Sky_Blue

Introduction

I don’t get worried easily, but as a European, I have to say that the energy crisis worries me – a lot. Energy and related prices have absolutely skyrocketed, risking a wave of mass bankruptcies, the destruction of the middle class, and even higher geopolitical tensions. On top of that, we’re dealing with rapidly rising energy demand in Asia and other countries as well. Especially natural gas is in high demand as it is the cornerstone of the transition toward renewable technologies. In this article, I will cover the situation in great detail and explain why EQT Corp. (NYSE:EQT) is a fantastic way to play what will be a (very) long-term bull case for natural gas-related equities.

So, let’s dive into what will be a mix of geopolitics, macro, and EQT fundamentals.

Energy Supply In General

But first, as most of my readers will know by now, energy markets, in general, are suffering from severe supply issues – completely unrelated to the situation in Europe. I recently wrote an article titled “Exxon Mobil: The Most Serious Bull Case Ever”, which explains these issues in great detail. If you can spare a few minutes, it will be worth your time as that info goes well with the information discussed in this article.

That said, I will discuss the most important points in this article as well.

Europe Is In Trouble

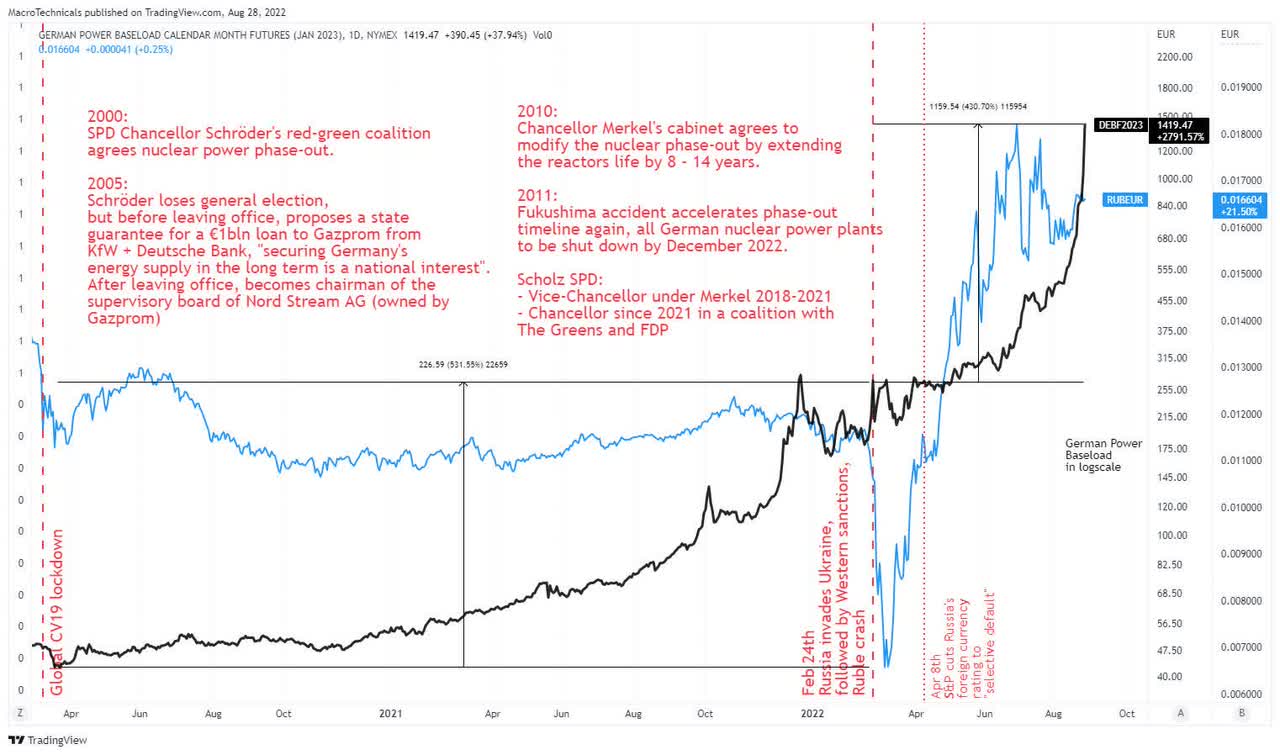

Let’s start this article with a chart that perfectly shows the problems facing Europe. What you’re looking at below is the chart of German Power Base load futures. Electricity prices have gone up 2,800% (not a typo) since the first lockdowns of 2020.

TradingView

The chart above includes a number of comments from my friend and financial markets expert Kai (from Twitter) showing the deep roots of the European energy crisis – or at least a big part of it.

