Design Cells

Thesis

Celyad is a Belgian overlooked and under-appraised company in a crowded and difficult-to-master oncology landscape. After a British oncology professor put the company on my radar some months ago, the stock sold off over the past months in bearish biotech times, and additionally over a clinical hold which may be able to be resolved in favor of its drug candidate.

Celyad’s strategy is to develop next-generation allogeneic immune cell constructs to fight cancer, allogeneic meaning the cells do not originate from the donor itself. That makes sense, as the future of immuno-oncology is allogeneic or off-the-shelf, the existing autologous drugs and drug candidates being too expensive and too time-consuming to make.

Celyad owns unique technology that allows plug-and-play construction of chimeric antigen receptors or CAR’s on T-cells, to trigger the body’s immune system against cancer cells, without any gene-editing.

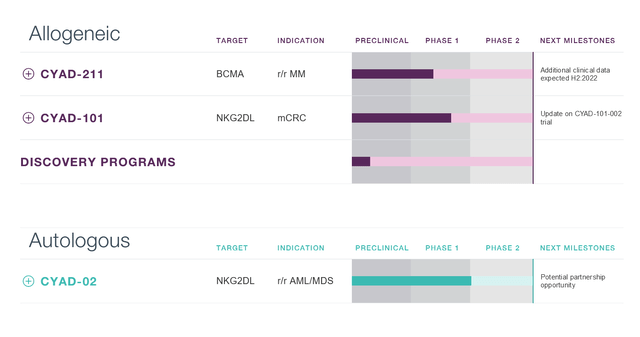

The focus is currently on two allogeneic candidates, CYAD-211 and CYAD-101, with Celyad wishing to partner its autologous CAR-T cell construct CYAD-02, which had equally brought good results.

CYAD-211 is being tried in a Phase 1 dose-escalation trial for relapsed/refractory AML and MDS, a hematological cancer, where it has shown good results so far, with no signs of graft-versus-host disease, and good engraftment. Results in cohorts 4 and 5, at maximal dosing of CYAD-211 combined with higher dosing of chemotherapy, will be read out in the second half of 2022. That could be a catalyst.

CYAD-101 has the more daunting task to show good results in metastatic colorectal cancer, where it builds on promising earlier results in the monotherapy alloSHRINK trial, and good results of CYAD-01, its autologous predecessor. CYAD-101, to me, is essentially a double killer, a CAR-T cell which also targets what NK cells target. It should furthermore come without the typical CAR-T toxicity, adding to its natural killer cell similarity, which is a great advantage. Solid tumors, a much larger market than liquid tumors, are the next frontier in immuno-oncology, and having a CAR-T cell drug candidate being successful there after so many failures would be big. The recent CYAD-101 trial in combination with Keytruda, a PD-1 inhibitor, is currently facing a clinical hold, with two deaths with similar pulmonary findings having occurred in the trial. I explain below that these pulmonary findings may not be related to CYAD-101 but to Keytruda, which has in fact often generated reports of pulmonary toxicity. To add to that, CYAD-101 was designed to inhibit graft-versus-host disease, and had shown no serious adverse events in the earlier alloSHRINK trial in metastatic colorectal cancer.

The combined lack of recent data, the March 2022 clinical hold and the May 2022 discontinuation of CYAD-203 in a biotech bear market have led this company to trade as low as it does. I believe inflection points could be near.

Analysts’ mean price target of $11 and consistent rating the stock as outperform with an almost +700% upside lead me to consider if the stock should be trading a lot higher.

Company overview

Share price and market cap

It has been a year-and-a-half ago since Celyad received coverage on Seeking Alpha, with Siva Kumar Raju Kolaru calling the moment a ‘chance to get in early and cheap’. The coverage was good, but the call was obviously wrong. Suffice to say few correctly predicted the biotech market obliteration due to macro-economic headwinds, or a clinical hold in a drug candidate that shouldn’t generate as much toxicity as other CAR-T’s.

