imaginima

I am downranking Vistra Corporation (NYSE:VST) from “buy” to “hold.”

Vistra is operating well. Positive factors are retail market growth on the back of steadier electricity pricing than competitors, hedging profile, “righting of the ship” after the emergency costs of Winter Storm Uri, generating plant location near surplus-again natural gas supplies particularly in west Texas, moderate interest rates on debt, and now the effort to extend the useful life of its 2400-megawatt Comanche Peak nuclear power plant.

Vistra pays a 3.4% dividend. It has repurchased $1.6 billion in shares; remaining authorization through year-end 2023 from two repurchase programs totals $1.65 billion.

Concerns are its high leverage ($12 billion of long-term debt and $10 billion of derivatives exposure against $37 billion of assets), the lack of ERCOT reform to incentivize reliability (unlike the New England ISO), government pressure to add intermittent renewables which change grid operations, and the possibility of higher future natural gas prices.

While gas is expected to be oversupplied in the US for about the next year–LNG exports to Europe are currently at capacity limits–once additional LNG export plants come on starting in 2023-2024, the demand pull toward higher-value markets may continue. How industrial gas demand in Europe and the US (and Asia) shifts in the short-term and long-term could also be key.

Natural Gas Prices and Production

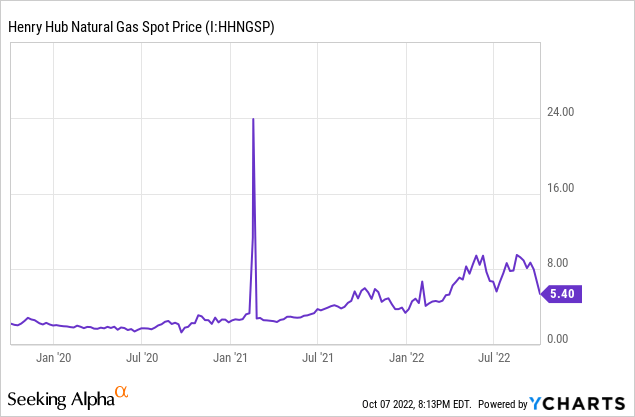

The Henry Hub, Louisiana NYMEX natural gas price for November 2022 delivery closed October 7, 2022, at $6.63/million British Thermal Units (MMBTU). October 6, 2022, futures prices for gas were similarly high relative to other years, at $7.38/MMBTU for the January 2022 contract and $4.85/MMBTU for the seasonally-lower May 2022 contract.

The cutoff of Russian gas exports to Europe, which accounted for about 40% of supply, has boosted liquefied natural gas prices there to as high as $90/MMBTU. While enough gas is now in storage for residential consumers in the winter, industrial users are closing. For example, between 70-80% of European fertilizer capacity is shut down.

Europe and the UK are seeking, and getting, natural gas from other sources, but the high prices there are expected to persist for several months. The Title Transfer Facility (TTF) price (Dutch LNG) on October 7, 2022, for November 2022 delivery was $50.85/MMBTU while the Japan Korea Marker (JKM, or Asian spot) LNG price was $35.86/MMBTU.

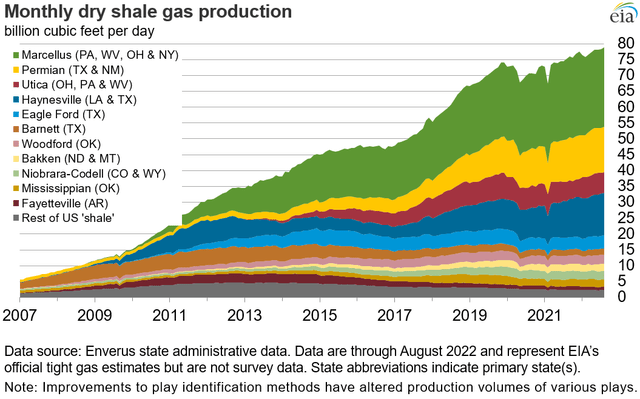

For the week ending October 5, 2022, total US gas production was 100.3 billion cubic feet/day (BCF/D), the highest on record. As the chart below shows, most of the total is shale gas.

EIA

At a recent Hart Energy natural gas conference, an analyst with East Daley Analytics projected US natural gas would be oversupplied relative to demand for the remainder of 2022, all of 2023, and into 2024, until more US LNG facilities come online.

Recall that Appalachian gas production is limited by takeaway capacity, depressing its price (Vistra’s East region). More gas than the 20.7 BCF/D already coming from the Permian (Vistra’s Texas region) can be expected for two reasons: a) associated gas volumes increase with oil volumes, and the Permian is the largest US oil play and b) oil fields get “gassier”—make higher percentages of gas–as they age.