Essentially, what we’re dealing with here is a problem that started more than 20 years ago when the German government made the decision to phase-out nuclear energy. Back then, Chancellor Gerhard “Gerd” Schröder also worked on a major energy deal with Russia, which made Germany more dependent on Russian gas and resulted in him getting a supervisory board seat on Gazprom-owned Nord Stream – as well as oil giant Rosneft.

Then, his successor Angela Merkel extended the nuclear phase-out by 8-14 years in 2010. That was an incredibly smart move.

Unfortunately, it was revised one year later when the Fukushima accident caused the already anti-nuclear movement in Germany to gain momentum.

This left Germany once again highly dependent on natural gas, which was now mainly provided by Russia through multiple pipelines including Nord Stream 1, which was pushed by Gerd Schröder and many other politicians – including former East-German Stasi officer Matthias Warnig, who became Nord Stream CEO.

As the chart below shows, more than 50% of German natural gas imports came from Russia.

Wells Fargo

Then the war in Ukraine happened…

In late 2021, Russia started to pressure Ukraine. It moved heavy equipment and troops to the Ukrainian border as it was preparing for what would become an invasion in early 2022.

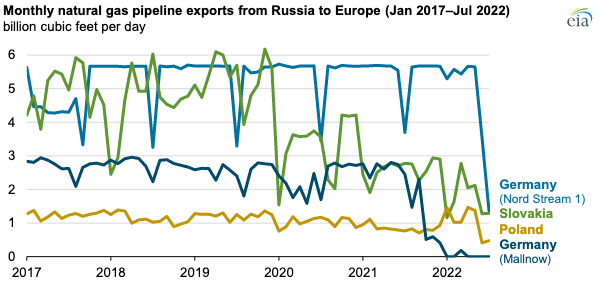

Almost needless to say, Russia used its leverage over Europe. Even in late 2021, gas flows started to fall in various pipelines, causing natural gas prices to start rising. Then in July, even the massive Nord Stream 1 pipeline saw volumes drop to just 20% of total capacity. Russia cited maintenance and the unavailability of turbines.

EIA

While I am writing this, Nord Stream 1 flows are dropping to zero due to maintenance. This is expected to last three days. After that, it remains to be seen if natural gas flows rebound to 20% again – or remain lower for longer.

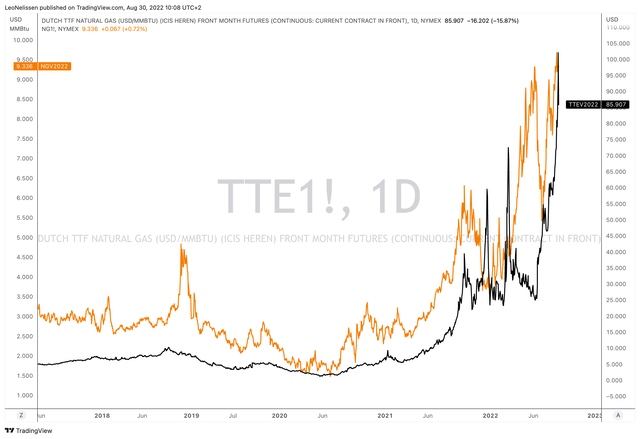

As a result of imploding gas flows, European gas futures as displayed by TTE futures in the chart below are trading at roughly $85 per MMBtu. That’s more than 9x more than US-based Henry Hub natural gas futures as displayed by the orange line below. Please note that I’m using two different y-axes as I wanted to highlight that both futures have been in a mind-blowing uptrend.

TradingView (Black = TTE, Orange = Henry Hub)

Moreover, note that even if German gas storage is filled ahead of winter (it looks like that can be achieved), gas won’t last for two winter months. Why? Because the flow of gas is more important than storage. Even under normal conditions, storage tends to fall to 20% during winter months.

In other words, Germany and all of Europe need high gas flows.

Because of skyrocketing gas prices, Europe’s prosperity is at risk. People everywhere are starting to struggle to pay for gas and electricity as providers start to hike prices. Moreover, governments are now bailing out companies in the industry, which requires funding.

German chemical giant BASF, for example, uses almost a quarter of German natural gas demand, or as much energy as all of Denmark. If BASF were to shut down its operations in i.e., Ludwigshafen, it would have a ripple effect in every single supply chain imaginable.