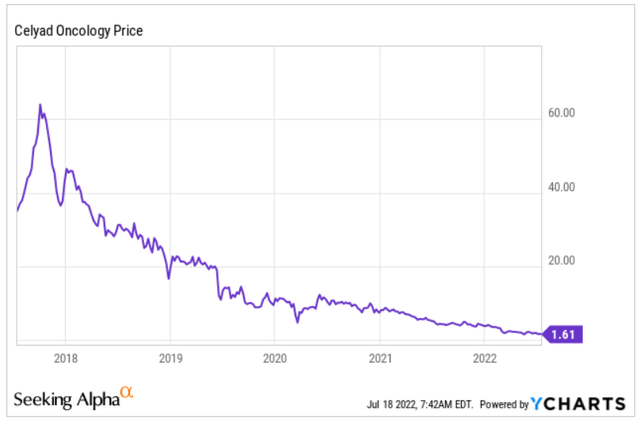

Celyad’s stock has over that period dropped by 81% percent. In 2017 it even traded above $50. By the looks of it, the company is a total bust. Yet, analysts and experts loved it and keep loving it. This is its five-year chart.

Celyad five-year chart (Ycharts)

At a share price of $1.61, its market cap is $36 million.

By the looks of it, this company seems like a total bust. However, still on June 24, 2022, Celyad claimed to be a leader in the field of allogeneic CAR T cell therapies. How can both be reconciled? Across my research in companies in the oncology space over the past years, I have seen Celyad’s name favorably mentioned time and again, including in a William Blair coverage of April 2022 on advances of immuno-oncology in solid tumors. And I agree Celyad is a gem, which is further advanced in solid tumors than many others are, with perfectly fine drug candidates. I believe the market/investors do not fully understand why Celyad is at the vanguard of its field, and I will explain this a bit below.

Celyad’s proprietary technology

Celyad’s proprietary technology is fourfold. I will focus on the three most relevant technological advances, which are the all-in-one vector, TIM-technology and shRNA-technology. Elucidating this technology first will make the understanding of its drug candidates mentioned below easier. The fourth aspect of its technology, called shARC, allows T-cell armoring with IL-18 and will be used for future drug candidates.

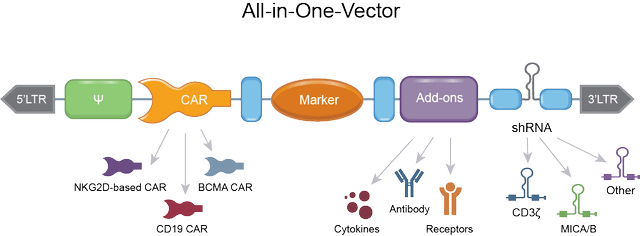

The all-in-one vector or plug-and-play approach

All immuno-oncology companies I have looked at mount always more complex elements on an immune cell, mostly a CAR-T or CAR-NK cell. This requires multiple immune-cell editing processes, with the accompanying construction time and cost. Celyad’s ‘plug-and-play’ vector can features all of the add-ons at once, which is innovative and process-friendly.

All-in-one vector (Celyad corporate presentation)

Is this necessary? I believe it will be if immuno-oncology’s goals are ever to reach larger addressable markets. Costs of creating billions and billions of allogeneic T- or NK-cells, with all sorts of always more complex cell editing processes, risk to make the end-product unaffordable. Affordability is a huge issue in immuno-oncology, with costs of therapy currently in the several hundreds of thousands up to a million dollars, not within the budget of most people. The proprietary plug-and-play approach streamlines CAR-development and lowers manufacturing costs. I believe that eventually, in an effort to address the masses, the field of immuno-oncology will look at process-simplifying solutions like these. The investor field does not seem to have evolved so far yet; the focus is currently still on the most complex immune cell-constructs, which are all fine in preclinical development and trials, but eventually they will need to be marketable post approval.

I believe that the stage of commercialization is where the highly-praised immuno-oncology companies praised for the moment, with many of their drug candidates still preclinical or in Phase 1 trials, may eventually fail. A look at some drug candidates by Fate (FT536), (FT596), (FT538), (FT573) shows how different cell editing processes are necessary to create a final immune-cell construct. We will see below that Novartis has already come to knock on Celyad’s door in 2017.

