Joe Raedle

The following segment was excerpted from this fund letter.

The Story of Peloton

Peloton was founded by John Foley, a man who knew nothing about the fitness industry, didn’t know how to code, was in his 40s with kids and a mortgage and a pretty safe job. Oh, and he didn’t have any money to launch the company. All he had was an exceptional idea and a lot of grit and determination to prove himself and make it work. Years later he built Peloton into a business with $4 billion in annual revenues.

Fitness is a $30b+ industry with 183 million global gym members and 62 million U.S. members. Boutique fitness like SoulCycle and Flywheel were growing particularly fast and their incredible success in NYC, where John is from, caught his attention. There was one problem that John saw with these classes — a spinning class could only accommodate about 20-30 people and could not be scaled further.

All the best classes with the best instructors got booked instantaneously, and even if you were lucky enough to get in, you had to participate in them on someone else’s schedule at a location that was not most convenient. And the classes were extremely expensive.

John saw an opportunity to create a better experience, at a better location (your home), on better hardware, with better instructors at a dramatically better value on a per workout basis. And the whole thing could scale where it would be possible for 5,000 or even a million people globally to participate in a class.

John took in some seed money ($400,000) from close people that knew him and trusted him at a valuation of $1.6 million, but then quickly faced an uphill battle trying to sell his idea to VCs. Desperately needing capital to make his idea work and to grow the business, he pitched to investors on average 3 times a day for about 4 years. VCs in Silicon Valley turned out to be very risk averse and no one was willing to make a bet on John and his idea.

All of them were looking to bet on another 20-year-old coder that was building the next Instagram or Snapchat (SNAP) in his mom’s garage. No one wanted to get involved in the “difficult hardware business” and an unproven concept. In John’s words: “Those were the dark days for a long time.” But despite the self-doubt and the never-ending rejections by all the big names, John managed to persevere and to move his company along.

In the early days, he had a big problem selling his idea to investors, but never had a problem selling it to customers once they have already tried out his product. According to John, if he could get someone on a bike, there is a 50% chance that they were gonna buy it! That is how engaging, fun and exhilarating the Peloton experience is.

“Peloton is so much more than a Bike — we believe we have the opportunity to create one of the most innovative global technology platforms of our time. It is an opportunity to create one of the most important and influential interactive media companies in the world; a media company that changes lives, inspires greatness, and unites people.” — John Foley

By now, pretty much everyone has heard of Peloton. In 2021, Peloton was ranked #1 on a list of 100 top global brands as well as #1 for Best Place to Work in New York. Peloton´s competitive advantage was seen as a superior user experience formed by tight vertical integration, a constantly evolving software, and a deep community that makes a fitness ecosystem that would be hard to replicate. Pelton also has a NPS (net promoter score) higher than even that of Apple (AAPL) and Tesla (TSLA).

Why was John Foley replaced in February 2022?

First of all, we would like to give credit to John Foley for building a multi-billion-dollar company like Peloton and creating a totally new Fitness-as-a-service (FAAS) category. What he has done was against all odds and John never gave up on his idea.

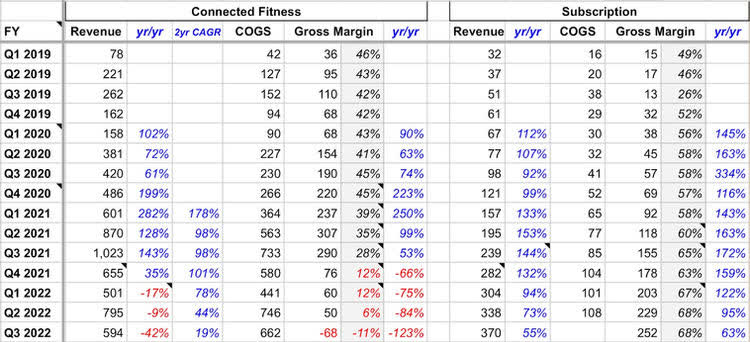

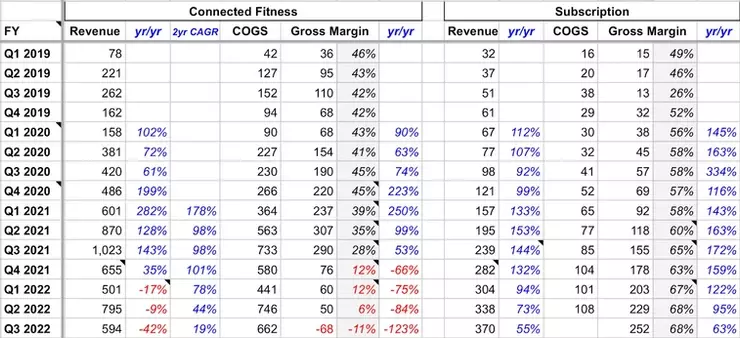

Also, we would like to add that it’s not normal for a company of any size to be able to respond to something as discontinuous and unpredictable as this pandemic turned out to be. Let’s take a look at how crazy and disruptive COVID was to Peloton’s operations. The table below depicts it very well:

As you can see, the company had triple digit growth from Q4 ‘20 until Q3 ‘21, followed by a steep fall-off in demand for their exercise equipment. In the latest quarter, Connected Fitness revenues fell by 42% year-over-year (however still grew 19% on a 2-year CAGR basis). As you see, pre-Covid and during COVID, Connected Fitness gross margins used to be very healthy at 40%+. By the end of 2021, the gross margins for CF have collapsed to 12% and actually incurred a gross profit loss in the latest quarter.

