DNY59

Introduction

In April 2022, I wrote a bearish article on SA about telecommunications and electric vehicle (EV) infrastructure company Charge Enterprises (NASDAQ:CRGE), in which I said that it looked overvalued as it had low profit margins and was far from achieving a positive net income.

In Q2 2022, Charge Enterprises booked an 11.1% quarter on quarter increase in revenues but the loss from operations shrank by less than 3% as it seems there are no economies of scale in its telecommunications business. With the company losing over $12 million per quarter, it seems that significant stock dilution in the near future is inevitable. In addition, the terms on the new Series D preferred shares look bad. Let’s review.

Overview of the Q2 2022 financial results

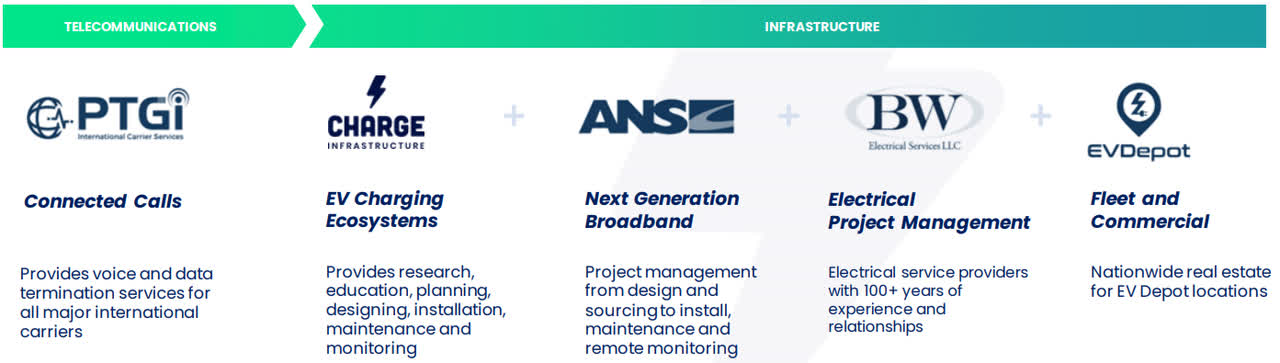

In case you haven’t read my previous article about Charge Enterprises, here’s a short description of the business. The company was founded in January 2019 and between October 2020 and January 2022 it acquired a total of five firms involved in connected calls, mobile charging, EV charging and micro mobility infrastructure, namely GetCharged, PTGi, ANS Advanced Network Services, BW Electrical Services, and EVDepot. The business of Charge Enterprises is currently split into two segments – telecommunications and infrastructure.

Charge Enterprises

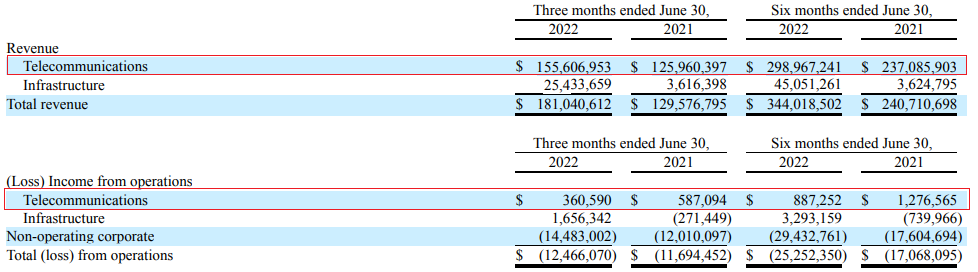

The recent acquisitions have been focused on the infrastructure segment and the vast majority of the latest corporate presentation of Charge Enterprises revolves around end-to-end solutions for intelligent EV charging and 5G wireless networks. However, most of the revenues are still coming from the telecommunications business. Looking at the Q2 2022 financial results, PTGi accounted for 86% of revenues and is growing rapidly. The revenues of this subsidiary grew by 8.5% quarter on quarter and 23.5% year on year. The issue here is that the provision of voice and data termination services is a very low margin business, and it shouldn’t be hard to gain market share considering few companies would want to compete here. Unfortunately for Charge Enterprises investors, it seems that there are no economies of scale as the income from operations of the PTGi is shrinking.