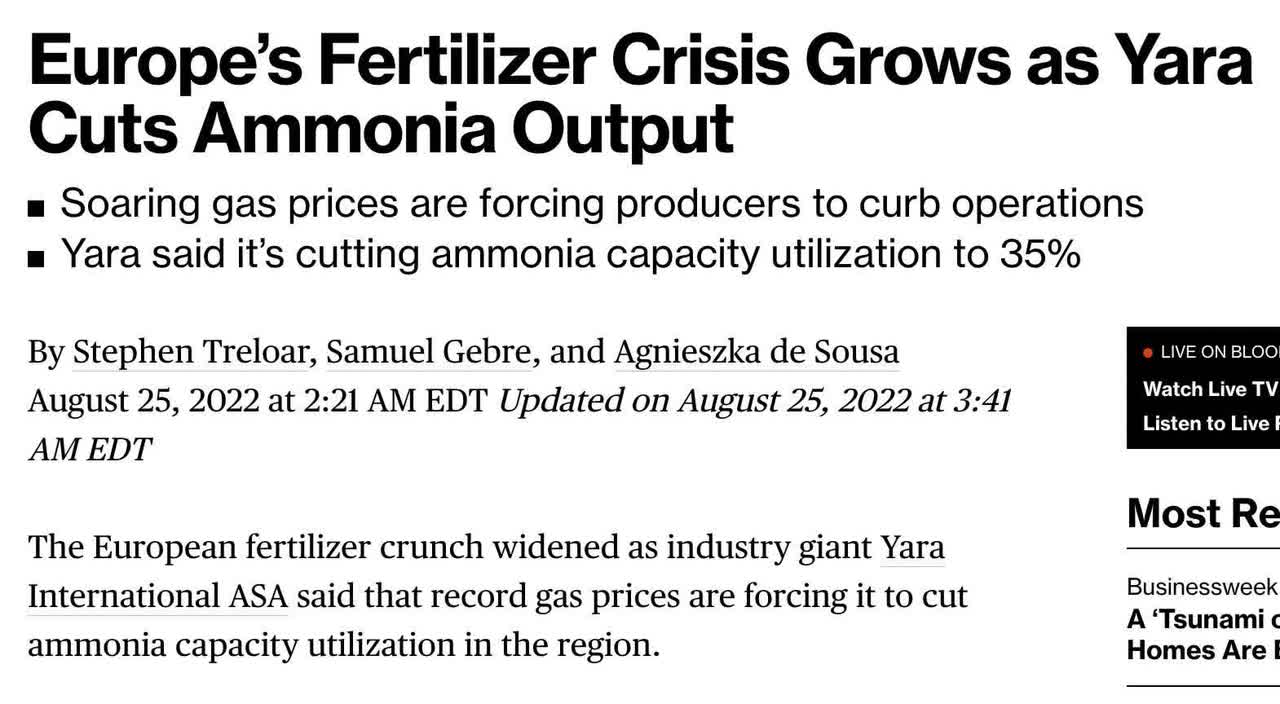

I would make the case that we’re already in a situation where production cuts will impact inflation in 2023 as well. For example, last week, three major European fertilizer producers cut production. One of them is Yara, one of the world’s largest producers.

Bloomberg

To make things worse, it is accelerating deindustrialization. This is what the Lanxess CEO said in Handelsblatt last week:

If German energy prices remain at current levels, we will see a wave of plants in key German industries closing,” he says. “And what is now being lost to more competitive regions like the U.S. will not come back.”

