Brothers91/E+ via Getty Images

With nearly 330 million people, the US requires a lot of food in order to function. Naturally, this would lead to the creation of a number of food distribution companies all dedicated to transporting food from farm or factory to plate. One player in this space that has a fairly large distribution network is Performance Food Group Company (NYSE:NYSE:PFGC). In recent years, the company has achieved some really attractive growth on both the top and bottom lines. Net income has been incredibly volatile from year to year. But when you look at it from a cash flow perspective, the company looks very appealing. Add on top of this the fact that shares are currently trading at low multiples, and I definitely like what I’m looking at. Of course, the business is not the most appealing prospect in this space. But it is trading at a low enough level to warrant consideration from long-term, value-oriented investors.

A look at food distribution

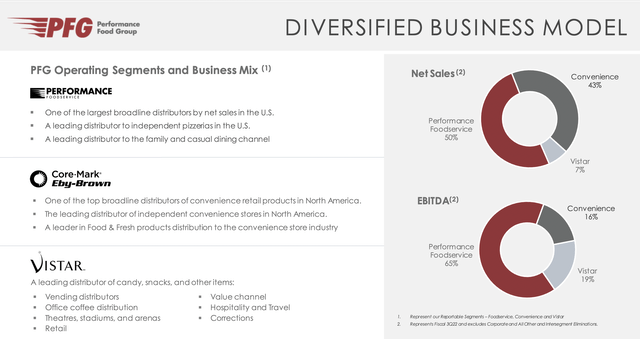

As of the end of its 2022 fiscal year, Performance Food Group Company operated a massive network that consisted of 142 distribution centers delivering more than 250,000 food and food-related products to over 300,000 customer locations across the country. These customers include everything from independent and chain restaurants, to schools, to businesses, to hospitals, to vending distributors, and so much more. To best understand the company, however, we should break it up into its individual operating segments.

The first of these is referred to as the Foodservice segment. Through this, the company provides food products like custom-cut meat and seafood, as well as other offerings, to a network that includes over 175,000 customer locations. The company’s customer base largely consists of players like fast-casual restaurants, bars and grills, chain restaurants, independent restaurants, and more. All in all, the company has 78 distribution centers dedicated to this particular segment.

Performance Food Group Company

The second segment worth discussing is the Vistar segment. Through this, the company acts as a national distributor of candy, snacks, and beverages to vending and office coffee service distributors, retailers, theaters, and hospitality providers. This unit alone has 25 distribution centers and four Merchant’s Mart locations, all collectively serving over 75,000 customer locations nationwide. Under the Merchant’s Mart Brand, the company has cash and carry operations where customers usually pick up orders rather than having them delivered. But as you can imagine, this is a fairly small portion of the company’s activities. The final segment, meanwhile, is called the Convenience segment. This operates as one of the largest foodservice and wholesaler customer products distributors in the convenience retail industry. Servicing around 50,000 customer locations across the US and Canada, this segment focuses on delivering cigarettes and other tobacco products, as well as candy, snacks, food, dairy products, and so much more, to its customers like mass merchants, drugstores, traditional convenience stores, and more. Of the 39 distribution centers that it has in operation, 35 are located in the US, with a remaining in Canada.

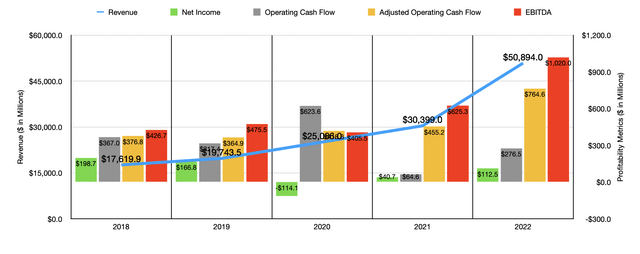

Over the past few years, the general trajectory seen by Performance Food Group Company has been positive. From 2018 through 2021, revenue with the company grew from $17.62 billion to $30.40 billion. During the 2022 fiscal year, however, sales jumped to $50.89 billion. From 2021 to 2022, the single largest contributor to the company’s top line growth was the firm’s acquisition of Core-Mark in a deal completed last year at a price of $2.5 billion. That transaction alone contributed $14.5 billion in revenue to the company’s 2022 fiscal year. Even so, the firm also saw sales increase because of a 7.9% rise in organic case volume and also because of higher pricing aimed at offsetting cost inflation of 11.9%.

