Drew Angerer/Getty Images News

In the last month, Beijing started to give signs to markets that it has the Chinese economy under a control. In addition to announcing another massive stimulus package to spur economic growth, the Chinese regulator has also reached an audit deal with its American counterpart in order to avoid the delisting of Chinese shares from the American exchanges, while at the same time CCP’s Premier Li Keqiang said that the state would keep favorable EV policies. All of those developments will undoubtedly help NIO (NYSE:NIO), which has been negatively affected by a series of lockdowns that were imposed in various Chinese cities earlier this year, to recover and expand its market share within the Chinese EV market. At the same time, while there are still major issues that weaken the bullish thesis, there’s an indication that investors nevertheless could be optimistic about the business’s long-term prospects.

Reasons To Be Optimistic

In late August, Beijing announced a $146 billion stimulus package to revive the economy after the Covid-19 lockdowns that occurred earlier this year hurt the private sector. In addition, the country’s central bank has been trimming interest rates in recent months, while the overall economy showed signs of improvement after the industrial output and retail sales increased in August.

On top of that, while the Chinese economy gradually improves, it appears that the EV sector has managed to weather the latest slowdown with relative ease, since in August a record 632,000 electric vehicles were sold in China, up ~12% Q/Q. This is mostly because Beijing for years has been supporting its automakers, and especially those who are developing electric vehicles, by providing subsidies and all the necessary support in order to make China a world manufacturing power in different heavy industries in the following years. In addition, Chinese high-ranking officials recently pledged to continue to support the electric vehicle manufacturers, which is a positive development for NIO.

At the same time, in late August, the regulators from the U.S. and China reached an audit deal, which allows the American side to fully inspect the books of Chinese-based firms that trade on American exchanges after years of preventing them from doing so. The SEC has already given the green light for PCAOB inspectors to go overseas and conduct an audit, and if it’s successful, then it will prevent a delisting of stock of companies such as NIO from the U.S. exchanges. Let’s not forget that NIO has been constantly added to the list of companies that are located in countries where authorities deny inspections and the results of the ongoing inspection could help NIO to finally comply with the HFCAA and prevent it from being added to that list ever again. Recently it was reported that the Chinese regulators joined the PCAOB inspectors in Hong Kong and the full inspection could take a couple of months until all the Chinese-based companies that trade on American exchanges are inspected. Nevertheless, this should be considered as another positive development that will benefit NIO in the long run.

In addition to all of this, NIO also managed to show a decent performance in Q2 when major lockdowns were imposed in various Chinese cities. Its Q2 earnings report, which was released earlier this month, shows that during the period the company managed to increase its revenues by 21.9% Y/Y to $1.54 billion, while its deliveries increased by 14.4% Y/Y to 20,059 vehicles. What’s also important to mention is that NIO also had a decent performance in July and August when its deliveries increased by 26.7% Y/Y to 10,052 vehicles and by 81.6% Y/Y to 10,677 vehicles, respectively. Its August deliveries were even higher than that of its closest competitors XPeng (XPEV) and Li Auto (LI), and thanks to the successful performance during the last summer months NIO has all the chances to reach its Q3 goal of delivering between 31,000 and 33,000 vehicles during a quarter. As a result, there’s a high possibility that its Q3 earnings results won’t disappoint shareholders as well.

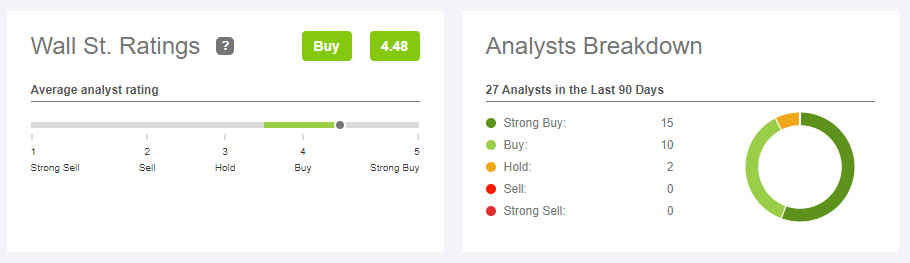

However, despite all of those positive developments, NIO continues to trade below the street consensus and could be considered undervalued at the current price. Overall, the street is optimistic about the company’s future, as the absolute majority of firms that rate the stock give it either a ‘Buy’ or a ‘Strong Buy’ rating, while its average consensus price target of $30.33 per share represents an upside of over 70% per share. Some analysts also believe that NIO’s upcoming ET5 EV sedan will be able to get on average 9000-10,000 monthly orders under normal conditions, which accounts for almost all of the company’s current monthly deliveries of all models. Therefore, NIO has an opportunity to continue to create additional shareholder value in the long run and is currently on track to reach profitability in FY24. In addition, if the Chinese economy continues to grow, and the audit issues are resolved by the end of the year, there’s a possibility that NIO’s stock will be able to appreciate due to the favorable environment.

NIO’s Street Ratings (Seeking Alpha)

Several Issues Weaken The Bullish Thesis

Despite all of those positive developments, there’s still a risk that the PCAOB inspectors won’t be able to get full access to the books of Chinese firms, which will result in their inability to do their job, and a subsequent inability for those companies to comply with HFCAA. In such a scenario, the chances of delisting of firms such as NIO will significantly increase and will continue to pressure the stock. Let’s not forget that back in 2013, the U.S. and Chinese regulators already made a deal under which the U.S. side will be able to inspect the Chinese-based firms by signing the Memorandum of Understanding. However, that deal didn’t lead to anything as Chinese authorities were still denying full inspections, which forced the U.S. to act and enforce the HFCAA. Considering this experience, it’s still too soon to say whether the current inspections will be successful in the end.

On top of that, while the Chinese economy grows, the growth rate itself is slower than a lot of people expected. At the beginning of this year, Chinese officials decided to target a 5.5% GDP growth rate in 2022, which was already the lowest in decades. However, after the relatively weak performance of the economy in the first half of the year, that target was dropped. Even though the EV industry was relatively resilient to lockdowns, which were the main reason behind the weaker-than-expected growth, there’s no guarantee that that’s going to be the case in the future. We know for a fact that China will continue to stick with a zero-Covid strategy, and therefore, there’s always a risk that NIO’s manufacturing capabilities as a result of this will be negatively affected, which could prevent the business from reaching its quarterly targets. There are already reports that Shenzhen could become the next city to face movement restrictions, and this could negatively affect NIO’s stocks going forward.

On top of all of this, I continue to believe that NIO doesn’t have much chance of competing with local automakers in Europe, where it recently expanded. The company has no manufacturing capabilities on the old continent, and as a result, it will be exposed to volatile freight prices that are likely going to dictate the final price of its vehicles in the region. The same is true for the U.S. market, which NIO supposedly plans to enter in the future. Considering that the Sino-Chinese relations are at historically low levels, there’s always a risk that the company will be caught in the middle of a potential trade war in the future, which could diminish its opportunities in the region. However, the good news is that China alone is a relatively big market for electric vehicles and as it’s forecasted to grow at a double-digit rate in the future, NIO has enough room for growth there.

The Bottom Line

Since the beginning of the year, NIO continued to establish a stronger presence in China. It has managed to go through the lockdowns with relative ease and thanks to its successful performance in July and August it has all the chances to report strong results for Q3. At the same time, as Beijing pledges to continue to support its automakers, the street believes that the company trades at a significant discount and its stock has all the chances to appreciate higher in the future, especially if the ongoing PCAOB inspection is successful.

Be the first to comment