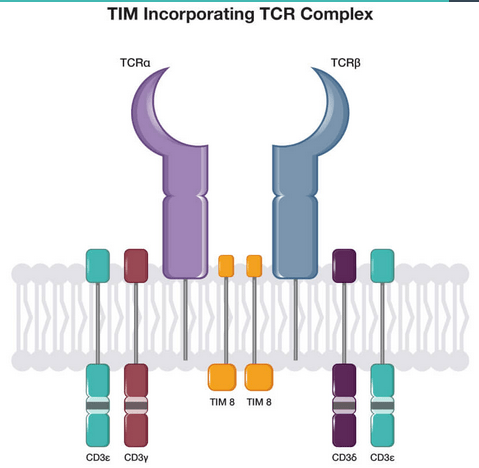

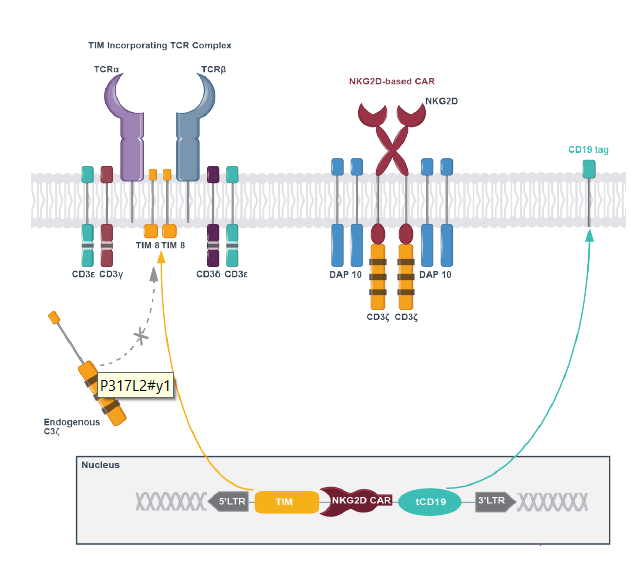

T-cell inhibitory molecule technology (TIM) to reduce graft-versus-host disease

Celyad’s T-cell inhibitory molecule or TIM technology inhibits T-cells signaling to induce graft-versus-host disease (GvHD). In the current T-cell-based immuno-oncology drugs and drug candidates, GvHD is the main cause of morbidity, of auto-immunity or neurotoxicity issues. It is also one of the main reasons why the field has moved away from T-cells to NK-cell based therapies. The T-cell receptor or TCR, present on the surface of T-cells, is responsible for GvHD. Celyad’s TIM technology allows overcoming the GvHD issue. It has been shown to work in CYAD-101 in metastatic colorectal cancer, with good results and without any of the first 15 patients showing any signs of GvHD. Again, I believe this is great technology that could be licensed to a larger number of parties in the space.

TIM complex (Celyad corporate presentation)

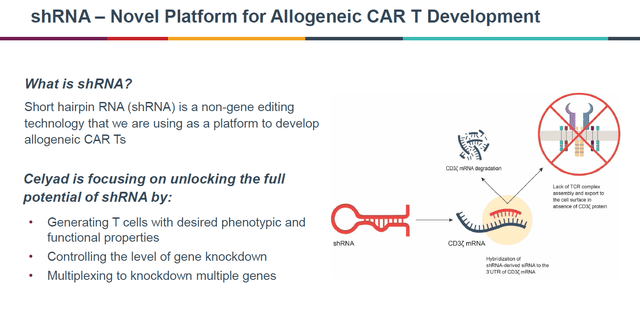

The short hairpin RNA technology

Celyad’s shRNA technology allows for gene modulation without gene editing. This may lead to longer persistence of immune cells, better engraftment, or knock-down of multiple genes such as MICA and MICB. As a result, there should be less tolerability issues, less cell manipulation, and a shorter manufacturing process.

shRNA technology (Celyad ASH 2021 presentation)

Celyad’s pipeline

Celyad pipeline (Celyad corporate presentation)

Celyad has two lead drug candidates, CYAD-211 and CYAD-101.