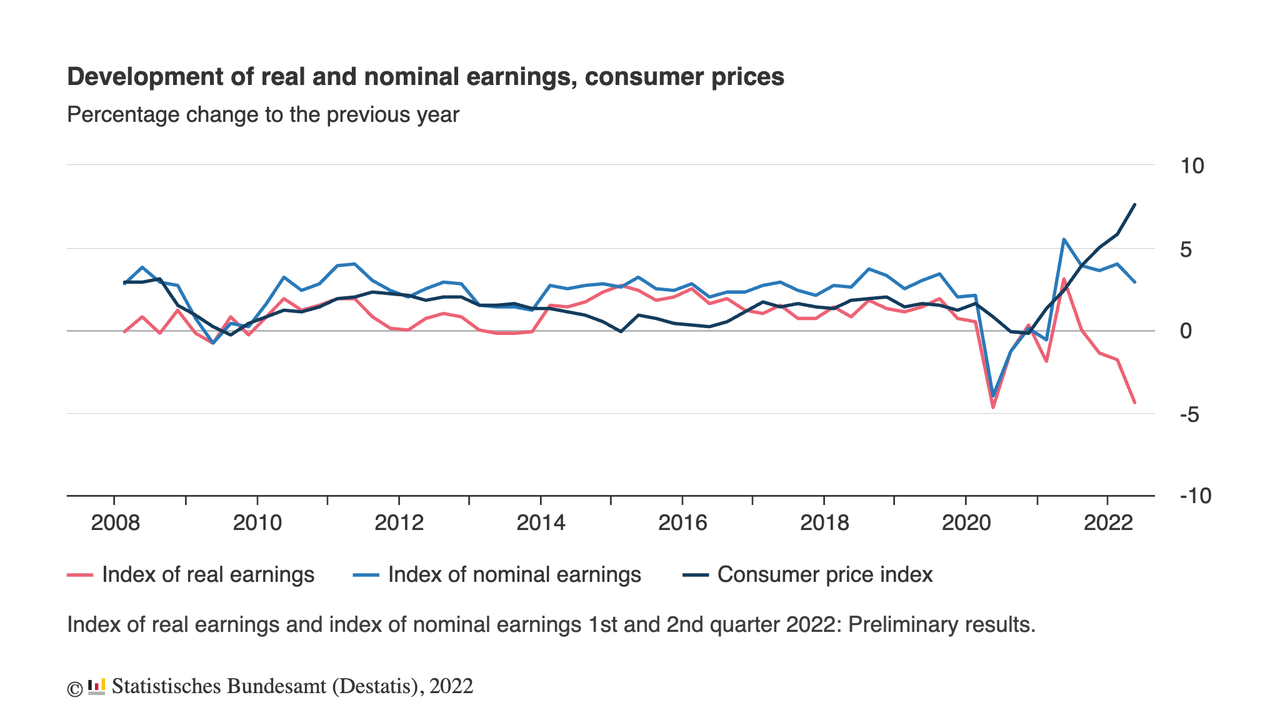

Moreover, because prices are rising, consumers are losing hope as German real earnings are now headed for a 5-6% decline given that inflation won’t likely peak below 10%.

Destatis

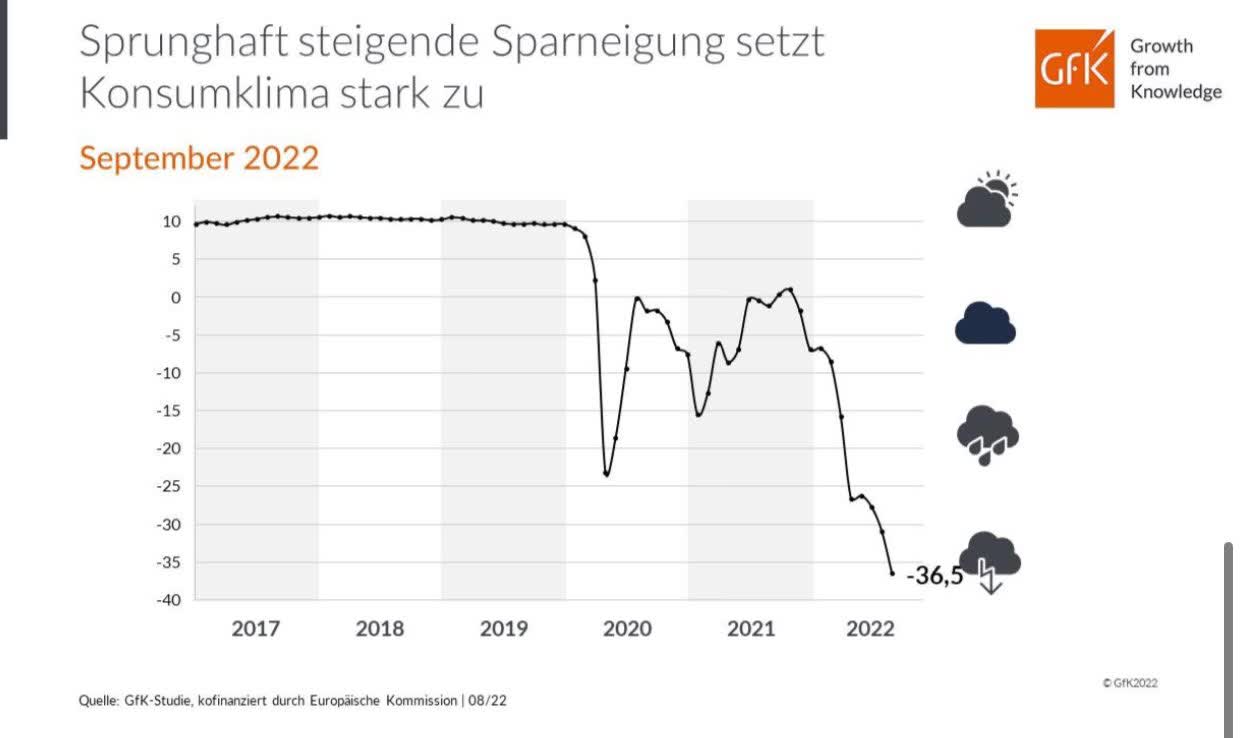

To visualize consumer confidence, we can use GfK numbers for the month of September, which show that German consumer confidence is now well below its 2020 pandemic lows.

GfK

Hence, a (steep) recession is now the base case in Europe.

Wells Fargo

As if this isn’t enough, it doesn’t look like the upcoming winter will be the last winter with challenges – not that anyone with industry knowledge expected that, but still.

Yesterday, the Shell CEO came out making the case for prolonged gas issues.

