Khanchit Khirisutchalual/iStock via Getty Images

When an individual company delivers such a singular, sector outperformance like that of Whitestone REIT’s (NYSE:WSR) 1st Quarter 2022, we must pause to analyze and acknowledge what has transpired. In this piece, we will examine WSR’s 1Q22 30%+ returns against a bleak backdrop, what might have contributed to them and what might yet come.

The Market Quarter

With surging inflation, soaring interest rates, and a horrible ground war waged by Russia in Ukraine, financial markets buckled under all that pressure during the first quarter. Our sector, REITs, delivered a better than most, but still negative performance.

MSCI

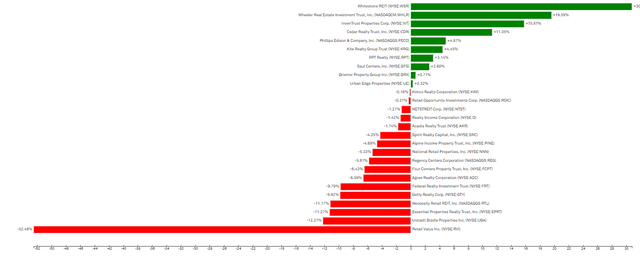

The negative performance was broad, no subsector was spared. WSR’s strong result might be attributed to a retail economy resurgent, coming out of two years of pandemic constraints, but that is not what the retail sector broadly demonstrated.

In this graphic of “Other Retail” REIT stock performance, you can see that results were commonly double-digit negative. Within the green bars, we see Cedar Realty (CDR) and Wheeler Realty (WHLR) as rather dubious products of the still misunderstood merger that Dane Bowler covered here. There is something far outside norms in WSR’s recent stock price performance, something that may be cause for hope.

Boosted Dividend

On February 22, Whitestone announced an 11.9% increase in their monthly dividend, boosting the annualized distribution from $0.43/share to $0.48/share. A huge improvement, but the new dividend still pales compared to the $1.14/share paid from 2010 through 2019. Besides, retail peers ADC, BRX, EPRT, FRT, FCPT, GTY, KIM, KRG, NNN, O, REG, and others raised their payouts during this period. Something else must be responsible for Whitestone’s recent share price ascension.

ESG

Over the last few years, ESG, shorthand for Environmental, Social, and Corporate Governance, has captured a staggering focus of all resources from most public companies. In the realm of real estate, the balance of ESG efforts has tipped significantly to the environmental considerations. Water saving fixtures, electricity saving LED lighting, rooftop solar installations; all positive, all at least a little bit capital intensive.

WSR has yet to make much noise about reducing their carbon footprint. In 2022, Whitestone’s move has been to dramatically improve the profile of their corporate governance. WSR’s move from bad to merely acceptable corporate citizenship has a quantifiable value.

On January 18, Whitestone announced the termination for cause of long-tenured CEO James Mastandrea. On February 11, WSR announced the termination of its onerous shareholder rights “poison pill” plan. On March 30, Whitestone announced improved avenues for shareholders to amend corporate bylaws. These decisions required no capital outlay but delivered profound value to long-suffering shareholders.

So What’s it Worth?

In securities analysis, we have always postured from a fundamental value orientation; we are trying to buy $1 for $0.75. Over the past decade, WSR has been a recurrent candidate for that proposition, but the effort always delivered only modest results.

Everything changed beginning in January with Whitestone’s changes in corporate governance.

If you consider that, on 12/31/21, we contentedly owned WSR at $10.03/share; a huge discount to its then consensus estimated NAV of $16.66.

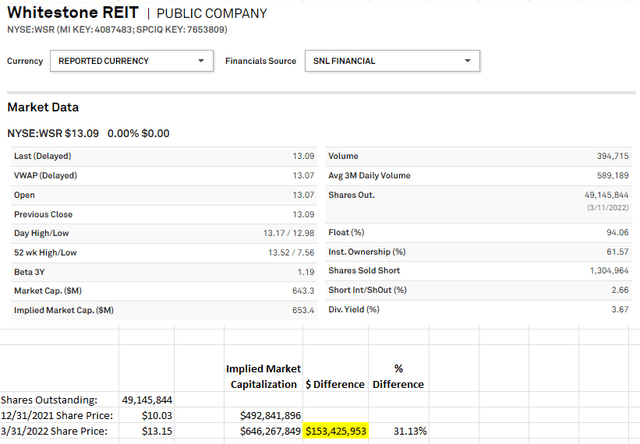

S&P Capital IQ (Author, Compiled from S&P Capital IQ data 03/31/2022)

We can place a dollar value on these decisions. We can’t calculate a Return on Investment (ROI); the denominator is zero so returns trend hyperbolic toward infinity.

The table describes the creation of $150 million of market capitalization that required no capital outlay, but transformed perceptions in the investment public. Whitestone didn’t do anything good, they just stopped being bad.

Forward

For factors undisclosed, WSR now sports a consensus NAV of $17.95/share. At a 04/04/22 closing price of $13.25/share, Whitestone REIT is still a similar value proposition to what we saw last fall. We hold our shares in anticipation of more improvement in corporate conduct and performance.

Bonus: Long shot sinners to be saved

In the broader scope of things, Whitestone has really been just a disappointment, not truly derelict. The many RMR Group (RMR) managed funds have been a perennial value trap. After more than a decade of underperformance, the below-listed REITs underwent name changes before they continued their denial of value to shareholders. Here is a rough calculation of the value they could create if they could straighten up and fly right in the WSR model.

|

Issue |

Ticker |

Price |

Consensus NAV |

Price/NAV |

Market Capitalization |

Improved Governance Premium |

|

Industrial Logistics Property Trust |

ILPT |

$22.47 |

$35.04 |

64.13% |

$1,473,000,000 |

$441,900,000 |

|

Office Properties Income Trust |

OPI |

$25.40 |

$50.48 |

50.32% |

$1,234,000,000 |

$370,200,000 |

|

Diversified Healthcare |

DHC |

$3.11 |

$4.55 |

68.35% |

$755,000,000 |

$226,500,000 |

|

TOTAL: |

$1,038,600,000 |

|||||

SOURCE: 2MCAC

We don’t own these shares and likely won’t but always hope the world will be a better place.

Be the first to comment