phototechno

(This article was co-produced with Hoya Capital Real Estate)

Introduction

I own PennyMac Mortgage Investment Trust (NYSE:NYSE:PMT) in two of our IRA accounts for the income it generates; for one it helps fund the RMD/QCD. I also own the PennyMac Mortgage Investment trust 6.75% Red PFD C (NYSE:NYSE:PMT.PC) as part of my laddered income strategy and is held in my Health Savings Account. Each asset comes with its own characteristics that affects how an investor, like me, might use them to meet the investment needs/goals they have set.

PennyMac MIT also has two other preferreds available, the PennyMac Mortgage Investment Trust PFD SER A (PMT.PA) and the PennyMac Mortgage Investment Trust CUM RED PFD B (PMT.PB). How they differ from PMT.PC will be covered too.

PennyMac Mortgage Investment Trust review

Seeking Alpha describes this mREIT as:

PennyMac Mortgage Investment Trust, a specialty finance company, primarily invests in mortgage-related assets in the United States. The company’s Credit Sensitive Strategies segment invests in credit risk transfer agreements, CRT securities, distressed loans, real estate, and non-agency subordinated bonds. Its Interest Rate Sensitive Strategies segment engages in investing in mortgage servicing rights, excess servicing spreads, and agency and senior non-agency mortgage-backed securities, as well as related interest rate hedging activities. The company’s Correspondent Production segment is involved in purchasing, pooling, and reselling newly originated prime credit residential loans directly or in the form of MBS. PMT was founded in 2009.

Source: seekingalpha.com PMT

This is how PennyMac describes themselves:

Our investment focus is on mortgage-related assets that we create through our industry-leading correspondent production activities, including mortgage servicing rights (MSRs). In correspondent production, we acquire, pool and securitize or sell newly originated prime credit quality loans. Our interest rate sensitive investments include the MSRs, mortgage-backed securities and related hedge instruments. Our credit sensitive investments primarily consist of credit risk transfer investments related to loans sourced through our correspondent production that were delivered to Fannie Mae.

Source: pennymacmortgageinvestmenttrust.com overview

Four risks that affect mREITs more than other REITs are:

- Interest rate risk: Changes in short- and long-term interest rates can affect net interest margins by increasing the costs of funding and reducing interest income. Interest rate changes can also affect the value of an mREIT’s mortgage assets, impacting its net asset value and share price.

- Prepayment risk: Mortgage borrowers can refinance their loans or sell the underlying real estate, forcing mREITs to reinvest the repaid loan proceeds in the current interest rate market.

- Credit risk: Mortgage REITs focused on commercial mortgages can face credit risks if borrowers default. Mortgage REITs that focus on residential loans backed by government agencies don’t have to worry about this nearly as much.

- Rollover risk: Residential mortgage REITs tend to own long-term mortgages funded by shorter-duration borrowing since short-term interest rates are generally lower than long-term rates. The shape of the interest-rate curve drives this risk.

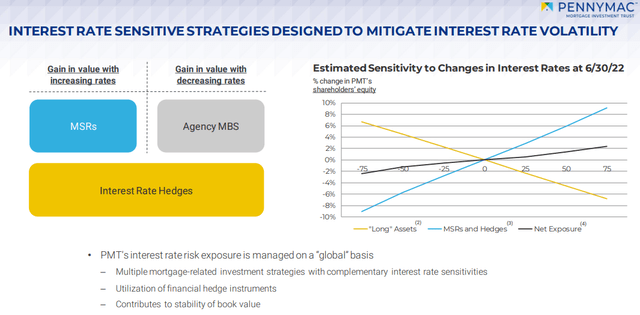

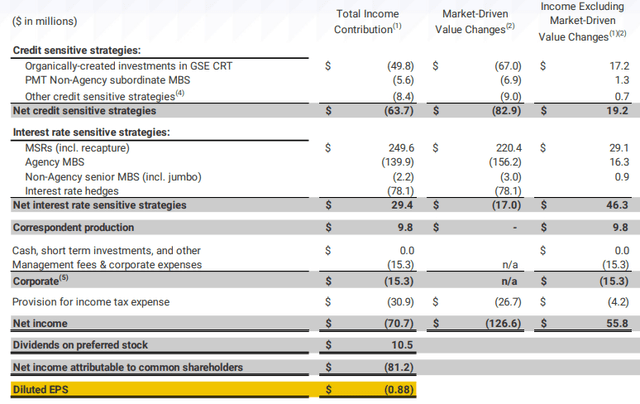

As listed above, PMT, like all mREITs, depends on a healthily “net interest margin”, which is affected by changes in both interest rates themselves and changes in the interest-rate curve. mREITs manage and control their risk associated with their short-term borrowings through hedging strategies. The portfolio of mortgages is likewise affected and PMT provided the following chart in their Q2 report to demonstrate those effects.

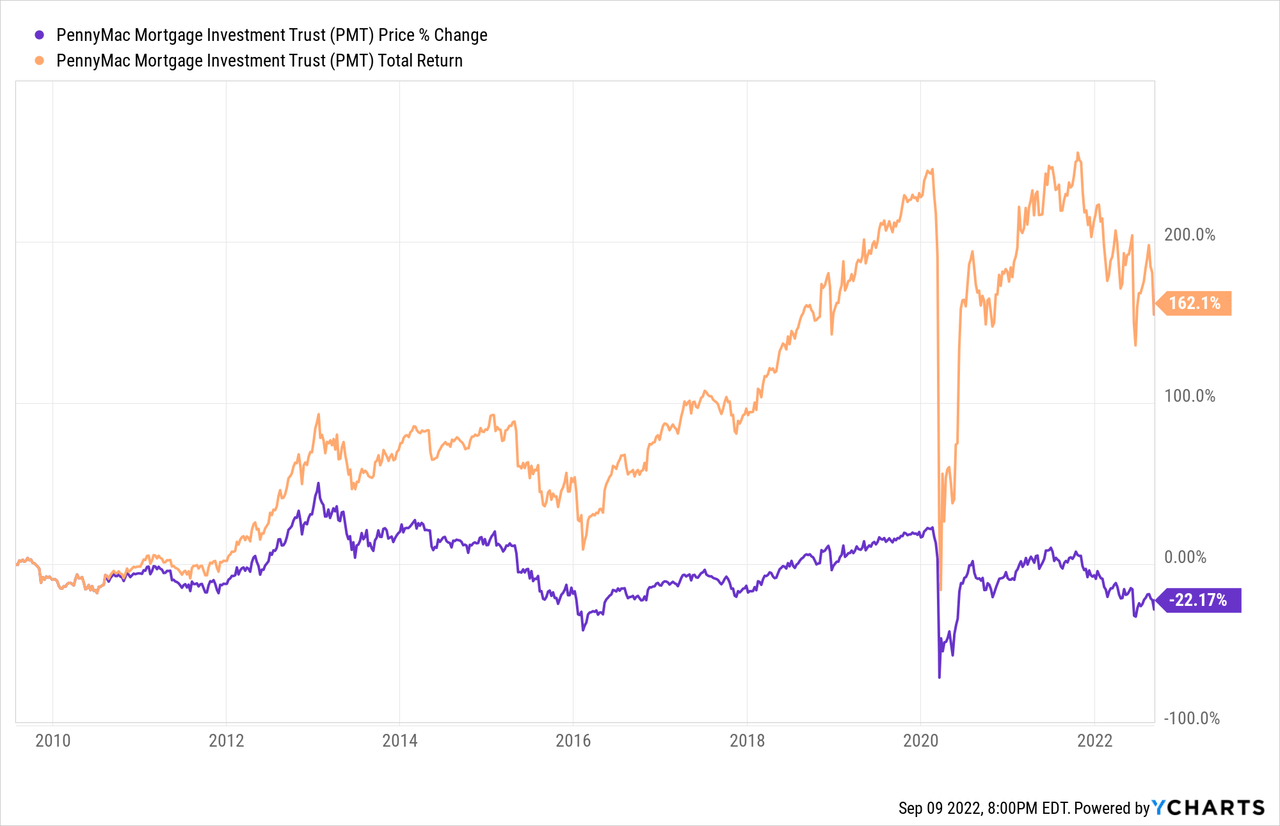

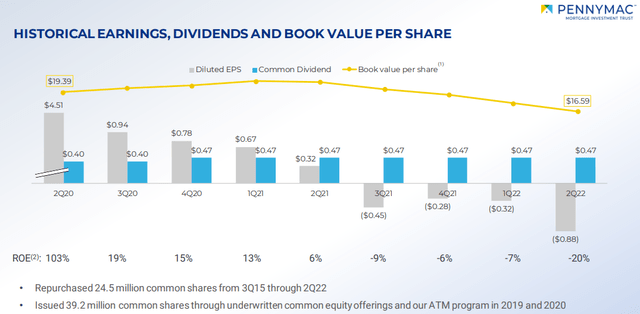

This is how the movement of rates and the interest-rate since COVID hit has affected PMT’s earnings and book value: not a great picture!

At the end of Q2, PMT was under $14/share, giving it a BV/P ratio close to 1.2X.