CYAD-211

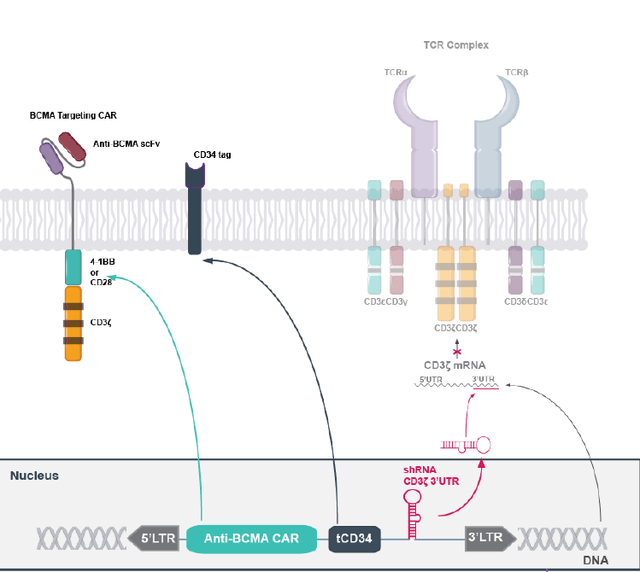

CYAD-211 is being tested in a Phase 1 dose-escalation trial called IMMUNICY-1 following preconditioning with CyFlu chemotherapy, for the treatment of relapsed/refractory multiple myeloma. It features a vector with a shRNA hairpin incorporating TIM to inhibit GvHD, and includes a CAR expressing an antigen against B-cell maturation.

CYAD-211 drawing (Celyad corporate presentation)

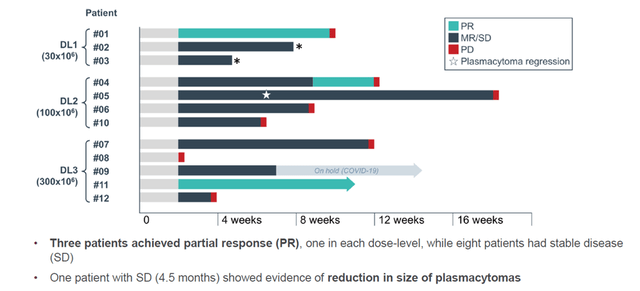

These are the results presented in December 2021, in heavily pretreated patients:

CYAD-211 results so far (Celyad Ash 2021 update)

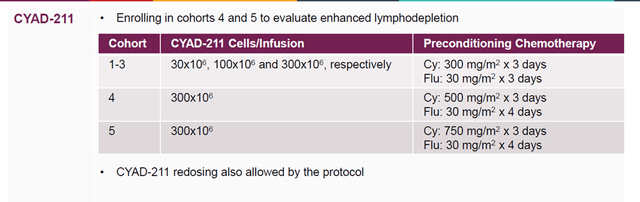

CYAD-211 is efficacious, shows no signs of GvHD probably due to the TIM-technology, and leads to engraftment. Again, combining efficacy with lack of GvHD in CAR-T trials is major. Celyad is now enrolling in cohorts 4 and 5 in its dose-escalation regimen, to see whether higher preconditioning chemotherapy at the highest dose of 300×106 cells per infusion leads to improved cell persistence and maximization of clinical benefit.

CYAD-211 dosing cohorts (Celyad corporate presentation)

To me, CYAD-211 looks like a perfectly fine drug candidate. I expect improved outcomes and no issues going forward. Additional data from the trial are expected in the second half of 2022. This could be a catalyst.

CYAD-101

Introduction

CYAD-101 as an allogeneic drug candidate for solid tumors which builds on good results of a prior drug candidate, CYAD-01, which is autologous. CYAD-01 was seen as a milestone development in immuno-oncology as it had mounted an NKG2D receptor on a T-cell. Earlier mostly preclinical developments with NKG2D being mounted on T-cells showed robust anti-cancer activity in AMS, but also in solid tumors such as cervical cancer or glioblastoma, and low toxicity.

CYAD-101 features an all-in-one vector with TIM to prevent GvHD, and an NKG2D-based CAR construct to bind to ligands expressed on many tumor cells.