There are a few factors at play here. Peloton reduced their prices pretty meaningfully across the portfolio back in April to drive scale and to drive growth. When you combine the price reduction of the original Bike with the rapidly increasing commodity and freight costs including the last mile delivery costs, you have a prescription for a gross margin contraction. With the lower demand forecast, they are not getting the fixed cost leverage that they would have been expecting when they made heavy fixed investments in warehouses, vehicles and people.

Income Statement

As we look further down the income statement, the biggest red flag is a massive increase in operating expenses. Through nine months in fiscal year 2022 (as of March 31), Peloton had $2.25 billion in operating costs compared to around $1 billion the prior year — 107% jump year over year. During that same nine-month period, revenue dropped 6% year over year. This is definitely not what Wall Street likes to see.

Balance Sheet

Peloton’s balance sheet is also worrisome for investors. In its latest report, Peloton management said the company had $879 million in available cash balanced against more than $1 billion in current liabilities. They recently signed a $750 million debt agreement with JP Morgan and Goldman to fund their recovery efforts. While this is good news in the short term (the company will be able to pay its immediate obligations), it will need to work hard to improve its balance sheet over the coming quarters.

As the demand fell off in the last 3 quarters, their inventory levels have been stuck in the range of $1.3-1.5 billion. Luckily, this inventory does not go out of fashion and is not perishable, but we will be looking out for Peloton’s ability to sell down its inventory and generate cash that it badly needs.

Even though, it is questionable whether another CEO could have made better operating decisions for Peloton over the course of past two years, there is no question that John Foley made a number of mis-steps in severely bloating Peloton’s costs structure and was caught “flat-footed” when the demand picture changed.

Moreover, we were surprised to learn that he also badly mismanaged his own family finances. Apparently, becoming a billionaire as Peloton’s stock skyrocketed got to his head, and he ended up borrowing against his appreciated stock (instead of selling and paying capital gains) in order to finance a lavish $55 million dollar home in the Hampton’s among other things. As PTON stock collapsed, he was faced with margin calls and had to put up his new home up for sale only two months after the purchase.

Clearly, this is not the kind of fiscal discipline that we want from our company managers. It takes quite a bit of time to get to know the true character of CEOs and managers, and the best way to do that is to observe their behavior and execution over time.

The difficult part about the recent 13-year bull market was that there were many great, innovative and disruptive businesses created during this time that fit our criteria for ownership, yet we have not had the chance to observe the execution of managers during the down-cycle, which is really what separates the winners from the losers.

Why have we not sold Peloton stock?

Our decision to buy or sell shares in a business is based on the same fundamental criteria. We begin sell discussions when one or more of the “three engine parts” of our compounding machine is “cracked or broken”.

Let’s take a look at all 3:

Business: From studying the company over the pandemic period and over the last couple of quarters as things have been going south for Peloton, it became clear to us that the troubles they are experiencing are mostly operational and not core fundamental business issues. We believe that the magic of the business is still there! Customers are just as fanatical about their product. Subscribers are growing and working out at a very healthy rate and the churn is as low as always (loyalty is still there).

Disciplined Reinvestment: This part of the “engine” is extremely important, and that’s what got Peloton in trouble in the first place. John Foley got carried away with Peloton’s growth and his ambitions for the company and piled a lot of cash into investments that got them into trouble. Here is a timeline of a few major acquisitions/investments:

October 2019: Acquired Tonic Fitness Technology, one of their two main manufacturing partners based in Taiwan for $47 million.

April 2021: Acquired the Precor business for a purchase price of approximately $412 million. The purpose of this acquisition was to establish its U.S. manufacturing capacity, boost research and development capabilities with Precor’s highly-skilled team, and accelerate Peloton’s penetration of certain commercial markets.

May 2021: Invested $400 million to build its first factory in the United States (200-acre site in Ohio to construct more than 1 million square feet of manufacturing, office and amenities to speed up production and delivery of its popular cycles and high-end treadmill machines). Here is a quote by John Foley as he was buying the plant, which perfectly reflects the pandemic kind of thinking:

“We had planned to do this for years, but I think the pandemic put an exclamation point on why it’s going to be awesome. Having more flexibility in running a global supply chain is also going to allow us to sleep better, as you can imagine.”

Please note that they are planning to sell the plant next year, which should provide a nice cash infusion for the company.

