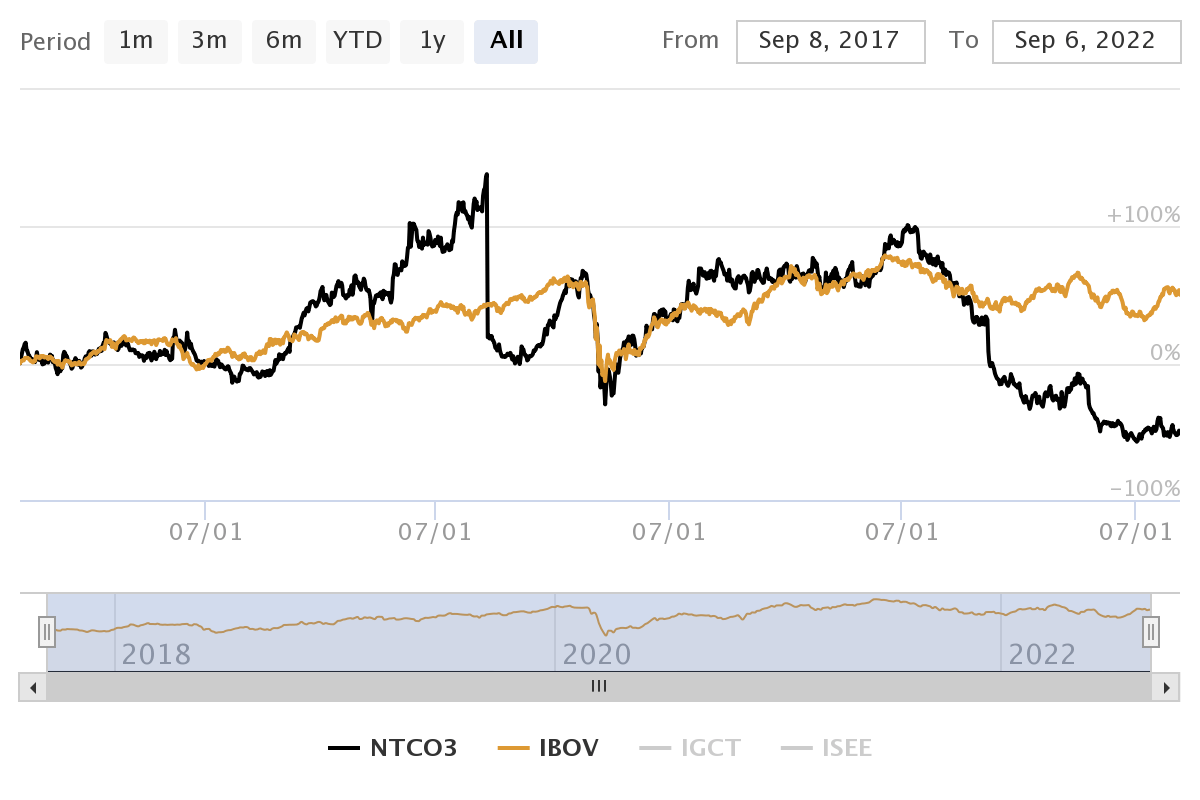

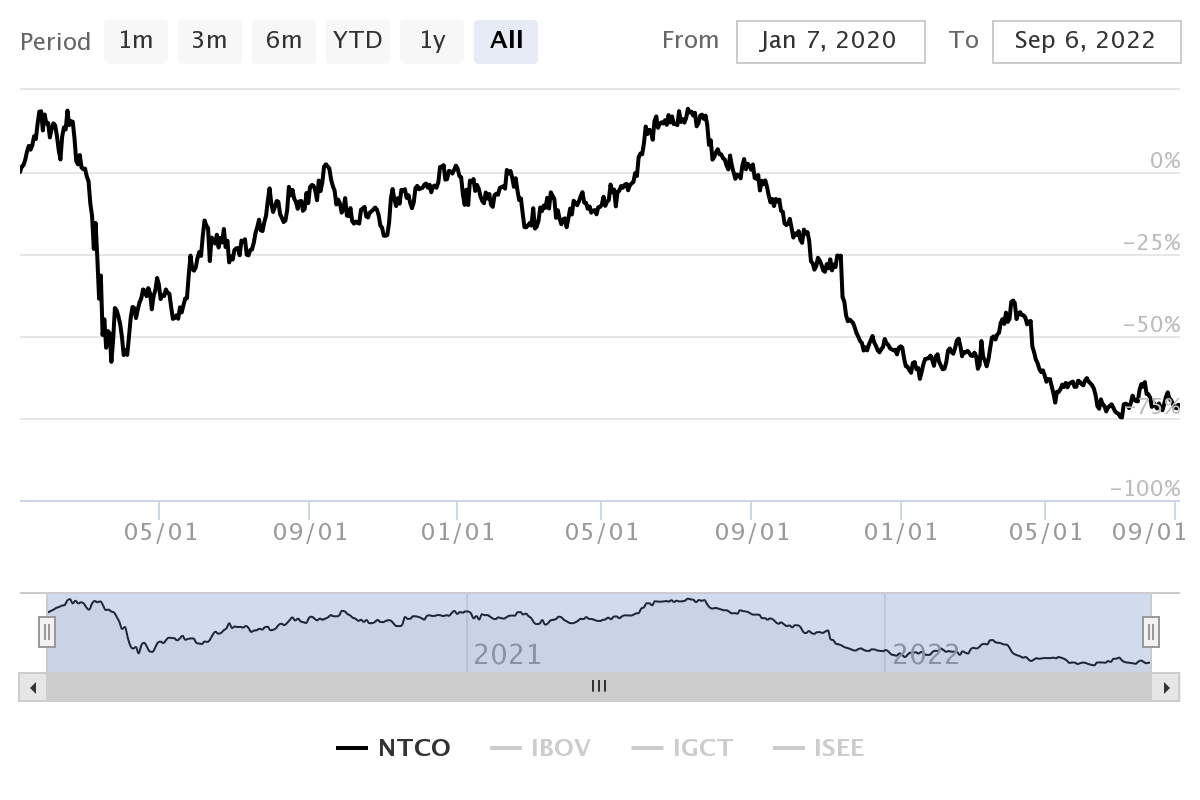

In the last five years, the Brazilian listed NTCO3 lost 51% against a 50% gain by the benchmark Bovespa Index. The company’s dismal profit trend — with net income peaking way back in 2012 and declining or stagnating since then — could not have escaped the attention of investors. The result is even more bleak for US-listed NTCO (although the unfortunate timing may be partly to blame): it dropped 71% since debuting 2.5 years ago; S&P 500, in contrast, returned 20%.

Nature &Co Quotes and Charts Nature &Co Quotes and Charts

As things stand, NTCO is very much undervalued. This has to be based on metrics other than pure earnings seeing that they are negative: twelve-month Price/Sales of 0.53 compares favorably to the five-year average of 1.68, and EV/Sales of 0.85 stands below the Consumer Staples median of 1.76. Weak fundamentals, however, warn against buying the stock at present.

Conclusion

Natura &Co is no longer an insulated company. Its brand power now extends beyond the Americas to the far reaches of the globe. Going global, however, also means stiffer competition, and in the beauty sector it is notoriously tough. No doubt, the business is still growing, albeit unsteadily. The bigger problems lie in the mounting debt load and low/negative profits. Sweeping cost cuts and efficiency improvements are already on the books. But how effective these changes will be and whether the problems are only transient in nature is a huge question mark.

Be the first to comment