CYAD-101 drawing (Celyad corporate presentation)

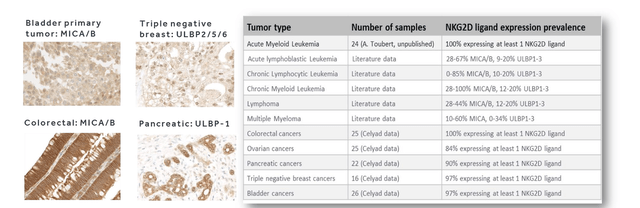

The NKG2D-based CAR basically renders a T-cell into a double killer, as the NKG2D receptor is usually expressed on the surface of NK cells to bind to multiple ligands on cancer cells, such as MICA, MICB and human UL16-binding proteins (ULBPs). So that’s a T-cell that can target both NK-cell and T-cell targets, with in principle no GvHD. The below chart shows which tumors express NKG2D ligands.

NKG2D expression on tumor cells (Celyad William Blair biotech focus august 2020 slides)

Why is this clever? Because a CAR-construct can normally only target a single antigen, which can easily be shed by the tumor to overcome killing and lead to cancer resistance. A solution to this could be to make engineering more complex, e.g. by having a CD19/CD20 CAR construct, which could still target CD20 if CD19 is shed by the tumor cell. More explanation as to why it would be useful to place an NKG2D receptor on a CAR-T cell can be found here (slides 3 to 7).

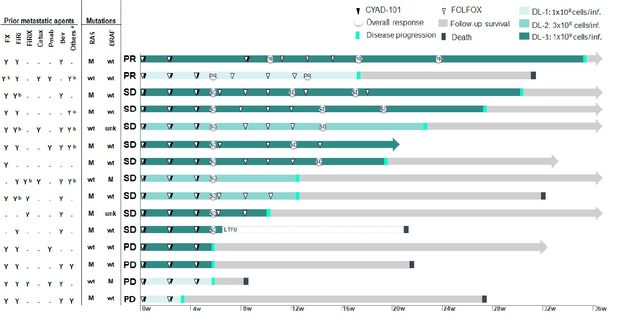

The finished alloSHRINK trial

Celyad has already done a Phase 1 trial of CYAD-101 as monotherapy after chemotherapy in mCRC, alloSHRINK, and results were impressive. This is a quote taken from Celyad in that regard:

“CYAD-101 is the first allogeneic CAR T candidate, to our knowledge, which has demonstrated confirmed objective responses in the treatment of a solid tumor indication, specifically advanced mCRC, with no clinical evidence of GvHD.

CYAD-101 had been given at three dose levels, showing no GvHD, no dose-limiting toxicities, no serious adverse events, and no patient discontinuation. With 15 patients treated, results were outstanding (again, this is well-tolerated T-cell-based immunotherapy in solid tumors). There was a 73% disease control rate, nine patients achieving stable disease, seven patients with disease stabilization of more than or equal to three months, and two patients achieving a partial response including one with a KRAS-mutation.

alloSHRINK trial results (Celyad William Blair biotech focus august 2020 slides)

Median progression free survival was 3.9 months, and median overall survival was 10.6 months.

There was a tumor burden decrease in 8 out of 15 patients, including six patients at dose level 3.

Three of four patients treated at the highest dose achieving partial response or stable disease also showed new T-cell clones, showing persistence and activation of the patient’s own immune system.

I want to reiterate here: immuno-oncology trials in solid tumors typically lead to no success at all, or barely any. Iovance, often considered as a very promising solid tumor play, has shown an objective response of 36% in melanoma and 44% in cervical cancer. Tmunity’s (private) MUC-1 trial has failed and led to discontinuation. BioNTech (BNTX) has just received a European priority medicines designation for its autologous CAR-T trial after having shown efficacy in third- or later-line testicular germ cell tumor. The data that were used for such designation came out of a small 16-patient phase 1/2 trial, showing a disease control rate of 86% and an overall response rate of 43%. Other interesting companies such as Poseida Therapeutics (PSTX) or Achilles Therapeutics (ACHL) have market caps of respectively $175 million and $100 million, with ACHL also being undervalued in my opinion. FT500, the first drug candidate that Fate Therapeutics (FATE) had started a trial in solid tumors with, was considered ‘commercially unviable‘ after trial results had come out.

