Khanchit Khirisutchalual/iStock via Getty Images

PennyMac Mortgage Investment Trust (NYSE:PMT) is an established leader in the U.S. mortgage market. They are the largest correspondent loan aggregator and the 2nd largest in overall loan production. In addition, they are the 6th largest in loan servicing. As a loan servicer, the company benefits from recurring fee income over the life of the loan, which naturally increases in an environment with rising interest rates.

Since 2010, the U.S. has added nearly 11M new households, yet housing supply is at an all-time low. As builders increase home completions, PMT will benefit from the continued growth in the purchasing market, driven by the millennial generation in their prime home buying years. Though interest rates are rising, they are still at historically low levels and households are significantly less indebted than they were in the years prior to 2010.

PMT is currently trading near their lows, and the share price has yet to return to their pre-pandemic levels. The dividend is currently yielding over 11%, which is well above most other REITs and higher than the current rate of inflation and the current rate on a risk-free I-Bond. An investment in the company is risky due to the inherently complex nature of their business and their weak fundamentals, but for investors with a high degree of risk tolerance looking to add a high yielding mortgage REIT to their portfolios, there are worse choices out there than PMT.

Business

PMT is a publicly traded REIT that operates as a specialty finance company that recognizes income primarily through their interests in mortgage-related assets. Their core business is in three primary segments; Correspondent Production; Interest Rate Sensitive Strategies; and Credit Sensitive Strategies.

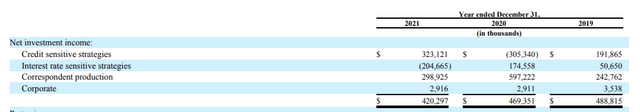

In 2021, the company reported $420M in total net investment income. While the Credit Sensitive Strategies segment accounted for most of the total in the current year, the Correspondent Production segment is typically the largest driver of net investment activity.

Net Investment Income Summary – Form 10-K

In the Correspondent Production segment, PMT purchases Agency-eligible loans, jumbo loans, and home equity lines of credit. They then sell the Agency-eligible loans meeting the guidelines of Fannie Mae and Freddie Mac on a servicing-retained basis where they retain the related MSRs. MSRs represent the value of a contract that obligates PMT to service the loans on behalf of the owner of the loan in exchange for servicing fees and the right to collect certain ancillary income from the borrower. In addition to loan production and interests in MSRs, PMT has a credit risk transfer (CRT) arrangement with Fannie Mae, where they earn income through the sale of pools of loans into Fannie Mae-guaranteed securitizations.

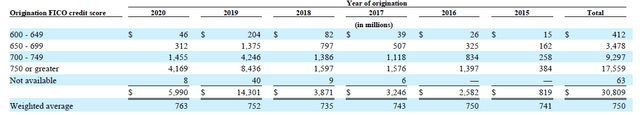

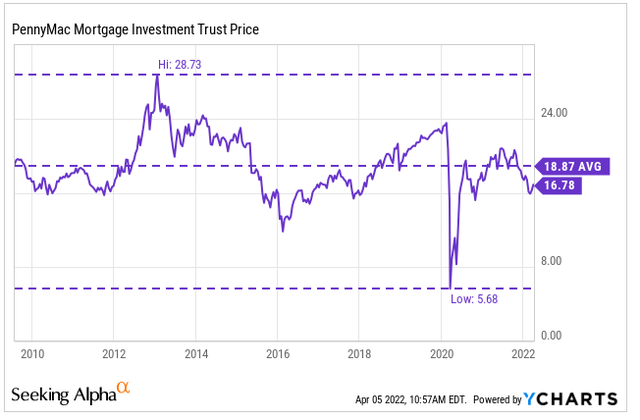

On origination, the weighted average FICO score of borrowers in their loan portfolio is above 750, which is above the national average. Furthermore, the score has been steadily increasing since 2018 as households continue to deleverage and build up their net worth.

Average FICO Scores – Form 10-K

Approximately 40% of total originations occur in five states: California, Florida, Texas, Virginia, and Maryland. From a regional standpoint, about 35% of total originations are in the Southeast. Moreover, the Southeast and Southwest, together, account for 60% of total originations.