Despite increased US gas supply, a combination of higher US demand (in 2024 and beyond) for LNG exports and potentially for increased US/Asian industrial needs (subbing for some European plants) could result in higher US natural gas prices in 2024 and beyond. Of course, overall EU and individual countries’ policies may dampen European gas prices below current high levels.

Still, this and other inflationary factors will create pressure on Vistra to raise rates and/or to seek generation fuels other than natural gas. While coal and nuclear are good baseload options—if their reliability factor is recognized and paid for–only natural gas has the instant off/on needed to back up intermittent renewables. Vistra is also investing in battery storage, but that, too, is costly (and at utility scale, scant replacement). Engineer Mark Mills estimates building enough battery storage for 12 hours of US electrical use would cost $1.5 trillion.

Second Quarter 2022 Results and Guidance

In the second quarter of 2022, Vistra’s GAAP net loss was -$1.36 billion. This loss includes -$2.0 billion of unrealized losses from mark-to-market valuations of commodity positions. However, according to Vistra, “the net impact of these losses is not expected to be realized in future quarters assuming the company fulfills its obligations through normal course operations.”

During 2Q22, Ongoing Operations Adjusted EBITDA (a non-GAAP measure) was $761 million.

Vistra’s net loss for the first six months of 2022 (1H22) was -$1.64 billion.

Adjusted EBITDA for 1H22 was +$1.3 billion: the difference between this and the first half net loss of -$1.64 billion includes add-backs for:

*non-cash depreciation and amortization of $864 million, and

*unrealized hedging loss of $2.3 billion.

Vistra is 80% hedged for 2023, less so for later years since the hedge pool is thinner.

Looking forward, Vistra expects strong results for full-year 2022, as shown in the table.

|

Vistra Full Year 2022 Guidance ($MM) |

||

|

Low |

High |

|

|

Net Income |

$887 |

$1,361 |

|

Adjusted EBITDA |

$2,670 |

$3,270 |

|

Cash From Operations |

$3,527 |

$4,127 |

|

Adj Free Cash Flow Bef Growth |

$1,840 |

$2,440 |

Operations

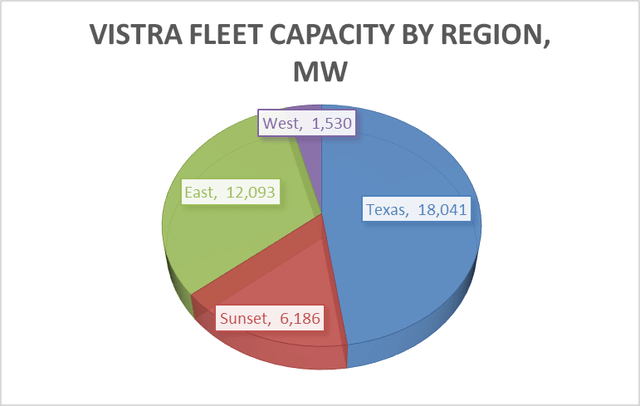

Vistra generates and retails electricity as an independent power producer. Headquartered in Irving, Texas with generation capacity of 37,850 megawatts, it serves 4.3 million customers around the country.

The company reports in six financial segments: Retail, Texas, East, West, Sunset, and Asset Closure. The “sunset” category is operations from (primarily) coal plants due to be retired in the next five years. For 1H22, Vistra reported adjusted EBITDA by segment:

*Retail +$566 million

*Texas +$351 million

*East +$312 million

*West +$66 million

*Sunset +$33 million

*Asset Closure -$30 million

*Corporate & other -$20 million.

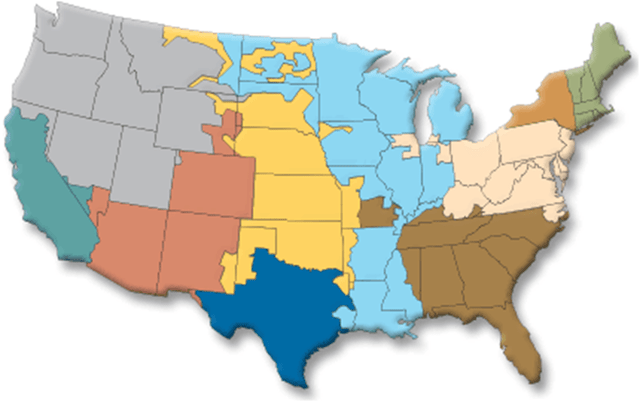

Vistra operates in the Electric Reliability Council of Texas (ERCOT) intrastate wholesale grid. It also operates in the PJM interstate reliability grid, with smaller operations in the MISO, ISO-NE, NYISO (or NY/NE), and CAISO grids. The reliability grids are illustrated below.