The Keynote-B799 trial under clinical hold

CYAD-101 is currently in a Phase 1b trial called KEYNOTE-B79, following FOLFOX chemotherapy and combined with Merck’s Keytruda as anti-PD-1 therapy for the treatment of refractory metastatic colorectal cancer (mCRC). First-patient dosing occurred in December 2021. The trial was placed on clinical hold in March 2022 due to deaths in two patients with similar pulmonary findings.

Given the safety profile of NKG2D-CAR’s and the lack of GvHD due to TIM, as shown in the alloSHRINK trial, the clinical hold came as a surprise.

I took a look at whether Merck’s Keytruda may have triggered this instead of CYAD-101. Keytruda has been reported multiple times to lead to pneumonitis, pulmonary toxicity and treatment-related mortality. This give me some comfort that Celyad may well be able to relate the pulmonary findings in its trial to Keytruda. One should not forget that, in a Phase 1 trial, one does not treat the patients one wants to treat, but those that one has to treat, after failure of multiple lines of (chemo)therapy. This is obviously the elephant in the room.

It is unclear how long clinical holds may take. As an example, the FDA’s clinical hold on all five of Allogene’s (ALLO) trials occurred in October 2021 and was removed in January 2022.

As the market now fully assumes CYAD-101 is a bust, despite showing efficacy and a good safety profile in the alloSHRINK trial, I find there is major opportunity in buying Celyad here. But I may be wrong, and the stock may fall further if the clinical hold does not get resolved.

CYAD-02 – up for partnering/sale

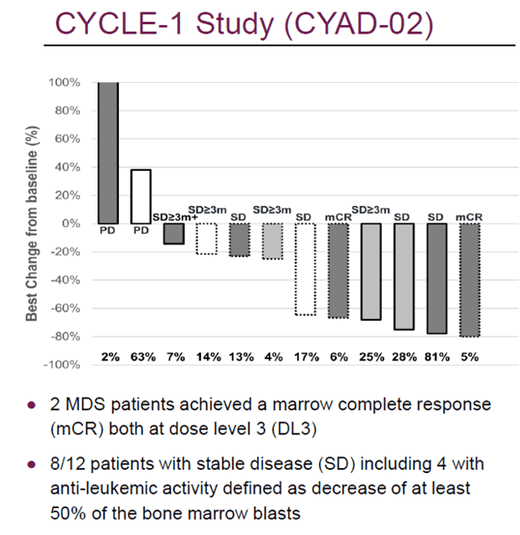

I will cover CYAD-02 briefly, as it is an autologous candidate which has shown good results, but which Celyad plans to sell as it wants to move ahead with allogeneic candidates. CYAD-02 includes a vector with a NKG2D-CAR and shRNA to knockdown MICA and MICB. The results of the CYCLE-1 study in relapsed/refractory acute myeloid leukemia (AML) and myelodysplastic syndromes (MDS) showed good efficacy and tolerability.

Cycle-1 study results (Celyad Ash 2021 update)

The discontinuation of CYAD-03

CYAD-03 is a so-called ‘armored’ CAR-T candidate, which saw the addition of IL-18 as a cytokine, to empower the T-cell’s anti-cancer activity, and to alter the balance of pro- and anti-inflammatory cells within the tumor microenvironment. Celyad planned to submit an IND by the end of 2022, but discontinued that plan on May 5, 2022, after further analysis of preclinical data. Biotech companies with limited budgets reassess their pipelines to only move forward with the best ones. In a competitive landscape, this is something that happens. As the discontinuation occurred before the IND, I am going to trust Celyad knew what it was doing.

Partnerships with Novartis, Mesoblast, Merck and Fortress Investment Group

Since 2017, Celyad has an ongoing partnership with Novartis (NVS), under which Novartis uses Celyad’s intellectual property to develop two undisclosed targets. Celyad has received a $4 million upfront payment, and is eligible to receive additional milestone payments of up to $92.0 million, plus royalties based on net sales at percentages in the single digits if these targets make it to market. Celyad is not excluded from licensing its IP rights to other partners.