Geographic Distribution – Form 10-K

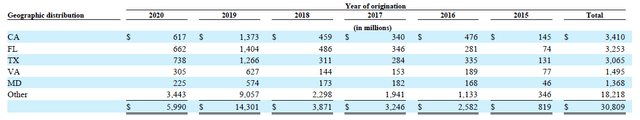

The Charts

PMT has yet to recover to pre-pandemic pricing levels, and they are currently trading at a price below their ten-year average of about $18.90. It hit a low of $5.68 in early 2020 but has since recovered to nearly $17.

YCharts – PMT’s Historical Share Price

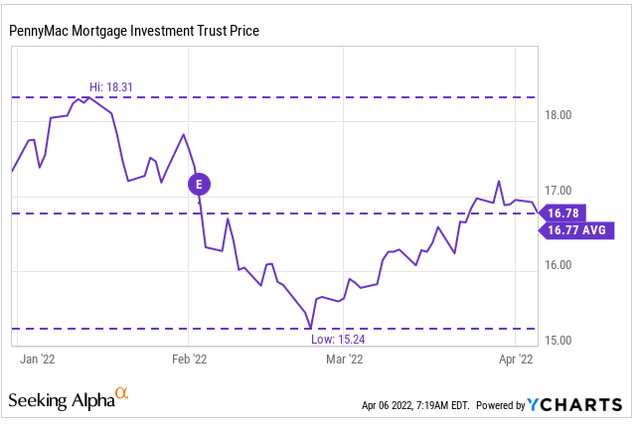

After their earnings release, the share price dropped to a low of $15.24, before returning to the $16 level. It has since been trading in a narrow range for the past few months.

YCharts – PMT’s Share Price Over Past Three Months

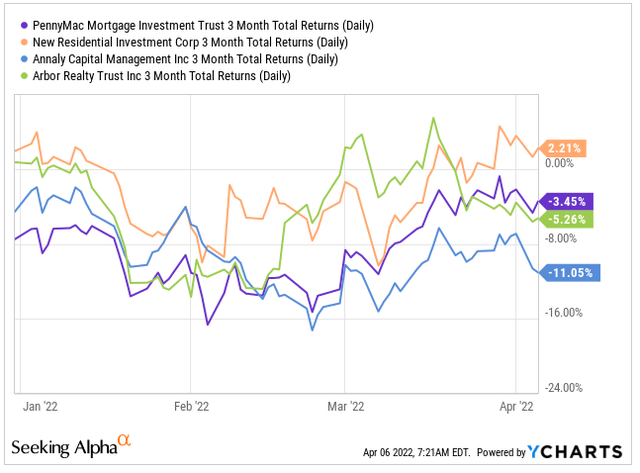

When compared to similar peers in the industry, PMT is down about 3% over the past three months, while both NLY and ABR are down 11% and 5%, respectively. NRZ, on the other hand, is up 2%, with much of the gains resulting in the past month as rates have risen.

YCharts – PMT Compared Against Related Peers Over Past Three Months

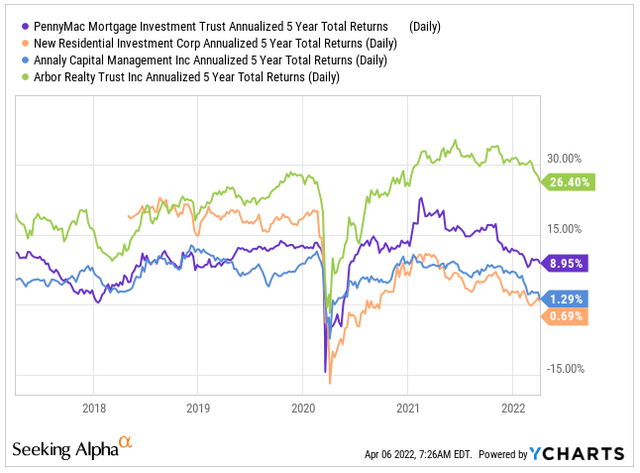

Over a longer timeframe, PMT has performed on par with most of their peers, except for ABR. And since 2020, they have outperformed. Overall, they have returned approximately 9% over 5 years versus negligible returns for both NLY and NRZ.

