Bosca78/iStock Unreleased via Getty Images

The clothing and apparel industry, as well as related markets tied to fashion, can be highly competitive and many of the players suffer from low margins. But some companies in this space have demonstrated the ability to expand and generate attractive cash flows. One such prospect is G-III Apparel Group (NASDAQ:GIII). With very little in the way of debt and shares trading on the cheap both relative to similar players and on an absolute basis, the company looks like a strong prospect for value investors to consider at this time.

Trying on G-III Apparel

Today, G-III Apparel specializes in the design, sourcing, and marketing of different types of apparel. Types of products the company sells include outerwear, dresses, sportswear, swimwear, suits, handbags, footwear, and more. The company also produces miscellaneous products such as luggage. Naturally, such a diverse player in the fashion space would have access to a number of brands at its disposal.

At present, the firm controls a portfolio that includes over 30 licensed and proprietary brands. The five big ones that the company has that management claims offer global appeal, are DKNY, Donna Karan, Calvin Klein, Tommy Hilfiger, and Karl Lagerfeld Paris. The first of these two listed are brands the company owns. Other owned brands include Vilebrequin, G.H. Bass, Andrew Marc, and Wilsons Leather, to name a few.

When it comes to selling its products, the company does work with major retailers such as Macy’s (M), Dillard’s (DDS), Hudson’s Bay Company, Kohl’s (KSS), and others. On top of this, the company sells its products directly online through its own retail channels, as well as through various partner sites and on major online platforms such as Amazon (AMZN) and Fanatics. Geographically, the company is largely focused around the US market. Overall sales here at home make up 85.5% of the company’s overall revenue.

In terms of how the company is structured, the business is organized around two different segments. The first of these is the Wholesale Operations segment, which is responsible for the sale of products to its retail and other major partners. During the company’s 2021 fiscal year, this particular segment was responsible for 95.8% of the firm’s overall revenue and for over 100% of its profits.

The other segment, called the Retail Operations segment, involves the direct-to-consumer operations of the company. It also includes certain retail operations like the stores the company actually owns. However, this segment is rather small by comparison, accounting for just 4.2% of revenue. And, in 2021, it generated an operating loss of $24.8 million.

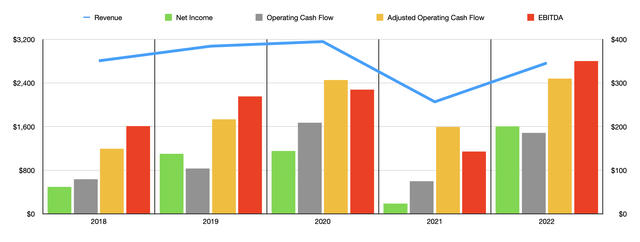

For the most part, financial performance achieved by G-III Apparel has been impressive in recent years. Revenue expanded from $2.81 billion in 2017 to $3.16 billion in 2020. During its 2021 fiscal year, as a result of the pandemic, revenue plummeted, coming in at just $2.06 billion. Then, in 2022, its sales increased, climbing up to $2.77 billion. Management expects this growth to continue, with sales for the 2023 fiscal year forecasted at around $3 billion. Clearly, this marks a significant but still partial recovery following the tough years caused by the pandemic.

Just as revenue has generally improved, the same can be said of profitability. Net income increased from $62.1 million in 2018 to $143.8 million in 2020. During its 2021 fiscal year, the plunge in revenue still allowed the company to generate net income of $23.5 million. Then, in its 2022 fiscal year, profits surged to $200.6 million. Of course, we should also pay attention to other profitability metrics. Operating cash flow, for instance, has followed a similar trajectory, rising from $79.7 million in 2018 to $209 million in 2020. In 2021, operating cash flow plunged to $74.8 million before rebounding to $185.8 million during the company’s 2022 fiscal year. Even if we adjust for changes in working capital, the overall trajectory for operating cash flow is unchanged. But the overall recording for cash flow would be higher, coming in during the 2022 fiscal year at $310.3 million. Also along this trajectory was EBITDA, ultimately rising from $201.3 million in 2018 to $350.2 million in 2022, but not before having dipped to $142.6 million one year earlier.

When it comes to the 2023 fiscal year, which is the current fiscal year for the company, management has provided some guidance. At present, keeping in mind continued supply chain issues, the firm anticipates net income of between $205 million and $215 million. Guidance was not provided for other profitability metrics. But if we assume that the midpoint for earnings will imply a similar outcome for the other profitability metrics, then adjusted operating cash flow should be $324.8 million for the year, while EBITDA should be $366.6 million.

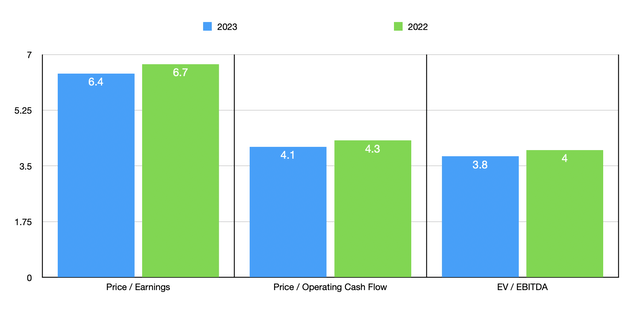

Taking these figures, we can now begin to price the company. Using the 2022 results reported by management, we find that the firm is trading at a price to earnings multiple of 6.7. If the 2023 forecast comes out accurate, this would drop only modestly to 6.4. Meanwhile, the price to adjusted operating cash flow multiple should come in at 4.3, ultimately dipping to 4.1 if we rely on 2023 figures. And finally, the EV to EBITDA multiple should come in at 4, with the 2023 forecast indicating a reading of 3.8.

To put in perspective how shares are priced today, I decided to compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 9.4 to a high of 16.8. On a price to operating cash flow basis, the range was from 7 to 14.6. And using the EV to EBITDA approach, the range was from 4.7 to 10.5. In all three scenarios, G-III Apparel was the cheapest of the group. Sometimes, when shares are much cheaper than similar firms despite the company reporting generally growing revenue and profits, one of the problems that investors should look at is leverage. Having said that, net debt on hand is only $53.6 million. So, in essence, leverage is inconsequential at this time.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| G-III Apparel Group | 6.7 | 4.3 | 4.0 |

| Movado Group (MOV) | 10.0 | 7.0 | 4.7 |

| Ralph Lauren (RL) | 16.8 | 9.6 | 6.9 |

| Delta Apparel (DLA) | 9.4 | 14.6 | 6.6 |

| Capri Holdings (CPRI) | 14.1 | 9.9 | 10.5 |

| Tapestry (TPR) | 12.2 | 8.2 | 7.6 |

Takeaway

Based on all the data provided, I believe that G-III Apparel is a solid prospect for investors interested in the fashion market. Though I generally eschew this space, shares do look incredibly cheap and overall risk appears low. To clarify, shares don’t look cheap just on a relative basis, they also look cheap on an absolute basis. So long as management can continue to grow the enterprise, I think investors will fare well in the years to come.

Be the first to comment