Justin Paget/DigitalVision via Getty Images

The following segment was excerpted from this fund letter.

Peloton (PTON)

PTON has been a costly mistake for the fund thus far. We started a small position back in September of 2020 and added to it as the stock declined and the price got “cheaper and cheaper”.

We would like to walk you through the rationale why we bought the stock in the first place and why we added to the position. We will give you just a short summary in the main body of the letter.

The trial is still out whether we made a mistake on the company, but we definitely made the mistake on the weighting of our position and the price that we originally paid.

What inspired us to start digging into the Peloton idea?

In September 2020, a friend of mine told me he is investing in Peloton and that he’s optimistic about the future prospects of the company. I am a gym goer myself and have never used Peloton, so naturally I did not take this idea seriously. “Sounds like a fad,” I told myself and automatically dismissed it. “What MOAT can a company that produces interactive exercise bikes possibly have? It’s Peloton today, and another brand next year… Besides, I like software businesses with high margins and have no interest in hardware — it’s a tough business. “

My friend, who is a very shrewd long-term investor and who has a very similar investment approach, convinced me not to automatically dismiss the idea and to take a closer look. “There is something special brewing in that company,” he said. “It looks like a hardware company on the outside, but when you look under the hood, it’s actually a global technology platform with a cult-like loyal community that is also an interactive media company.”

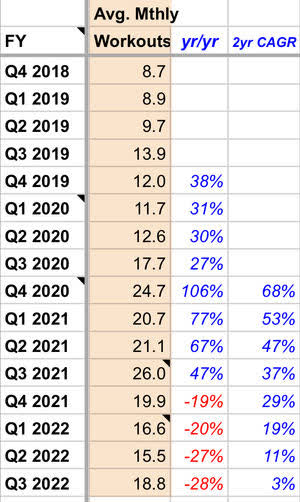

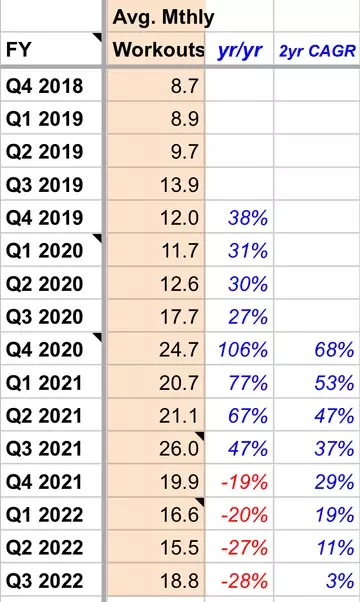

What also caught my attention is my friend was not only an investor in Peloton, but a very loyal user that raves about the product. He is one of those guys that had always absolutely hated exercising — it was always a huge chore for him that he dreaded. He sent me his Peloton’s workout screenshots and the guy had been working out 29 days a month (the average for all Peloton Connected Fitness Subs was 22 per month in 2021).

How many people do you know that go to the gym 22 times a month (5-6 workouts per week)? More importantly, he stayed consistent with his workouts for a year and half now, and he actually looks forward to his workouts. He said it’s the favorite part of his day when he gets on his Peloton bike. I joined a Peloton Facebook group to see what the users are saying and from what I learned, their experiences have been very similar to that of my friend. A bike with an iPad? Unlikely. It was pretty apparent to me that there is something special cooking there and I had to find out what it was.

A few key business fundamentals that sparked our interest:

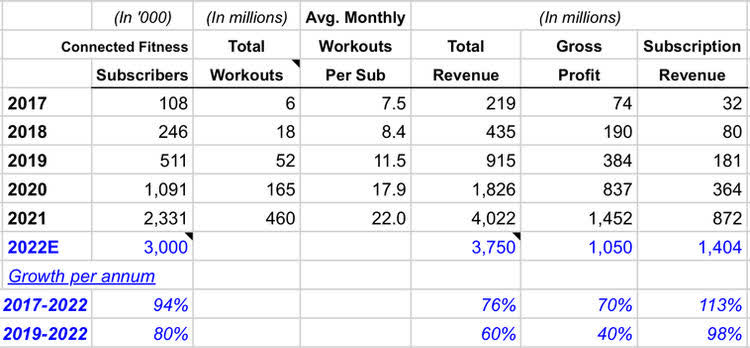

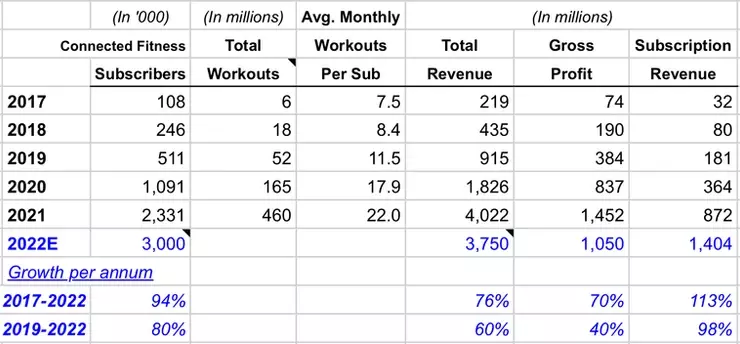

Peloton grew its revenues from $219 million in 2017 to $4 billion in 2021 — astonishing 18x growth. The company derives a rapidly growing part of those revenues from a very lucrative subscription business, which enjoys almost 70% gross margins — subscription revenues grew from $181 million pre-pandemic in 2019 to an estimated $1.4 billion in 2022 (7.7x). Their subscribers grew from 108,000 in 2017 to 2.3 million recently (21x). Before the pandemic started, they had just 511,000 subscribers and they are expected to end this year with 3 million subscribers.

Once people buy the equipment and start working out with Peloton, they become almost fanatical about it. From the table below, you can see that pre-pandemic subscribers were working out a healthy 3x per week on average. When the lock-downs started, the workouts increased to 26 times per month (almost every day) as people were trying to keep their sanity and Peloton was their escape and the only source of endorphins. As expected, when things opened up and people could start living their normal lives, the frequency of workouts decreased, but are still holding up at much higher levels than pre-pandemic.

In the latest quarter, subs worked out a very impressive 18.8 times per month (almost 5 times a week). Again, how many people with gym memberships do you know that work out 5 times a week?

So, the main question is: If Peloton was a private company and you owned a portion of its privately held stock, and there were no daily market quotes to look up, as a business owner, how would you feel about the past 5 years of its business performance highlighted above? Doesn’t look too bad, does it?