Seeking Alpha

As reported by Seeking Alpha:

It is a “fantasy” to think that shortages caused by Russia’s gas supply cuts can be resolved quickly, van Beurden told an energy conference in Norway. “We should confront the reality” that Europe may suffer “a number of winters where we have to somehow find solutions through efficiency savings, through rationing, and through a very quick buildout of alternatives” such as gas imports and alternative energy sources.

US LNG To The Rescue

I could have made the first part of this article even longer. 10x as long if I wanted. However, the key message here is that because of questionable (to put it in the nicest way possible) political actions, Europe was too dependent on Russian natural gas going into the war. Now Russia is using its leverage knowing that Europe cannot find short-term imports that offset Russian influence. The result is a recession as a base case and the desperate need to diversify natural gas sources.

That’s where the US comes in – and EQT Corp.

According to Wells Fargo:

A decade ago, there was very little the United States could have done to counteract the impact of Russia cutting off the gas supply to Europe. Thanks to innovation and investment over the intervening years, U.S. natural gas exports roughly doubled between 2012 and 2017. Increases in U.S. natural gas production over the next five years helped the price competitiveness of U.S. natural gas in international markets. Since 2017, those exports have more than doubled again.

It’s all about LNG. LNG is liquified natural gas, which makes it possible for the US – or any other country with the resources – to export it without the use of pipelines. In order for that to happen, natural gas is produced and liquified in exporting nations. It’s then pumped into ships and turned into a gas at its destination.

US LNG exports are accelerating. After 2025, the US is expected to ship roughly 18 billion cubic feet of LNG per day. Right now, it’s slightly above 12 billion. That’s up from roughly zero in 2016.

Wells Fargo

What we are dealing with there is a long-term development that goes well beyond anything related to Russia. LNG/natural gas is cleaner than oil and coal and a perfect way to reduce pollution while maintaining high energy input.

As I wrote in a prior article:

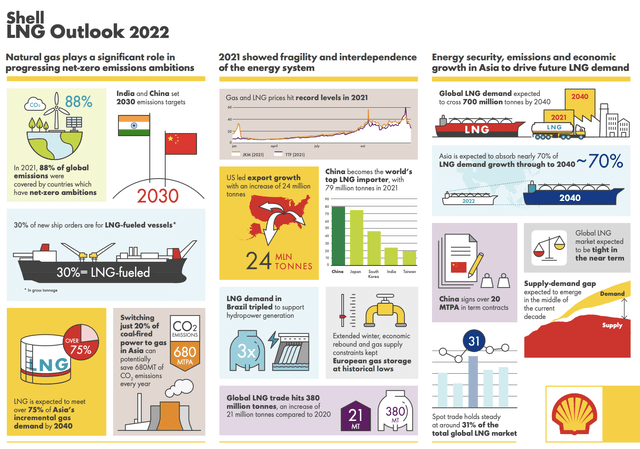

With regard to demand, we’re seeing high growth. Asian demand, for example, is expected to account for 70% of global LNG demand by 2040. In 2021, China was the world’s top importer, accounting for almost 80 million tonnes of LNG. In 2040, global LNG demand is set to exceed 700 million tonnes. In Brazil, demand tripled due to higher hydrogen production. Total LNG trade was 380 million tonnes in 2021. An increase of 21 million tonnes over 2020.

Shell

As the Shell overview above shows (without giving numbers), LNG demand is expected to rapidly outgrow supply, which makes sense as building supply takes time. Deciding to focus on natural gas does not take a lot of time.

Europe will likely get its desired LNG supply by 2030 as it needs to ramp up spending on new facilities. According to Rigzone:

“On the longer term, industry group Gas Infrastructure Europe (GIE) estimates LNG terminals in the EU could provide a gateway for more than 285 billion cubic meters of imports by 2030, enough to meet estimated import demand at that time, compared to Europe’s current import capacity of around 220 Bcm per year,” Illardo continued.

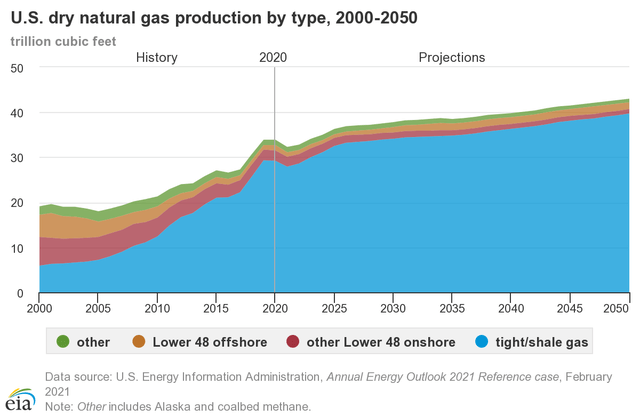

With all of this in mind, the surge in natural gas/LNG demand comes at a time when gas production in the US is slowing tremendously.