YCharts – PMT Compared Against Related Peers Over Past Five Years

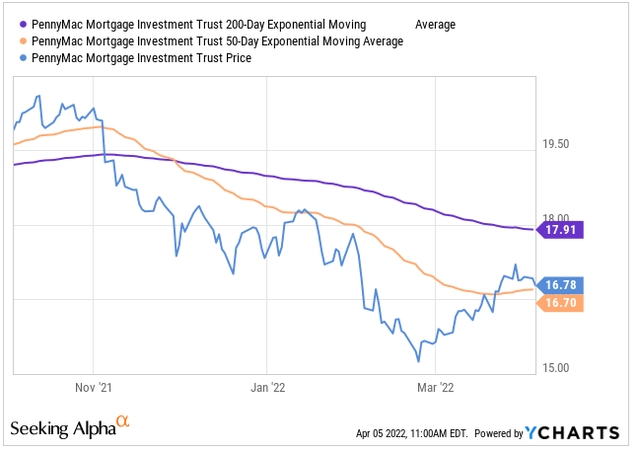

In late December, the 200-day moving average of PMT crossed over the 50-day moving average. This was an indication of bearish sentiment, and as can be seen, the stock declined further afterwards. Additionally, it met strong resistance every time it approached their 50-day average. Recently, however, the share price has moved above resistance. Whether it can hold above this level will be important to monitor moving forward.

YCharts – PMT’s 50/200 Day Moving Averages

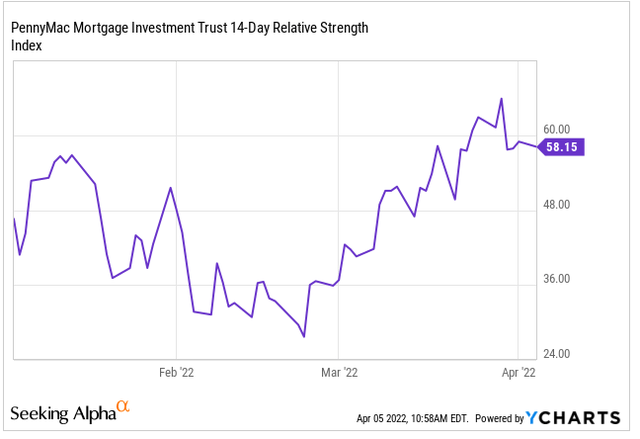

The RSI appears to be trending higher from its lows, which were at oversold levels. At present, the RSI is at a neutral level. When compared to the moving averages, however, it’s indicating bearish sentiment. Any further increases in the RSI would suggest the stock is overbought, which would then likely result in the stock retreating to a level below their 50-day moving average.

PMT is trading below their historical averages, and their share price is currently hovering around their resistance levels. Sentiment has been bearish for the past few months, but the charts are indicating a reversal. The stock has a history of outperformance compared against certain peers, but the overall industry has lagged the broader REIT indexes and the market in general. For a more complete analysis, an earnings review and a deeper fundamental analysis are necessary.

Earnings & Outlook

PMT reported full-year net income of +$56.9M, which was up about 8.5% from 2020. For the quarter, however, the company reported a net loss of ($27.3M), primarily due to declines in the fair value of their interest rate-sensitive strategies resulting from interest rate volatility and the flattening of the yield curve. Increased competition on production also pressured volumes and margins.

Net Income Summary – Form 10-K

The increase in net gains on investments from 2020 was due primarily to increased gains from the company’s CRT arrangements, which reflects the recovery in fair value from the turbulence in the credit markets experienced in 2020.

Net Investment Income Breakout – Form 10-K

Additionally, during the quarter, PMT repurchased 2.2 million shares and their book value per share ended the period at $19.05, which represents a premium of between 10-15% of the current share price.

The origination market is expected to shrink in 2022, with total originations expected to average +$3.1T, which is 35% lower than volumes in 2021, but still large by historical standards. A smaller origination market and increased competition for conventional loans are expected to result in near-term pressures for PMT. However, in 2022 the purchase origination market is expected to total a record $2.0T. As the supply of homes gradually increases and younger generations enter the residential market, PMT is well-positioned for long-term success.

The Fundamentals

Author’s Assessment of PMT’s Strength of Fundamentals

PMT had total assets of +$13.8B at the end of December 31, 2021. This was approximately 20% greater than the prior year, driven by an increase in loans acquired for sale at fair value. The other primary drivers were the company’s increased holdings of investments in loan securitizations backed by loans held in consolidated VIEs and growth in the MSR portfolio from PMT’s correspondent lending activities.

