ImagesbyTrista

Investment Thesis

Peabody (NYSE:BTU) has been a stock that has gone nowhere fast for months.

Even though the bull case continues to be just as strong as it was since the start of the Russian war. No, scrap that. I believe that with each passing day that this stock languishes the risk-reward becomes increasingly more compelling.

Right now, it’s getting to the point that this coal stock is just absurdly cheap at 3x free cash flow.

Is Coal Still a Thing?

Unlike countless other commentators, I don’t blame anyone for their well-meaning proclamations that we could wean off coal. If we, as a collective, didn’t buy into the idea that coal is bad and sought alternatives, we would not advance any other alternative energy sources. Coal is bad. There’s no ambiguity here.

But despite our highfalutin proclamations, we need coal. We need its properties for electricity generators, industrial facilities, and steel manufacturing. These are crucial needs.

And irrespective of the idea that we may be entering a global recession, we simply can’t do without coking and thermal coal. Despite an alluring narrative that persuades commentators to eschew coal, coal is still the backbone of our world economy.

But this is preaching to the converted. Anyone reading this post already knows this. Fundamentally, it doesn’t answer the crucial question that interests you.

Why Doesn’t Peabody Trade Higher?

Given all the stigma around coal, I cannot foresee a realistic event where regulators are going to substantially approve a large increase in coal mines.

Or perhaps I should rephrase. China is very much focused on increasing its coal production because irrespective of any declarations of their ambition to start decarbonizing around 2030, the reality is that they prefer cheap energy first and foremost. In fact, China openly admits that coal is the country’s most important energy source.

However, the West feverishly shuns coal production. One way or another, we are in a situation where we need coal; demand for coal remains just as high as always, but supply has been substantially reduced.

In fact, just yesterday, the headlines showed that coal prices in the US broke through an all-time high of $200/ton.

So after everything that we’ve just discussed, do you believe analysts’ EPS estimates for Peabody?

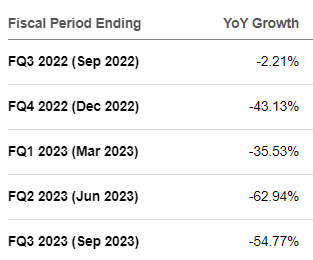

BTU EPS consensus estimates

As you can see above, despite soaring coal prices, analysts following Peabody believe that its EPS will fall off a cliff.

Indeed, looking out just to the start of 2023, analysts are expecting EPS figures to fall by more than 40% y/y.

There’s a very serious mismatch here between what the Street is expecting and the underlying reality at hand today. At least that’s what I believe.

Capital Returns Program?

Peabody’s balance sheet is now in a net cash position. Peabody, like other coal producers, has absolutely no incentive to ramp up production. Why?

Firstly, the stigma associated with this dirty fossil fuel. Secondly, the investment community is clearly not buying into the story of a rosy future for coal.

Investors only want one thing from Peabody, and that is a strong capital return program.

And herein lies the problem for investors. Peabody hasn’t got a clear capital allocation strategy, since its debt has restrictive covenants. This is what Peabody’s SEC filings state:

the Company entered into a transaction support agreement with its surety bond providers which prohibits the payment of dividends through the earlier of December 31, 2025, or the maturity of the Credit Agreement (currently March 31, 2025).

So until its debt structure gets sorted, investors will remain in limbo waiting to get a green light on Peabody’s capital return program.

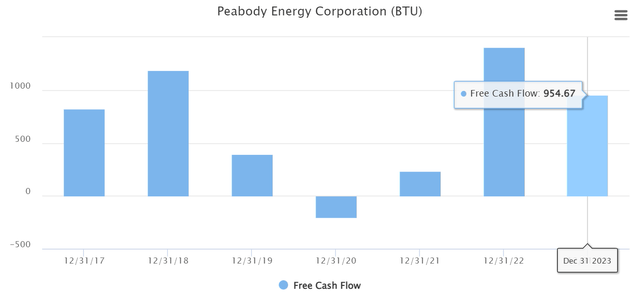

BTU Stock Valuation – Priced at 3x Free Cash Flow

We are now less than 3 months away from putting a close to 2022. And how are analysts forecasting 2023 to shape up?

As touched on throughout, analysts expect 2023 to see Peabody’s free cash flow substantially fall next year.

And even though I can’t forecast coal prices any better than anyone else, the fact that coal prices just crossed through an all-time high doesn’t tally up with free cash flows falling off a cliff.

And even if coal prices were to come down, and even if analysts were right about Peabody, something that I don’t believe to be true, in that case, Peabody trades for 3x free cash flow. Surely, that’s cheap enough?

The Bottom Line

On Wall Street, there’s a near ubiquitous call for demand destruction. However, the underlying facts don’t support that narrative. Or better said, coal prices are not supportive of that narrative. Coal prices in the US are soaring and crossed an all-time high.

Meanwhile, investors don’t want anything to do with coal companies. For its part, Peabody needs to fully resolve its capital structure so that investors can gain confidence that there is a clear path towards strong capital returns to shareholders.

To sum up this case fully, on one side there are doubters of coal. On the other side, there are investors that “get” the coal story, but are running towards companies that are able to return significant capital to shareholders.

And in the middle lies Peabody. Trading in the bargain basement because it’s unwanted and unloved by everyone. Why? Because investors don’t want to wait around until March 2025 for Peabody’s restrictive covenants to get lifted.

Yet, I believe that with its balance sheet dramatically improving as it enters 2023, there’s a serious possibility that those covenants may get renegotiated.

Be the first to comment