EIA

Accelerating demand growth and slowing supply growth mean one thing: better times ahead for high-quality producers.

More Upside For EQT

With a market cap of $18.5 billion and more than 1,800 core net drilling locations, Pittsburgh, PA, located EQT is the nation’s largest natural gas driller.

The company is so large that it would be the 12th-largest producer in the world if it were a country. EQT produces 6% of total US natural gas production through its Appalachian assets, resulting in 4.0 billion cubic feet per day.

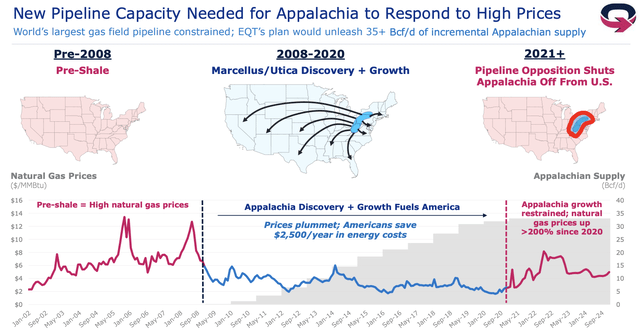

What’s interesting is that the company sees a new “era” for natural gas – at least under current conditions. The chart below shows three different periods of natural gas prices. Pre-2008, natural gas prices were higher as companies hadn’t accelerated shale production. That changed after the Great Financial Recession. It was backed by a rapid expansion of infrastructure, allowing the gas supply to explode. The result was cheap gas for more than a decade. It’s one of the reasons why inflation was subdued during these years as natural gas is one of the most important commodities in the world.

After 2020, growth was restrained, demand accelerated, and prices jumped.

EQT Corp.

The good news is that among all politicians, 69% support higher natural gas production. The same goes for 70% of voters. Over the past few years, at least six major pipeline projects were either canceled or opposed. If these pipelines come online, supply could rise by 7.0 billion cubic feet per day.

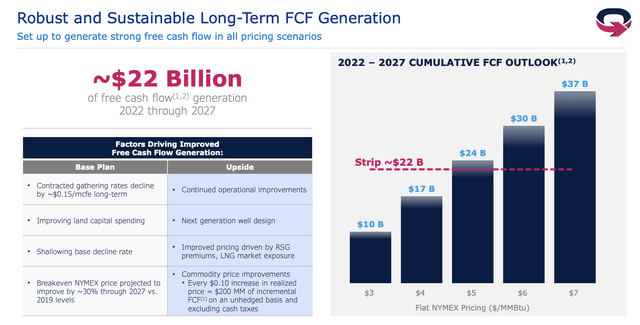

With all of this in mind, EQT is becoming a cash cow. The company is breakeven at a gas price of just $2.30. Moreover, just half of its 2023 gas volumes are hedged providing the company with high cash flow in multiple scenarios. According to management:

[…] if NYMEX retraced to approximately $3 per MMBtu in 2023, we would still expect to generate approximately $1.6 billion of free cash flow next year or a 10% free cash flow yield. Conversely, if natural gas averaged $7 per MMBtu level, we would expect to generate almost $6 billion of free cash flow in 2023 or nearly a 40% free cash flow yield.

Hence, even if NYMEX prices remain at $7 on a long-term basis, the company can do $37 billion in cumulative free cash flow between 2022 and 2027, that’s more than twice its current market cap.

EQT Corp.

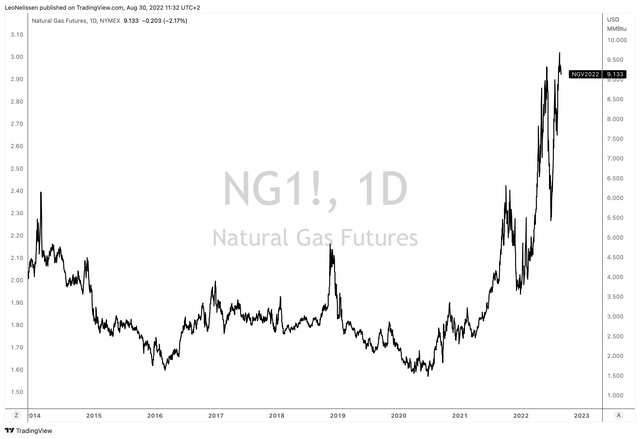

As a reference, this is where NYMEX Henry Hub is trading right now:

TradingView (Henry Hub)

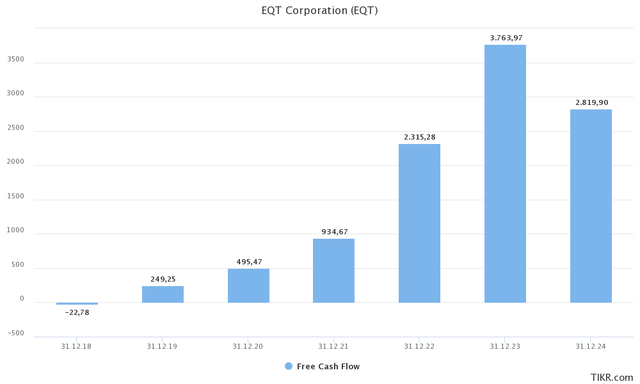

The chart below shows what analysts believe EQT can generate in annual free cash flow. This year, FCF is expected to be $2.3 billion, or 12.4% of the company’s market cap. Next year, that number is expected to be $3.8 billion (20.5%). Even if FCF is expected to come down after 2023, it’s not expected to come down meaningfully anytime soon.

TIKR.com

Moreover, the company has roughly $5.0 billion in gross debt. Net debt is almost equal to that, as cash is very close to zero. This year, the company repaid $570 million in debt. Now, EQT faces no new maturities until at least 2025 when $1.0 billion in maturities are due (yielding 6.2%). I have little doubt that the company will refinance at much better rates and with a much smaller volume due to higher FCF.

The net leverage ratio is just 1.6x, with BBB- credit ratings from both S&P and Fitch (outlook stable).

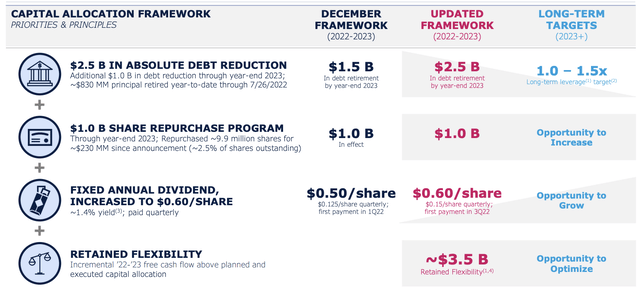

What this means is that the company’s leverage ratio is just a bit above its long-term target of 1.0 to 1.5x EBITDA, which will allow the company to boost buybacks and dividends. For now, the company pays a 1.4% yield, yet that number is expected to grow considerably as EQT will more than likely maintain a double-digit FCF yield on a (very) long-term basis.

EQT Corp.

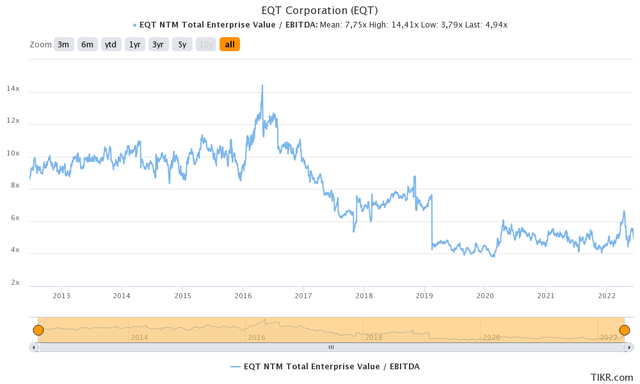

Related, it also helps that EQT is very attractively valued.

Valuation & Outperformance

EQT has an implied enterprise value of $20.8 billion based on its $18.5 billion market cap and $2.3 billion in expected 2023 net debt. I’m using that number as free cash flow not spent on dividends and buybacks is almost certainly going to reduce net debt to that number – if not further. On a side note, this would imply a net debt ratio of less than 0.5x EBITDA, which means EQT can open up the floodgates when it comes to shareholder distributions starting in 2023.

Moreover, using longer-term EBITDA estimates of $5.0 billion (2023 EBITDA will likely be 25% higher than that), gives us an EV/EBTIDA multiple of 4.2x, which is way too cheap.

As I wrote in my last article:

Based on these numbers, I would give the company a fair value of $60-$65 per share. The problem is getting there. I do not recommend trading this stock. Long-term investments make more sense given that we’re dealing with a long-term bull case that will further develop in the years (and decades) ahead.

TIKR.com

Bear in mind that this isn’t my long-term target. I expect EQT to return more than 15% (15-20% range) per year in the years ahead, including dividends.