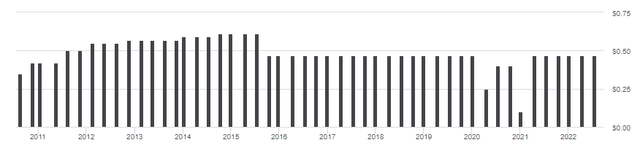

PMT distribution review

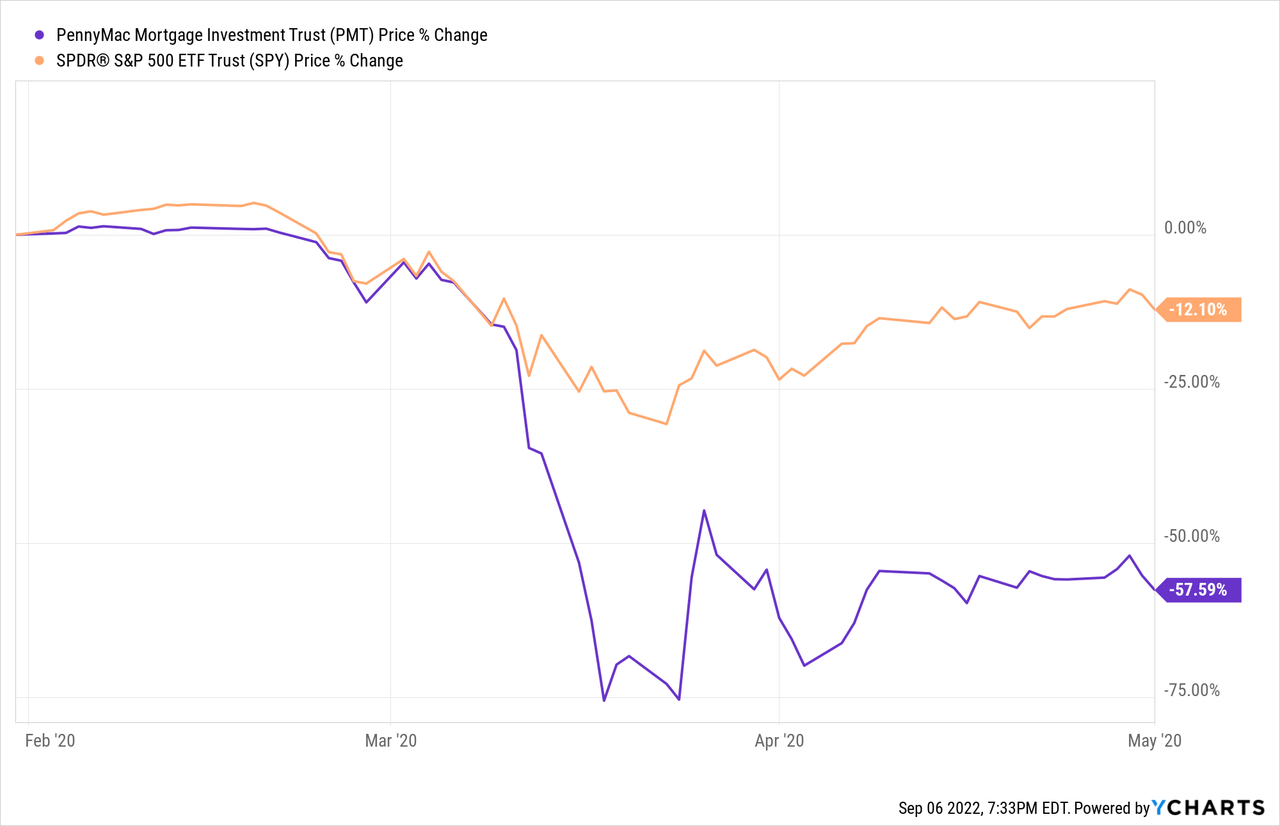

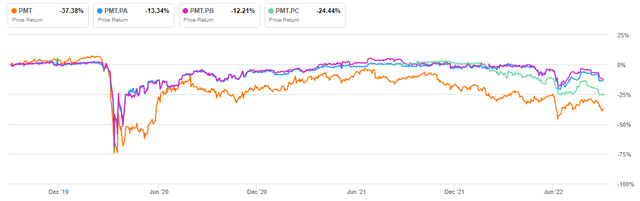

All the 2020 payments were reduced as concerns really rippled through financial instruments, especially the mortgage market. Just looking at the PMT price collapse demonstrates this clearly.

PennyMac Mortgage Investment trust 6.75% Red PFD C review

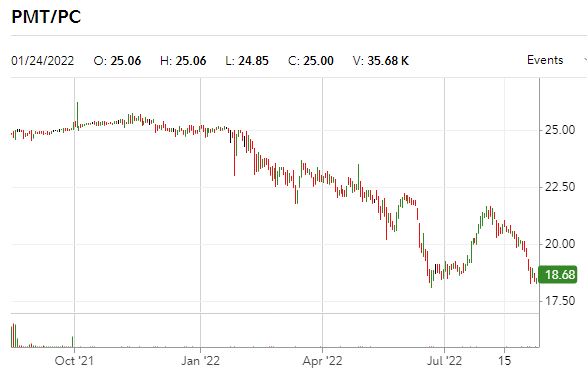

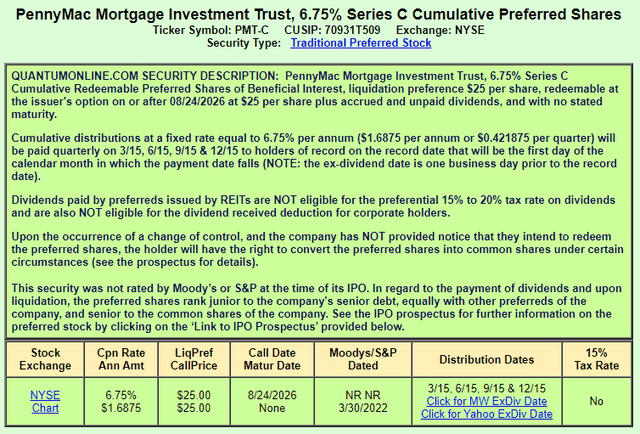

Fidelity PMT-C (QuantumOnline.com)

While callable in four years, the other two issues are callable two years sooner and carry higher interest rates currently. Both of the others are Fixed-to-Float as described next.

| Factor | PMT-A | PMT-B | PMT-C |

| Issued Date | 3/9/2017 | 6/27/2017 | 8/17/21 |

| Issued Amount | $115m | $175m | $250m |

| Call Date | 3/5/2024 | 6/15/2024 | 8/24/2026 |