2021: Aiqudo for $57.7 million; Latitude 32 Engineering for $8.5 million

New Management

Barry McCarthy, the 68-year-old former chief financial officer of Spotify (SPOT) and Netflix (NFLX), took over as CEO of Peloton earlier this year. An early employee at Netflix, Mr. McCarthy worked closely with Reed Hastings to develop the subscription service’s revolutionary streaming business and to take the company public in 2002. When he became Spotify’s chief financial officer in 2015, he pioneered the audio company’s advertising strategy, including its push into podcasts. We have owned both Netflix and Spotify, thus we know Barry pretty well.

Mr. McCarthy’s immediate task is to right the ship — the company’s CFO said he wanted to save at least $800 million annually, on the same day Peloton announced it would lay off 20% of its corporate workforce. But he also needs to fend off constant sale speculation, curtail frequent leaks and determine a post pandemic strategy.

Barry’s immediate restructuring plan include:

- reducing the Company’s headcount;

- closing several assembly and manufacturing plants, including the completion and subsequent sale of the shell facility for the Company’s previously planned Peloton Output Park;

- closing and consolidating several distribution facilities, and

- shifting to third-party logistics providers in certain locations.

New York Times recently did an interview with Barry McCathy. A couple of his answers stood out at us:

Why did you think you could fix it?

I know subscriptions. I know consumer-facing businesses. I know growth. I know founders. I certainly know business models. And I know from my experience that product market fit is the hardest thing on the planet to find. And once you find it, it’s almost impossible to screw it up no matter how hard you try. And arguably, we’ve tried pretty hard here, but the customer love is just off the charts. The monthly churn is less than 1 percent.

What did you see in the story?

The two narratives on the company: One is “Implosion peaks during Covid: downward spiral, incompetent management team, company should get sold.” Another narrative is “No, actually Covid was the marketing campaign the company could never have afforded. Peloton has built this large recurring revenue base with subscribers that is growing at 20-plus percent a year. The cost structure got out of whack with revenues, and they spent money on things that they shouldn’t have. But if you resize the cost structure, and you begin to reinvest in growth with product-line extensions and new markets and some other things, then there’s a lot to work with here.

We agree with Barry that the product market is the hardest thing to find, and that the magic of Peloton is still in place. What needs to be done at this stage is their operations need to be fixed. We believe that Barry is the right man for the job.

As we are writing this letter, Peloton announced that they are exiting all owned-manufacturing operations and will have Rexon (leading Taiwanese manufacturer) to be the primary manufacturer of the hardware for their iconic Bike and Tread products lines.

“Today we take another significant step in simplifying our supply chain and variablizing our cost structure – a key priority for us. We believe that this along with other initiatives will enable us to continue reducing the cash burden on the business and increase our flexibility. Partnering with market-leading third-party suppliers, Peloton will be able to focus on what we do best – using technology and content to help our 7 million Members become the best versions of themselves.”

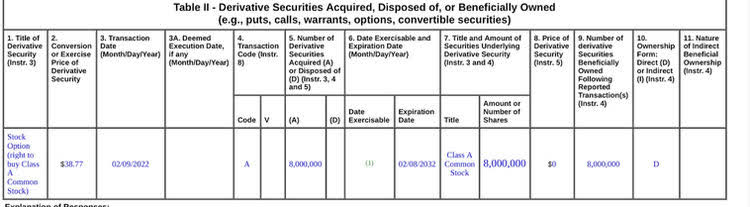

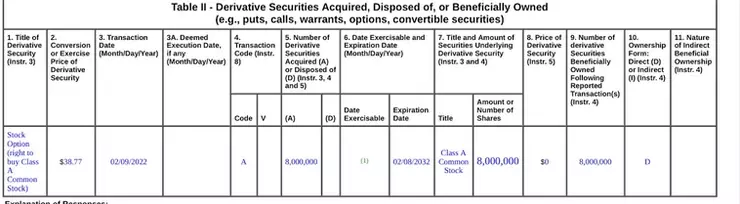

We expect Barry to keep steering Peloton in this direction, which is exactly what’s needed to get the Wall Street confidence back. Barry was awarded a very nice long-term incentive back in February this year, 8 million stock options at an exercise price of $38.77, which means two things:

- First, he is very much aligned with Peloton’s shareholders.

- Second, Barry saw a lot of potential value in Peloton when its stock was selling for 3.9x of where it is today.

Recent CFO Change: As we expected, Jill Woolworth, the CFO under Jim Foley’s frivolous spending days was recently replaced by Liz Coddington, who most recently served as VP of Finance for Amazon Web Services (AWS). Prior, she served as CFO of Adara (ADRA) and Walmart.com (WMT), as well as Vice President, Financial Planning and Analysis of Netflix.

In summary, with the new management in place, we believe Peloton still has all three parts of the “compounding machine” back in place. The valuation at the current price reflects a very dire scenario for the company, and it’s very likely that Barry and Co. will surprise to the upside. We will closely watch the execution by the new management team, and plan to continue holding the shares as long as all three parts we had talked about remain intact.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment