Toyota Surpasses General Motors In Annual Car Sales During 2021 In U.S. Brandon Bell/Getty Images News

Toyota (NYSE:TM) has struggled along with other global automobile manufacturers in the wake of supply chain snarls and shortages of key components such as semiconductor chips. Its retail dealer network in the U.S., which typically can offer customers a 60-day supply of vehicles from which to choose, counted a two-day supply at the beginning of May.

Tight inventory has been a boon for dealer profit and has allowed Toyota to cut or eliminate discounts on some models, effectively raising prices and adding to the automaker’s operating profit. At the same time, unit sales have been depressed.

Fewer vehicles, fewer sales

Per Automotive News:

With one of the industry’s leanest stockpiles of new cars and light trucks, Toyota said volume skidded 27 percent to 175,990 last month, with deliveries off 27 percent at the Toyota division and Lexus. It was the tenth straight monthly decline for the Toyota brand and fourth consecutive drop at Lexus.”

Honda was down 36% in unit sales for the month, with other automakers also posting declines. (General Motors Co. (GM) and Ford Motor Co. (F) only disclose sales on a quarterly basis.)

Having passed GM in 2021 as the leading seller of vehicles in the U.S., Toyota appears poised to repeat in 2022 – and perhaps for years to come.

Toyota’s profit in its fourth fiscal quarter ended March 31 fell 31%, though the automaker was able to increase profit 27% for the full fiscal year. Due to rising costs, Toyota warned on May 11 that net profit could fall as much as 20% in the current fiscal year.

But even if the warning proves to be accurate, Toyota would earn more than $18 billion in net income and remain in solid financial condition.

New models coming

The Japanese automaker, with its substantial financial depth, is investing aggressively in its fleet of conventional and gas-electric hybrid models as well as battery-powered electrics, favoring a balanced approach instead of an accelerated strategy in favor of zero-emission models – such as adopted by GM, Ford and Volkswagen AG (OTCPK:VWAGY).

Among new and refreshed models headed for the U.S. market are an all-new 2023 Lexus RX 350, a 2023 Toyota Corolla with a stronger base engine and 2023 Corolla Cross, a crossover version of the popular Corolla small car. Toyota has notably bolstered market share gains against rivals, especially in the U.S., by maintaining its car models even as trucks and SUVs have dominated consumer preference.

On the pure-electric front, expect to see Toyota’s bZ4X battery model and its Lexus counterpart, the RZ, in the U.S. over the next year. Toyota has been forced to defend itself rhetorically against environmental advocates and other critics favoring a quick rollout of BEVs – the company responds that it will introduce BEVs at a pace consistent with authentic market demand (or to meet future government mandates).

Toyota also is pinning hopes on a new Sequoia large SUV that debuts this fall as a 2023 model, replacing a predecessor that had been selling in steadily diminishing numbers for 14 years. Sequoia, which is based on the new Tundra pickup truck platform, plays a relatively small role among large SUVs compared to competitors such as Chevrolet Tahoe and Ford Expedition. But Toyota expects the new version – which utilizes the same basic mechanical architecture on the global Land Cruiser and on Lexus LX – to seize a small but meaningful 10% of the roughly 350,00-unit segment.

2023 Toyota Sequoia large SUV (Toyota)

Third-generation Sequoia will feature a twin-turbo V6 i-Force gas-electric hybrid motor generating 437 horsepower and 583 lb.-ft of torque with a ten-speed automatic transmission. Towing capacity is rated as sufficient for a 9,500-pound load. No other engine options will be offered.

Sequoia rear/side view (Toyota)

Hybrids still prominent

As rivals GM and Ford develop large body-on-frame battery-electric vehicles (BEVs), which are being rolled out in pickups like the Ford F150 Lightning and later will appear in big SUVs, Toyota has been candid about its intention to rely for the time being on gas-electric hybrids. The automaker contends that its fuel-efficient hybrids will appeal to more customers than BEVs and therefore will have a bigger impact on limiting carbon emissions.

The three-row SUV will offer several seating configurations and five trim levels, with pricing starting at around $60,000. The third row will feature what Toyota says is an industry exclusive: A sliding adjustment of six inches to allow more seating or cargo room and an adjustable cargo shelf. The towing capacity represents a 26% increase over the previous model.

While Sequoia will not be a big seller in terms of unit sales, it does underscore the automaker’s commitment to maintaining a broad and comprehensive model lineup – one of the factors behind Toyota’s emergence as the market-share leader in the U.S. in 2021 for the first time, displacing GM – the titleholder for 90 years.

Toyota executives insist that No. 1 market share status is far less important than maintaining a high satisfaction rating with customers and dealers. But the two are connected and will be important for investors because market share leadership can be a key element of competitive advantage over rivals. For example: Toyota’s entry-level small sedans can serve as a gateway to younger, less affluent customers who later in life will be loyal to the brand and purchase more expensive and sophisticated models.

Low but solid ground

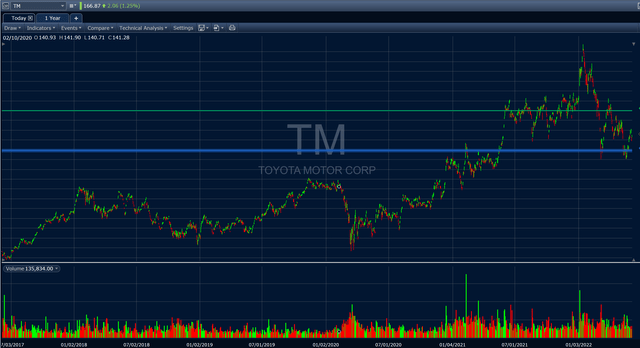

Toyota ADRs (American Depositary Receipts) have been a reliable if unspectacular investment for investors focused on the long term. Over the past five years, the stock has posted a total return of nearly 9%, solid but well behind the market in general. The current dividend yield is 2.7%.

Toyota five-year stock chart (Fidelity)

Toyota’s finance executives tend to manage the price and total return of company shares with dividends, buybacks and issuance like it manages its automotive business: with a bias toward steady, even unspectacular growth rather than the steep ups and downs often seen in other automotive shares.

I like Toyota stock, which has been a regular and valued member of my portfolio for years, and rate it as a buy. After a runup in price in March and May, shares fell below their technical resistance point and now are slightly above, which represents a logical entry point for investors oriented toward longer-term holdings.

Be the first to comment