| Current Coupon | 8.125% | 8.00% | 6.75% |

| Current Price | $23.10 | $23.07 | $18.65 |

| Current Est Yield | 8.8% | 8.7% | 9.0% |

| Estimate YTC | 14.2% | 13.2% | 15.3% |

| Floating Coupon | 5.831%+3mo LIBOR* | 5.99%+3mo LIBOR | N.A. |

* Currently the 3-mo LIBOR rate is just over 3%, a level last seen in early 2019, and is still climbing. The 3-mo LIBOR only needs to be near 1% for “A” or “B” to have a floating rate above “C” fixed rate, though that increases the odds PMT might Call either issue. I would expect PMT to pick a new floating component since LIBOR is going away in 2023.

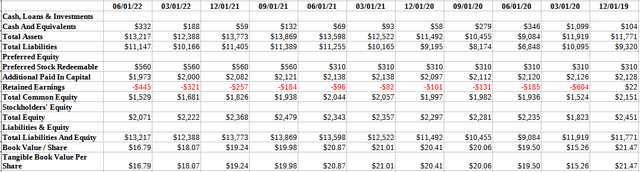

Since PMT.PC does not mature, and assuming it is held for income, not potential capital gains, income generation or cash-on-hand to make the coupon payments is important data. This is where the data gets interesting/confusing, at least to me.