Balance Sheet Summary – Form 10-K

As a mortgage REIT, the company’s liquidity strength is based on its ability to purchase loans from correspondent sellers, cover their operating expenses, and retire their debt and derivatives positions. Additionally, they may also be required to meet margin calls if the value of their collateral falls below levels required by their lenders.

The primary sources of liquidity include the cash on hand balance of $59M, cash earnings on their investments, and liquidations of existing investments. At the end of the year, PMT had total liabilities of +$11.4B, which was 83% of total assets versus 80% in 2020. Furthermore, the leverage ratio, which is calculated as total debt, excluding other liabilities, divided by shareholder’s equity, also ticked higher in the current year to 4.72x versus 3.78 in the prior year.

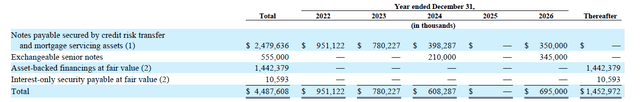

Below is a summary of upcoming debt maturities. Approximately 70% of total debt is due in the years prior to 2027, with $951M due in 2022. While the company does have readily available access to debt and equity markets and benefits from low interest rates, it’s critical that the company is able to generate enough cash flow to, at a minimum, cover their minimum interest obligations and maintain compliance with existing debt covenants.

Summary of Debt Maturities – Form 10-K

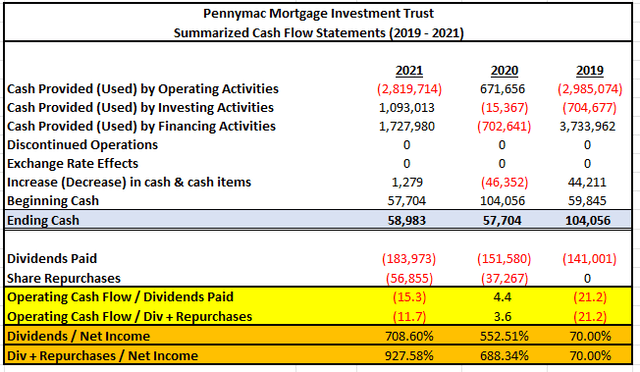

Net cash used in operating activities was +$2.8B in 2021 versus $672M of cash flows generated in 2020. The decrease was related to increased purchases of loans acquired for sale. The acquisitions were significantly greater than in 2020, which saw only $165M in purchases. Compared to 2019, however, purchases were down by about +$600M.

Within the investing section, net cash provided was +$1.1B. This increase was due primarily to +$1.3B in distributions from CRT arrangements that were not replaced by new investments. Furthermore, the increase over 2020 reflected the company’s reduced investments in MBS during the year.

Net cash provided by financing activities was +$1.7B versus +$703M used in 2020. The increase in the current year includes increased borrowings that the company made to finance their investment activities. Additionally, within the financing section is the company’s dividend and repurchase activity. In 2021, the company paid out +$184M in dividends to their common shareholders and repurchased +$57M in shares. While the dividend is not covered by operating cash flows or net income, the payouts are not being financed by debt. In early 2020, the quarterly dividend was cut to 0.25 per share from 0.47 per share, but it has since been restored back. At present, no indications have been made that the dividend will be cut or suspended in 2022 or beyond.

Author’s Summary of Cash Flow Statement

As a mortgage REIT, PMT’s cash flows are highly dependent upon their leveraged investments in loans acquired for sale. The limited cash on hand exposes the company to the risks of changing conditions in the industry and the overall economic environment. Despite this, their short-term liquidity position appears stable given their efficient use of repurchase agreements and their steady receipt of cash flows from their investments held for sale. Cash flows, however, have been weak over the past two years due partly to extraneous circumstances, but also to structural factors such as the slowdown in originations and the increased competition in the market. The current fundamentals of PMT, therefore are weak.

Price Target

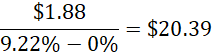

The use of a dividend discount model (DDM) yields a share price of approximately $20.00, as explained below.

The first step in the model was to obtain the expected future dividend payment. Since the dividend has been essentially fixed at $1.88 for the years prior to 2020 and through 2021, an assumption was made that the dividend will remain at this level for the foreseeable future.