FERC

Credit: www.ferc.gov/market-oversight

Above:

ERCOT = dark blue

CAISO = teal

MISO = aqua

PJM = tan

ISO-NE = green

NYISO = medium brown

The company’s generation capacity by region is shown in the chart below.

Vistra and Starks Energy Economics, LLC

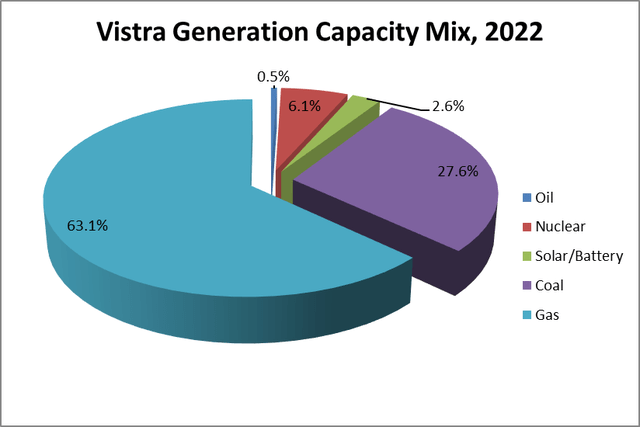

Vistra Generation by Fuel Type

Current total generation capacity is 37,850 megawatts.

Nearly two-thirds (63.1)% of Vistra’s generation capacity, about 24,500 megawatts, is natural gas fueled, with 27.6% coal and 6.1% nuclear. Solar/battery are 998 megawatts of capacity and oil-fired capacity is 203 megawatts. It is important to realize capacity does not equal generation: coal, nuclear, and natural gas plants typically have higher capacity factors than solar or wind, that is hydrocarbon and nuclear plants can be and are online for more hours (more intensively) as baseload or intermediate sources rather than intermittently. Battery and natural gas backup is included to bridge the intermittency of wind and solar.

Due to sunsetting of seven coal plants with 6000 megawatts of capacity (and two small natural gas plants) between now and 2027—and several renewable plants slated to come online—Vistra’s capacity mix will move somewhat away from coal and toward natural gas and renewables.

However, it is key to remember that the plants divide in use between baseload, intermediate, and intermittent. Baseload plants (coal and nuclear) can operationally run at close to 100% capacity all the time but take time to turn off and on. Intermediate plants (natural gas and oil) are quick-on and quick-off and operate as needed to supply demand. They also back up solar plants, as do batteries. Solar and wind are intermittent and so require back-up—either batteries (for solar)—or natural gas or purchased power for wind and solar.

Vistra’s 1H22 capacity factors are:

*nuclear 94%

*coal 53%-70%

*natural gas 39%-55%.

Vistra and Starks Energy Economics, LLC

Governance

At October 1, 2022, Institutional Shareholder Services ranked Vistra’s overall governance as 1, with sub-scores of audit (3), board (2), shareholder rights (4), and compensation (1). On the ISS scale, 1 represents lower governance risk and 10 represents higher governance risk.

Shorts are 3.4% of floated shares.

The company’s beta is 0.95, near that of the overall market.

On June 29, 2022, the five largest institutional stockholders, some of which represent index fund investments that match the overall market, were Vanguard (11.8%), FMR/Fidelity (7.1%), Oaktree (6.1%), Blackrock (5.5%), and Brookfield Asset Management (3.6%).

Brookfield Asset Management and Oaktree, which is majority-owned by Brookfield, are alternative asset and distressed asset investors.

Financial and Stock Highlights

Vistra’s trailing twelve months earnings per share (EPS) is $0.77 for a current price/earnings (P/E) ratio of 29. Analysts’ average estimated full-year 2022 and 2023 EPS are $2.08 and $3.00 respectively, resulting in a forward P/E ratio range of 7.3-10.6.

Trailing twelve months’ operating cash flow is $128 million and levered free cash flow is negative at -$863 million.

At June 30, 2022, the company had $32.1 billion in liabilities and $37.5 billion in assets, giving Vistra a nosebleed liability-to-asset ratio of 86%. Of the liabilities, short-term borrowings are $1.3 billion, derivative contracts, a current liability, are $9.9 billion, and long-term debt is $11.95 billion.