Charge Enterprises

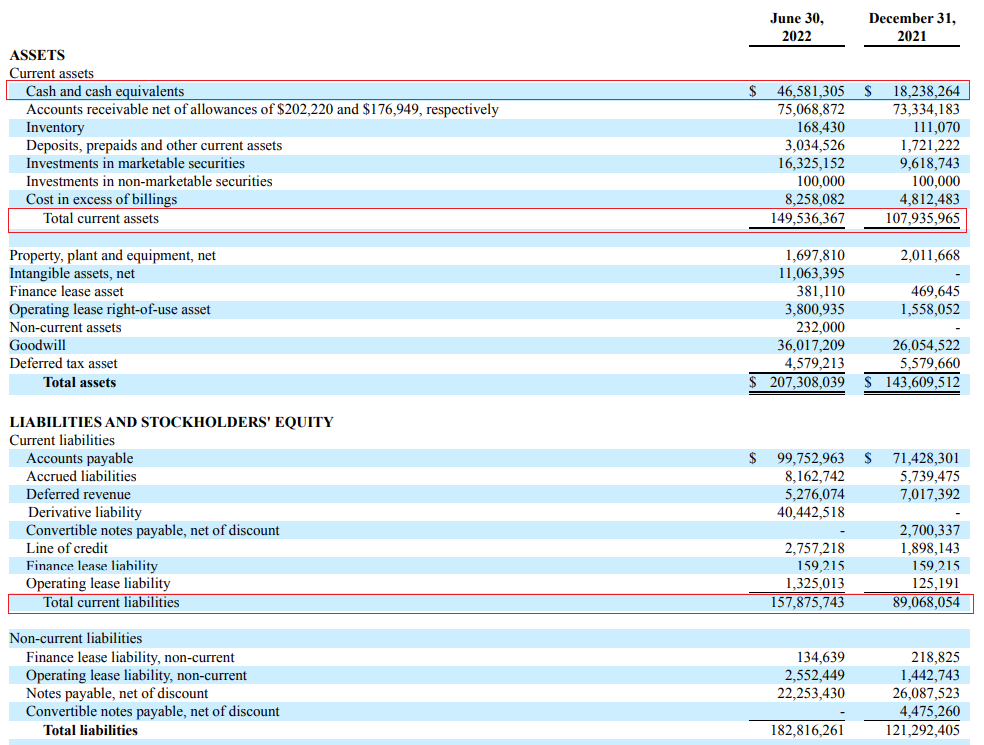

Turning our attention to the infrastructure segment, at first glance it seems that revenues are growing fast, especially compared to Q2 2021. The income from operations is also much higher than that of the telecommunications segment. However, we aren’t comparing apples to apples here. You see, EV Group was bought on January 14, 2022, and Charge Enterprises doesn’t provide pro-forma financial information. As a result, we don’t know for certain whether the results of the infrastructure segment are improving or not. Even if they were, I think it matters little at this point as the loss from operations of Charge Enterprises is above $12 million per quarter as the company seems unable to shrink its G&A expenses. I think there could be significant stock dilution coming in the next few months. The company had $46.5 million in cash as of June 2022 and its working capital was negative at the end of the quarter. In addition, shareholders’ equity was down to $7.2 million.

Charge Enterprises

What’s even worse is that Charge Enterprises created a new class of preferred stock in June when it decided to pay off its $12.5 million convertible debt. The 1,177,023 Series D preferred shares have a liquidation preference equal to $10.62 per share and there is a 2.25% annual dividend based on that liquidation price. In addition, they can be converted into common stock at just $0.4248 per share.

Overall, I think the business of Charge Enterprises is close to worthless in its current state and that the margins of the telecommunications business are unlikely to improve. Turning our attention to the market valuation of the company, the share price has declined by over 60% since my first article came out but I think there is more to go as retail investor interest seems to be fading. Back in May, I said that the company was attracting a lot of attention on websites like StockTwits and Twitter and that it was being mentioned in tweets leading to two significant stock trading rooms on Discord, namely Eagle Investors, and Bull Trades. Today, there are few posts about Charge Enterprise on StockTwits and Twitter and many of them are bearish. In addition, the daily trading volume has decreased significantly.

Seeking Alpha

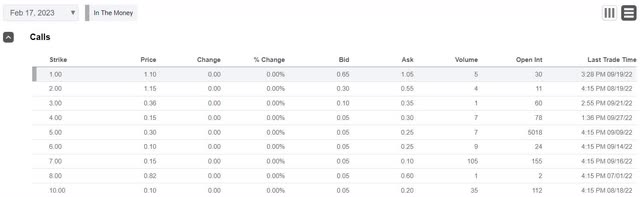

So, how do you play this one? Well, data from Fintel shows that the short borrow fee rate stands at 11.25% as of the time of writing which isn’t too bad, but it takes almost 11 days to cover. With short interest at 9.09% of the float, I think there is a high risk of a short squeeze here. Unfortunately, call options are currently expensive so hedging against risks is a tough task.

Seeking Alpha

In my view, it’s a viable idea to open a small short position but it could be best for risk-averse investors to avoid Charge Enterprises.

Looking at the risks for the bear case, I think there are two major ones besides the potential short squeeze. First, I could be wrong about the lack of economies of scale and the operating margins improve rapidly in the future. Second, the share prices of microcap companies can increase for spurious and unknown reasons.

Investor takeaway

Charge Enterprises has grown into a group of companies with annual revenues of about $600 million in the span of less than four years, but the bulk of that amount comes from the provision of voice and data termination services. The financial results for Q2 2022 showed that there just aren’t any economies of scale in the telecommunications segment while the income from operations from the infrastructure segment is too low to make a difference.

It seems that retail investor interest in Charge Enterprises is fading, and I wouldn’t be surprised if the share price falls below $1.00 as I think that significant stock dilution in the near future could be inevitable. However, there risk of a short squeeze here is high and I think that risk-averse investors should avoid this stock.

Be the first to comment