My understanding is the Market-Driven Value data reflects the value change in the portfolio and is not a cash-flow affecting activity.

PMT balance sheet (Seeking Alpha)

Combining the two sets of data we see that PMT needs $10.5m per quarter to cover the Preferred stocks dividends. Currently, PMT hold $332m in cash and can influence its cash-flow via portfolio transactions. Total Equity (less Pfd) is 2.7X the redemption value of the three Preferred stocks.

Comparing choices

Like me, an investor’s goal and time horizon will influence which, or both assets, the PMT stock or Preferred best fits their portfolio.

- Yield: PMT currently has a yield of 12.7% versus only 9% on the PFD. That said, PMT did cut it payments after COVID but it would need to drop payouts to $.33 to match the preferred’s lower yield.

- Payouts: Being a fixed-rate issue, PMT.PC payouts are set. As for PMT, the current $.47 is the best holders have seen in seven years so while increases are possible, financials/book value data does not lean in that direction.

- Payout safety: PMT payouts come after all three preferreds are made. If skipped, then PMT payouts stop. If stopped, the preferred holders have to be made “whole” before they are called or PMT payouts restart.

- Price: All the existing issues fell 65-75% during COVID. The Preferreds recovered faster and show less volatility compared to PMT’s shares. In 2022, PMT.PC is performing worse than the other two issues, most likely related to its fixed, not floating coupon potential.

- Total return: If called, PMT.PC holders would get a ROI of about 15.3%. Assuming no payout changes, PMT holders would need less than $1 in price improvement by August 2026 for the same ROI.

- Bankruptcy: Preferred holder would be in better shape as they are paid off before the PMT holders are. That said, if the Book Value is above the investor’s cost, they should be made “whole” too.

Portfolio strategy

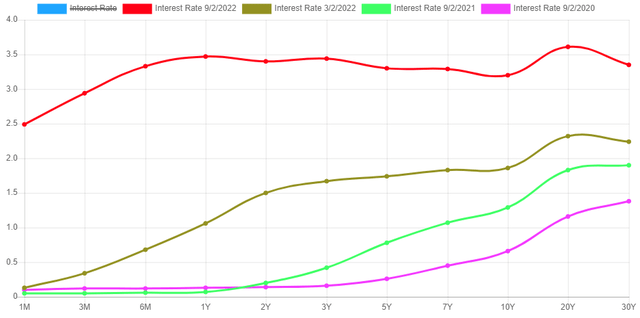

While not an expert on mREITs, I do understand the importance to them of having an upward sloping yield curve since the “borrow short, lend long”. The next chart shows how the UST curve has changed since September 2020.

Not only has it climbed with the FOMC actions in 2022, but since they have more sway over the short-term rates, it has flattened considerably, which squeezes the net-credit-margin mREITs depend on.

Final thoughts

As I was writing this comparison, Trapping Value looked at the PMT.PB preferred as opposed to the Dynex Capital, Inc. 6.9% SER C PFD (DX.PC) and reviewed PMT itself from perspectives besides those covered here. It is worth a read if readers are considering either choice presented here: Dynex Vs. PennyMac Preferred Shares: Is This A Free Lunch? His expertise with mREITs far exceeds mine and I rely on those experts when investing in this arena.

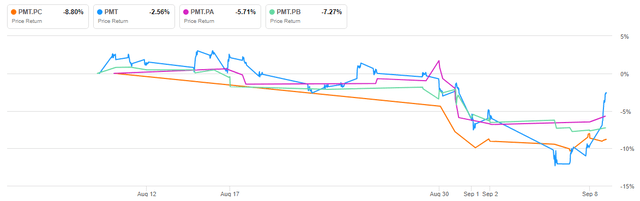

The next chart shows how all four issues have moved over the past month.

While all four were sliding most of this period, PMT was affected by the economic news more than any of the preferreds, with PMT.PC suffering the worst. The other point is PMT likes to jump around, with it climbing $1.07 on the day this article was submitted for review.

Be the first to comment