The table below shows the timing and amounts of Vistra’s long-term debt.

|

Vistra Long-Term Debt June 30, 2022 |

|

|

$ Million |

|

|

Credit Facilities |

$2,500 |

|

Senior Secured Notes |

|

|

4.875% due May 13, 2024 |

$400 |

|

3.55% due July 15, 2024 |

$1,500 |

|

5.125% due May 13, 2025 |

$1,100 |

|

3.700% due January 30, 2027 |

$800 |

|

4.300% due July 15, 2029 |

$800 |

|

Total Senior Secured |

$4,600 |

|

Senior Unsecured Notes |

|

|

5.500% due Sept 1, 2026 |

$1,000 |

|

5.625% due Feb 15, 2027 |

$1,300 |

|

5.000% due July 1, 2027 |

$1,300 |

|

4.375% due May 15, 2029 |

$1,250 |

|

Total Senior Unsecured |

$4,850 |

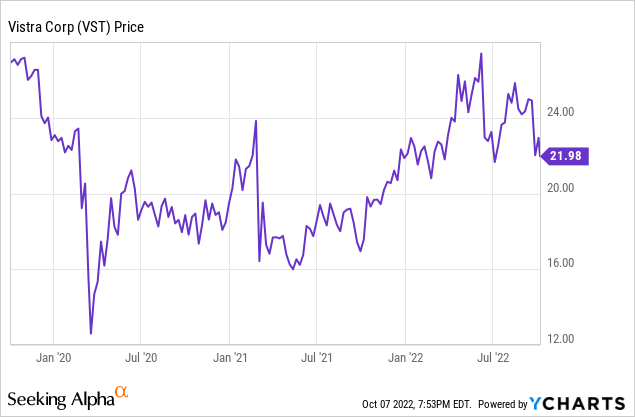

Market capitalization is $9.15 billion at an October 7, 2022, stock closing price of $21.97 per share. The company’s enterprise value (EV) is $24.0 billion.

With a 52-week price range of $17.46-$27.39 per share, the October 7, 2022, closing price is 80% of the 52-week high. The company’s one-year target price is $32.67/share, putting the closing price at 68% of that level, or an upside of 49%.

Vistra pays a dividend of $0.74/share to yield 3.4%. In August 2022, the remaining total through year-end 2023 from two repurchase authorizations totals $1.65 billion. Since November 2021, repurchases have already been another $1.6 billion (14% of stock outstanding.)

Overall, the company’s mean analyst rating is a 1.9 or “buy,” leaning slightly toward “strong buy” from the seven analysts who follow it.

Notes on Valuation

The ratio of enterprise value to EBITDA is 20.7, above the preferred maximum of 10.0 or less.

The ratio of debt to EBITDA is a high 12.4.

Positive and Negative Risks

Vistra’s interest costs on its existing are moderate, a positive. However, any debt rolled over will likely require a higher cost.

Vistra can access some of the lowest-priced gas in the country; however, gas prices worldwide have and will be pushed higher by the cutoff of 40% of Europe’s gas supply (from Russia). In the US, this will accelerate (and ideally natural gas prices in Europe will moderate) in 2023 and 2024 as more US LNG export plants come online.

Vistra has hedged 80% of its production, but higher US gas costs are likely to remain a factor.

Investors should consider their expectations of economic growth, especially for Texas. Electricity use is directly correlated to economic activity.

Alternative asset and distressed asset investors (Brookfield Asset Management and Oaktree, which is majority-owned by Brookfield) have stakes of 3.6% and 6.1% respectively in the company – and so have a say in operations.

Recommendations for Vistra Corp.

Vistra has significant liabilities. Some are left over from sky-rocketing gas prices during winter storm Uri in 2021. Some are due to derivatives exposure as gas prices popped up worldwide after Russia invaded Ukraine in February 2022 and later cut off gas (and oil and distillate) exports to Europe.

The company pays a dividend of 3.4% and has an investor-friendly share repurchase program with remaining authorization of $1.65 billion through the end of 2023.

Vistra’s proposal to extend the life of its nuclear plant is a positive, as is its retail marketing in Texas and the Midwest. The company’s hedging program and generating plant locations near available long-term US gas supply are also pluses.

However, ERCOT’s unwillingness to incentivize reliability, the company’s long-term debt and derivative exposure, federal pressure toward adding intermittent renewables, and the likely continued upward price pressure on Vistra’s primary generating fuel of natural gas mean the company still has several hurdles before it will appeal to many long-term investors.

As noted, I have downranked Vistra from buy to hold.

Vistra

Be the first to comment