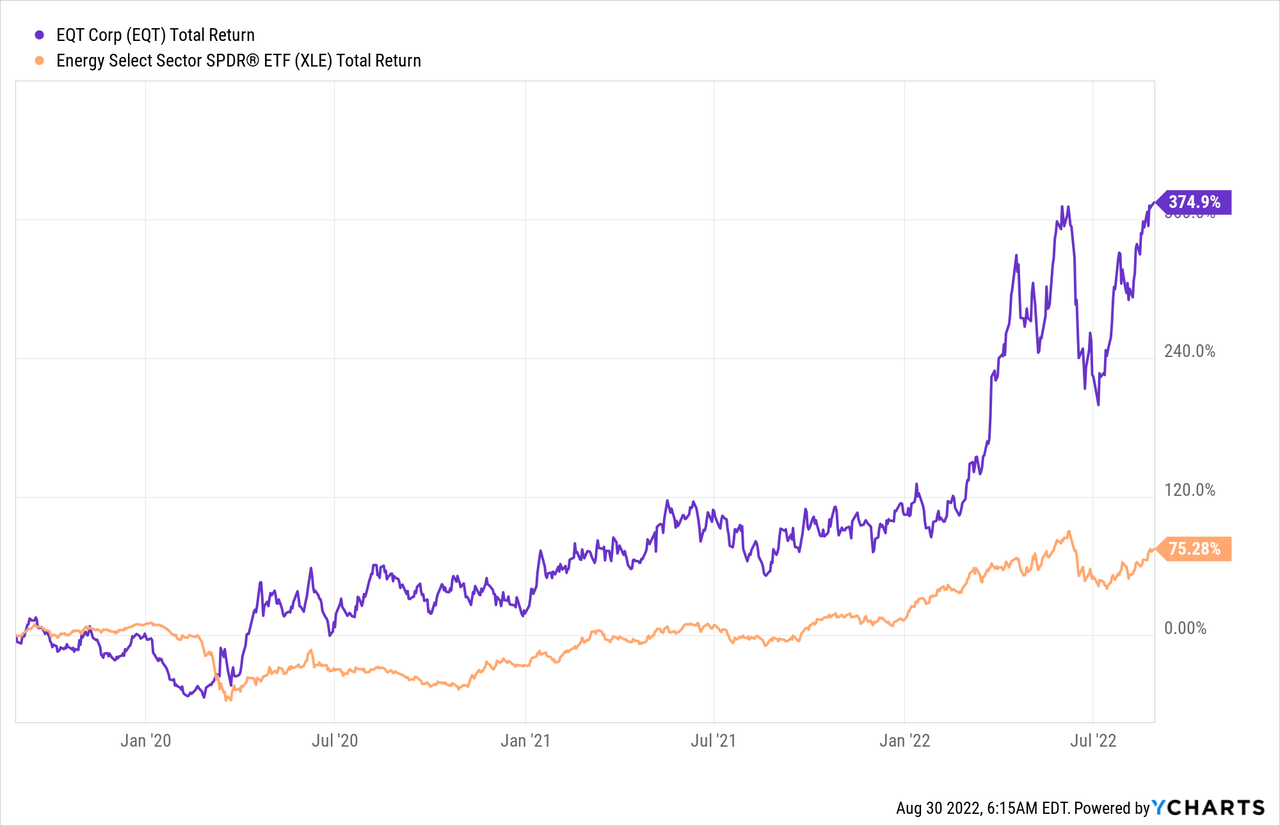

Moreover, since the end of 2019 ( three years ago), EQT has finally started to outperform its peers. Natural gas isn’t trading closely above costs anymore, and investors have started to acknowledge the potential of what was a boring, money-losing, investment for a lot of investors prior to 2021.

Takeaway

It’s one of these articles, that I could have made at least 10x longer as we’re discussing one of the most important and complex topics driving markets. In fact, I have little doubt that people will write scientific papers on these developments for many years to come.

Europe is facing the worst recession since the second world war. The continent is highly dependent on natural gas imports due to past “mistakes” that have given Russia the leverage it needs in its war against Ukraine.

If Russia reduces gas flows even further, we need to expect severe supply chain problems in the months ahead, which means that I wouldn’t rule out emergency talks with Russia or backdoor talks to somehow get Russia to provide the supply needed to get through the winter.

Related, natural gas demand will accelerate regardless of the war. It’s the perfect bridge technology between coal and renewables, and it allows industrial nations to reduce emissions from polluting production processes. It’s also a reliable and cheap (it used to be) source of energy.

The United States is in a terrific position to deliver much-needed LNG supplies on a long-term basis. It has the production capacity and export facilities (also the ones under construction) to satisfy long-term demand.

This benefits EQT, the nation’s largest natural gas producer. The company now benefits from a “new era” of natural gas, which means high demand, strong pricing, and even support from politicians given the importance of natural gas.

EQT is quickly reducing its debt load, accelerating free cash flow, and lowering production costs.

The dividend yield isn’t high, but I have little doubt that shareholder distributions will rapidly accelerate after 2022 as the company has hit its leverage targets.

Given the long-term outlook for natural gas, the dire situation in Europe, and EQT’s own situation, I remain very bullish on this company on a long-term basis.

(Dis)agree? Let me know in the comments!

Be the first to comment