adaask

Both FS KKR (NYSE:FSK) and Main Street Capital (NYSE:MAIN) have investment grade (BBB- Stable from S&P) credit ratings, vaulting them into the upper echelon of quality Business Development Companies (i.e., BDCs) (BIZD). Both also happen to offer mouthwatering dividend yields, with FSK boasting a mouthwatering 12.6% dividend yield and MAIN offering a juicy 6.2% dividend yield.

In this article, we will compare them side by side and offer our take on which one is a better buy.

Balance Sheet

As was already stated, both FSK and MAIN have the same investment grade credit rating and outlook (FSK has a Baa3 rating with a Stable outlook from Moody’s and MAIN has a BBB- rating with a Stable outlook from S&P), which puts them on similar footing in terms of perceived risk and access to capital.

FSK has $2.6 billion in total liquidity (~17% of its enterprise value) with a leverage ratio of 1.12x. 47.4% of FSK’s total outstanding debt is floating rate as of the end of Q1.

MAIN, meanwhile, has $535 million in total liquidity (~11.2% of its enterprise value) and a leverage ratio of under 1x. 18.5% of its total outstanding debt is floating rate as of the end of Q1.

While both appear to be in solid shape and FSK’s liquidity position seems stronger, MAIN seems to have the stronger balance sheet overall with lower leverage and much less floating interest rate exposure.

Investment Portfolio

FSK’s portfolio consists of 69% senior secured debt and 87% of its debt investments are floating rate, meaning that nearly 80% of the total investment portfolio benefits from rising interest rates. Furthermore, FSK’s portfolio is generally overweight more defensive sectors, with its top five sectors being software, capital goods, healthcare, commercial and professional services, and real estate. Non-accruals were very low as of 3/31/22 at just 1.5% at fair value.

MAIN’s portfolio consists of 69% senior secured debt and 73% of its debt investments are floating rate, meaning that 58.6% of the total investment portfolio benefits from rising interest rates. Furthermore, MAIN’s portfolio is generally overweight more defensive sectors, with its top five sectors being commercial and professional services, machinery, capital goods, software, and distributors. Non-accruals were very low as of 3/31/22 at just 0.6% at fair value.

Both portfolios have their strengths. FSK’s is larger and therefore better diversified, has significantly more exposure to debt investments, and is better positioned to see income increase from rising interest rates. Meanwhile, MAIN has a lower non-accrual rate (though it is not quite as good as it first appears given that it has less exposure to debt, which is the only investment class that can go on non-accrual status) and potentially better growth potential given its greater exposure to equity.

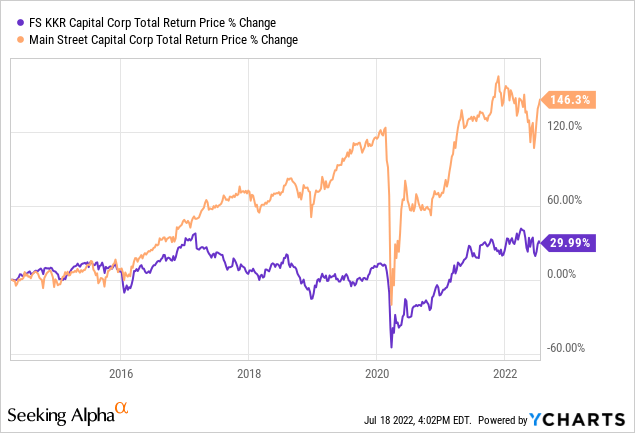

It is also worth noting that MAIN has outperformed FSK over the years:

While it is extremely close, we are going to give a slight edge to FSK here, though we also recognize that MAIN has a tremendous track record. However, given that we have a separate section for that, we will just stick with objective evaluation of the numbers here. Given that FSK has much greater exposure to floating rate interest rates, is better diversified, and has greater exposure to debt relative than equity, we favor FSK’s portfolio in the current climate.

Dividend

This section is not entirely relevant to the comparison as FSK implements a varying dividend policy by paying out nearly all of its earnings each quarter, whereas MAIN pursues a progressive monthly dividend policy where it supports its base dividend and tries to grow it over time. As a result, we are simply going to say here that we think that FSK’s total recent dividend payout of 12.6% more than doubles MAIN’s 6.2% payout and therefore believe that FSK’s margin of safety for paying out a higher yield than MAIN does over the course of a fiscal year is sufficiently large to give it a more attractive overall dividend.

Track Record

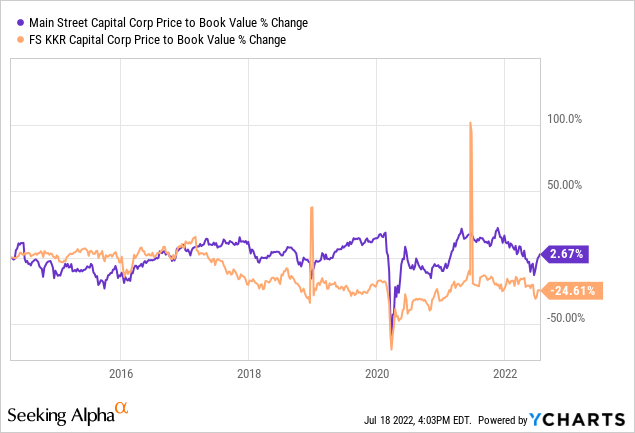

As we already discussed in a previous section, MAIN’s track record is convincingly superior to FSK’s. However, there are some caveats to that superior performance. For example, this outperformance was largely facilitated by an expanding P/B ratio for MAIN and a shrinking P/B ratio for FSK as well as a major equity bull market, which provided outsized benefits to MAIN:

Additionally, FSK has gone through several changes over the years which are expected to improve its performance moving forward, including a merger about 13 months ago which has improved the BDC’s leverage ratio, unlocked synergies and efficiencies, and prompted management to institute a buyback program.

Nevertheless, MAIN still wins the track record comparison without a doubt.

Valuation

FSK wins the valuation comparison with flying colors. Not only is its dividend yield more than twice that of MAIN’s, but MAIN currently trades at a whopping 58.25% premium to NAV while FSK trades at the largest discount of investment grade BDCs with a 24.95% discount to NAV. When you consider that FSK’s portfolio is arguably as conservatively positioned – if not more so than MAIN’s – and also benefits from parental support from the credit arm of one of the top alternative asset managers in the world (KKR (KKR)), this valuation gap seems unreasonably large.

Investor Takeaway

Unsurprisingly, this comes down to a competition between track record and value. MAIN has a stronger balance sheet and a vastly superior track record. Meanwhile, its portfolio is more aggressively positioned than FSK’s is. As we head into a recessionary environment, it becomes increasingly important to account for the support FSK receives from KKR, its greater diversification, and its more defensive portfolio positioning. Additionally, its recent changes designed to improve efficiencies and unlock shareholder value via buybacks and aggressive dividend payouts along with its deep discount to NAV make it a very compelling buy here. In fact, we rate it a Strong Buy and it is one of our top BDC picks at High Yield Investor. Meanwhile, MAIN’s heavier equity exposure and massive premium to NAV force us to rate it a Hold, even though we certainly have regard for its impressive track record.

Be the first to comment