Since May 2018 and with an amendment in 2022, Celyad has entered into agreements with Australian biotech company Mesoblast (MESO) to develop and commercialize an intra-myocardial injection catheter. Celyad received an upfront fee of $1 million in 2018. In the framework of the 2022 amendment, Celyad will receive $1,5 million Mesoblast ordinary shares (currently worth about $4.5 million), and Celyad may be eligible up to $20 million in clinical, regulatory, and commercial milestone payments.

Since September 2020, Celyad has a collaboration agreement with Merck (MRK) to enter into a clinical trial collaboration agreement – the KEYTRUDA-B79 trial.

In December 2021, apart from a private placement shares at $5 per share, about 18% above the share price at the time, Fortress Investment Group can choose two persons to be either members of Celyad’s Board of Directors or non-voting observers, insofar as Fortress Investment Group continues to hold at least 10% of Celyad’s outstanding ordinary shares.

Competitors

Competitors are numerous in the oncology space. Some of them for solid tumors have been mentioned above. Celyad’s latest annual results are a good source for information in that regard. I do notice that, in light of its technology and promising candidates, Celyad seems much undervalued compared to some of its peers, many of which are even less advanced in trials or unsuccessful, certainly in solid tumors. I have already mentioned Fate Therapeutics (FATE) and Nkarta (NKTX) above, with most product candidates in preclinical or phase 1 trials. Some others are mentioned below. Arcellx (ACLX), with a market cap of around $900 million, has preclinical or stage 1 products. Kura Oncology (KURA), with a $1.2 billion market cap, has preclinical or phase 1 drug candidates. GT Biopharma (GTBP), with a $90 million market cap, has assets that are either preclinical or in Phase 1. VOR Biopharma (VOR), with a $190 million market cap, has assets that are either preclinical or in Phase 1.

Analysts

Analysts have revised their price targets downward in light of recent events, but consistently rate Celyad as outperform, with price targets far above the current share price. The average price target of analysts is $11, which would mean an upside of a bit less than 700% compared to the current share price.

Risks

As mentioned above, the clinical hold of the Keynote-B79 is an issue. The question here is whether it can be resolved, and if so, in which timeframe. If it doesn’t, Celyad may have to reorganize its trials, either pursuing CYAD-101 as a monotherapy or combining it with another drug.

As Celyad’s assets are early-stage, further risks along the development path can still be encountered. There is no certainty that the drug candidates are ever approved, and the competitive field may look different as time progresses. The FDA may impose restrictions on certain combinations of drugs (e.g. PD-1 inhibitors + CAR-T), and the first allogeneic CAR-T trial has yet to be approved.

Financing is another risk factor. At a given time, Celyad may need to dilute shares as it is looking for additional funding. That may happen sometime in 2023.

Finally, Celyad trades both on the Nasdaq and on Euronext with low liquidity. Buying or selling large numbers of shares at one time may be an issue.

Financials

Celyad has a cash position of about $20.5 million. Its net cash burn for the last quarter was $10.6 million. It claims that, with access to an equity purchase agreement with Lincoln Park Fund LLC, it has sufficient access to cash to fund operating expenses and capital expenditure requirements until mid-2023.

Conclusion

I see Celyad as an undervalued oncology play with state-of-the-art science, including a plug-and-play vector, CAR-T’s that inhibit graft-versus-host-disease and two promising drug candidates. Efficiently and prohibiting graft-versus-host disease, Celyad has turned CAR-T cells into double killers.

One of its drug candidates CYAD-101 is in solid tumors, where it has shown impressive results in the alloSHRINK monotherapy trial. However, in combination with Merck’s PD-1 inhibitor, this trial is on clinical hold since four months. I assume this will not be the end of development of this drug candidate, and explain above why I believe the clinical hold may be related to Keytruda’s pulmonary toxicity issues. But that is a possibility, and I could be wrong here.

Although some immuno-oncology companies may have been overvalued before the biotech bear market, Celyad has consistently been the most undervalued one that I have seen. The sell-off has been so bad that the market assigns little to no value to this company’s drug candidates, partnerships or technology. The sell-side analysts’ mean price target is about 700% higher than the actual share price.

Apart from a possible lift of the clinical hold, I see some other possible near-term inflection points, such as upcoming data release for CYAD-211, at highest dosing combined with higher-doses of chemotherapy, scheduled for the second half of 2022.

Be the first to comment