The next step was to calculate the cost of equity capital. To derive this rate, the use of the CAPM formula was preferable. The key inputs into this model are the risk-free (RF) rate, which is typically the yield on 10-YR U.S. Treasuries, the stock beta, and a risk premium. The current yield on 10-YR Treasuries is 2.6%, as reported in The Wall Street Journal. However, 3.00% was used in anticipation of higher rates in 2022. The beta of PMT is 1.13, as reported in Morningstar. Finally, the historical risk premium is 5.5%. Thus, the expected return on the market is 8.50%. Upon inputting these variables into the CAPM formula, a discount rate of 9.22% was obtained.

The final input into the DDM was the expected long-term dividend growth rate. For this, 0% was used because the dividend has not been increased, and there are no indications that it will increase in future periods.

Author’s Calculation of Target Share Price Using The DDM

Upon inputting all variables into the DDM, a result of $20.00 was obtained, as shown above.

Primary Risks

PMT is highly dependent on U.S. government-sponsored entities. Elimination or significant changes in the traditional roles of Fannie Mae and Freddie Mac would severely affect PMT’s ability to sell and securitize loans. In the past, legislative proposals have been introduced that would wind down or phase out the GSEs, including a proposal by the prior federal administration to end the conservatorship and privatize Fannie Mae and Freddie Mac. If future efforts to change the status of these two GSEs are successful, PMT’s results of operations could suffer a material adverse effect.

The success of the company’s business strategies and their results of operations are also materially affected by current conditions in the real estate market and the broader economic environment, in general. A destabilization of the real estate and mortgage markets or deterioration in these markets may adversely affect the performance and fair value of the company’s investments or adversely affect their ability to sell the loans that they acquire. This in turn could negatively impact the company’s financial condition, liquidity, results of operations and ability to make distributions to their shareholders.

In addition, the company is significantly impacted by fluctuations in the interest rate environment. Their primary interest rate exposure relates to the yield on their investments, their fair values, and the financing cost of their debt, as well as any derivative financial instruments that they utilize for hedging purposes. Since net interest income is one primary revenue source, they will be negatively impacted by any increase in rates that exceed their income on investment. Additionally, an increase in prevailing interest rates could adversely affect the volume of newly originated mortgages available for purchase in their correspondent production activities.

Conclusion

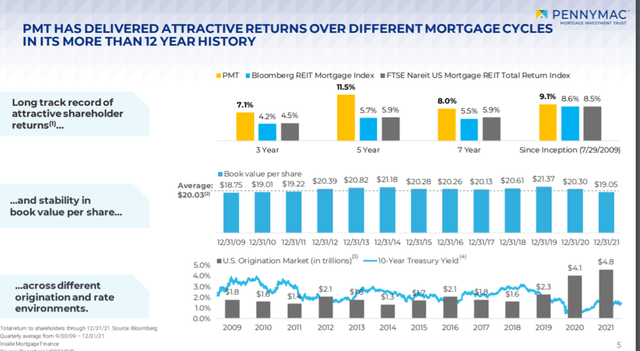

PMT has delivered strong returns over 12 years in business. Since inception, they have delivered total return to shareholders of 9.1% compared to the industry average rate of 8.5%. Moreover, in the past five years, they delivered 11.5% in returns versus an industry average of 6%.

PMT’s Investor Day Presentation

Despite various mortgage cycles, PMT’s book value per share has remained stable since inception, and a strong management team continues to successfully navigate them through changing mortgage conditions. As a leading purchase originator, PMT’s scale positions it well over the long term for continued growth.

PMT’s annual payout is $1.88 per share, which is a yield of approximately 11% based on today’s share price. At this yield, it would take an investor less than ten years to recover their principal. Additionally, the application of a DDM results in a target share price of $20, which is nearly 20% above current levels. The current yield in addition to significant upside potential provides investors with an attractive entry point.

The investment, however, would come with an elevated degree of risk, given the company’s weak fundamentals and bearish market sentiment. A stop-loss may provide reassurance to the weary. In the meantime, holders will receive sizeable dividend payouts that will continue to reduce their basis for the duration of the time the stock trades above the designated limit. For investors with a high degree of risk tolerance, there are certainly worse options out there than PMT.

Be the first to comment