Although it has generally been nice to see revenue rise, profits have been all over the map. This much can be seen in the first chart in this article. What has been more consistent, however, has been adjusted operating cash flow. Unlike traditional operating cash flow, which also saw volatility, with a low point in the past five years of $64.6 million and a high point of $623.6 million, adjusted operating cash flow ignores changes in working capital. Using this approach, we can see that the metric rose pretty consistently, dipping from $376.8 million in 2018 to $364.9 million in 2019. After that, it rose year after year, eventually hitting $455.2 million in 2021 before spiking to $764.6 million last year. A similar trend can be seen when looking at EBITDA, with the metric climbing from $426.7 million in 2018 to $1.02 billion in 2022.

Although the company just reported its results for its 2022 fiscal year, management is already hopeful about what the 2023 fiscal year should bring. Driven in large part by a complete year of having Core-Mark under its belt, the company is forecasting sales of between $56 billion and $58 billion. At the midpoint, that would translate to a year-over-year increase of 12%. The only profitability metric management provided involves EBITDA, with the current expectation being that this metric should come in at between $1.15 billion and $1.25 billion. No guidance was given when it came to operating cash flow. But a good estimate for that might be $899.5 million. Because of how volatile earnings have been, I have decided to leave those out of the analysis since I don’t think they are a large determinant of the company’s valuation.

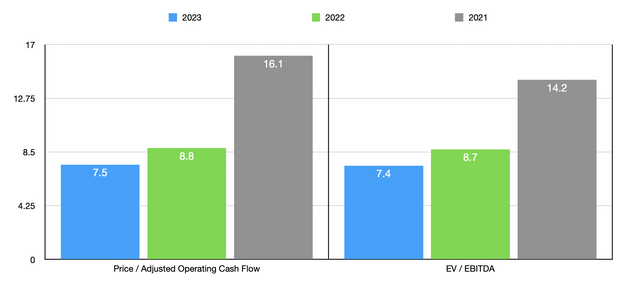

On a forward basis, Performance Food Group Company is trading at a price to adjusted operating cash flow multiple of 7.5 and at an EV to EBITDA multiple of 7.4. Even if we use data from the 2021 fiscal year, these multiples are still low at 8.8 and 8.7, respectively. A return to the kind of profitability we saw in 2021, as unlikely as that is given the aforementioned acquisition, would still leave these multiples at reasonable levels of 16.1 and 14.2, respectively. As part of my analysis, I also compared the business to five similar firms. On a price to operating cash flow basis, these companies range from a low of 6.3 to a high of 46.7. In this case, only one of the five firms was cheaper than our target. And using the EV to EBITDA approach, the range is between 5.5 and 15.1. In this case, three of the five companies were cheaper than our target.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Performance Food Group Company | 8.8 | 8.7 |

| US Foods Holding Corp (USFD) | 13.9 | 13.6 |

| United Natural Foods (UNFI) | 6.3 | 5.5 |

| The Chef’s Warehouse (CHEF) | 46.7 | 15.1 |

| Andersons (ANDE) | N/A | 7.2 |

| SpartanNash (SPTN) | 8.9 | 7.9 |

Takeaway

At first glance, the food distribution space may not look all that appealing. But when you dig into the numbers, it becomes clear that there are some fundamentally appealing plays in this space. Compared to similar firms, Performance Food Group Company may not be the cheapest of the group, but management has demonstrated a desire to grow and shares are trading at low enough levels to warrant nice upside. All of this, combined, leads me to rate the business a ‘buy’ at this time, reflecting my belief that the firm is likely to outperform the broader market moving forward.

Be the first to comment