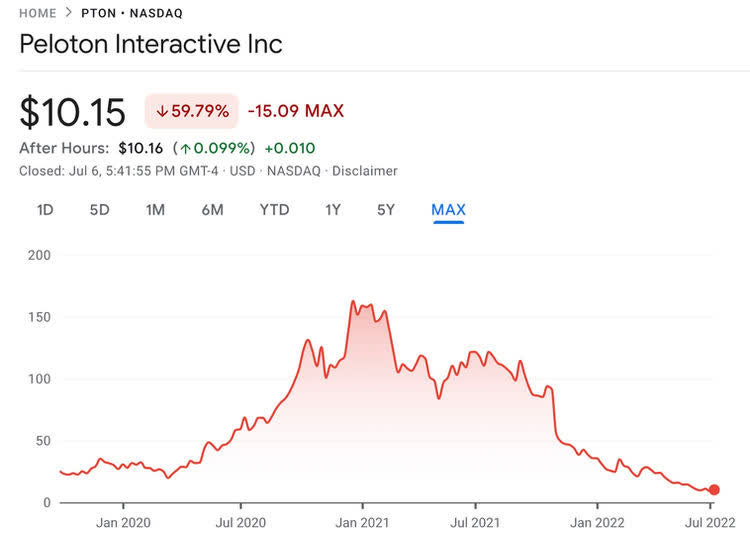

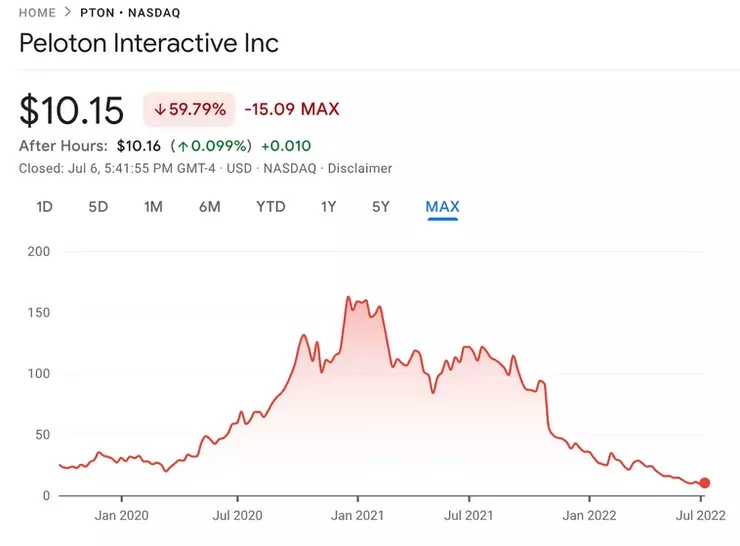

Remember from Buffett’s passage above: “Even though the business may have economic characteristics that are stable, Mr. Market’s quotations will be anything but. For, sad to say, the poor fellow has incurable emotional problems.” The chart below is a perfect depiction of the incurable emotional problems of Mr. Market from year to year. PTON went public in September of 2019 and its stock took off like a rocket advancing from $24 to its peak of $162 in December of 2020 (a mind-blowing 550% increase in just 15 months).

At the peak, the entire company was valued above $40 billion. Was it a reasonable valuation for a company with $1.8 billion in sales and $837 million in gross profits? Absolutely not! In the following 18 months the stock declined 93% to just $10 per share (almost 60% below its IPO price in 2019).

Why did this happen?

The story behind the connected-fitness company’s struggles is a fairly straightforward one of supply and demand. During the pandemic when gyms were closed, exercise enthusiasts were looking for alternatives that accommodated social distancing, and stimulus checks were inflating spending power, demand was so high for Peloton Interactive products that the company couldn’t keep up with it.

Although Pelton was already growing at triple digit rates prior to the pandemic, the demand for their products in 2020-21 was so high that the company had to grow its manufacturing capacity 9x over the course of just 16 months (think about that) and completely stop all Sales & Marketing efforts just to keep up with demand.

“We have capacity to make close to 2 million fitness units of hardware this year, which is just incredible considering, when we founded the company, we approached the biggest contract manufacturer we could find, and they said they could make up to 10,000 bikes a year. That was just 8 years ago.” — John Foley, Founder and Former CEO

Naturally, there was a lot of demand pull from the future years in 2020. When the lockdowns ended and the economy started opening up at the end of 2021, demand naturally started falling from the insane and unsustainable levels of the previous 16 months. A difficult operating environment for the CEO and the management team would be an understatement. I would say that the degree of difficulty in which they had to operate over the past two years would be akin to replacing the engine of an airplane mid-flight.

As the pandemic eased and vaccines allowed for people to again gather in fitness centers, the demand for Peloton products fell hard, along with the need for the ramped-up production. Layoffs and changed plans and outlooks soon followed.

As it happens every so often, Mr. Market can go from extreme optimism to extreme pessimism on a dime. It can go from a “cultural icon” to a “struggling firm” in the course of one year. It never ceases to amaze me how fast most investors, Wall Street analysts and news media can go from “cannot praise the company enough” to “this thing was a fad all along and has no future.” Once unrealistically high expectations hit a “temporary” speed bump, emotions run high and all logic and reasoning goes out the window.

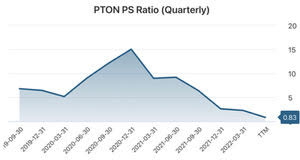

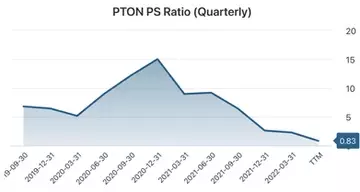

Thus, the valuation multiple experienced two extremes in 2020, when the average P/S multiple was pushed up to 19x at peak optimism and today the multiple contracted to 0.8x (see graph).

The entire company is selling for $3 billion as we are writing this letter. Peloton’s Subscription revenues alone are estimated to grow 70% to $1.4 billion this year. This is a sticky revenue stream that has ~70% gross margins. Peloton’s stock is currently trading at 2.1x subscription revenues alone (not accounting for their Connected Fitness business).

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment